Trade Bodies Petition CM Against State GST Harassment: When Coimbatore trade bodies petitioned the Chief Minister of Tamil Nadu against state GST harassment, it wasn’t just another headline—it was a cry for help from one of India’s most important industrial powerhouses. Coimbatore is home to tens of thousands of small and medium businesses, globally known textile mills, and engineering units that supply parts to industries across the world. But lately, instead of scaling up production and boosting exports, these businesses find themselves bogged down by overzealous GST officials, repeated audits, and stiff penalties for the smallest mistakes. And while this story unfolds in India, it echoes something many of us in the U.S. would understand too. Imagine if every few weeks, the IRS came knocking on small businesses in Illinois or Texas, not because of fraud but for clerical errors like a missing comma or a misprinted invoice number. Yeah—you’d be pulling your hair out. That’s exactly what Coimbatore’s trade associations are dealing with.

Trade Bodies Petition CM Against State GST Harassment

The petition by Coimbatore trade bodies against state GST harassment isn’t just a local issue—it’s a warning bell for India’s entire economic system. When compliance becomes harassment, it undermines ease of doing business, weakens exports, and discourages entrepreneurs. By adopting practical reforms, Tamil Nadu has a chance to lead the way in showing how governance can support, not strangle, its business community.

| Point | Details |

|---|---|

| Issue Raised | Harassment by State GST (Goods and Services Tax) authorities |

| Petitioners | 40+ trade bodies including CODISSIA, SIMA, ICCI |

| Main Complaints | Repeated audits, vehicle detention despite valid invoices, penalties for clerical errors, appeal delays |

| Legal Reference | Section 126 of the CGST Act protects businesses from penalties for minor mistakes |

| Demands | Timeline for appeals, automatic stay during appeals, risk-based inspections |

