Eight States Demand GST Compensation: When you hear that eight states demand GST compensation levy on sin and luxury goods, it may sound like a mouthful of political jargon. But behind those words lies a debate that could affect how much you pay for certain products, how states fund hospitals and schools, and how India balances federal finances. This isn’t just a boring government tussle—it’s a tug-of-war over money, power, and fairness. At the heart of it is the Goods and Services Tax (GST). It was designed to simplify India’s tax system, but like many “big ideas,” it has come with its fair share of complications. Now, with a major GST reform on the table, states fear massive revenue losses. To protect themselves, they’re demanding a new compensation levy on sin and luxury goods—things like cigarettes, liquor, and luxury cars.

Eight States Demand GST Compensation

The demand for a GST compensation levy on sin and luxury goods shows how fragile India’s fiscal balance is. For eight opposition-led states, this levy isn’t just about politics—it’s about survival. They argue that without it, public services could collapse under the weight of revenue losses. For businesses, it’s a compliance and pricing challenge. For consumers, it’s a question of higher costs. And for the nation, it’s a test of how fairly power and money are shared between the Union and the states. Whatever happens in the upcoming GST Council meeting, the outcome will ripple through India’s economy—and perhaps even shape how future tax reforms are designed.

| Topic | Details |

|---|---|

| Issue | Eight opposition states demand a compensation levy on sin & luxury goods |

| Proposed GST Reform | Simplify rates to 5% and 18%, with 40% for sin/luxury goods |

| Estimated Revenue Loss | ₹1.5–2 lakh crore annually |

| States Involved | Tamil Nadu, Kerala, West Bengal, Karnataka, Jharkhand, Himachal Pradesh, Punjab, Telangana |

| Compensation Demand | Levy proceeds fully go to states; 5-year window; 14% annual growth guarantee |

| Why It Matters | States rely on GST for funding welfare, health, infrastructure |

| Official Resource | GST Council – Ministry of Finance, Government of India |

GST: A Throwback to Its Origins

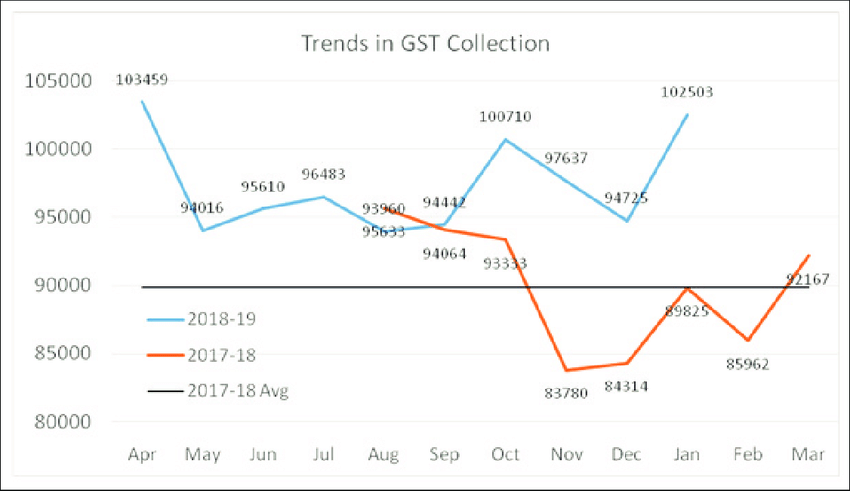

India rolled out GST in July 2017, calling it “One Nation, One Tax.” The old system, where each state had its own taxes (like VAT, octroi, and entry tax), was scrapped. GST replaced all that with a uniform system meant to ease business and increase compliance.

But there was a trade-off: states lost their biggest sources of local tax revenue. To avoid a financial meltdown, the Union government promised a compensation mechanism: states would get 14% annual revenue growth over a base year, funded through a compensation cess on products like cigarettes, coal, and cars.

This worked—for a while. But the five-year compensation window expired in 2022, leaving states scrambling. COVID-19 made things worse, with revenues falling while welfare spending surged.

Why the Current Reform Is So Controversial?

The Union government now wants to simplify GST slabs. Instead of multiple rates (0%, 5%, 12%, 18%, and 28% plus cess), it’s proposing:

- 5% slab for essentials

- 18% slab for most goods/services

- 40% slab for sin and ultra-luxury goods

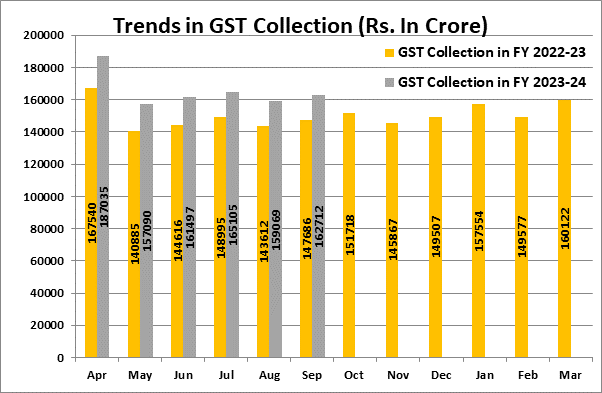

Sounds cleaner, right? But states say this will cost them dearly—about ₹1.5–2 lakh crore per year, or roughly 70–80% of the losses falling on their shoulders.

