Coal Industry Faces GST Uncertainty: The coal industry faces GST uncertainty as compensation cess may end soon, and this is not just another policy headline. It could significantly impact the way coal is taxed, how states earn money, and what consumers ultimately pay for electricity, steel, and cement. For many businesses and households, these changes might feel distant, but the truth is they ripple through everything from your monthly light bill to the price of building a home. This article breaks down the issue in simple terms so anyone—even a 10-year-old—can follow along. At the same time, it delivers expert-level insights for industry professionals, government watchers, and policy analysts who need the full picture.

Coal Industry Faces GST Uncertainty

The reality is clear: the coal industry faces GST uncertainty as compensation cess may end soon, and the fallout will be widespread. For businesses, this is a time to prepare, not wait. For states, it means hunting for new revenue. And for consumers, it could mean higher or more volatile electricity costs. At the same time, this shift creates an opportunity to align India’s tax system with its clean energy ambitions. If policymakers seize it, the move away from compensation cess could mark a turning point not just for tax reform, but for India’s energy future.

| Aspect | Details |

|---|---|

| Current Tax on Coal | 5% GST + ₹400 per tonne Compensation Cess |

| Scheduled Expiry | March 31, 2026 |

| Proposed Early End | October 31, 2025 (awaiting GST Council decision) |

| Reason for Change | ₹2.69 lakh crore loan repayment nearly done; cess originally for GST revenue loss & COVID-19 borrowing support |

| Possible GST Shift | Could move from 5% to 18% if cess is removed |

| Winners | Captive users like cement and steel plants (less tax burden if cess ends) |

| Losers | State governments relying on cess, some power generators |

| Environmental Impact | Push toward clean energy levies after 2026 (Health Cess, Clean Energy Cess) |

| Official Reference | GST Council – Ministry of Finance, Government of India |

The Backstory – Why Was the Compensation Cess Introduced?

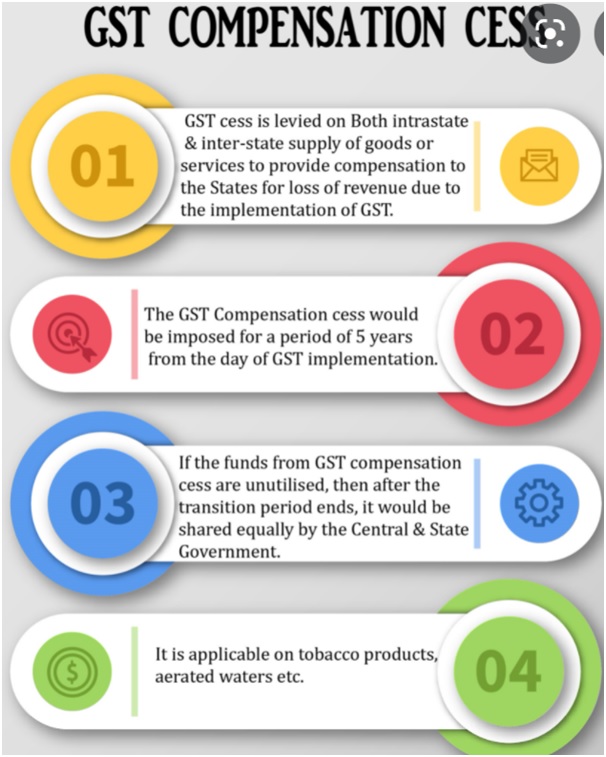

The Goods and Services Tax (GST), rolled out in July 2017, was India’s biggest tax reform in decades. It replaced a tangled web of state and central levies with a unified system. But states feared losing out because many local taxes, like entry taxes and octroi, were abolished. To reassure them, the central government promised to compensate states for five years.