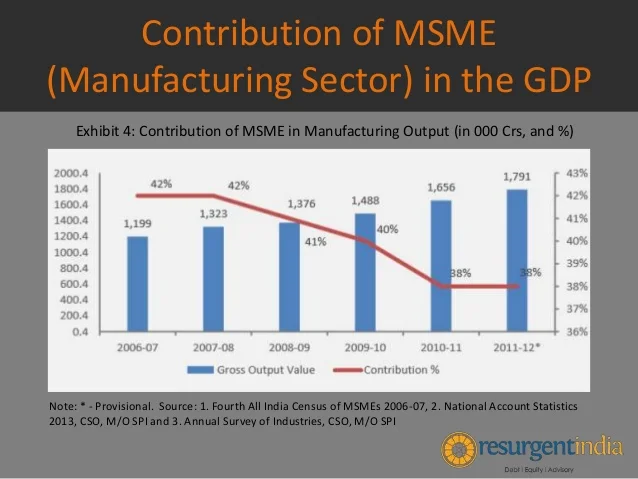

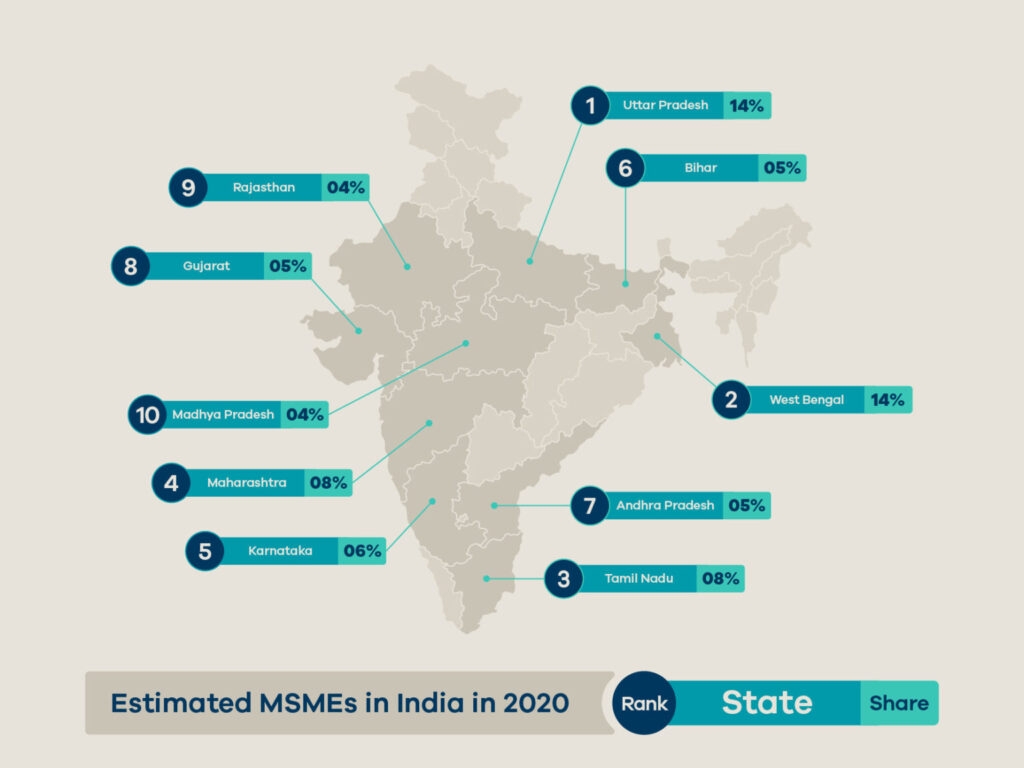

| Economic Impact | Coimbatore MSMEs contribute over $9 billion annually, employing 700,000+ workers |

| Official Resource | GST Portal – Government of India |

A Brief History of GST in India

The Goods and Services Tax (GST) was rolled out nationwide in 2017 with the slogan “One Nation, One Tax.” The idea was simple: replace a jungle of state-level taxes, excise duties, and service taxes with a single, streamlined system. On paper, it promised to boost ease of doing business, reduce corruption, and create a transparent tax structure.

And in fairness, GST did achieve some wins. Tax collections improved, digital invoicing reduced some forms of tax evasion, and compliance became easier for bigger corporates. According to India’s Ministry of Finance, GST revenues hit ₹1.65 lakh crore ($20B) in May 2024, showing its importance to India’s economy.

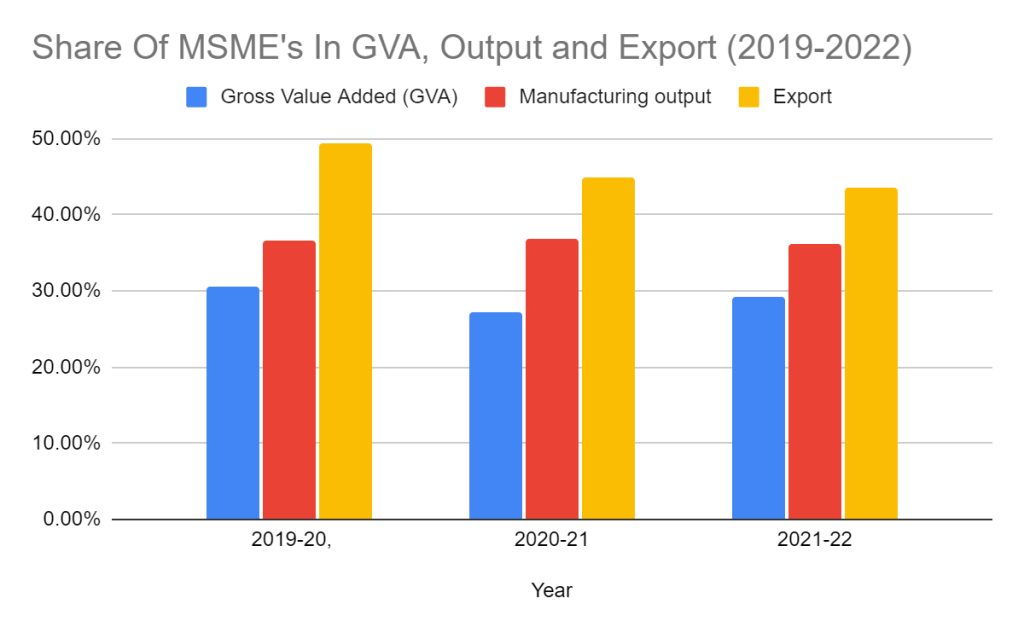

But for MSMEs (Micro, Small & Medium Enterprises)—the backbone of India’s economy—the ground reality is different. Instead of fewer headaches, many feel overloaded with inspections, paperwork, and unpredictable enforcement.

