Is Your Income Tax Refund Stuck: If you’ve ever thought, “Is my income tax refund stuck again?” you’re not alone. Each year, millions of Americans file their tax returns hoping for that much-anticipated refund check or direct deposit. For many households, this refund is more than just extra money—it’s a critical part of their financial planning. Yet sometimes, the refund doesn’t arrive on time. Instead of showing up in your bank account within weeks, it lingers in IRS limbo. The truth is, refund delays are more common than you think. And while the IRS doesn’t send out apology texts, there are usually clear, predictable reasons behind the wait. Understanding these reasons—and knowing what steps to take—can make the difference between weeks of anxiety and a smooth, stress-free process.

Is Your Income Tax Refund Stuck

Waiting for your tax refund can be frustrating, but it doesn’t have to be a mystery. The five main causes—errors, credit-related holds, identity theft, debt offsets, and paper filing—cover most situations. By filing electronically, double-checking your return, and staying on top of IRS communications, you can minimize delays. A refund isn’t just “extra money.” For millions of households, it’s the difference between getting ahead and falling behind. Stay informed, be proactive, and next tax season could feel a lot less stressful.

| Point | Details |

|---|---|

| Top Reasons for Delays | Errors on returns, mismatched info, missing forms, or IRS backlogs. |

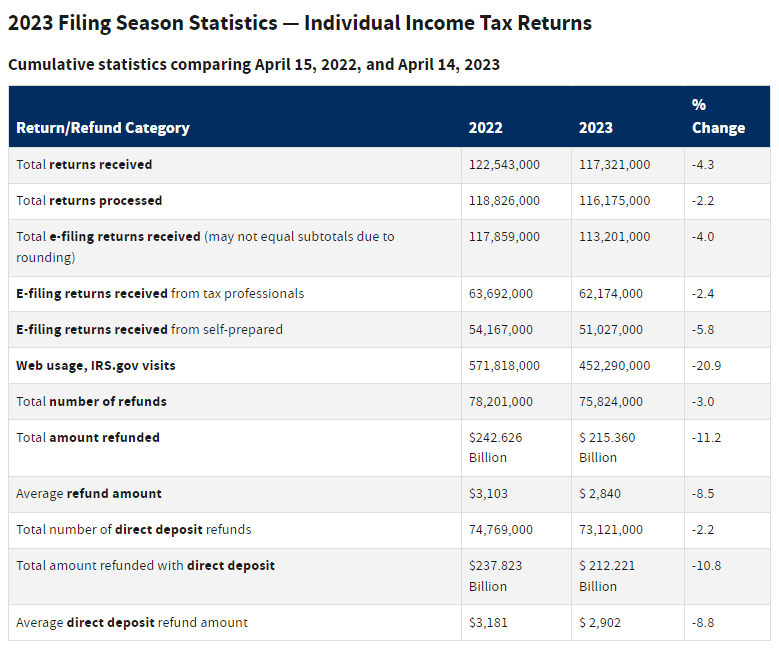

| Average Refund (2024) | $3,011. |

| Typical Timeline | 9 in 10 refunds issued within 21 days (e-file + direct deposit). |

| Special Holdups | Refunds with Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) delayed until mid-February by law. |

| Offset Programs | Refund may be reduced for unpaid taxes, child support, or loans. |

| IRS Tracking Tool | Where’s My Refund? – IRS |

Why Tax Refunds Matter?

For many Americans, a tax refund is more than a bonus—it’s a financial safety net. According to IRS statistics, the average refund for the 2024 filing season was over $3,000. That’s enough to pay down credit card debt, cover two months of rent, or put a down payment on a used car.

A 2024 Bankrate survey revealed that nearly 44% of U.S. adults depend on refunds for major expenses, from groceries and bills to emergency savings. With household budgets already stretched thin by inflation, waiting on that refund can feel like waiting for rain in the desert.

1. Errors or Incomplete Returns

Your tax return is like a puzzle, and the IRS needs every piece to fit perfectly. When there’s an error—whether it’s a typo, a missing form, or a math mistake—your return gets kicked out of the automated system for manual review. That means delays.

Common mistakes include:

- Entering the wrong Social Security Number

- Forgetting to sign a paper return

- Misreporting income from W-2s or 1099s

- Incorrectly claiming dependents

In 2023, the IRS flagged more than 6 million returns for errors or identity verification issues. These delays can add weeks, sometimes months, to refund processing.

