Hotel Rooms, Casinos, and Services Face 12%–28% GST Rates: When you’re booking a hotel stay, enjoying a fine dinner, or trying your luck at a casino, there’s one thing you can’t avoid—taxes. In India, these charges fall under the Goods and Services Tax (GST), a unified indirect tax system that touches almost every purchase and service. As of now, hotel rooms, casinos, and related services fall into GST slabs of 12% to 28%, making them some of the most heavily taxed services. And the situation could soon change, as the GST Council is actively reviewing whether to simplify the system, reduce burdens, or increase certain levies. This article dives deep into the subject—offering history, current rules, examples, and a look ahead.

Hotel Rooms, Casinos, and Services Face 12%–28% GST Rates

Currently, hotel rooms, casinos, and services in India face 12%–28% GST, with luxury categories taxed highest. These rates have far-reaching impacts on tourism, hospitality, and consumer behavior. As policymakers debate scrapping slabs and possibly introducing a new 40% category, the stakes are high for both businesses and travelers. The future could mean cheaper mid-range travel but pricier casinos. One thing’s clear: GST remains at the heart of India’s tourism economy, shaping how people spend, travel, and enjoy leisure.

| Category | Current GST Rate | Key Notes |

|---|---|---|

| Hotel Room (< ₹1,000 tariff) | 0% | Exempt (tourism.gov.in) |

| Hotel Room (₹1,000–₹2,499) | 12% | Budget & mid-range stays |

| Hotel Room (₹2,500–₹7,499) | 18% | Premium hotels |

| Hotel Room (≥ ₹7,500) | 28% | Luxury hotels & resorts |

| Casino / Gambling Services | 28% | New 40% sin slab under discussion |

| Restaurants (non-AC) | 12% | Small eateries |

| AC or Liquor Restaurants | 18% | Upscale dining |

| Outdoor Catering | 18% | Events & weddings |

| Air Travel (Economy) | 5% | Affordable air travel |

| Air Travel (Business Class) | 12% | Premium tickets |

What Is GST and Why It Matters?

GST (Goods and Services Tax) was introduced in India in July 2017 to simplify a tangled web of indirect taxes. Before GST, hotels could face luxury tax, service tax, VAT, and additional local cesses. Casinos and amusement parks were taxed differently across states, creating confusion.

GST aimed to solve this by creating a nationwide system where services are taxed under slabs: 0%, 5%, 12%, 18%, and 28%. For the hospitality and entertainment industries, it replaced multiple state-level levies with a single charge—making compliance easier but bills often higher.

Historical Context: Pre-GST Days

- Hotels: A hotel in Delhi could be taxed differently from one in Goa. Travelers often complained about hidden charges, with combined taxes going above 20%.

- Casinos: Goa, Sikkim, and Daman had their own state-level gambling taxes. Enforcement was patchy, leading to revenue leakage.

- Restaurants: Diners faced VAT and service tax separately, making bills complex to read.

When GST came in, the government grouped these services into higher slabs, citing them as luxury consumption. The move was praised for uniformity but criticized for being too harsh on mid-range tourism.

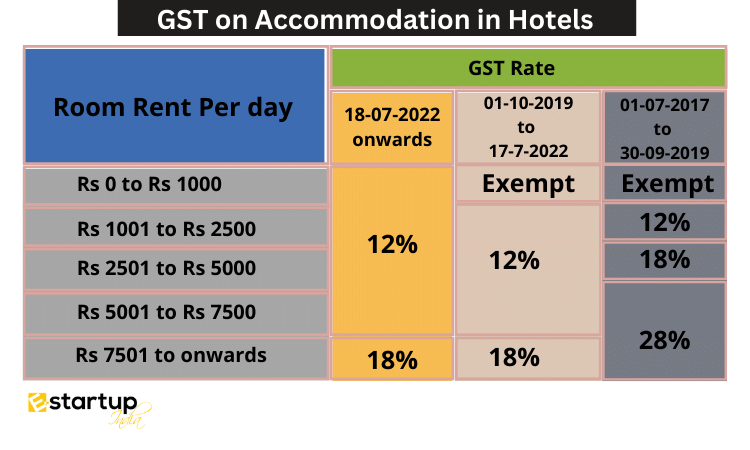

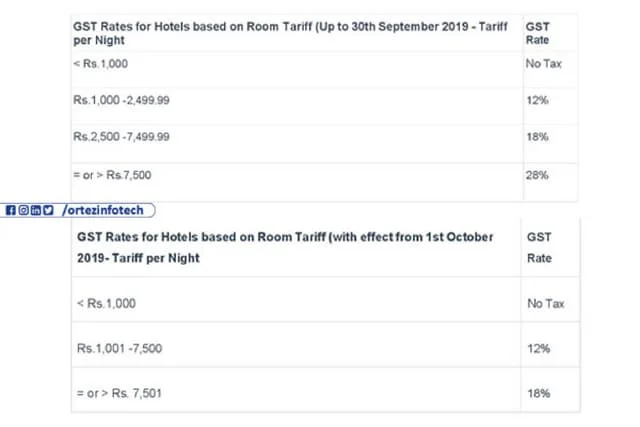

Breakdown of Hotel Rooms, Casinos, and Services Face 12%–28% GST Rates

GST on hotels depends not on what you actually pay but on the declared tariff.

