Tariff Issues Ease: When it comes to India’s economy, one thing is clear: tariff issues are easing, and GST reforms are shaping up as the next big growth story. Think of it like a football game—you’ve battled hard through the first half, but now it’s time to switch playbooks and lock in the win. For India, that playbook is Goods and Services Tax (GST) 2.0, a reform that could reshape businesses, households, and even global trade dynamics. This article unpacks the story step by step—why tariffs shook India’s economy, what GST reforms mean, how different sectors will feel the impact, and how consumers and professionals can prepare for what’s coming.

Tariff Issues Ease

Tariff issues may be easing, but GST reforms are now India’s biggest lever for growth. By simplifying the tax system, cutting costs on essentials, and boosting domestic consumption, GST 2.0 could transform India’s economy. Of course, challenges remain—state revenues, political negotiations, and implementation delays. But if the reforms are executed well, GST 2.0 could be the spark that drives India’s next decade of growth.

| Point | Details |

|---|---|

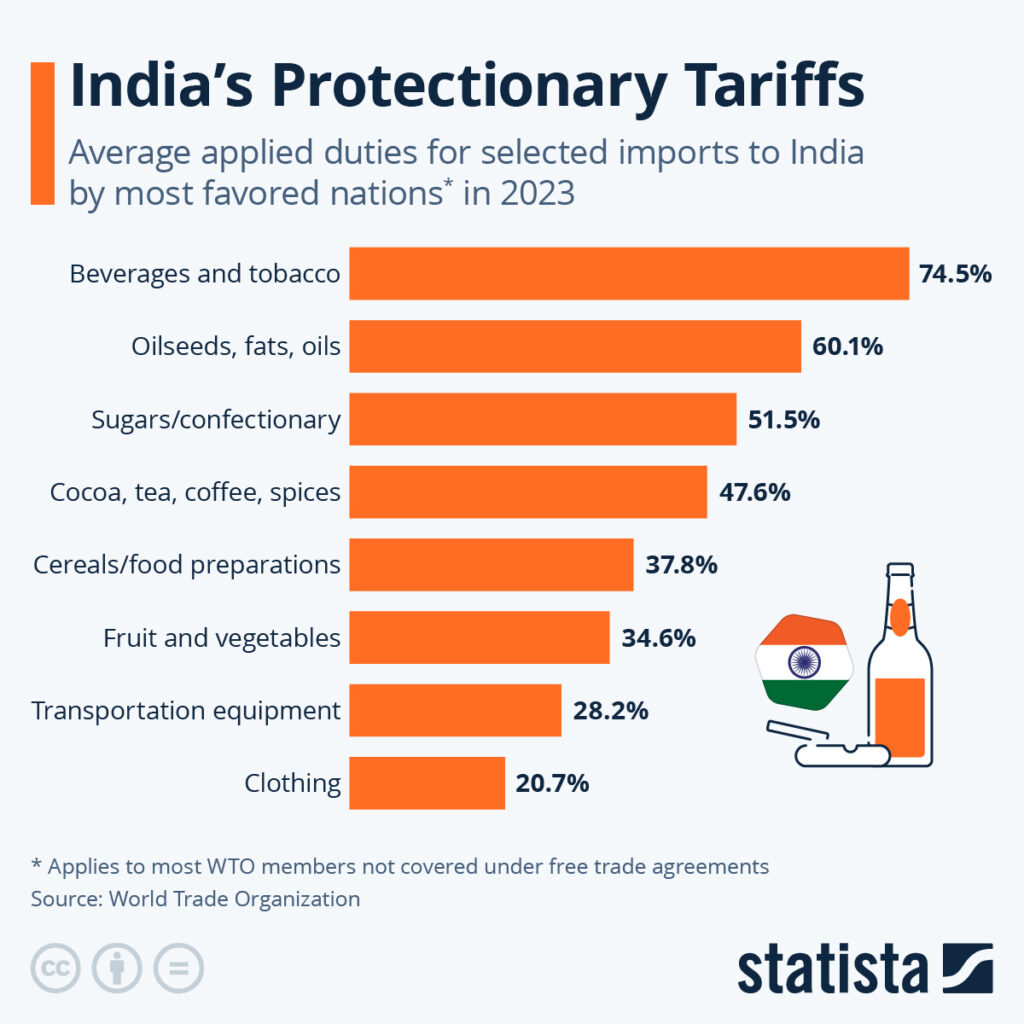

| Tariff Issues | U.S. imposed 50% tariffs on Indian exports like textiles, metals, and apparel. |

| GST 2.0 Proposal | Simplify to two main tax slabs: 5% (essentials), 18% (most goods/services), plus a 40% surcharge on luxury items. GST Council |

| Economic Growth | India’s GDP grew 7.8% YoY in Q1 FY 2026 despite tariff headwinds. |

| Consumption Boost | GST cuts could inject ₹5.31 lakh crore (~$63 billion) into the economy, ~1.6% of GDP. |

| Market Impact | Auto, FMCG, and consumer durables sectors expected to benefit most. |

| State Finances | Fiscal trade-offs: possible annual revenue loss of ₹70,000–₹1.8 lakh crore. |

