GST Cuts Cost Telangana ₹26,900 Crore in 2024-25: The phrase “GST cuts cost Telangana ₹26,900 crore in 2024-25, says Deputy CM” has set off ripples across India’s political and economic circles. Deputy Chief Minister and Finance Minister Mallu Bhatti Vikramarka revealed that the Goods and Services Tax (GST) system left Telangana with nearly ₹27,000 crore less revenue than what it would have earned under the older Value Added Tax (VAT) system. For Telangana—a state that heavily invests in welfare programs—this isn’t just a budgetary concern. It’s about whether schools, hospitals, subsidies, and infrastructure projects can keep running smoothly. To put it in American terms, imagine if a federal policy cut billions from your state’s sales tax collections, leaving little money for highways, Medicaid, or public schools. That’s the situation Telangana is grappling with.

GST Cuts Cost Telangana ₹26,900 Crore in 2024-25

The revelation that GST cuts cost Telangana ₹26,900 crore in 2024-25 is a wake-up call. With welfare-heavy budgets, shrinking revenues, and mounting losses, states like Telangana are demanding fair compensation. The upcoming GST Council meeting will decide whether the federal structure can strike a balance between uniform tax policy and protecting state finances. For policymakers, the message is clear: GST reform is unfinished business. For citizens and businesses, the impact will be felt in taxes, prices, and welfare delivery. The story of Telangana is a reminder that behind every big policy reform are very real consequences for people’s daily lives.

| Point | Details |

|---|---|

| Revenue Shortfall (2024-25) | ₹26,930 crore loss compared to VAT system |

| Projected Additional Loss | ₹7,000 crore annually if GST rates are rationalized |

| Cumulative Loss Since GST Rollout | Approx. ₹80,000 crore |

| GST-to-GSDP Ratio | Dropped from 3.07% (2022-23) to 2.58% (2024-25) |

| Impact on Welfare Spending | Over 80% of revenue tied to welfare schemes |

| Deputy CM’s Call | Seeks federal compensation via cess on sin/luxury goods |

| Official Reference | GST Council Website |

What is GST and Why Was It Introduced?

The Goods and Services Tax (GST) was launched in 2017 with a big promise: “One Nation, One Tax.” It was designed to replace the old system of VAT, service tax, excise duty, and other levies with a single unified tax structure. The goal was to:

- Create a seamless national market,

- Eliminate tax cascading,

- Simplify compliance for businesses,

- Increase transparency in collections.

Initially, the central government promised to compensate states for five years to cover revenue losses from GST. That safety net expired in 2022, and now states like Telangana feel the pinch more than ever.

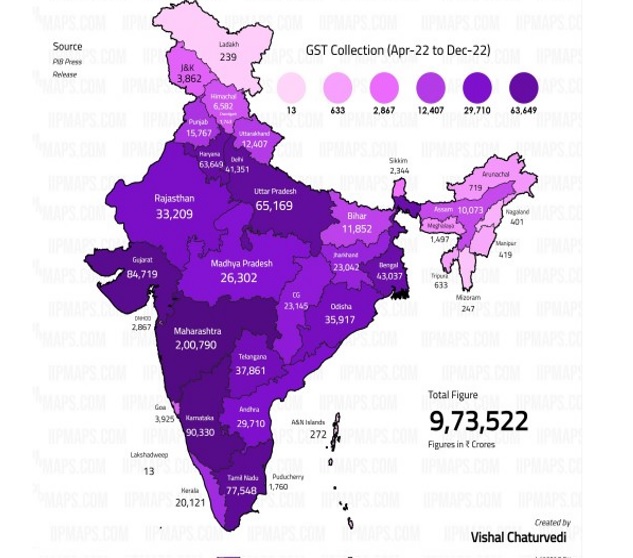

Telangana’s Fiscal Reality: Breaking Down the Numbers

Deputy CM Vikramarka presented a stark financial comparison:

- Under VAT, Telangana would have earned ₹69,373 crore in 2024-25.

- Under GST, the state collected only ₹42,443 crore.

- That’s a ₹26,930 crore shortfall in one year.

