Home Sale Of Rs 70 Lakh: If you’ve ever heard of someone selling a house worth Rs 70 lakh and paying only Rs 33,000 in income tax, you might wonder if that’s a trick or a loophole. But in reality, it’s a recent ruling by the Income Tax Appellate Tribunal (ITAT), Mumbai, which explained why this is fully legal under Indian tax law. The secret lies in how long-term capital gains (LTCG) are calculated and how the indexation benefit is applied. In simple terms, indexation adjusts the purchase price of an asset to account for inflation. And in this particular case, the timing of when indexation started made all the difference.

Home Sale Of Rs 70 Lakh

The ITAT Mumbai’s ruling in the Rs 70 lakh property sale case shows the power of understanding tax law. By recognizing that indexation begins from the agreement year instead of the possession year, the tribunal ensured a fair outcome for taxpayers. For homeowners, investors, and NRIs, this case is a reminder: keep your documents, know your rights, and plan your taxes smartly. Sometimes, the difference between paying Rs 33,000 and Rs 15 lakh can come down to one correct interpretation of the law.

| Aspect | Details |

|---|---|

| Sale Price | Rs 70 lakh |

| Purchase Price | Rs 36 lakh |

| Taxpayer’s Claim | LTCG of Rs 1.6 lakh → Tax payable Rs 33,296 |

| Tax Dept’s Claim | LTCG of Rs 17 lakh → Tax much higher |

| ITAT Ruling | Indexation starts from agreement year (2007–08), not possession year |

| Tax Saving | Approx. Rs 15 lakh |

| Reference | Income Tax Department – Official Website |

Home Sale Of Rs 70 Lakh: The Case Explained

The taxpayer bought a house for Rs 36 lakh. Years later, he sold it for Rs 70 lakh. Normally, one might assume his profit was Rs 34 lakh, which would be taxable as capital gains.

The tax department argued that since possession was taken in 2010–11, indexation should start only from that year. Under this approach, the taxable gain came to about Rs 17 lakh.

The taxpayer argued differently. He said he signed the sale agreement and paid a substantial portion in 2007–08, so indexation should start from then. Under this method, the inflation-adjusted cost rose significantly, leaving only Rs 1.6 lakh in taxable profit.

The ITAT Mumbai ruled in favor of the taxpayer, agreeing that the “holding” of the property begins not when you physically get the keys but when the sale agreement is signed and payment is made. As a result, his tax liability dropped to Rs 33,000.

Why This Ruling Matters?

This is not just one lucky taxpayer’s story. It sets a precedent for similar cases across India. Here’s why it is significant:

- Fairness in Taxation – The ruling ensures people aren’t taxed unfairly just because builders delay possession.

- Clarity on Ownership – It distinguishes between “ownership” and “possession.” Legally, ownership begins when you sign an agreement and pay for the property.

- Massive Tax Savings – As seen in this case, the right interpretation can save lakhs of rupees.

