GST Cut Won’t Solve Cement’s Woes: When we hear about a possible GST cut on cement, it feels like big news. Cement isn’t just about construction sites—it’s the backbone of roads, bridges, housing, skyscrapers, and almost every piece of infrastructure we rely on. Recently, India’s government floated the idea of cutting cement’s GST from 28% to 18% under its new two-slab tax system. That sounds like a breakthrough, right? But here’s the real story: while the proposal looks promising on paper, it won’t magically fix the cement industry’s deeper struggles. A tax tweak might bring short-term relief, but the sector’s long-term challenges demand systemic reforms and a pricing overhaul. Think of it like patching a cracked wall with paint—the surface looks better, but the cracks are still growing underneath.

GST Cut Won’t Solve Cement’s Woes

A GST cut on cement from 28% to 18% is certainly welcome news. But it is not the silver bullet the industry needs. The real problems—rising input costs, inverted duty structures, refund bottlenecks, and limited pricing power—remain unsolved. Without broader reforms, the GST cut will offer only temporary relief. For lasting growth and competitiveness, India’s cement industry needs nothing short of a comprehensive pricing and structural overhaul.

| Aspect | Details |

|---|---|

| Current GST on Cement | 28% (one of the highest in core industries) |

| Proposed GST Rate | 18% under the new two-slab GST system |

| Timeline | GST Council meeting set for September 3–4, 2025 (official site) |

| Market Impact | Stocks jump: Nuvoco Vistas (+47%), JK Cement (+42%), Star Cement (+34%) |

| Key Challenges | Rising fuel costs (+17% in petcoke), gypsum shortages, competition squeezing pricing power |

| Winners if Cut Happens | Premium brands: UltraTech, Ambuja, Shree Cement |

| Why Cut Alone Fails | Cost inflation, inverted duty structure, and refund delays remain unresolved |

Cement and GST: A Quick History

When India introduced the Goods and Services Tax (GST) in 2017, cement was classified in the highest slab—28%. Policymakers argued that cement wasn’t a “necessity” for daily living, unlike food or medicines. But critics quickly pointed out the irony: cement is essential for building homes, schools, hospitals, and infrastructure.

Since then, the cement industry, real estate developers, and housing associations have consistently pushed for relief, calling the 28% tax “unfair” and “counterproductive to affordable housing goals.” The government has reduced taxes on many consumer goods over the years, but cement has remained stuck in the top bracket. That’s why the current proposal to bring it down to 18% is generating so much attention.

Why a GST Cut Feels Like a Game-Changer?

Dropping cement GST to 18% could, in theory, reduce costs for consumers and businesses alike. For the average homeowner, that might shave off thousands—or even lakhs—when constructing a house. For large-scale infrastructure projects, it could slightly reduce project budgets, freeing up funds for expansion.

Investors are already reacting positively. According to The Economic Times, cement stocks are performing strongly:

- Nuvoco Vistas: up 47% in FY26 Q1

- JK Cement: up 42%

- India Cements: up 33%

- Dalmia Bharat: up 25%

This market optimism shows how much faith investors have in tax cuts as a demand booster.

The Catch: Why GST Cut Won’t Solve Cement’s Woes

While a GST cut would provide some relief, the cement sector’s core issues run deeper. Let’s break them down:

1. Rising Input Costs

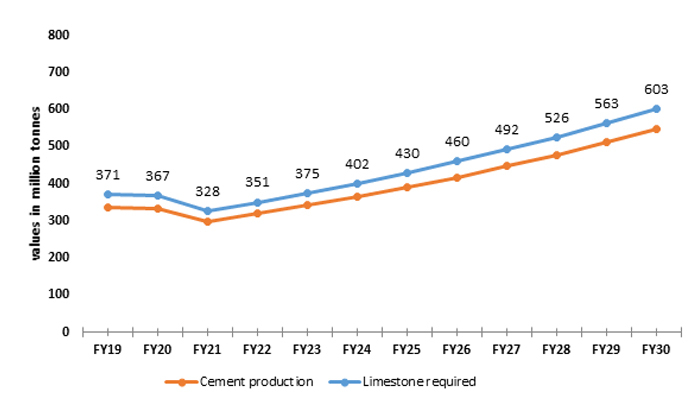

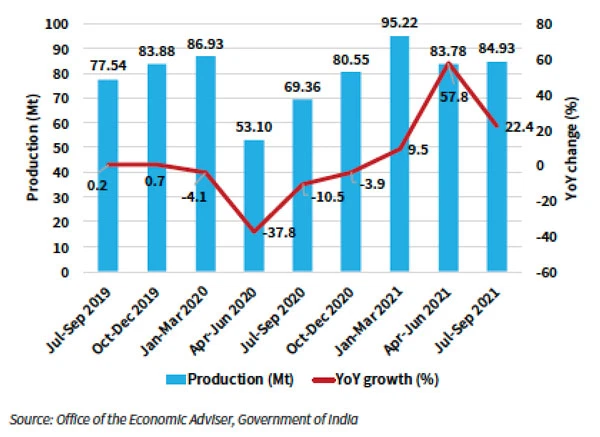

Cement production is energy-intensive. Plants rely on fuels like coal and petcoke, and also need gypsum as a raw material. In FY26, petcoke prices surged 17%, driving cement prices up by nearly 8% year-on-year. According to ScanX, these rising costs have already neutralized much of the industry’s profitability gains.

2. Limited Pricing Power

Cement markets are highly competitive. In many regions, oversupply forces companies to keep prices low. Even if GST is reduced, firms may not be able to pass on all the savings to consumers because of price wars and local competition.