On top of that, the proposed GST rate rationalization—which means merging existing tax slabs for simplicity—could further shave off ₹7,000 crore annually from Telangana’s revenue.

And here’s the kicker: since the rollout of GST in 2017, Telangana estimates it has cumulatively lost ₹80,000 crore in revenues compared to what VAT would have fetched.

Why GST Cuts Cost Telangana ₹26,900 Crore in 2024-25?

Let’s break it down in simple terms.

Imagine you run a lemonade stand. Before, you kept all the money you earned from your local sales tax. Then one day, the federal government steps in and says, “We’ll collect the tax for you and give you back your fair share.” Sounds fine, right?

Except over time, you realize the money sent back is way less than what you used to earn. That’s Telangana’s reality under GST.

- Before GST: Telangana had autonomy through VAT.

- After GST: Revenue is pooled and redistributed from the Centre.

- Result: A steady decline in the state’s GST-to-GSDP ratio, which dropped from 3.07% in 2022-23 to 2.58% in 2024-25.

Welfare Commitments: Why This Shortfall Matters

Telangana isn’t just any state—it’s known for ambitious welfare programs like:

- Rythu Bandhu (Farmer Support): Direct income support for farmers,

- KCR Kits and Aarogyasri: Healthcare and maternal support programs,

- 2BHK Housing Scheme: Subsidized housing for low-income families,

- Free Electricity for Farmers.

According to the Deputy CM, over 80% of state revenue is already locked into these welfare commitments. That means:

- There’s little room for new infrastructure projects,

- Debt repayment burdens increase,

- Fiscal stress builds up year after year.

Think of it like living paycheck-to-paycheck. Once rent, groceries, and bills are paid, there’s barely anything left. Telangana’s welfare-heavy budget is in that same bind.