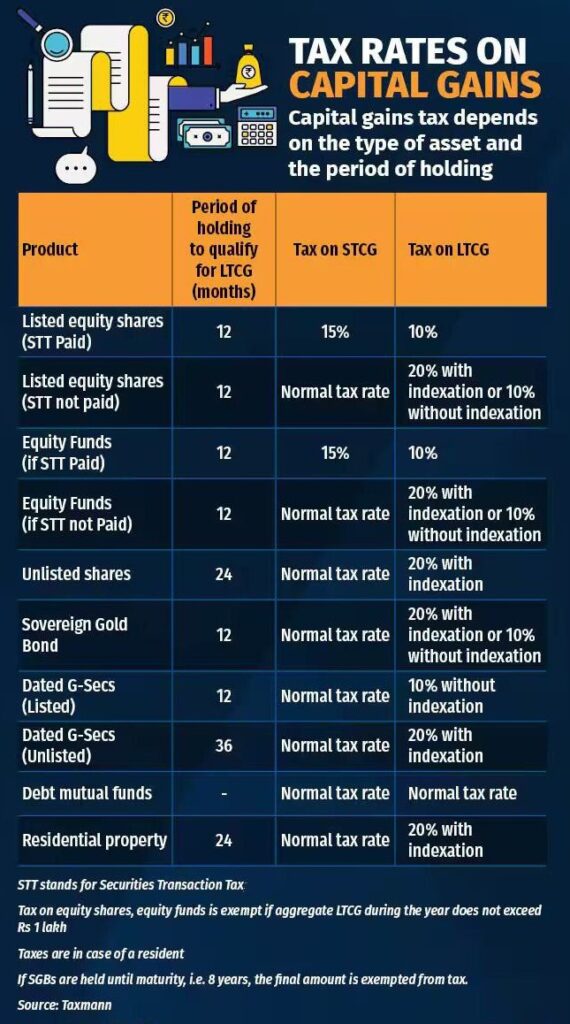

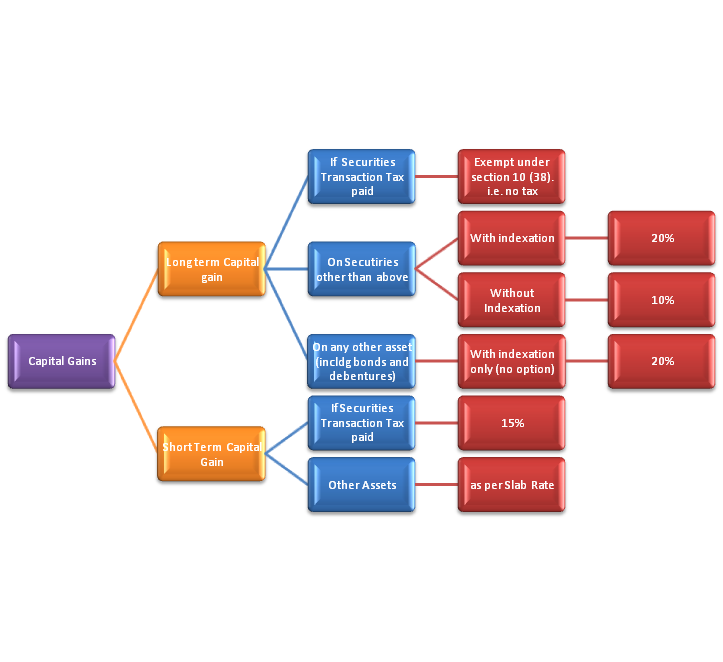

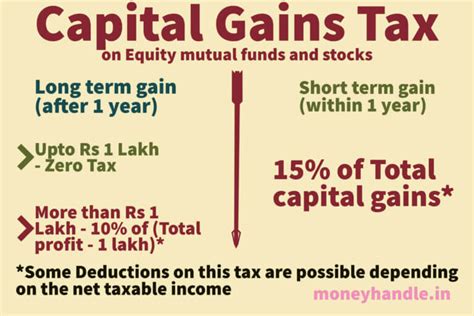

Historical Context of Capital Gains Tax in India

India’s capital gains tax system has gone through several changes:

- Before the early 2000s, capital gains were taxed without much adjustment for inflation, which was often unfair.

- The government introduced the Cost Inflation Index (CII) to ensure taxpayers were taxed on real profits, not just price increases caused by inflation.

- Over the years, rules for exemptions (like Section 54 and 54F for reinvestment) and deductions have been added to promote reinvestment in housing and infrastructure.

This ruling is in line with the principle that taxpayers should not be punished for inflation or builder delays.

Comparison with the United States

In the U.S., capital gains are taxed differently. There is no indexation benefit. Instead, tax is based on whether gains are short-term (less than a year, taxed at regular income rates) or long-term (more than a year, taxed at 0–20% depending on income).

However, U.S. homeowners get a primary residence exemption of $250,000 (or $500,000 for couples). India doesn’t offer such a blanket exemption but allows indexation and reinvestment-based exemptions.

This comparison highlights that India’s system, though complex, provides more protection against inflation.

How Indexation Works in India?

Indexation adjusts your purchase price using the government’s Cost Inflation Index (CII).

Formula:

Indexed Cost = Purchase Price × (CII of Sale Year ÷ CII of Purchase Year)

Example from this case:

- Purchase price = Rs 36 lakh in 2007–08

- CII of 2007–08 = 129

- CII of 2017–18 (sale year) = 272

- Indexed cost = 36,00,000 × (272 ÷ 129) = Rs 68.4 lakh

- Sale price = Rs 70 lakh

- Taxable gain = Rs 1.6 lakh

- LTCG tax @20% = Rs 33,000

This method ensures that tax is only on real gains, not on inflation-driven increases.

Professional Insights

- Chartered Accountants recommend that sellers keep all agreements, receipts, and bank statements. Without these, claiming early indexation is difficult.

- Lawyers emphasize that ITAT rulings are persuasive but not the final word. The department may appeal, though such rulings carry strong weight.

- Financial Planners see this as a reminder to plan taxes while planning property investments. Smart structuring of agreements can save large amounts later.

Practical Checklist for Property Sellers

- Keep your sale agreement and payment proofs safe.

- Always check the CII table on Income Tax India.

- Claim exemptions under Section 54 if you reinvest in another property, or 54EC if you invest in bonds.

- File your tax returns correctly and declare capital gains accurately.

- Consult a professional before selling. Small mistakes can result in large tax bills.

Real-Life Scenarios Where This Ruling Helps

- Metro Homebuyers: Many people buy under-construction flats years before possession. If agreements are old, indexation from the earlier year can mean lakhs in savings.

- NRIs: Non-resident Indians selling Indian property often face heavy TDS. Correct indexation reduces the final tax, and they can claim refunds.

- Inherited Property: For inherited assets, indexation begins from the year the previous owner bought the asset, not the year of inheritance. This can be a huge relief.

Larger Impact on Tax Collections

Capital gains form a major source of India’s direct tax revenue. According to the Central Board of Direct Taxes (CBDT), India collected over Rs 1.5 lakh crore from capital gains taxes in 2023. Real estate is one of the top contributors.

As property prices in metros grow 7–10% annually (Knight Frank Report, 2024), indexation benefits have become critical to ensure fairness in taxation. Without them, many taxpayers would be paying tax on inflation alone.

How India’s Broken Tax System Is Crippling the Circular Economy Revolution

Shocking Demand – Should Tax Crimes Lead to Citizenship Denaturalization?

36 Shops Sealed in Indore – Property Tax Non-Payment Crackdown Intensifies