Income Tax Act 2025: The Income Tax Act 2025 is officially set to replace India’s Income Tax Act of 1961 beginning April 1, 2026. For over six decades, the 1961 law served as the backbone of India’s taxation system, guiding everything from individual salary filings to billion-dollar corporate taxation. But times have changed. The digital age, globalization, and new forms of income like cryptocurrency have made the old framework outdated and unwieldy. This landmark reform marks the most significant shift in India’s tax history since independence. For taxpayers, businesses, and investors, the change is both a challenge and an opportunity. The new Act is designed to simplify compliance, modernize tax administration, and provide clarity for a fast-evolving economy.

Income Tax Act 2025

The Income Tax Act 2025 represents more than a tax reform—it symbolizes India’s evolution into a modern, digital, and globally integrated economy. After 60 years under the 1961 Act, taxpayers can expect a system that is easier to understand, less litigation-prone, and more in tune with today’s realities. For individuals, this means less paperwork and clearer slabs. For businesses, it means adapting to digital-first compliance. For investors, it means confidence in a transparent system. But as with any big change, preparation is key. Start now, and by April 2026, you’ll be ready to embrace the future of taxation in India.

| Key Aspect | Details |

|---|---|

| New Law Title | Income Tax Act, 2025 |

| Replaces | Income Tax Act, 1961 |

| Effective Date | April 1, 2026 |

| Presidential Assent | August 21, 2025 |

| Official Gazette Notification | August 22, 2025 |

| Focus Areas | Simplification, digital compliance, reduced litigation, clarity on global income and new-age assets |

| Impact Groups | Salaried employees, freelancers, small businesses, corporations, NRIs, foreign investors |

| Official Resource | Government of India – Income Tax |

Why Replace the 1961 Income Tax Act?

The Income Tax Act of 1961 was revolutionary at the time. It replaced the colonial-era 1922 Act and provided India with a comprehensive tax structure in its early years of independence. For decades, it worked reasonably well, but over time, the cracks started to show.

- By 2025, the 1961 Act had been amended thousands of times, creating a patchwork system full of exceptions, exemptions, and contradictions.

- Ordinary taxpayers often found themselves lost in jargon. Even seasoned professionals sometimes struggled to interpret provisions.

- Courts became overloaded with tax disputes—nearly 40% of pending litigation in Indian courts is related to taxation.

- New income sources like digital assets, cross-border freelancing, and global investments were never envisioned in 1961, making the law feel outdated.

The new law is meant to reset the system, reduce confusion, and bring taxation in line with India’s ambitions as a $4 trillion economy and global investment hub.

What’s Changing in the Income Tax Act 2025?

