UK Can Squeeze More From Oil and Gas: The UK can squeeze more from oil and gas with faster tax changes, according to Offshore Energy UK (OEUK), a leading industry lobby group. They argue that if the government replaces the current windfall tax on North Sea producers sooner—say in 2026 instead of 2030—the country could unlock billions in new investment, jobs, and tax revenue. Now, that may sound like a mouthful, but let’s break it down in simple, straight-up terms. Imagine you’ve got a leaking faucet at home. The longer you wait to fix it, the more water you waste—and the higher your bill gets. That’s pretty much the same story here. The UK government’s slow approach could mean missed opportunities, while a faster fix could bring in more energy, more money, and more security for the future.

UK Can Squeeze More From Oil and Gas

The call for faster tax reform in the UK oil and gas sector is more than just a technical policy tweak—it’s about energy security, jobs, and the nation’s economic resilience. Offshore Energy UK’s proposal paints a picture of billions in fresh investment and a slower decline in production. Whether the government listens or not, one thing is clear: the clock is ticking, and waiting too long could cost the UK dearly.

| Point | Details |

|---|---|

| Main Claim | UK could earn 25% more tax revenue from oil & gas by 2050 if windfall levy is replaced earlier. |

| Proposed Timeline | Shift from current windfall tax in 2026 instead of 2030. |

| Investment Boost | Potential £41 billion in new capital investment. |

| Production Impact | Additional 2.5 billion barrels of oil equivalent by 2050. |

| Industry Concern | Current annual production decline at ~11%. |

| Official Source | Offshore Energy UK |

Why Does This Matter?

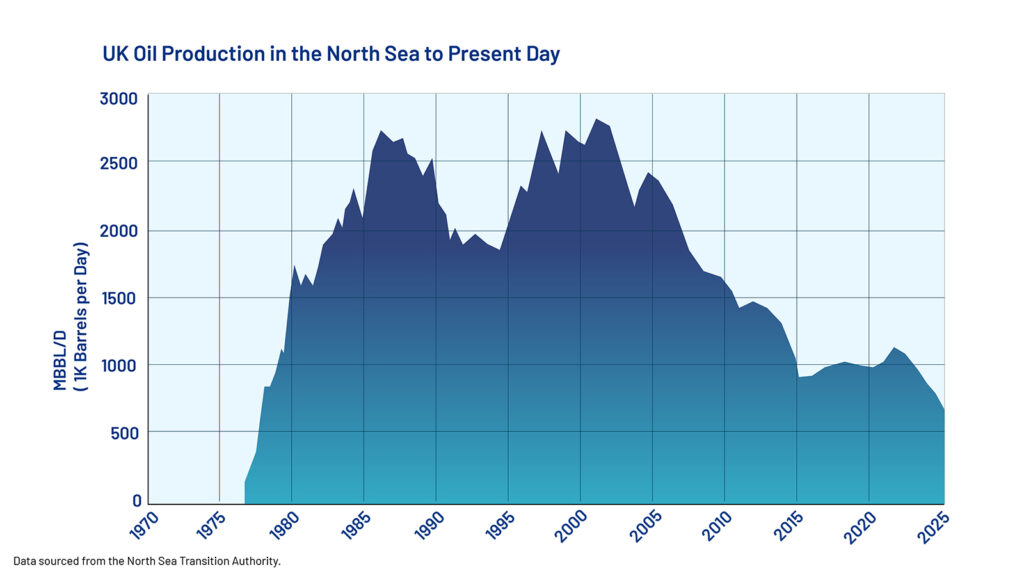

If you’re living in the UK—or anywhere else, really—energy policy affects your daily life. Think gas prices, heating bills, and even job markets. The North Sea has been the UK’s energy backbone for decades, but production is falling fast. Right now, it’s shrinking at a rate of about 11% a year, which is like losing a football field-sized chunk of your backyard every season.

By switching to a price-responsive, profits-based tax regime earlier, OEUK says the government could slow that decline. More importantly, it could preserve the UK’s offshore supply chain, which employs tens of thousands of workers and supports local economies in Scotland, Northern England, and beyond.