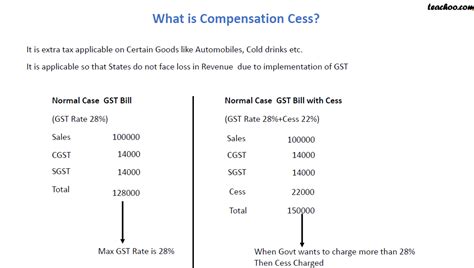

To fund this, a compensation cess was created. Coal, being a major and steady revenue generator, was an easy target. A flat ₹400 per tonne cess was levied on top of 5% GST. Other luxury and “sin” goods such as tobacco, aerated drinks, and luxury cars also carried similar cess burdens.

Originally meant to last until 2022, the cess was extended until March 2026 when the pandemic struck. The government borrowed heavily to support states, raising about ₹2.69 lakh crore, with cess collections earmarked to repay those loans.

Why the Early Exit Debate Now?

By 2025, repayment of these loans is nearly complete. With the original purpose almost fulfilled, policymakers are debating: should the cess continue until March 2026 or be phased out earlier?

One proposal is to end the coal cess by October 31, 2025. However, without cess revenue, the government may need to adjust the GST structure. The most talked-about option is raising GST on coal from 5% to 18%.

This is where confusion enters. To the average citizen, “cess ending” sounds like good news. But if GST shoots up, coal users may not see any real savings. For some, it may actually mean higher costs.

Winners and Losers

The Likely Winners

Cement and Steel Producers: These industries often run captive power plants. Because electricity is exempt from GST, they couldn’t claim credits for the cess paid on coal. If cess disappears, their effective cost per tonne falls. That can reduce overall production expenses.

Infrastructure Developers and Builders: Cheaper cement and steel could make housing, road, and infrastructure projects slightly more affordable. Even a few percentage points matter in large projects worth billions of rupees.

The Potential Losers

State Governments: States such as Jharkhand, Chhattisgarh, and Odisha rely on cess revenue to balance budgets. Without it, they may increase local levies. Jharkhand already raised its mineral levy from ₹100 to ₹250 per tonne. Other states could follow, neutralizing the benefit of cess removal.

Thermal Power Plants: Electricity is not under GST, which means no input tax credits. If coal GST rises to 18%, thermal plants will bear the full brunt. This could increase electricity tariffs, especially for households and small businesses.