For example:

- Karnataka expects a 15–20% drop in GST revenues.

- Kerala already reported a ₹21,955 crore shortfall last year, projecting another ₹8,000–10,000 crore gap this year.

That’s like pulling billions out of state budgets—money that pays for teachers, doctors, and basic infrastructure.

Why Focus on Sin and Luxury Goods?

Taxing sin goods (cigarettes, liquor, sugary drinks) and luxury goods (expensive cars, yachts, jewelry) is politically easier than raising taxes on essentials. The logic is simple:

- Health benefit – High cigarette and liquor taxes discourage unhealthy habits.

- Fairness – The wealthy can afford higher luxury taxes.

- Revenue stability – These industries are less price-sensitive, so tax collections remain steady.

Globally, many governments rely on “sin taxes.” In the U.S., for instance, New York charges more than $4 in taxes per pack of cigarettes, funneling the money into healthcare programs.

India’s states are pushing for the same logic: if we need more revenue, let’s get it from the luxury spenders and smokers, not from the poor.

The States’ Demands in Detail

The eight states—Tamil Nadu, Kerala, West Bengal, Karnataka, Jharkhand, Himachal Pradesh, Punjab, and Telangana—have outlined a framework:

- New levy on sin and luxury goods, over and above the 40% GST.

- Full transfer of levy proceeds to states, not the Union.

- Base year: 2024–25, with a 14% guaranteed revenue growth rate.

- Compensation period: at least five years, extendable if state revenues don’t stabilize.

Think of it as a state safety net. Without it, states argue they’ll be forced to cut welfare schemes, halt infrastructure, or borrow more.

Political Angle: Eight States Demand GST Compensation

This is not just an economic debate—it’s political. All eight states pushing for the levy are opposition-ruled. They accuse the Union government of centralizing power and weakening federalism by cutting off state finances.

The upcoming GST Council meeting on September 3–4, 2025, is expected to be heated. States are even holding a pre-meeting on September 2 to finalize their strategy. This echoes past showdowns, like in 2020, when states accused the Union of delaying GST compensation during the pandemic.

If history is any guide, expect walkouts, public statements, and political grandstanding.

How Businesses Could Be Affected?

For businesses, especially those dealing with sin or luxury goods, this is more than background noise. It has real-world consequences:

- Price increases – Companies may need to raise prices to cover higher levies.

- Profit margin pressure – Higher taxes could squeeze margins if costs can’t be fully passed on.

- Compliance complexity – Additional levies mean new filings, audits, and paperwork.

For small businesses and retailers, the biggest challenge will be explaining price hikes to customers without losing them.

Advice for CFOs: Start planning for different tax scenarios. Adjust pricing models early, and communicate clearly with stakeholders.

Consumer Impact: Will You Pay More?

If you’re a smoker, drinker, or luxury shopper—the answer is yes. You’ll feel it immediately in your wallet.

But even if you don’t fall into that category, you’re not completely safe. Taxes on trucks, freight, and hospitality could indirectly raise prices for everyday goods and services.

So while the levy is aimed at sin and luxury, ripple effects may still reach the average household.

Expert Opinions

Economists and policy experts are weighing in:

- M. Govinda Rao, former member of the Finance Commission, says: “Without compensation, state finances are unsustainable. Welfare schemes will collapse.”

- Industry bodies, however, warn that sudden levies could hurt investment: “Uncertainty in tax structures deters foreign investors. A time-bound, transparent framework is key.”

What Happens If the Levy Is Approved—or Rejected?

- If Approved:

- States get temporary financial relief.

- Consumers see higher sin/luxury prices.

- Businesses adjust margins and compliance.

- If Rejected:

- States may slash spending, borrow heavily, or raise their own taxes.

- Welfare programs could suffer.

- The Union-state rift could deepen, straining federal relations.

Either way, the September GST Council meeting will shape India’s fiscal future.

Global Comparison: Beyond the U.S.

Other countries also use sin and luxury taxes:

- Singapore has some of the world’s highest liquor and car taxes to control consumption and congestion.

- Australia imposes strict tobacco excise duties that make cigarettes among the most expensive globally.

- United Kingdom taxes “luxury” items like champagne, tobacco, and gambling, channeling funds into healthcare.

India’s proposed levy would be similar, but with a stronger focus on state-level financial survival.

Practical Advice for Stakeholders

- For Businesses: Run financial simulations. Plan price hikes in a phased manner to reduce customer backlash.

- For Consumers: If you’re eyeing a big-ticket luxury purchase, you may want to buy before the levy kicks in.

- For Policymakers: Transparency is key. Clear communication will build trust and reduce panic.

Lower GST On Household Items – What The Council Is Planning

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

GST Reforms Update — Will Insurance Finally Get Tax Exemption?