Life And Health Insurance Tax Exemptions: If you’ve been sweating over the rising cost of your life and health insurance premiums, here’s a major update that could ease the pressure on your budget. The GST Council has agreed to exempt life and health insurance policies from Goods and Services Tax (GST). That means the extra 18 percent you’ve been paying on premiums may soon be history. Sounds great, right? But before you assume your next bill will magically shrink, let’s dig deeper. What does this really mean for everyday folks, professionals, insurers, and the larger economy? Will your premiums actually go down, or will insurers find ways to balance things out?

Life And Health Insurance Tax Exemptions

The GST Council’s decision to exempt life and health insurance premiums from GST could be a landmark reform for India’s insurance sector. For families, seniors, and young professionals, it could mean more affordable coverage and fewer financial surprises. But the true test lies in execution. If insurers pass on the full benefit, policyholders win big. If not, this could end up being another missed opportunity. Either way, consumers should stay sharp, track changes, and demand transparency.

| Point | Details |

|---|---|

| Topic | GST Council agrees on exempting life and health insurance from GST |

| Current GST Rate | 18% on life and health insurance premiums |

| Estimated Revenue Impact | ₹9,700–9,900 crore annual shortfall for the government |

| Consumer Impact | Lower premiums if insurers pass on the benefit |

| Industry Impact | Loss of Input Tax Credit (ITC); possible base premium hikes |

| Council Meeting Date | September 3–4, 2025 |

| Official Source | GST Council Website |

How Did We Get Here? A Quick Background

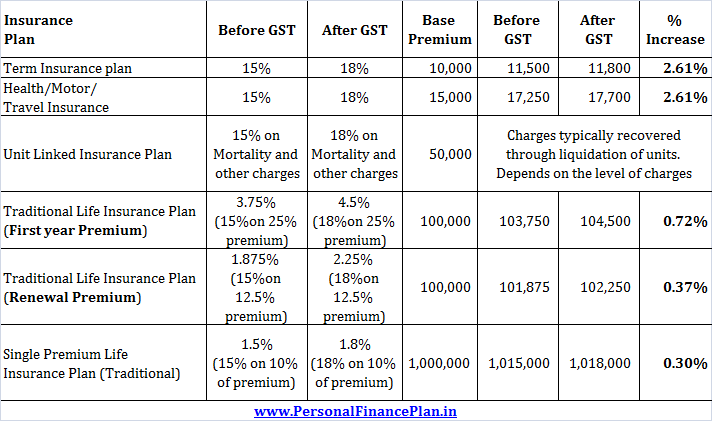

When GST was introduced in July 2017, one of the biggest changes was how financial services were taxed. Insurance premiums, which earlier carried service tax rates of 12–15 percent, jumped to a flat 18 percent GST.

At the time, the government defended this move by saying GST would create a uniform, transparent tax structure. But policyholders quickly felt the pinch. Insurance—already seen by many as optional—became even less attractive. For middle-class families juggling school fees, home loans, and medical bills, those extra charges made a big difference.

Over the years, industry associations like FICCI and CII lobbied for relief, pointing out that insurance is a social security tool, not a luxury item. It’s taken nearly eight years, but the Council finally seems to agree.

Why Life And Health Insurance Tax Exemptions Matters in 2025?

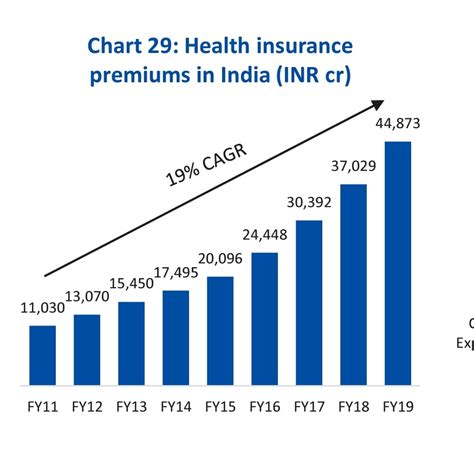

Healthcare inflation in India is running at nearly 12–14 percent annually, far higher than the global average. A hospital bill that cost ₹2 lakh in 2018 can easily cross ₹4–5 lakh today. According to a NITI Aayog report, nearly 62 percent of healthcare costs are still paid out-of-pocket.

This is where insurance comes in. By removing GST, the government is signaling that health and life insurance are basic protections, not optional extras. The timing also matters—post-pandemic, people are more aware than ever of the need for financial safety nets.

What Exactly Is Changing?

- Before: Life and health insurance premiums were taxed at 18 percent.