A Quick History: Oil, Gas, and Taxes in the UK

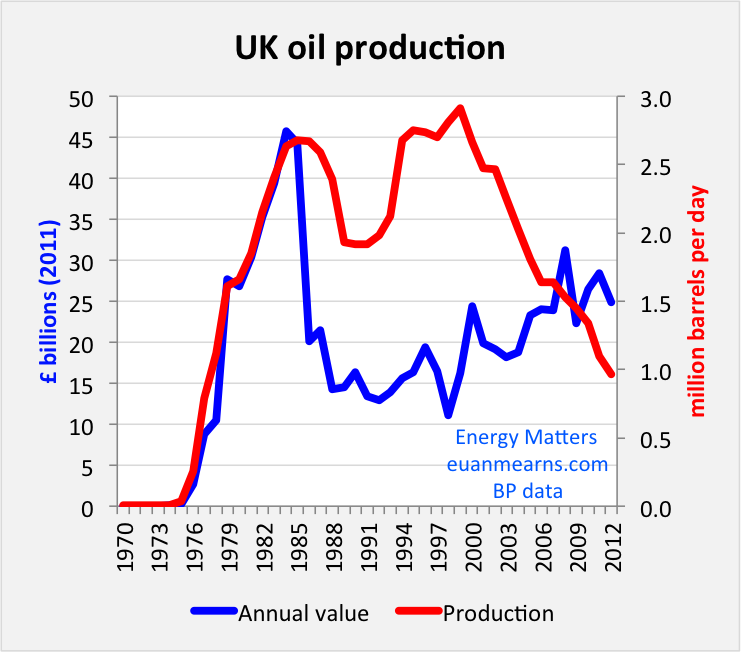

The North Sea oil boom kicked off in the 1970s, turning Scotland into a global energy hub. At its peak in the late 1990s, the UK was producing more than 4.5 million barrels of oil equivalent per day. Today, that figure is closer to 1 million, highlighting how fast production has declined.

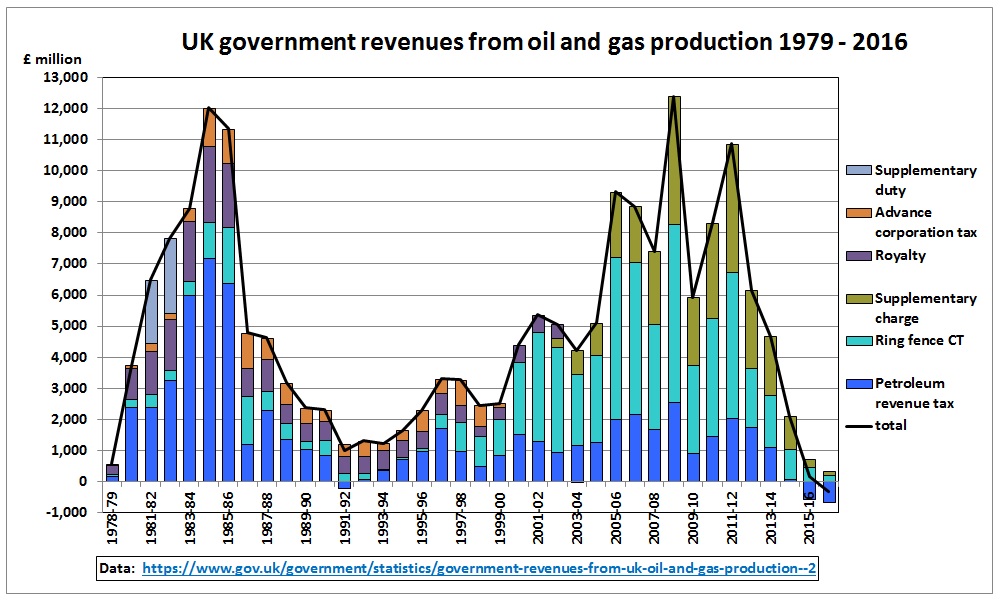

Tax policy has always played a major role:

- 1975: The Petroleum Revenue Tax was introduced to ensure the government captured its share of profits.

- 1980s–2000s: Adjustments reflected boom-and-bust oil cycles.

- 2010s: Tax cuts were used to encourage investment during oil price downturns.

- 2022: The Energy Profits Levy (windfall tax) was introduced after Russia’s invasion of Ukraine sent global energy prices soaring.

This constant back-and-forth has created uncertainty. Investors prefer stability, and frequent tax changes make long-term planning difficult.