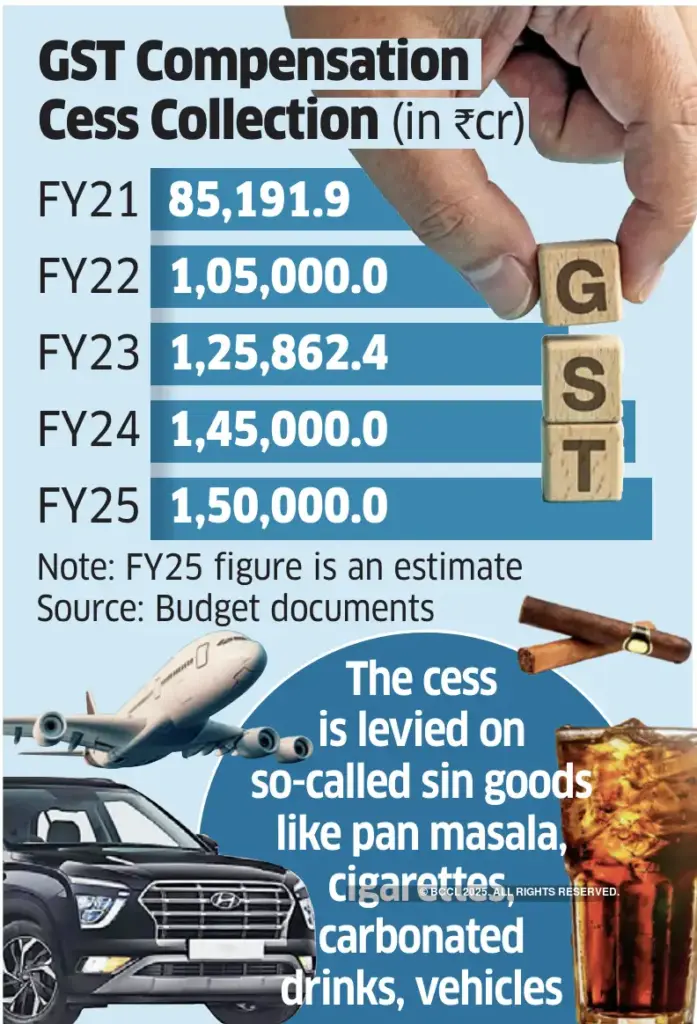

Historical Revenue Trends

According to government data, the compensation cess has been a strong contributor to the exchequer. Coal alone generates tens of thousands of crores annually. This consistent stream helped states bridge GST-related losses. But with collections stabilizing and loans nearly repaid, continuing the cess risks being seen as an unjustified burden.

Global Comparison – How Do Other Countries Handle Coal Taxes?

United States: Coal producers pay a federal excise tax, around $1.10 per ton for underground mines and $0.55 for surface mines. Several states also impose severance taxes on extraction.

China: Uses a resource tax, with coal taxed between 2% and 10% of sales. The country also levies fees for environmental damage and carbon reduction programs.

Australia: States like Queensland charge royalties on coal production, often tied to price levels. A national carbon tax briefly existed but was repealed in 2014.

Compared to these, India’s flat-rate cess looks inflexible. A more modern approach could involve carbon-linked taxation, where dirtier coal is taxed higher.

The Environmental Angle

Coal still provides over 70% of India’s electricity (International Energy Agency). Keeping it cheap could delay the shift to renewable energy. By ending the cess, the government may unintentionally favor coal, unless it introduces replacement taxes.

This is why proposals for a Clean Energy Cess are gaining traction. Such a levy could fund renewable projects, subsidize solar and wind, and provide transition packages for workers.

Ending the current cess may be the first step toward a tax structure that balances affordability with climate goals.

State-Level Implications As Coal Industry Faces GST Uncertainty

For coal-rich states, the end of the cess is worrying. Jharkhand, for instance, depends on mining revenues for social programs. If central transfers shrink, states may either:

- Raise mineral royalties or levies.

- Cut spending on development schemes.

- Push for a share in new replacement cesses like the Clean Energy Cess.

This could fuel political debate, as states argue their natural resources should yield them more direct revenue.

Jobs and Communities

Coal taxes aren’t just numbers in spreadsheets. They affect entire communities. A tax hike or removal that changes coal demand can influence:

- Miners’ livelihoods in states like Jharkhand and Chhattisgarh.

- Truckers and transporters who move coal across the country.

- Small businesses around coal belts that rely on mining income.

If cess is replaced by clean energy programs, funds could be directed toward retraining miners or creating renewable energy jobs, easing the social transition.

Expert Opinions

Industry bodies like the Confederation of Indian Industry (CII) warn that increasing GST to 18% would raise power and industrial costs. Economists suggest a phased approach: taper cess while introducing carbon-based taxation.

Policy analysts also argue that states must be given certainty. A sudden revenue drop could hurt welfare spending, causing political tension.

Practical Checklist for Businesses

If you are in energy, mining, cement, or finance, here’s what to do now:

- Run Scenario Models: Simulate costs under 5%, 12%, and 18% GST.

- Review Contracts: Clarify tax pass-through clauses with suppliers and buyers.

- Engage with State Authorities: Stay informed about local levies and royalty hikes.

- Diversify Energy Use: Invest in renewables to hedge against coal tax volatility.

- Monitor GST Council Meetings: Follow updates on the official site.

The Future Beyond 2026

The big question: what happens after March 2026? Likely candidates include:

- Health Cess: Focused on tobacco and unhealthy goods.

- Clean Energy Cess: Aimed at discouraging dirty fuels and funding renewable projects.

- Higher Slabs for Sin Goods: Discussions include a 40% tax bracket for luxury and harmful items.

So while the name of the tax may change, coal users should not expect to escape levies entirely.

GST Cut Won’t Solve Cement’s Woes; Industry Needs Urgent Pricing Overhaul

Medical Device Industry Warns Govt: Sudden GST Cuts Could Disrupt Entire Supply Chain