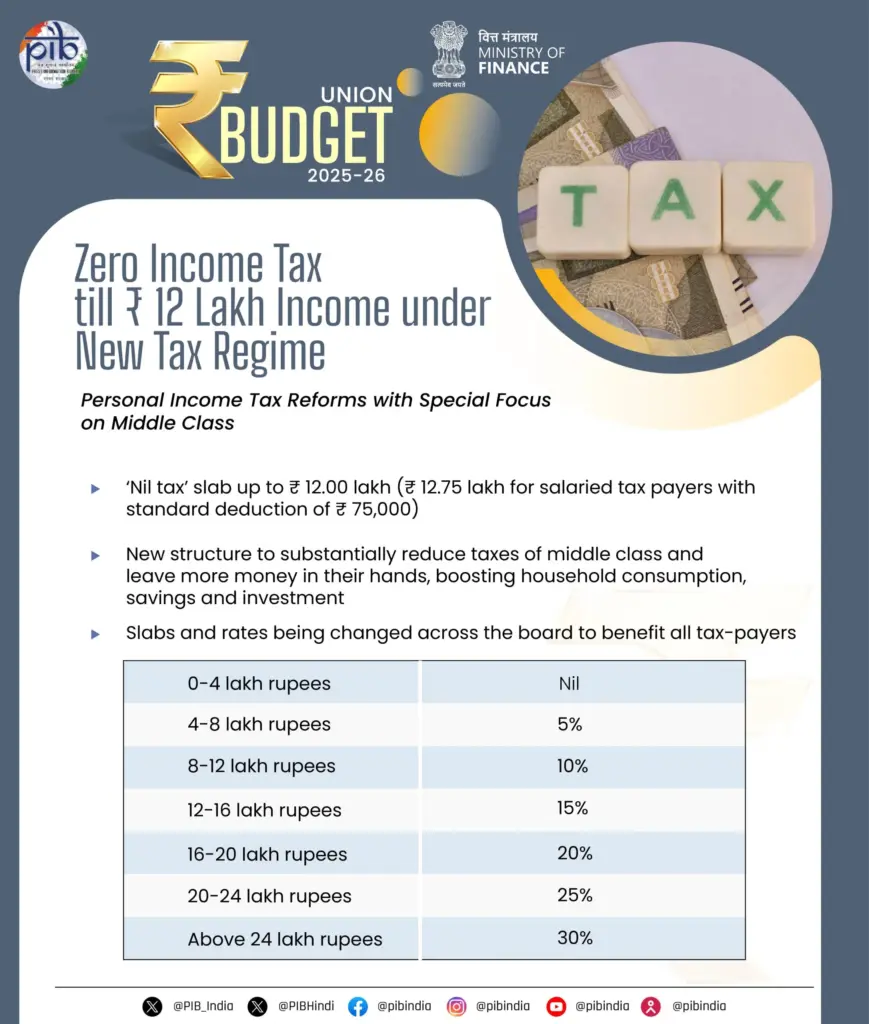

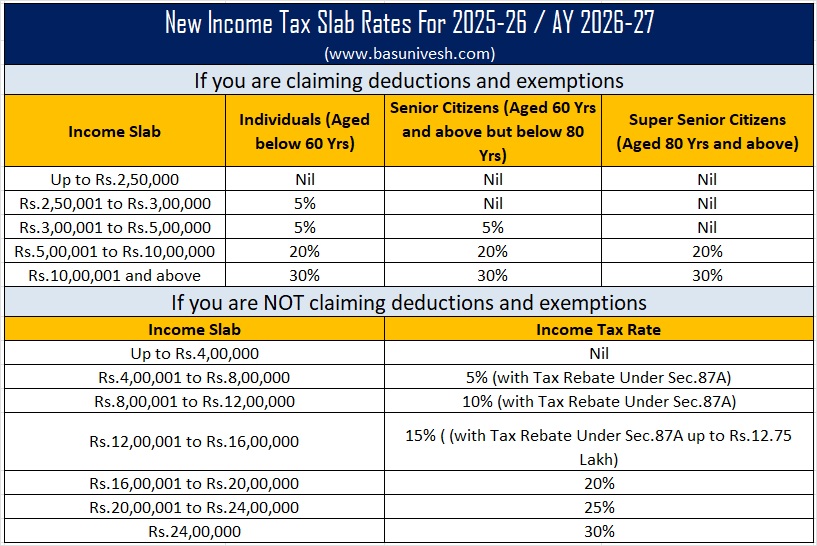

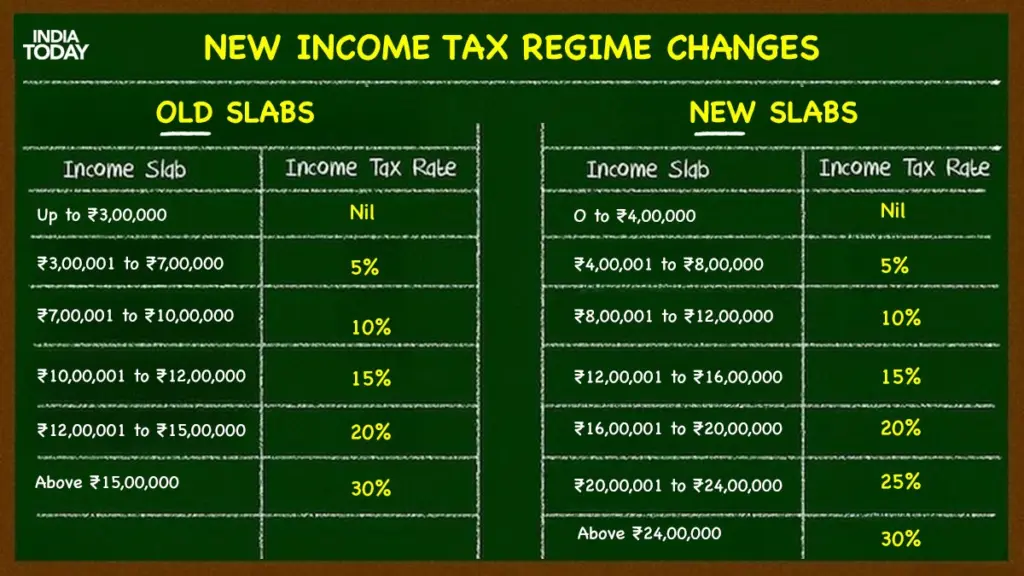

New Income Tax Slabs

The government intends to create a unified and simplified slab structure. Currently, taxpayers can choose between the “old regime” (with exemptions and deductions) and the “new regime” (lower rates, fewer deductions). The dual system causes confusion. The 2025 Act is expected to consolidate this into a single, easy-to-follow structure.

