Festive Sales Hit Hard by GST Uncertainty: When we talk about the festive season in India, we’re not just talking about lights, sweets, and celebrations—we’re also talking about one of the biggest shopping booms of the year. But this time around, things are hitting a road bump. Festive sales hit hard by GST uncertainty is the headline across industries, and it’s sending shivers down the spines of retailers, automakers, and e-commerce sellers alike. The buzz? Nobody wants to make big purchases without knowing how the Goods and Services Tax (GST) is going to shake out. Will the new rates make cars, gadgets, and appliances cheaper, or will buyers end up overpaying if they pull the trigger too early? That’s the million-dollar (or should we say, million-rupee) question.

Festive Sales Hit Hard by GST Uncertainty

The headline—“Festive Sales Hit Hard by GST Uncertainty — Retailers and Automakers Brace for Impact”—sums it up perfectly. This festive season, it’s not just about fairy lights and fireworks; it’s about financial decisions influenced by policy shifts. While shoppers are pausing, retailers and automakers are bracing. The good news? Once GST rates are clarified, India’s festive buying spree could come roaring back, stronger than ever.

| Category | Key Data & Facts |

|---|---|

| Retail Sales Impact | Retailers report up to 15% drop in pre-festive shopping due to GST rate confusion |

| Automakers | Vehicle purchases delayed, dealers see 10% potential price drop post-GST adjustment |

| E-commerce | Platforms like Amazon/Flipkart facing billing and compliance issues during GST transition |

| Consumer Behavior | Big-ticket items (cars, electronics, appliances) seeing sharp slowdown as buyers adopt wait-and-watch |

| Timeline | GST Council meeting set for September 3–4, rate clarity expected before Navratri (Sept 22) |

| Official Reference | Government of India – GST Council |

Why the Festive Season Matters So Much?

The period from Ganesh Chaturthi to Diwali is like the Super Bowl of shopping in India. Families save up all year to splurge on cars, gold, smartphones, furniture—you name it. According to industry estimates, festive sales usually contribute up to 30–35% of annual revenue for retailers and automakers.

This year, however, uncertainty around GST reforms is making both businesses and buyers slam on the brakes. The government is expected to announce revised GST slabs in early September, but until that’s official, wallets are staying zipped.

Think of it this way: imagine being at a Black Friday sale in the U.S., but someone tells you, “Hey, if you just wait two weeks, prices might drop another 10%.” Would you rush to buy? Or would you wait? Exactly.

Historical Context: We’ve Been Here Before

This isn’t the first time GST has made waves. Back in 2017, when GST was first rolled out, retailers reported a 12–15% dip in sales during the adjustment phase. Consumers held back purchases until tax slabs became clearer.

That experience set a precedent. Every time major tax or duty changes are hinted at, Indian consumers tend to adopt a wait-and-watch strategy. With 2025’s festive season overlapping with the Shraddh period, retailers already face a shortened sales window. This combination is making the impact even sharper than in 2017.

The Domino Effect: Who’s Affected and How

Retailers

Local shops and big-box outlets alike are struggling to predict demand. Many are reporting double-digit dips in foot traffic compared to last year. Popular items like refrigerators, washing machines, and high-end smartphones are sitting on shelves longer than expected. Some malls in Delhi and Mumbai reported sales being 20% lower in August compared to 2024’s pre-festive period.

