Fake Invoice Scam: When you hear about a fake invoice scam, you might imagine some shady paperwork in a back office. But the truth is much bigger. Recently, the Directorate General of GST Intelligence (DGGI) uncovered a fake invoice racket worth ₹145 crore, which led to a jaw-dropping ₹43 crore in GST evasion. That’s not just money missing from the government’s pocket. It’s taxpayer money—yours, mine, and ours—that should have gone into building roads, improving schools, funding healthcare, and supporting growth. If you think scams like these don’t touch your life, think again.

Fake Invoice Scam

The ₹43 crore GST evasion scam is more than just a headline. It’s a wake-up call for governments, businesses, and citizens alike. Fraud like this chips away at trust, weakens the economy, and burdens taxpayers. The good news? With tighter systems, smarter technology, and stronger awareness, such scams can be caught and prevented. Whether you’re a small shop owner in Bengaluru or a corporate executive in New York, the lesson is clear: compliance and vigilance are non-negotiable.

| Detail | Information |

|---|---|

| Scam Value | Fake GST invoices worth ₹145 crore |

| Tax Evasion Detected | ₹43 crore |

| Agency Involved | Directorate General of GST Intelligence (DGGI), Belagavi Zonal Unit |

| Modus Operandi | Fake GST registrations, shell companies, forged Aadhaar cards, bogus e-way bills |

| Arrest | One accused arrested under Section 69 of CGST Act, 2017 |

| GST Collection Context | India collected ₹1.74 lakh crore GST in July 2025 (source: Economic Times) |

| Official Reference | Press Information Bureau (PIB) – Government of India |

What Exactly Happened?

The scam involved setting up shell companies—businesses that existed only on paper but looked legitimate with fake documents. Fraudsters then created bogus invoices and e-way bills to show fake trade activity. Using this paper trail, they wrongfully claimed Input Tax Credit (ITC), which allows businesses to offset the tax they’ve already paid on purchases.

Think of it like someone faking thousands of grocery bills and then demanding cashback from the store. On a small scale, it’s fraud. On this scale, it’s a national concern.

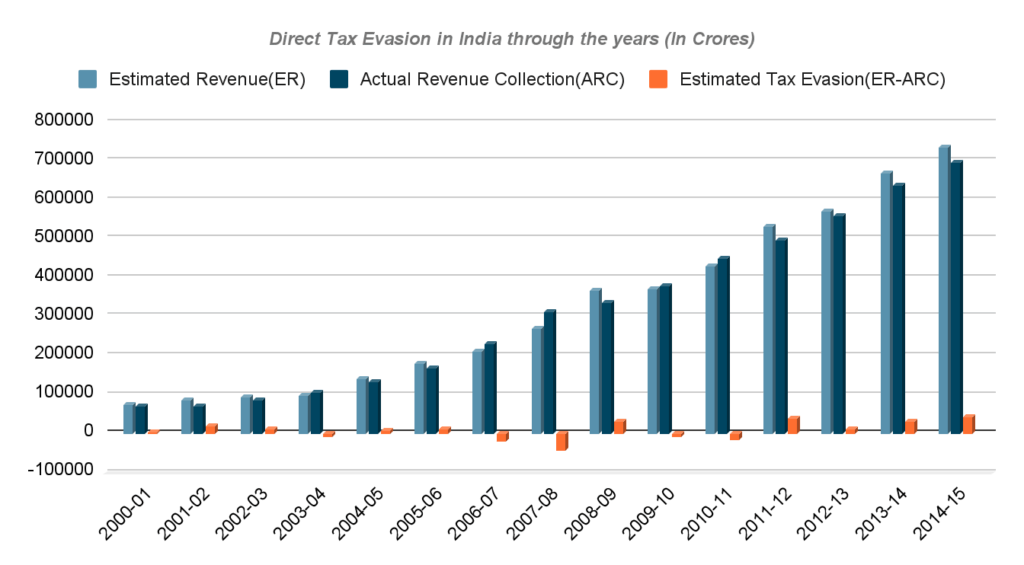

Historical Context: This Isn’t the First Scam

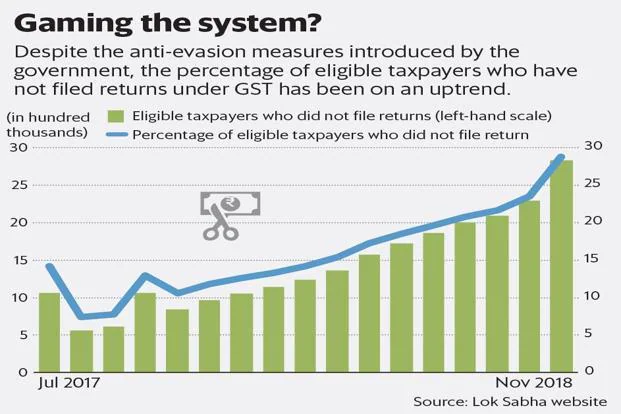

India has been fighting GST fraud since the tax system launched in 2017. Here are some recent examples that highlight how widespread the problem is:

- Visakhapatnam (2024): A staggering ₹643 crore GST fraud was uncovered involving bogus firms and ITC misuse.