- After (if approved): No GST will be levied on individual policies.

- The Catch: Insurers will lose Input Tax Credit (ITC)—a mechanism that allowed them to claim credit for taxes paid on business inputs and expenses.

Real-Life Example: How Much Could You Save?

Imagine you pay ₹30,000 annually for your health insurance.

- With GST: You’re paying ₹35,400 (₹5,400 is tax).

- Without GST: You’ll go back to ₹30,000.

That’s a direct saving of 18 percent. Now multiply that by a family of four with multiple policies. The savings quickly cross ₹15,000–20,000 a year—money that can be redirected toward groceries, school tuition, or retirement savings.

How Does India Compare Globally?

India isn’t breaking new ground here. In fact, it’s catching up with global norms.

- United States: Health insurance premiums are generally exempt from sales tax.

- United Kingdom: Life insurance is exempt from VAT, and health coverage is treated favorably.

- Singapore: Insurance premiums are exempt from GST, making coverage widely accessible.

By moving in this direction, India is aligning with international best practices and making insurance more inclusive.

Who Stands to Benefit?

Families

A family paying ₹50,000 for health insurance could save nearly ₹9,000 annually.

Senior Citizens

Older adults often pay higher premiums due to health risks. Eliminating GST could ease the strain during retirement years.

Young Professionals

Lower costs may encourage millennials and Gen Z to purchase term insurance earlier, building long-term financial security.

Rural Households

With schemes like Ayushman Bharat already in play, removing GST could make add-on private insurance policies more appealing for rural families.

Why Insurers Are Wary?

While the news is music to consumers’ ears, insurers are a bit less enthusiastic. Here’s why:

- Loss of ITC: Without tax credits, operational costs rise.

- Margin Pressure: Profit margins shrink, especially for smaller companies.

- Possible Price Tweaks: To balance the books, insurers might raise base premiums, diluting consumer benefits.

According to Economic Times, this could even spark consolidation in the insurance sector, as smaller players struggle to cope.

Expert Insights

- ASSOCHAM praised the decision as a “transformative step toward financial inclusion.”

- Some analysts, however, argue that unless the Insurance Regulatory and Development Authority of India (IRDAI) enforces compliance, insurers may absorb the benefits themselves.

- Reuters reported that while the government faces a revenue loss of about ₹9,900 crore annually, the long-term gain in insurance penetration could outweigh the fiscal hit.

A Step-by-Step Guide for Policyholders

- Review your latest premium receipt. Note how much GST you’re paying today.

- Stay updated on the September 3–4, 2025 GST Council meeting—that’s when the final decision will be announced.

- Ask your insurer or agent: “Will my premiums reduce after GST is removed?” Don’t settle for vague answers.

- Compare policies across different insurers once the exemption kicks in. Some may offer bigger reductions than others.

- Keep copies of old and new premium invoices to ensure the benefit is actually reaching you.

The Larger Economic Picture

This isn’t just about saving a few thousand rupees. It ties into bigger national goals:

- Financial Inclusion: More people with insurance means fewer households wiped out by medical bills.

- Health System Relief: Private insurance uptake reduces pressure on government hospitals.

- Economic Stability: Families with insurance are less likely to dip into savings or take on debt for emergencies, strengthening household balance sheets.

Future Outlook: Where Does This Lead?

If the exemption is approved and implemented properly, here’s what the next decade could look like:

- Insurance penetration (currently around 4.2 percent of GDP) could inch closer to global averages of 7–8 percent.

- Digital-first insurers and aggregators could flourish, offering cheaper, customized plans.

- More product innovation, with micro-insurance and bundled health covers designed for rural and semi-urban markets.

Think of it like the moment when 401(k) retirement plans in the U.S. went mainstream—suddenly, saving for the future wasn’t just for the wealthy.

Case Study: Meet the Sharmas

The Sharma family in Delhi currently pays ₹60,000 annually for health insurance. With GST, their bill jumps to ₹70,800.

- Without GST, they save ₹10,800 annually.

- That money could cover a year of school fees for their child, or a month’s groceries.

Now imagine this effect multiplied across millions of households—it’s clear why this move is a big deal.

Practical Checklist for Consumers

- Review existing policies.

- Ask for a revised quote after September 2025.

- Compare at least three insurers before renewing.

- Track whether your premiums actually drop.

- Report unfair practices to IRDAI.

Lower GST On Household Items – What The Council Is Planning

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

Zero GST on Health & Life Insurance Proposed – Will Your Premiums Finally Drop?