Digital-First Filing

The future of taxation is digital compliance. India already has an advanced online filing system, but the new law will expand it further. Real-time income reporting, AI-powered verification, and faster refunds will reduce delays and errors.

Global Income and Cross-Border Clarity

Non-Resident Indians (NRIs), foreign investors, and digital freelancers have long struggled with unclear rules on how cross-border income is taxed. The new Act aims to clarify:

- How foreign income will be taxed in India.

- Treatment of crypto and digital assets.

- Rules for companies paying Indian contractors abroad.

Reduced Litigation

Ambiguities in the 1961 Act created a flood of disputes. The 2025 Act uses simpler language, clearer definitions, and fewer loopholes to reduce the burden on courts and taxpayers.

Benefits of the New Act

- Simplified compliance: Filing will be easier, faster, and more transparent.

- Investor-friendly environment: Clearer global rules will attract more foreign investment.

- Digital transparency: Reduced dependence on physical paperwork and tax officers.

- Global alignment: India’s tax framework will be closer to international standards.

Challenges and Concerns

- Transition pains: Taxpayers and professionals will need to unlearn old systems and adapt.

- Loss of some deductions: If exemptions like 80C are reduced or removed, some taxpayers may lose benefits.

- Implementation hurdles: Ensuring that digital infrastructure works smoothly across India, including rural areas, will be a challenge.

- Business adjustment costs: Companies may need to update accounting systems and retrain staff.

Global Comparison: How India Stacks Up

- United States (IRS System): The U.S. uses standard deductions and straightforward slabs but is infamous for complex paperwork and audits.

- United Kingdom (HMRC System): The U.K. uses a “Pay As You Earn” model where most taxes are automatically deducted, making life simpler for individuals.

- India 2025 Model: India is moving toward a hybrid—digital-first filing like the U.S., but aiming for simpler structures like the U.K.

Step-by-Step Guide: Preparing for the Income Tax Act 2025

Step 1: Stay Updated

Regularly check official announcements on Income Tax India and follow reliable news outlets.

Step 2: Review Your Income Streams

If you earn money abroad, invest in crypto, or freelance for overseas clients, pay special attention to how the new law treats these categories.

Step 3: Re-Evaluate Investments

Currently, many Indians invest in tax-saving products mainly for exemptions. Since the new Act may change deductions, rethink investment strategies with financial goals in mind, not just tax savings.

Step 4: Upgrade Digital Tools

Small businesses and freelancers should adopt modern accounting and tax software. This will make compliance under the new Act smoother.

Step 5: Consult Professionals

The first year of the new law (FY 2026-27) will be critical. Consulting a tax professional will help avoid mistakes and penalties.

Impact Analysis: Who Gains and Who Loses?

Salaried Employees

For most middle-class workers, the new law should make filing easier. If the government offers standardized deductions instead of multiple exemptions, it could mean less confusion.

Freelancers and Gig Workers

This group, especially those earning from abroad, stands to benefit from clearer rules on cross-border income.

Small Businesses

Compliance costs may rise initially as systems are upgraded, but in the long run, reduced litigation and clearer rules will help.

Startups

Clarity on capital gains, ESOP taxation, and foreign funding will be beneficial for India’s growing startup ecosystem.

NRIs and Foreign Investors

Perhaps the biggest winners. Clear rules on taxation of global income will reduce uncertainty and make India more attractive for investment.

Income Tax Department Raids Over 10 Locations Across Tamil Nadu

Jane Street Tax Probe Deepens as EY Pulled Into Investigation

India On the Edge of Crypto Tax Reform—What It Means for Your Digital Wallet

Historical Perspective: Lessons from the 1961 Act

The 1961 Act itself was a replacement for the outdated 1922 law. It introduced comprehensive rules for income classification, tax computation, and exemptions. Over decades, it was repeatedly amended through Finance Acts, but the core framework remained the same. The result was a bulky, complex law full of contradictions.

The Income Tax Act 2025 is, in many ways, history repeating itself—a clean slate for a new era. But unlike 1961, this law is being built in an age of digital finance and global integration.