The good news? Most of these errors are avoidable. Tax software like TurboTax or H&R Block automatically checks for inconsistencies, reducing the chance of mistakes.

2. Credits That Require Extra Scrutiny

Tax credits like the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) can significantly boost your refund, but they also invite extra scrutiny. By law, the IRS cannot issue refunds that include these credits until mid-February—even if you filed on opening day.

This delay comes from the PATH Act of 2015, designed to prevent fraud. Since credits like EITC are refundable (meaning they can generate a refund even if you owe no tax), they’re often targeted by scammers.

Example: Sarah, a single mother in Texas, filed her return on January 20. Despite filing early, she didn’t see her refund until February 28 because she claimed the EITC.

Planning ahead is key here. If you know your refund will include these credits, adjust your budget so you’re not caught off guard in February.

3. Identity Theft or Security Flags

Tax-related identity theft has become a growing problem. Criminals use stolen Social Security Numbers to file fake returns and claim refunds. When the IRS suspects something unusual, it freezes the refund until you verify your identity.

If you get a notice like Letter 5071C or 4883C, it means the IRS needs you to confirm your identity online or by phone. Until you do, your refund will remain on hold.

The IRS reported that it stopped 1.1 million fraudulent returns in 2022, saving more than $6 billion.

To protect yourself, sign up for an Identity Protection PIN (IP PIN) at IRS.gov. This six-digit code prevents anyone else from filing a return using your SSN.

4. Refund Offsets for Debts

Sometimes your refund doesn’t show up because it’s been applied to debts you owe through the Treasury Offset Program (TOP). These debts can include:

- Past-due federal or state income taxes

- Defaulted federal student loans

- Overdue child support

- Certain unemployment overpayments

For example, John in Ohio expected a $2,500 refund. Instead, he received $1,300 because $1,200 was applied to his defaulted student loan.

If your refund is offset, you’ll receive a notice explaining where the money went. To check if you’re at risk, call the Treasury Offset Program at 1-800-304-3107.

5. Paper Returns, Backlogs, or IRS System Issues

If you’re still filing a paper return, prepare to wait. Paper returns typically take at least 6 weeks to process, and during periods of backlog, that timeline can stretch much longer.

During the COVID-19 pandemic, the IRS was swamped with a backlog of over 10 million returns. While things have improved, staffing shortages and system updates mean delays can still occur.

According to the IRS Data Book, 92% of taxpayers filed electronically in 2023. Those who e-filed and used direct deposit typically saw their refunds within three weeks.

The lesson? E-file whenever possible and opt for direct deposit. It’s faster, safer, and less prone to error.

What To Do If Your Income Tax Refund Stuck?

If your refund hasn’t arrived, don’t panic. Here’s a step-by-step plan:

Step 1: Use the “Where’s My Refund?” Tool

Head to IRS.gov/refunds, enter your Social Security Number, filing status, and refund amount. The tool updates once daily.

Step 2: Respond to IRS Notices Immediately

If you get a letter, take it seriously. Ignoring it only leads to longer delays.

Step 3: Double-Check Your Bank Account Info

Refunds can bounce if your account number or routing number is incorrect. Always confirm before filing.

Step 4: Call the IRS (and Be Patient)

You can reach the IRS at 1-800-829-1040, but expect long wait times. Early mornings mid-week tend to be best.

Step 5: Contact the Taxpayer Advocate Service

If your refund has been delayed for over 60 days without explanation, reach out to the Taxpayer Advocate Service. They provide free, independent help.

Special Cases: Freelancers and Small Business Owners

If you’re self-employed, you may face unique challenges. Returns with Schedule C income, multiple 1099s, or complex deductions are more likely to be flagged for review. The IRS wants to ensure you’re reporting income accurately and not inflating deductions.

Freelancers and gig workers should keep detailed records and reconcile all 1099 forms with their actual deposits. Even small mismatches can trigger delays.

Preventive Checklist for Next Year

- File early (but wait until all your documents arrive).

- Always e-file and choose direct deposit.

- Double-check Social Security Numbers for yourself and dependents.

- Match reported income with W-2s and 1099s.

- Keep copies of any IRS notices.

- If you’re self-employed, consider hiring a tax professional.

Big Tax Bill Update – Child Tax Credit Changes Every Family Should Know About

India Fires Back at Trump’s 50% Tariffs With GST Cuts and Bold Reforms – Here’s the Game Plan

Not Just About Russia: US Treasury Signals Strategic India-US Partnership on Horizon