Automakers

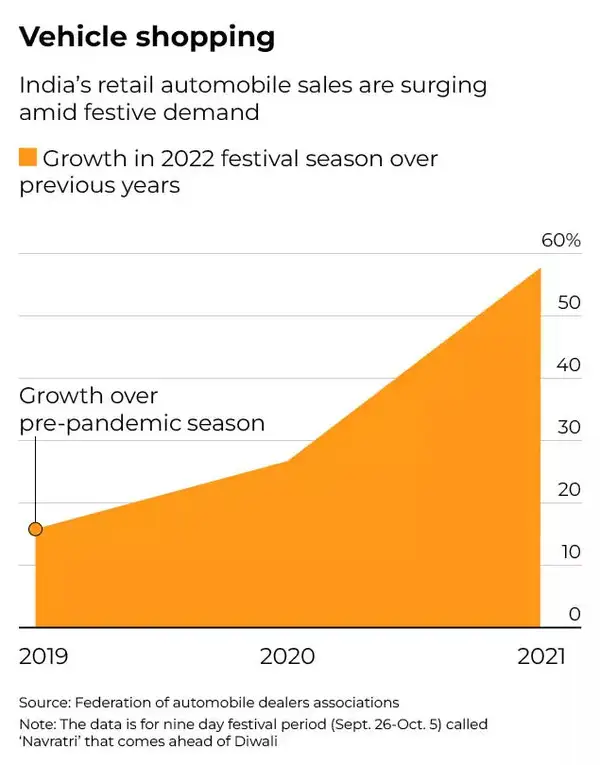

This is where the hit feels strongest. Auto dealers say buyers are delaying purchases in hopes of a GST-led price cut, which could shave as much as ₹1–2 lakh ($1,200–$2,500) off certain vehicles.

Luxury automakers like BMW, Audi, and Mercedes-Benz are also pressing the government for clarity, because their festive quarter typically brings in 40% of annual sales. Entry-level cars are also affected. Dealers are cautious about stocking inventory, preferring to wait until GST slabs are finalized.

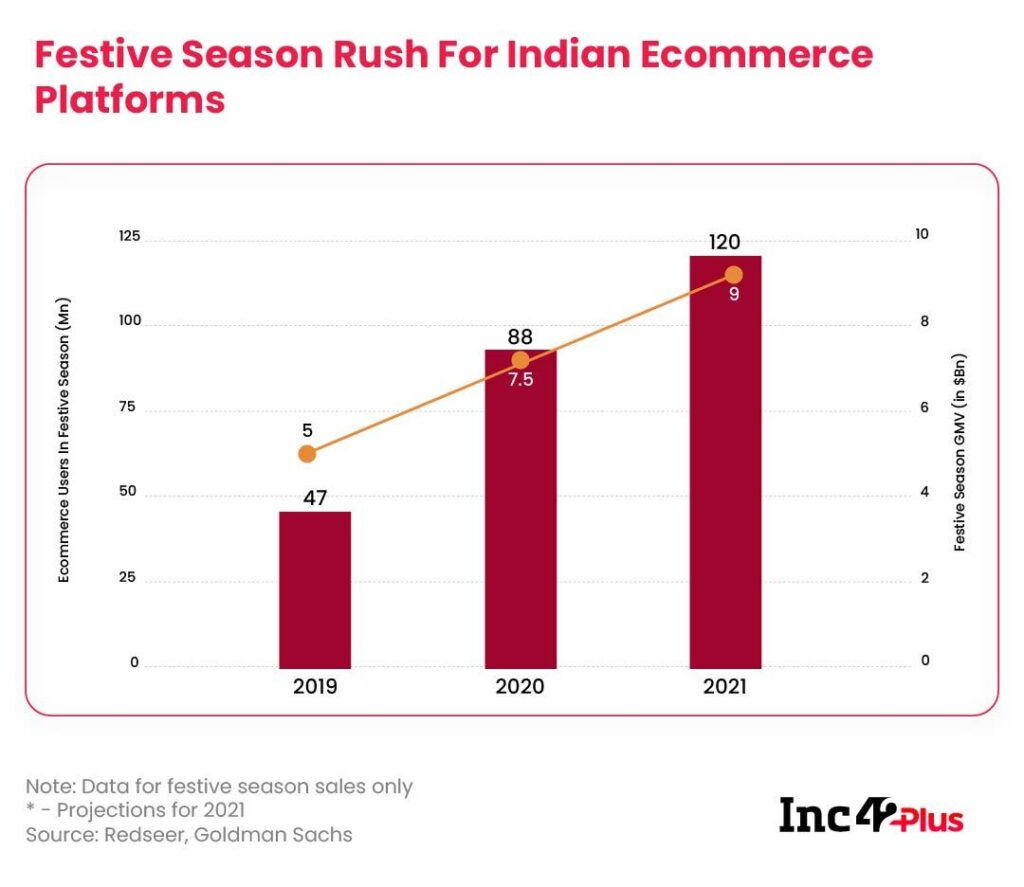

E-commerce Players

Platforms like Amazon India and Flipkart are gearing up for their mega sales events, but sellers on these platforms are stressed. The GST rejig means rewriting invoices, adjusting tax credits, and avoiding compliance slip-ups.