Why Coimbatore Trade Bodies Petition CM Against State GST Harassment?

Coimbatore, nicknamed the “Manchester of South India,” is not just a textile hub—it’s also a center for engineering goods, motors, pumps, and auto parts. According to the Tamil Nadu Government’s Industrial Policy, Coimbatore exports over $3 billion worth of goods annually, contributing massively to India’s foreign exchange earnings.

So when over 40 trade associations—from the Coimbatore District Small Industries Association (CODISSIA) to the Southern India Mills Association (SIMA)—file a joint petition with Chief Minister M.K. Stalin, it signals serious trouble.

Their complaints are straightforward but alarming:

- Roving squad checks: Vehicles are stopped and detained even with valid GST invoices, causing shipment delays.

- Clerical penalties: A typo in an invoice number can cost thousands in penalties.

- Repeated audits: Firms are asked for the same documents multiple times for the same year.

- Appeal delays: Cases take years to resolve, while recovery actions like bank freezes happen immediately.

- Misuse of Section 74: This section—meant for fraud cases—is allegedly used on routine disputes.

For industries that rely on just-in-time exports, these hurdles aren’t just irritating—they can kill contracts, cause layoffs, and erode trust with overseas buyers.

Expert Voices from the Ground

“MSMEs don’t have the legal bandwidth to fight these cases,” says tax analyst R. Narayanaswamy in The Hindu BusinessLine. “A clerical slip should not be treated like a fraud.”

CODISSIA President S. Venkatesh echoed the sentiment: “We are not anti-compliance. We want rules to be applied fairly and appeals to be resolved within a time frame. At this point, honest taxpayers are being treated like offenders.”

The Human Side: Stories of Disruption

Consider a yarn exporter from Tiruppur, near Coimbatore. Despite paying GST on time, his truck carrying goods to Chennai port was stopped because of a typo in an invoice. By the time it was released, the European buyer had canceled the order. Loss: ₹15 lakh ($18,000)—a huge blow for an MSME.

Or take a pump manufacturer in Coimbatore who faced three audits for the same financial year. Each time, officers demanded files already submitted. “We feel like hamsters on a wheel,” the owner said in a local press report.

Global Comparison: How Other Countries Do It

Looking abroad, India’s challenges stand out:

- United States (IRS): Less than 0.5% of taxpayers face audits yearly, thanks to risk-based targeting. Honest businesses are rarely hassled.

- United Kingdom (HMRC): Focuses on digital self-compliance. Small errors qualify for relief, not penalties.

- India (GST): Businesses often face multiple audits, arbitrary penalties, and harassment, even for trivial errors.

The lesson? Enforcement needs to move from “catch everyone” to “target the real fraudsters.”

What Trade Bodies Are Demanding?

The petition lays out practical reforms:

- Timelines for Appeals – Ensure appeals are resolved within 90 days.

- Automatic Stay on Recovery – Recovery actions should pause once an appeal is filed.

- Intelligence-Driven Inspections – Use data analytics, not random checks.

- Respect for Section 126 – Minor errors should not attract harsh penalties.

- Centralized Tracking – Every audit and appeal should be visible on a single GST portal.

If implemented, these reforms could give MSMEs space to focus on growth instead of firefighting.

Practical Tips for MSMEs

For businesses navigating GST—or the IRS in the U.S.—a few practical steps can save trouble:

- Automate accounting – Use platforms like Tally, Zoho Books, or QuickBooks to avoid typos.

- Keep multiple backups – Digital and hard copies of invoices and filings.

- Never miss appeal deadlines – And always get written acknowledgments.

- Use associations – A collective voice carries more weight.

- Push for risk-based audits – Demand modern systems over manual harassment.

What Policymakers Should Do?

If Tamil Nadu wants to attract more investors and strengthen MSMEs, policymakers should:

- Set up fast-track GST tribunals for small businesses.

- Train GST officers on a “compliance first, penalty later” approach.

- Reduce audit frequency for firms with clean compliance histories.

- Adopt global best practices—from the IRS in the U.S. and HMRC in the U.K.

As one Coimbatore business leader put it: “We don’t want favors. We want fairness.”

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

States Back GST Simplification to 5% & 18% – But Will Sin Goods Be Taxed More?

Big GST Cut on Cars Could Change India’s Auto Market Overnight- Check Details