GST Collections Rise 6.5%: When we talk about GST collections rising 6.5%, it’s more than just a number on a government report. It’s like when the U.S. government announces higher sales tax collections—it shows people are spending, businesses are thriving, and the economy is chugging along despite speed bumps. In August 2025, India collected a whopping ₹1.86 lakh crore (around $21 billion USD) in Goods and Services Tax (GST). The kicker? This boost came almost entirely from domestic demand—people and businesses inside India powering the engine—while imports actually dipped. According to The Economic Times, domestic GST revenue jumped 9.6% year-on-year, even as import revenues shrank.

GST Collections Rise 6.5%

The rise of GST collections by 6.5% in August 2025 is a powerful sign of India’s economic resilience. While imports slowed, domestic demand roared ahead, pushing revenues past ₹1.86 lakh crore. Net collections surged even higher thanks to reduced refunds. For professionals, entrepreneurs, and families alike, the message is clear: India’s growth engine is powered from within, and the road ahead looks steady, if not exciting.

| Metric | August 2025 | YoY Growth | Notes |

|---|---|---|---|

| Gross GST Collections | ₹1.86 lakh crore (~$21B USD) | +6.5% | Driven by domestic demand |

| Net GST Collections | ₹1.67 lakh crore | +10.7% | Boosted by lower refunds |

| Domestic GST Revenue | ~₹1.37 lakh crore | +9.6% | Strong consumer spending |

| Import GST Revenue | ~₹49,300 crore | -1.2% | Slight dip in imports |

| Refunds | Down ~20% | Helped net revenues rise | |

| Official Data Source | GST Council, India |

Why This Matters for the Indian Economy?

Just like sales tax collections in the U.S., higher GST collections signal stronger consumer confidence. More people buying goods and services means businesses are selling more, creating jobs, and reinvesting in growth.

A couple of things stand out:

- Net revenues grew by 10.7%, largely because refunds dropped sharply.

- Imports slowed due to U.S. tariff hikes and global uncertainty, but local industries carried the weight.

- High-frequency indicators like digital payments crossing 20 billion transactions and manufacturing hitting a 17-year high back up this growth story.

In plain English: while the world economy is catching a cold, India’s domestic market pulled on a hoodie and kept hustling.

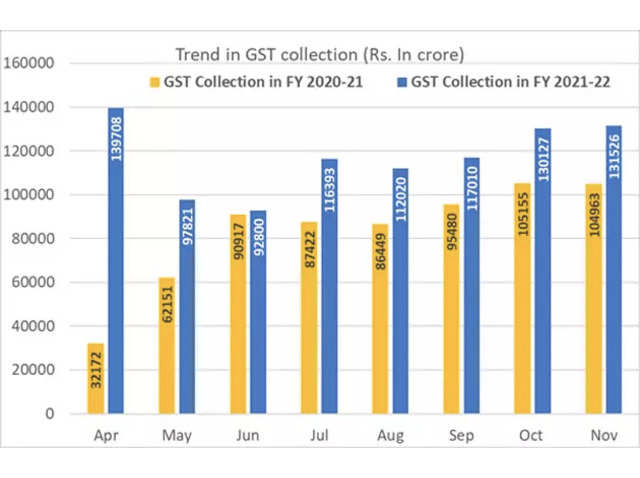

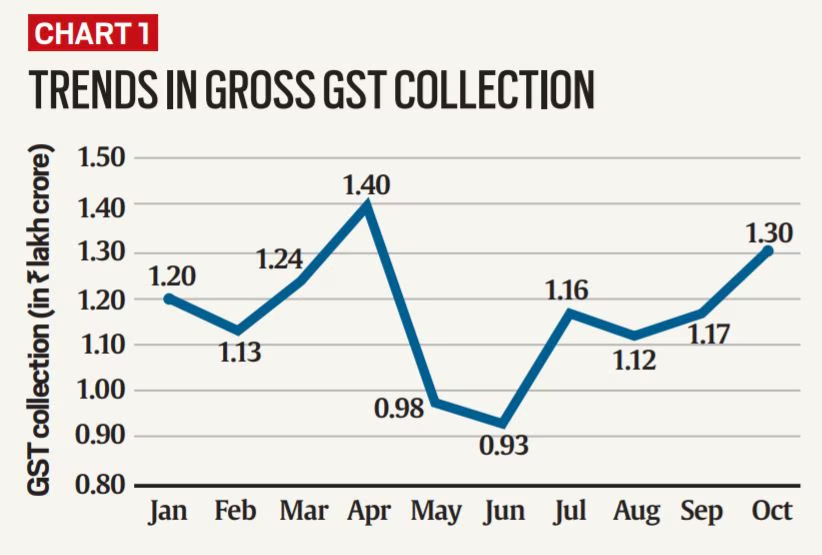

Historical Context: How GST Has Been Trending

This isn’t the first time India’s GST collections have made headlines. Here’s how the trend looks:

- July 2025: ₹1.83 lakh crore collected (5% growth).