- Ludhiana (2024): A network of shell companies was caught evading ₹30.2 crore in taxes.

- Surat (2025): A textile trader was arrested for orchestrating a ₹30 crore ITC scam.

According to the Central Board of Indirect Taxes and Customs (CBIC), fake invoice cases have been on the rise. In 2023–24 alone, authorities detected scams worth over ₹1.3 lakh crore.

Globally, this problem isn’t unique to India. The IRS in the United States estimates a tax gap of $688 billion annually due to fraud and non-compliance. Similarly, the European Union loses nearly €93 billion every year to VAT fraud.

Why Does Fake Invoice Scam Matter to Everyone?

For Businesses

Fraudsters who save money illegally gain an unfair advantage. Honest companies struggle to compete with those cutting corners.

For the Government

Every rupee lost is a rupee that can’t be used for public services or infrastructure projects. Large-scale fraud undermines economic stability.

For Citizens

When governments lose tax revenue, they either raise taxes elsewhere or reduce spending on essential services. In the end, ordinary taxpayers foot the bill.

The Legal Angle

The DGGI acted swiftly, arresting one accused under Section 69 of the Central GST Act, 2017. The law provides strict penalties:

- Up to 10 years in prison for tax evasion exceeding ₹5 crore.

- Fines equal to or greater than the tax amount evaded.

- Seizure of assets linked to fraudulent transactions.

For full details, the CGST Act, 2017 outlines provisions on fraud, arrests, and penalties.

How the Fake Invoice Scam Worked (Step-by-Step Breakdown)?

- Fake GST Registrations: Fraudsters used stolen or fabricated Aadhaar and PAN cards to register businesses.

- Paper-Only Companies: These firms had no workers, no warehouses—sometimes only a fake signboard for appearance.

- Invoice Engineering: They created and circulated fake invoices, inflating trade volumes.

- Claiming ITC: Using these bogus transactions, they claimed tax credits on goods and services that never existed.

- Cover-Up Efforts: The scammers relied on forged IDs, photos, and manipulated digital trails to dodge suspicion.

Despite their efforts, forensic teams uncovered forged documents and fake signboard photos, unraveling the entire racket.

Government’s Countermeasures

The Indian government is aggressively plugging loopholes in the GST system. Some of the tools in action include:

- E-Invoicing System: Linking every invoice directly to the GST Network (GSTN) to reduce forgery.

- AI and Machine Learning: Advanced data analytics to detect unusual patterns in transactions.

- Verification Drives: Field checks and audits of suspicious firms.

- Cross-Agency Collaboration: Working with banks and financial intelligence units to trace money flows.

- Public Awareness Campaigns: Encouraging whistleblowing to report suspicious activity.

Lessons for Businesses

If you’re a business owner, here’s how you can protect yourself:

- Verify Vendors and Clients: Use the GSTN search tool to validate GST numbers and business details.

- Keep Accurate Records: Document every invoice, payment, and filing. Fraudsters thrive on poor record-keeping.

- Leverage Technology: Use reliable accounting and GST software to integrate transactions with official systems.

- Spot the Red Flags: Beware of suppliers offering unrealistically low prices or firms with no physical presence.

- Consult Professionals: Accountants and tax advisors can help identify risks and ensure compliance.

Impact on Careers and Professionals

This case is more than a legal battle—it reflects a growing career opportunity. Demand is increasing for:

- Forensic Accountants specializing in fraud detection.

- Tax Consultants guiding businesses through compliance.

- Data Analysts working with AI-driven fraud detection systems.

- Compliance Officers monitoring corporate governance.

According to the Bureau of Labor Statistics, accounting and auditing jobs in the U.S. are projected to grow steadily, fueled partly by the rise in fraud investigations.

Practical Guide: Avoiding Fake Invoice Traps

Here’s a simple roadmap to avoid becoming a victim—or an accidental accomplice—in a fraud scheme:

Step 1: Train Your Staff

Teach employees what genuine invoices look like and how to spot anomalies.

Step 2: Double-Check Everything

Use the GST portal to validate invoices and tax details.

Step 3: Automate Checks

Adopt software that syncs with the GSTN and flags mismatches.

Step 4: Get Professional Oversight

Hire certified accountants to review records regularly.

Step 5: Report Suspicious Activity

Use official DGGI channels to report fraud—it protects the system as a whole.

International Comparisons

Fraud isn’t limited to GST. Around the world, governments deal with similar challenges:

- United States: The IRS combats payroll fraud, identity theft, and offshore tax shelters.

- Europe: VAT fraud remains a massive problem, especially cross-border carousel frauds.

- Australia: The ATO has cracked down on GST refund fraud schemes using AI-driven analytics.

The methods differ, but the playbook is often the same: create fake paper trails to trick tax systems.

₹332 Crore Bogus Copper Supply Scam Uncovered in Telangana Tax Fraud Raid

₹50 Crore GST Scam Busted: Two Mumbai Businessmen Arrested in Massive Tax Fraud

Massive GST Scam In Nepal Exports – Tiles And Auto Parts Dealers Under Fire