Breaking It Down: What’s the Windfall Tax Anyway?

A windfall tax is like when your buddy wins the lottery, and Uncle Sam steps in to take a bigger chunk than usual. It’s designed to grab extra revenue from companies making unusually high profits—like oil and gas producers during the energy price spike.

The UK government imposed this in 2022, starting at 25%, then raised it to 35%. Combined with existing taxes, some companies now face effective tax rates of up to 75% on UK profits. That makes the North Sea one of the highest-taxed oil provinces in the world.

The concern is simple: if companies feel the deck is stacked against them, they’ll take their money elsewhere—to Norway, the US Gulf of Mexico, or even emerging markets like Guyana.

What Could Faster Tax Changes Deliver?

Here’s where the numbers get juicy:

- £41 billion in capital investment unlocked by 2050.

- 2.5 billion extra barrels of oil and gas equivalent (enough to power millions of homes).

- Nearly 25% more tax revenue for the UK government.

These aren’t just abstract figures. Think about what £41 billion could do—it could fund new schools, hospitals, and infrastructure projects while also keeping lights on across the nation. It also means energy independence—less reliance on imports from volatile regions.

A Step-By-Step Guide: How It Could Play Out

- 2026: Early Policy Switch

- Government replaces the windfall tax with a fairer, profits-based regime.

- Investors breathe easier, knowing the rules of the game won’t keep changing.

- 2027–2035: Investment Surge

- Oil and gas firms pour billions into new drilling and production.

- Jobs boom across Scotland, Northern England, and offshore hubs.

- 2036–2050: Steadier Production

- Decline in output slows, ensuring more domestic energy security.

- The UK collects more steady, long-term tax revenue instead of short bursts.

How Do Other Countries Handle UK Can Squeeze More From Oil and Gas?

- Norway: Norway taxes oil profits heavily (78%) but provides stability and reinvests revenues into its sovereign wealth fund, now worth over $1.6 trillion. Investors know the system won’t shift overnight.

- USA: The shale boom was fueled by predictable tax regimes and state incentives. Texas, for example, uses severance taxes to fund schools. Investors trust the stability.

- Canada: Provinces like Alberta rely on oil royalties but face challenges when prices crash, highlighting the need for diversification.

Compared to these systems, the UK looks unpredictable—companies don’t know if taxes will rise, fall, or be rewritten every few years.

Regional Impact: Scotland and Beyond

Most North Sea operations are tied to Aberdeen and the Scottish economy. The region employs over 200,000 people directly and indirectly in oil and gas. If investment dries up:

- Jobs disappear.

- Local businesses (from catering to logistics) struggle.

- Communities dependent on oil and gas face decline.

But with faster tax reform:

- Aberdeen could see job growth instead of layoffs.

- Northern ports could expand.

- Supply chain companies—from welding to robotics—could thrive.

The Debate: Industry vs. Environmental Voices

- Industry view (OEUK): Faster tax changes = more investment, jobs, and energy security. Without it, production falls faster, and the UK imports more energy from abroad.

- Environmental groups: More drilling = more emissions. They argue the UK should double down on renewables instead.

Critics point to the UK’s Net Zero 2050 target and say new drilling sends the wrong message. Supporters counter that the transition must be managed, not rushed, and that oil and gas will still play a role for decades.

The Investor Perspective

Markets hate uncertainty. When governments change tax rules mid-game, companies cut back. Some North Sea producers, including majors like Shell and BP, have already delayed or canceled projects, citing the windfall tax as a factor.

If the government signals stability, however, capital will flow back in. Investors want to know that if they sink billions into drilling a new field, they won’t face a surprise tax grab halfway through.

Practical Advice: What This Means for You

- For professionals: Engineers, finance experts, and project managers should watch North Sea opportunities—faster tax reform could mean a surge in hiring.

- For everyday folks: More stable domestic energy production could mean fewer wild price swings, helping with household budgets.

- For policymakers: Think long game. Use oil & gas wisely, but reinvest profits into cleaner energy for future generations.

New £40,000 Pension Rule Could Hit Every UK Household; Here’s What You Need to Know

GST Shake-Up May Cushion Trump’s Tariff Blow, Report Suggests

Jefferies Sees Auto Boom Ahead: GST Cuts Could Supercharge M&M, Maruti, and Hero Moto