- June 2025: ₹1.82 lakh crore (steady performance).

- May 2025: ₹1.88 lakh crore (seasonal high).

- 2024 Full Year: Averaged ~₹1.75 lakh crore monthly.

This steady upward trajectory mirrors how the U.S. monitors retail sales and tax revenues to measure economic momentum.

Sector-Wise Breakdown: Who’s Driving Growth?

Certain industries were the MVPs of August’s GST spike:

- Manufacturing – Surged on the back of strong factory output.

- E-commerce & Retail – With festive shopping and digital payments booming, these sectors fueled consumption.

- Services (IT & hospitality) – Outsourcing and travel saw solid rebounds.

- Imports – Slowed due to tariffs and reduced global trade appetite.

This balance shows that India’s internal consumption is becoming its biggest strength, reducing reliance on imports.

How GST Works?

Imagine you buy a pack of candy for $1. In the U.S., your state might charge a 6% sales tax, so you pay $1.06 at checkout. India’s GST works the same way, except it’s a nationwide system—a single set of rules across all states.

- GST is collected on goods and services at every step—from manufacturer to wholesaler to retailer.

- But businesses get credit for the tax they’ve already paid, so the final consumer bears the full tax.

This unified system keeps things simple and transparent.

Comparison of GST Collections Rise 6.5% with U.S. Tax Trends

For an American reader, here’s a parallel:

- In the U.S., state sales taxes vary—it’s 0% in Oregon, 7% in Tennessee, and over 9% in California when local taxes are included.

- In India, GST is uniform across states, preventing tax chaos.

So when India reports GST growth, it’s like the entire U.S. announcing that all states collected higher sales taxes at once—a big deal!

Practical Takeaways for Professionals & Entrepreneurs

- For Business Owners

If you’re eyeing India as a market, now’s the time. Domestic demand is strong, and consumers are spending confidently. - For Policymakers

These numbers justify more infrastructure spending—roads, power, and digital systems—to keep momentum rolling. - For Global Investors

India’s economy is showing resilience. With imports slowing, companies that align with “Made in India” strategies will benefit. - For Families

Higher GST doesn’t mean higher prices—it just reflects more transactions. Think of it as your community mall buzzing with shoppers.

Step-by-Step Guide: How to File GST

For SEO and practical value, here’s a simple guide:

- Register for GST – Businesses earning above the threshold must register at GST Portal.

- Collect GST – Charge GST on sales invoices.

- Keep Records – Maintain digital records of purchases and sales.

- File Returns Monthly/Quarterly – Submit GSTR-1, GSTR-3B online.

- Pay Dues – Clear payments through net banking or UPI.

- Claim Input Tax Credit – Deduct GST already paid on business purchases.

This system ensures businesses only pay taxes on the value they add, not double or triple taxation.

Challenges in the GST System

No system is perfect, and GST has its bumps:

- Complex compliance: Small businesses often struggle with multiple return filings.

- Refund delays: Exporters face cash flow issues when refunds are slow.

- Fraud prevention: Fake invoices and tax evasion are persistent challenges.

- Technology barriers: Rural businesses sometimes lack digital literacy.

India is working on reforms, including simplified returns and AI-based fraud detection, to smoothen these wrinkles.

Global Comparisons: How Other Countries Do It

India isn’t alone—many countries use VAT/GST models:

- European Union – VAT rates average around 20%.

- Canada – Uses GST at the federal level (5%) plus provincial sales taxes.

- Australia – Has a flat 10% GST nationwide.

India’s GST at 18% on most goods is higher than some peers, but its uniformity across states is a major advantage.

Policy Implications & Future Reforms

Experts believe India’s GST system will evolve further:

- Bringing fuel and electricity under GST – Currently excluded, but could simplify taxes.

- Simplified returns for small businesses – To reduce compliance headaches.

- Lower rates on essentials – To reduce inflationary pressure on consumers.

- Tech-driven audits – AI and big data to curb fraud.

The government has already hinted at reforms in upcoming GST Council meetings.

Expert Opinions

According to a report by IBEF, the steady rise in GST indicates “India’s domestic market resilience despite external shocks.” Economists agree that sustained collections above ₹1.8 lakh crore monthly will give the government fiscal space for infrastructure spending.

Future Outlook

Economists predict:

- If domestic demand stays strong, GST collections could cross ₹2 lakh crore by early 2026.

- Festive seasons (October–December) will likely see further spikes.

- Imports may stay sluggish, but internal demand is set to remain India’s backbone.

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

New DDP Indicators and GST Collections Reveal Economic and Cultural Shifts in Districts