Madurai Corporation Hikes Property Tax: The Madurai Corporation has recently rolled out strict measures to reassess and hike property taxes on residential buildings converted to commercial use. The move comes as part of an ongoing citywide initiative to streamline property classifications, boost civic revenue, and ensure tax fairness. If you own a property in Madurai and have converted it into a shop, restaurant, office, or rental space, your tax bill may be heading north. Whether you’re a property owner, tenant, or business operator, understanding the recent updates is crucial to avoid penalties and plan your finances better.

Madurai Corporation Hikes Property Tax

The Madurai Corporation’s property tax reassessment is a significant step toward ensuring fair taxation and boosting civic infrastructure funding. While property owners converting their spaces to commercial use may face higher taxes, this measure will help close tax gaps and improve overall city services. If you’re a property owner, stay informed, update your records, and be proactive. Early action can save you from penalties and unexpected tax burdens.

| Aspect | Details |

|---|---|

| Topic | Madurai Corporation hikes property tax on buildings converted to commercial use |

| Effective From | Ongoing reassessment since mid-2025 |

| Primary Reason | Ensure correct classification, increase revenue, and fix irregularities |

| General Hike | 6% increase in base property tax from Oct 2024 (applies to all) |

| Impact on Commercial Conversions | Higher tax slabs applied when a residential property is used commercially |

| Reassessment Drive | Initiated under Madras High Court monitoring |

| Special Tax Camp | Conducted in August 2025 for property reclassification and clarifications |

| Who’s Affected | Property owners, shopkeepers, business operators, tenants |

| Penalty Risk | Misreporting or hiding property usage can lead to fines |

| Official Website | www.maduraicorporation.co.in |

Why Did Madurai Corporation Hikes Property Tax?

The Madurai Corporation has been under mounting pressure to plug revenue leaks caused by incorrect property tax assessments. Investigations revealed that hundreds of properties were operating businesses while paying residential tax rates.

For example, several multi-story homes had been converted into restaurants, shops, and commercial complexes but were still classified as “residential” on tax records. This resulted in significant losses for the civic body, forcing an urgent need for correction.

Furthermore, the Madras High Court intervened, directing the Corporation to conduct comprehensive reassessments and ensure accurate property categorization. The reassessment now directly affects owners who have converted their homes into commercial properties.

How Property Tax Classification Works in Madurai?

Before we understand the impact, let’s break down how property tax is calculated in Madurai:

1. Residential Property Tax Slabs

- Lower tax rate compared to commercial properties.

- Calculated based on plinth area, location, and guideline value.

- Intended for properties used solely for living purposes.

2. Commercial Property Tax Slabs

- Higher tax slabs are applied because commercial properties generate income.

- Covers shops, restaurants, offices, warehouses, and rental units.

- The tax rate can be 2x to 3x higher than residential tax in certain prime zones.

3. Mixed-Use Properties

- If a property is partly residential and partly commercial, it is taxed proportionately.

- Example: A two-story house where the ground floor operates as a shop and the upper floor is used for living.

This reassessment ensures tax fairness — properties that generate income are taxed accordingly.

Impact on Property Owners and Businesses

If your property was previously classified as residential but is now identified as commercial, you can expect:

- Significant Increase in Tax Bills

Taxes for commercial buildings can be 30% to 150% higher depending on the zone. - Penalty for Misreporting

If you failed to declare your property’s commercial usage, you may face fines. - Revised Bills for Pending Years

In some cases, arrears for previous years may also be collected. - Business Owners Will Face Higher Costs

Shopkeepers and restaurateurs may need to adjust pricing or budgets.

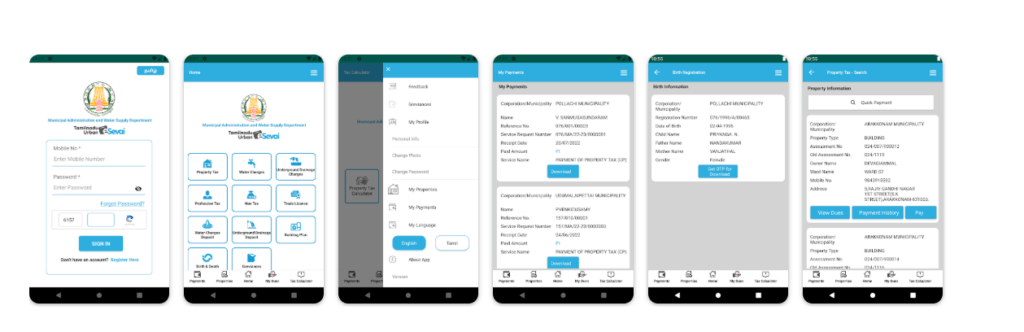

Role of Technology in the Reassessment Drive

One of the biggest game-changers in the Madurai property tax reassessment has been the use of digital mapping and GIS-based surveys. The Madurai Corporation has introduced satellite imaging, drone inspections, and AI-powered mapping tools to accurately identify properties being used commercially.