- Rooms under ₹1,000 tariff → 0% GST.

- ₹1,000 to ₹2,499 → 12% GST.

- ₹2,500 to ₹7,499 → 18% GST.

- ₹7,500 and above → 28% GST.

Example: A ₹10,000 per night room offered at a discount of ₹6,000 still attracts GST at 28%, because the declared tariff is above ₹7,500. This often surprises customers, especially international travelers used to “final price” billing.

Casinos and Gambling Under GST

Casinos are taxed at the 28% slab, equal to the luxury hotel tier. But policymakers argue that gambling and betting should be treated like alcohol or tobacco—services that carry social risks.

This is why the GST Council is considering a new 40% sin slab. Proponents say it deters excessive gambling while boosting government revenue. Critics, including casino operators in Goa and Sikkim, argue that higher rates will push players to illegal markets and hurt tourism.

Globally, India’s casino tax rate is among the highest. In Nevada, USA, casino gaming revenue faces a 6.75% state tax. Singapore charges a casino entry fee for locals but keeps GST moderate. India’s 28–40% regime makes legal gambling comparatively expensive.

Restaurants, Catering, and Food Services

Restaurants fall into two main categories:

- Non-AC restaurants, no liquor: 12% GST

- AC or liquor-serving restaurants: 18% GST

Outdoor catering, which is big for weddings and corporate events, is also taxed at 18%. For businesses, this means event budgets must factor in substantial GST.

Air Travel Under GST

Air tickets are treated more lightly:

- Economy class → 5% GST

- Business class → 12% GST

The rationale is that air travel should remain accessible for the general public while premium travel can absorb higher taxation.

Industry Response

- Hotels: Associations like the Federation of Hotel & Restaurant Associations of India (FHRAI) have lobbied for reduced GST, especially on mid-range hotels. They argue India loses international tourists to countries with lower hotel tax rates.

- Casinos: Operators in Goa warn that a 40% GST would “cripple” the legal industry. They emphasize that casinos employ thousands and support tourism-driven local economies.

- Restaurants: Many restaurateurs welcome GST for simplifying compliance but say slabs should be rationalized to avoid penalizing AC dining disproportionately.

Consumer Psychology: How GST Shapes Behavior

Taxes influence how people spend. High GST slabs on luxury hotels encourage some travelers to downgrade to mid-range stays. Others shift to platforms offering bundled packages with inclusive pricing. Casinos, facing high GST, may see reduced participation or shorter visits.

For professionals, understanding these behaviors helps plan business strategies. For example, hotels often create “GST-absorbed” packages where they include the tax in the price to make billing smoother for customers.

Global Comparisons

- USA: No GST. States levy hotel occupancy taxes (NYC ~14.75%). Casino taxes vary, but Nevada’s is 6.75%.

- European Union: VAT rates on hotels average 10%.

- Singapore: Hotels & dining taxed at 9%, but locals pay a flat casino entry levy.

- India: With 28% on luxury hotels and casinos, India is among the highest globally.

This positioning makes India less competitive for high-end global tourists, especially when neighboring countries like Thailand and Malaysia keep hospitality taxes lower.

Economic Impact

Tourism accounts for 9.2% of India’s GDP and supports over 42 million jobs (World Travel & Tourism Council). High GST slabs risk discouraging spending.

Example: A family booking three ₹8,000 rooms for two nights:

- Under 28% GST, bill = ₹1,34,400.

- Under 18% GST, bill = ₹1,18,080.

- Savings = ₹16,320, which could be spent on dining, shopping, or sightseeing—further fueling the economy.

Future Outlook

The GST Council is discussing:

- Merging slabs → Scrapping 12% and 28%, keeping only 5% and 18%.

- Adding a 40% slab → For casinos and other sin goods.

If approved, mid-range hotels and dining may become cheaper, boosting tourism. Casinos, however, could face higher burdens. The outcome will depend on balancing revenue needs with economic growth.

Practical Advice

For Travelers:

- Check declared tariffs before booking hotels.

- Watch for “GST inclusive” deals to avoid surprises.

- Factor GST into event and wedding budgets.

For Businesses:

- Clearly display tariffs with GST.

- Reconsider pricing strategies if slabs change.

- Stay updated via GST Council notifications.

Lower GST On Household Items – What The Council Is Planning

GST Council To Hold Two-Day Meeting From September 3 – Key Decisions Ahead

Tracking GST on Foreign OIDAR Services? Supreme Court Says “Let the Council Decide”