One seller explained that a single misstep in invoicing could lead to penalties or canceled orders, which during the high-demand festive period can spiral into major losses.

Expert Take: Voices from the Ground

Industry analyst Ramesh Krishnan told the Economic Times: “Consumers are extremely price-sensitive in India. Even a 5% drop in GST can swing buying decisions dramatically. The government must act quickly to avoid missing the festive sales window.”

Automotive dealer associations have urged the government to shorten the time between the GST Council meeting (Sept 3–4) and the official notification of rate changes. They argue that even a two-week delay could cost them millions in lost festive sales.

Retail consultants also note that smaller mom-and-pop stores, which depend heavily on festive demand, will be hit the hardest if clarity comes too late.

Regional and Global Insights

- Tier-1 Cities (Delhi, Mumbai, Bengaluru): High-value items like cars, large appliances, and luxury products are seeing the biggest slowdown.

- Tier-2 & Tier-3 Cities: Consumers are cautious but still making smaller purchases such as clothing, cosmetics, and gadgets under ₹20,000.

- Rural Areas: Less affected in terms of GST sensitivity but impacted by slower financing approvals.

Globally, this situation is not unique. In the U.S., when sales tax holidays are announced, shoppers deliberately delay purchases to maximize savings. Similarly, in China’s Singles’ Day sales, consumers hold off until official discount announcements drop. India’s GST uncertainty is creating the same type of pause before the buying frenzy begins.

Why Are Shoppers Holding Back?

It all comes down to three simple reasons:

- Price Sensitivity

Indian consumers are famously value-conscious. A potential 10% drop in GST on vehicles or electronics is enough to make families hit pause. - Shraddh Period

The overlap with the Shraddh period (Sept 17–21), considered inauspicious for shopping, adds another reason to wait until Navratri (Sept 22) and beyond. - Wait-and-Watch Mentality

With headlines blasting “GST changes incoming,” consumers feel it’s smarter to hold out. It’s like waiting for that iPhone price cut after Apple launches the new model—logic wins over impulse.

Practical Advice for Consumers on Festive Sales Hit Hard by GST Uncertainty

If you’re in the market for big purchases this festive season, here’s a handy breakdown:

For Shoppers

- Hold off if you can. If your need isn’t urgent, wait until after the GST Council meeting (Sept 3–4).

- Do your math. A ₹1.2 lakh smartphone could get cheaper by ₹10–15k. That’s worth waiting a few weeks for.

- Check official sources.

For Car Buyers

- Ask dealers about pre-booking options. Some automakers are offering to lock current prices but adjust if GST drops.

- Look out for financing deals. Banks and NBFCs may sweeten offers post-GST to boost lending.

- Don’t rush to register. Some buyers are choosing to book cars now but delay registration until the new rates are confirmed.

For Retail Bargain Hunters

- Watch for early-bird sales. Retailers may roll out “GST-proof” discounts to keep cash registers ringing.

- E-commerce mega sales. Flipkart’s “Big Billion Days” and Amazon’s “Great Indian Festival” could still offer killer deals.

Professional Tips for Businesses

If you’re in retail or auto sales, here’s how to adapt:

- Educate your customers. Communicate clearly about GST impacts. Transparency builds loyalty.

- Stay compliant. Upgrade billing software for seamless GST invoicing.

- Stock wisely. Focus on essentials and avoid overloading high-ticket items until clarity comes.

- Offer flexibility. Consider providing refund or adjustment policies if GST rates drop post-purchase.

The Bigger Picture

The festive season slowdown isn’t just about numbers—it’s about sentiment. In India, buying a car, jewelry, or a major appliance during Diwali isn’t just a purchase; it’s tradition. But traditions are now clashing with tax policy.

Experts believe this is just a short-term hiccup. Once clarity arrives, sales could rebound sharply. Analysts predict a 15–20% surge in e-commerce sales post-GST, as buyers rush to make up for lost time. Auto sales are also expected to recover, especially if GST relief extends to mid-range and luxury vehicles.

Lower GST On Household Items – What The Council Is Planning

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

Tracking GST on Foreign OIDAR Services? Supreme Court Says “Let the Council Decide”