Tariffs: The Storm Before the Calm

Imagine you’re running a small factory in Ohio, and suddenly the government doubles import duties on steel from abroad. Your costs shoot up overnight. That’s similar to what Indian exporters faced when the U.S. imposed 50% tariffs on products like textiles, apparel, and metals.

The move was meant to protect American jobs, but it hit India’s exporters hard. Factories had to slow production, workers worried about job security, and trade deficits widened. For a country that relies heavily on global exports, this was a serious gut punch.

But here’s the kicker: India didn’t just take the hit and move on. Instead, policymakers turned inward, focusing on domestic tax reforms that could fuel consumption and soften the tariff blow. Enter GST 2.0.

A Quick History of GST in India

India introduced the Goods and Services Tax (GST) in July 2017, calling it “One Nation, One Tax.” It replaced a messy patchwork of state and central taxes. For businesses, this was like upgrading from a clunky old flip phone to a modern smartphone—smoother, faster, and easier to use.

But problems soon cropped up:

- Too many tax slabs (5%, 12%, 18%, 28%).

- Confusion for small businesses managing compliance.

- Revenue disputes between the central government and states.

These cracks grew over time. Businesses complained about high rates on essentials, consumers grumbled about rising prices, and states worried about compensation. That’s why the call for a streamlined GST 2.0 is louder than ever.

What GST 2.0 Looks Like?

The proposed reforms are designed to simplify the system and boost spending:

- 5% tax on essentials like groceries, medicines, and basic utilities.

- 18% tax on most goods and services, including electronics, appliances, and cars.

- 40% surcharge on luxury and sin goods such as tobacco, alcohol, and high-end cars.

This two-tier model is a big step away from the complicated four-tier structure. The goal is to make compliance easier for businesses, reduce consumer costs, and stimulate demand.

Why It Matters: From Wall Street to Main Street

Boosting Everyday Spending

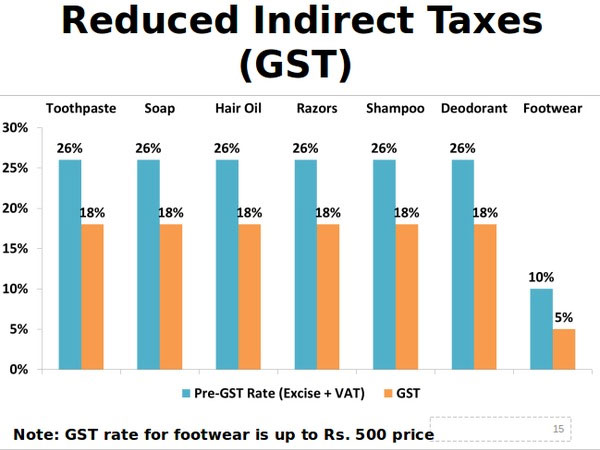

When taxes on basics like toothpaste, ACs, or a small car fall from 28% to 18%, families have more money left in their wallets. That extra spending can snowball into broader economic growth.

Helping Businesses

Simpler slabs mean less paperwork and lower compliance costs. For entrepreneurs and startups, this could free up time and money to focus on growth rather than tax headaches.