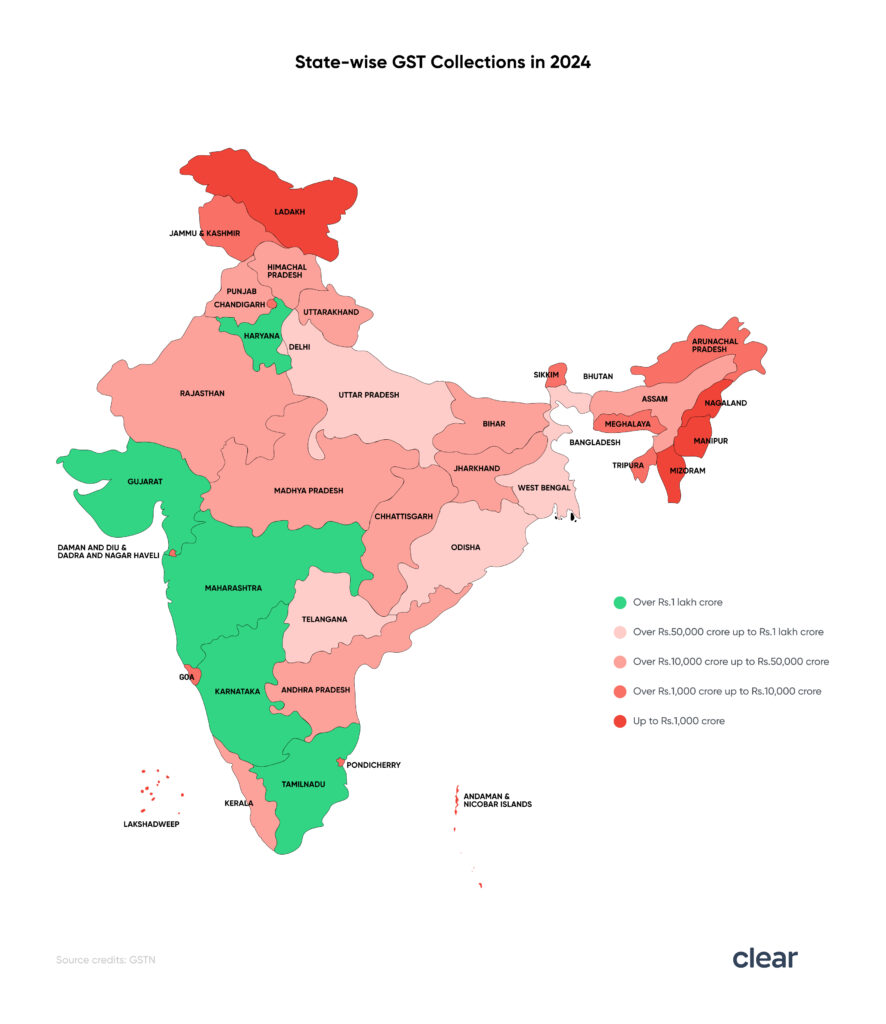

Telangana Isn’t Alone: Other States Speak Up

The GST issue isn’t unique to Telangana. Across India, multiple states are raising red flags:

- Tamil Nadu: CM M.K. Stalin warned that GST reforms must protect state revenues.

- Kerala: Expressed concerns about falling GST-to-GSDP ratios.

- Punjab and Andhra Pradesh: Highlighted fiscal strain due to welfare spending and reduced GST income.

This indicates a systemic challenge with how GST revenues are shared.

Expert Views: What Economists and Analysts Say

- Business Standard reports that many states may have to borrow more heavily to meet expenditure if compensation isn’t provided.

- Economists argue that while GST simplified taxation and boosted compliance, it hasn’t matched the buoyancy of VAT-era revenues for high-growth states.

- Reuters cautioned that ongoing wrangles between Centre and states could delay consumer tax reforms, affecting India’s economic outlook.

U.S. Parallel: Federal vs State Tax Control

To explain this for American readers:

- In the U.S., states independently set sales tax rates. California can charge 7.25%, Texas 6.25%, and so on. That independence means states directly benefit from local economic growth.

- In India post-GST, states ceded this autonomy. Now, all indirect tax goes to a central pool, and states receive a share.

Imagine if Washington told Texas, “We’ll collect your sales tax and decide how much you get back.” Texans wouldn’t stay quiet. Telangana’s frustration is similar.

The Road Ahead: GST Council Meeting

The GST Council meeting on September 3-4, 2025 will be critical. Telangana plans to argue for:

- A compensation mechanism for revenue loss,

- Imposing a cess on luxury and sin goods (alcohol, tobacco, luxury cars) to make up the shortfall,

- Long-term structural safeguards for states.

The outcome could decide whether welfare-heavy states like Telangana can sustain their budgets or face painful cutbacks.

Practical Advice for Stakeholders

For Businesses in Telangana

- Stay alert to GST Council updates—changes in slabs can affect supply chains overnight.

- Expect higher compliance enforcement as the state tries to maximize revenue.

- Budget for possible state-level surcharges if compensation doesn’t come through.

For Citizens

- Welfare schemes may continue but new programs could slow down.

- Expect price increases in alcohol, tobacco, and luxury goods if cess is added.

- Infrastructure spending may take a backseat to welfare commitments.

Step-by-Step Guide to Understanding GST’s Impact

- Understand the Systems: VAT gave states autonomy; GST centralized revenue.

- Look at the Data: Telangana lost ₹26,930 crore in 2024-25.

- Add Cumulative Losses: Nearly ₹80,000 crore gone since 2017.

- Spot the Ratio Drop: GST-to-GSDP fell from 3.07% to 2.58%.

- Project the Future: Another ₹7,000 crore annual hit if rationalization happens.

- Consider the People: Welfare-heavy budgets mean citizens will feel the crunch.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

GST Cuts Could Boost Consumption by ₹2 Lakh Cr – Can Economic Growth Offset Losses?

Retail Sales Take a Hit This Festive Season—Is the Wait for GST Cuts to Blame?

The Bigger Picture: India’s Federal Fiscal Future

The Telangana case isn’t just about one state’s loss. It’s about the structure of India’s federal finances. When states lose fiscal autonomy, it creates tensions that can slow down reforms and weaken public confidence in the system.

For a growing economy like India, balancing central efficiency with state-level autonomy is critical. If not, states may cut welfare or increase borrowing, which can raise debt burdens and slow growth.