This advanced technology ensures real-time verification of property size, location, and usage patterns, reducing manual errors and disputes. Property owners can also track their property records online, verify classifications, and even file corrections digitally.

By leveraging these modern tools, the Corporation aims to speed up the reassessment process, bring transparency, and make the system more citizen-friendly. For businesses and homeowners, this means fewer surprises — and a smoother experience while handling property tax-related issues.

Madurai Corporation’s Special Tax Camps

To make the process smoother for residents, the Corporation held special tax-related camps in August 2025.

At these camps, property owners could:

- Reclassify properties from residential to commercial.

- Apply for corrections in tax records.

- Clarify disputes regarding property measurements or assessments.

- Pay pending dues without facing heavy penalties.

These camps were widely attended, signaling that thousands of properties may have been misclassified earlier.

Madras High Court’s Role

The reassessment drive stems directly from an order by the Madras High Court. The court directed Madurai Corporation to:

- Form special reassessment teams.

- Use digital mapping and field inspections to verify property usage.

- Submit periodic reports to ensure transparency and compliance.

This judicial monitoring ensures the process is transparent, accurate, and fair to both citizens and the civic body.

Practical Advice for Property Owners

Here’s what you should do if your property has been converted to commercial use or is under review:

1. Check Your Current Property Classification

- Visit the Madurai Corporation’s official website or the nearest zonal office.

- Verify whether your property is marked as residential, commercial, or mixed-use.

2. Apply for Voluntary Reclassification

- If you’ve converted your property, declare it proactively.

- Voluntary declaration can help reduce penalties.

3. Keep Payment Records Updated

- Always retain payment receipts for property tax to avoid future disputes.

- Pay pending arrears before the due dates.

4. Seek Clarifications at Special Camps

- Attend tax-related camps whenever announced.

- You can discuss disputes and negotiate payment structures in person.

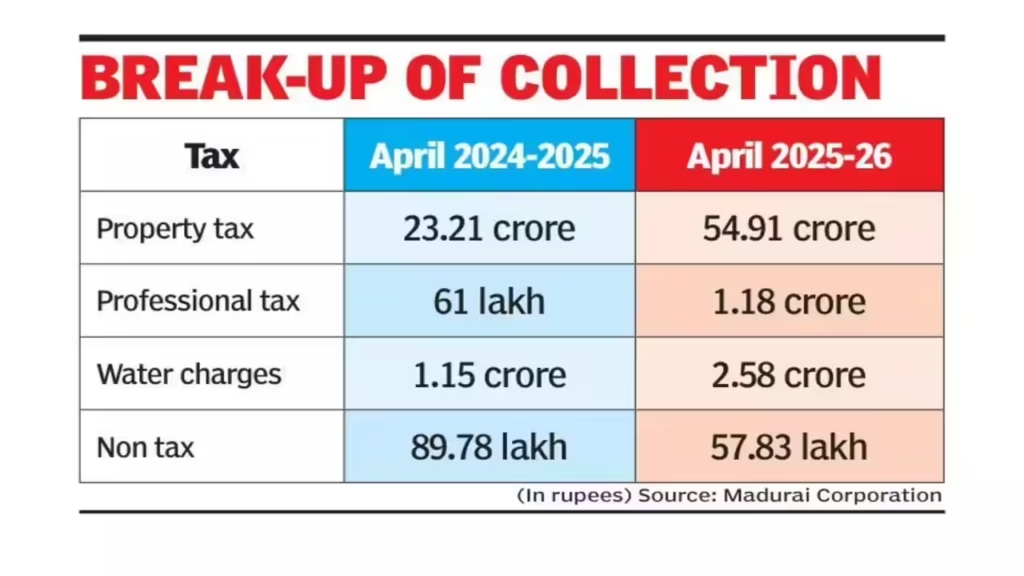

Economic Impact on Madurai

The hike is expected to bring hundreds of crores in additional revenue to Madurai Corporation. This money will be used for:

- Road repairs and maintenance.

- Improved drinking water supply.

- Better waste management systems.

- Enhanced drainage and flood-prevention measures.

While property owners may feel the pinch, citizens stand to benefit from improved civic amenities.

Property Tax Shock? Madurai Corporation Submits Action Plan to High Court

36 Shops Sealed in Indore – Property Tax Non-Payment Crackdown Intensifies

State Tax Assistant Commissioner Caught Taking Bribe — Check Full Details

Common Mistakes to Avoid

Many property owners unknowingly make mistakes that lead to penalties:

- Not updating records after converting a home into a shop.

- Underreporting the plinth area to reduce tax liability.

- Ignoring reassessment notices from the Corporation.

- Missing deadlines for paying revised property tax.

Avoiding these mistakes can save you time, money, and legal trouble.