3. Inverted Duty Structure

The inverted duty structure—where raw materials attract higher GST than finished cement—creates input tax credit mismatches. This reduces working capital efficiency and squeezes profitability.

4. Administrative Bottlenecks

GST refund delays, classification disputes, and lack of transparency create cash-flow bottlenecks. For cement companies, this means capital is stuck in the system instead of being reinvested in growth.

How India Compares Globally?

To understand India’s challenge, it helps to look abroad:

- United States: No national GST. States levy sales tax, typically 4–9%. Cement prices are more competitive.

- European Union: VAT on cement ranges from 5% to 20%, depending on the country.

- China: VAT is around 13%, far below India’s 28%.

In short, India taxes cement among the highest in the world. This not only hurts affordability but also reduces competitiveness in global markets.

Industry Voices and Analyst Opinions

- Builders’ Associations: Groups like CREDAI have long argued that high GST on cement contradicts the government’s push for affordable housing.

- Brokerage Houses: Nomura expects premium cement’s market share to rise from 40% to 55–60% by FY30 if GST is cut.

- Government Officials: Finance ministry sources say the cut is aimed at supporting infrastructure spending under schemes like PM Awas Yojana and Bharatmala.

Real-World Implications

For Homeowners

Building a house costs could reduce slightly if GST falls, but don’t expect dramatic savings. Rising input costs may offset much of the relief.

For Infrastructure Projects

Large government projects may benefit more since bulk procurement magnifies even small savings. Still, bottlenecks in refunds and input costs will weigh heavily.

For Real Estate Buyers

Affordable housing could become somewhat cheaper, but land, labor, and steel still account for major costs. Cement is just one piece of the puzzle.

Winners and Losers of a GST Cut

Likely Winners

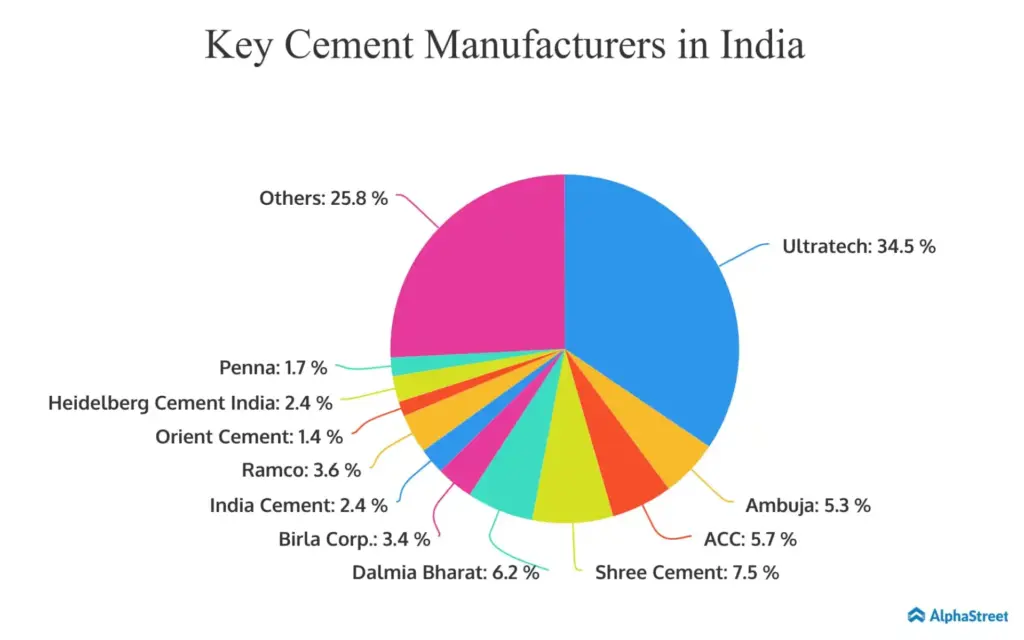

- UltraTech Cement: Scale and brand give it an edge in premium markets.

- Ambuja Cements: Strong consumer branding, positioned for growth.

- Shree Cement: Known for efficiency and premium segment play.

Potential Losers

Smaller regional players may struggle as competition intensifies. Without pricing power, they could lose market share to larger players.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

What the Cement Industry Really Needs

A GST cut is a welcome step, but it is not enough. Long-term reform requires:

- Energy Policy Support: Incentives for renewable and alternative fuels to cut input costs.

- Transparent Pricing Rules: Encourage healthy competition while discouraging cartelization.

- GST System Reform: Streamlined refunds, better ITC flow, and simpler classifications.

- Industry Consolidation: Mergers and partnerships to improve scale and reduce inefficiency.

Actionable Guide for Stakeholders

For Builders and Contractors

- Plan budgets cautiously. Expect modest, not massive, relief from GST cuts.

- Lock in long-term supply contracts to hedge against input volatility.

For Investors

- Focus on companies with strong brand value and pricing power.

- Look for signs of energy policy reform before betting long-term.

For Policymakers

- Pair tax cuts with reforms in pricing, energy, and administration.

- Address inverted duty structures to unlock working capital for businesses.

Future Outlook

Even if the GST cut goes through in September 2025, the benefits may take time to filter through. Analysts expect FY26 to be a transition year, with modest demand growth in housing and infrastructure. By FY27–28, if structural reforms are also implemented, the cement industry could finally see sustainable growth.

However, if reforms stall, India risks keeping cement prices among the highest globally, undermining its ambitious infrastructure push.