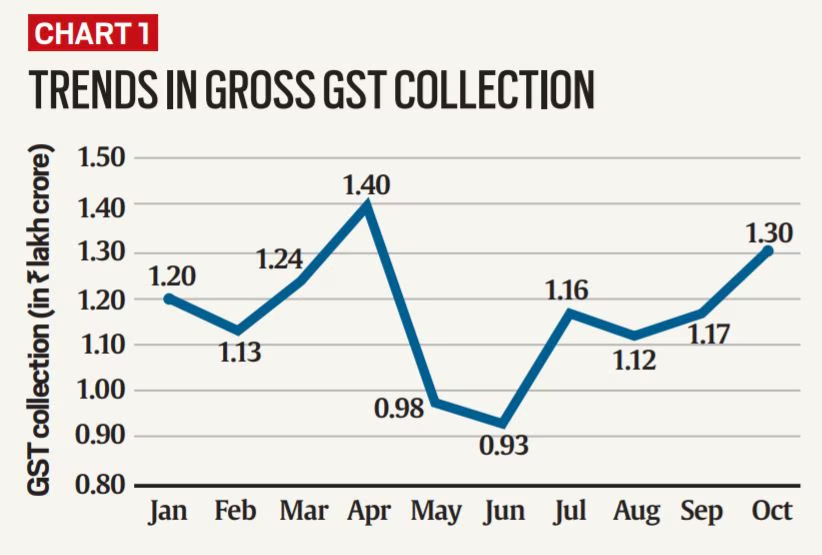

Strengthening the Economy

According to SBI Research, GST cuts could inject ₹5.31 lakh crore (~$63 billion) into the economy—roughly 1.6% of GDP. That’s like adding an entire state’s economy to India’s growth story.

Boosting Investor Confidence

Global investors love predictability. A streamlined GST signals stability, making India a safer bet for foreign direct investment (FDI).

How India Compares Globally?

- United States: No national GST; states impose their own sales taxes ranging from 4% to 10%.

- European Union: VAT rates average around 20%, with some essentials taxed lower.

- India (proposed GST 2.0): 5% on essentials, 18% on most goods, 40% on luxury—making India competitive internationally while still protecting low-income households.

This balance could help India attract more global investors while keeping goods affordable for local consumers.

Sector-Wise Winners and Losers

Automobiles

Small cars and mid-range vehicles, currently taxed at 28%, will fall to 18%. That’s a big win for companies like Maruti Suzuki and Tata Motors.

FMCG (Fast-Moving Consumer Goods)

Products like shampoo, soap, and packaged food will get cheaper. Companies like Hindustan Unilever and ITC stand to gain as volumes rise.

Consumer Durables

TVs, refrigerators, and air-conditioners will see price cuts, spurring demand for both local and global brands.

IT and Startups

Lower GST on services could reduce costs slightly, but the impact here is more about simpler compliance than price cuts.

MSMEs (Micro, Small, and Medium Enterprises)

Simpler slabs mean less confusion and more breathing space to grow, especially for small businesses in semi-urban areas.

Luxury Sector

High-end goods will face a 40% surcharge, so luxury cars, imported watches, and tobacco may remain expensive.

The Flip Side: What’s the Catch?

- Revenue Losses: States could lose ₹70,000–₹1.8 lakh crore annually. This makes them nervous about signing off on reforms.

- Implementation Challenges: Rolling out new slabs requires coordination across 28 states and 8 union territories—a big logistical challenge.

- Uneven Benefits: Middle- and upper-income groups may feel the positive impact sooner than low-income households.

Consumer Example: A Day in the Life

Let’s say a middle-class family in Bengaluru decides to upgrade:

- Small car – current GST 28%, proposed 18%. Savings: ₹50,000–₹70,000.

- Air conditioner – current GST 28%, proposed 18%. Savings: ₹5,000–₹8,000.

- Shampoo and toiletries – current GST 28%, proposed 18%. Annual savings: ₹1,200–₹1,500.

That’s thousands of dollars in annual savings—money that could go into investments, debt repayment, or a family vacation.

Practical Advice: What You Should Do After Tariff Issues Ease

For Businesses

- Revisit pricing strategies before reforms roll out.

- Upgrade accounting and tax software for the new slabs.

- Plan inventory purchases to avoid overpaying during the transition.

For Investors

- Watch sectors like autos, FMCG, and consumer durables for growth opportunities.

- Stay diversified—global tariffs still create uncertainty.

- Track GST Council updates; reforms may roll out in phases.

For Consumers

- Plan big-ticket purchases around the rollout timeline.

- Use household savings from lower GST to invest or pay off loans.

- Rework monthly budgets to reflect reduced costs on essentials.

Expert Opinions

- Confederation of Indian Industry (CII): GST reforms can “even out tariff impacts” and strengthen growth.

- SBI Research: Projects a ₹5.31 lakh crore boost to the economy from increased consumption.

- Economists: Many warn the reforms won’t be a quick fix, but most agree GST 2.0 could be a long-term game changer.

US Abruptly Cancels India Trade Talks Amid Tariff Tensions

GST Shake-Up May Cushion Trump’s Tariff Blow, Report Suggests

Diwali Tax Cuts May Backfire as Trump’s Tariff Threat Looms Large