PAN-Aadhaar Linking Deadline: The PAN-Aadhaar linking deadline is one of the most important financial compliance rules in India today. If you’ve been hearing about it from your bank, your HR department, or even in government ads, you might be wondering why it’s such a big deal.

To break it down simply: your Permanent Account Number (PAN) is like your tax ID in India, similar to the Social Security Number (SSN) in the United States. Your Aadhaar is your universal ID card with biometric details. Linking them ensures that the government has a unified record of taxpayers, helping to stop fraud, tax evasion, and duplicate PAN usage. But here’s the catch: miss the deadline, and your PAN becomes inoperative. That means you won’t be able to file taxes, claim refunds, or even open a bank account smoothly. Let’s break this down in detail.

PAN-Aadhaar Linking Deadline

The PAN-Aadhaar linking deadline is more than just a government requirement. It is a safeguard for financial security, tax compliance, and smooth transactions. With the government giving time until December 31, 2025 for specific PAN holders, the best advice is to complete the process now rather than wait. Delaying increases the risk of penalties, blocked refunds, and unnecessary stress. Linking is free, fast, and available online. By taking action today, you ensure your financial journey remains smooth and hassle-free.

| Point | Details |

|---|---|

| Latest Deadline | December 31, 2025 (for PANs issued using Aadhaar enrolment ID on/before Oct 1, 2024) |

| Consequence of Missing | PAN becomes inoperative from January 1, 2026 |

| Penalty | No penalty if linked before Dec 31, 2025. ₹1,000 fine for late linking in other cases |

| Impacts of Inoperative PAN | Cannot file ITR, no refunds, higher TDS/TCS, restrictions in financial transactions |

| Legal Basis | Section 139AA, Income Tax Act, 1961 |

| Official Resource | Income Tax e-Filing Portal |

Why Has the Government Made PAN-Aadhaar Linking Mandatory?

The Central Board of Direct Taxes (CBDT) has made this linkage compulsory under Section 139AA of the Income Tax Act, 1961. The reasons are clear:

- Prevent duplicate or fake PAN cards

- Ensure transparency in income reporting

- Track high-value transactions more efficiently

- Curb tax evasion and financial fraud

According to government data, more than 51 crore PANs have already been linked to Aadhaar, which is nearly 80% of all PAN cards issued. Still, lakhs remain unlinked, prompting the government to give multiple extensions.

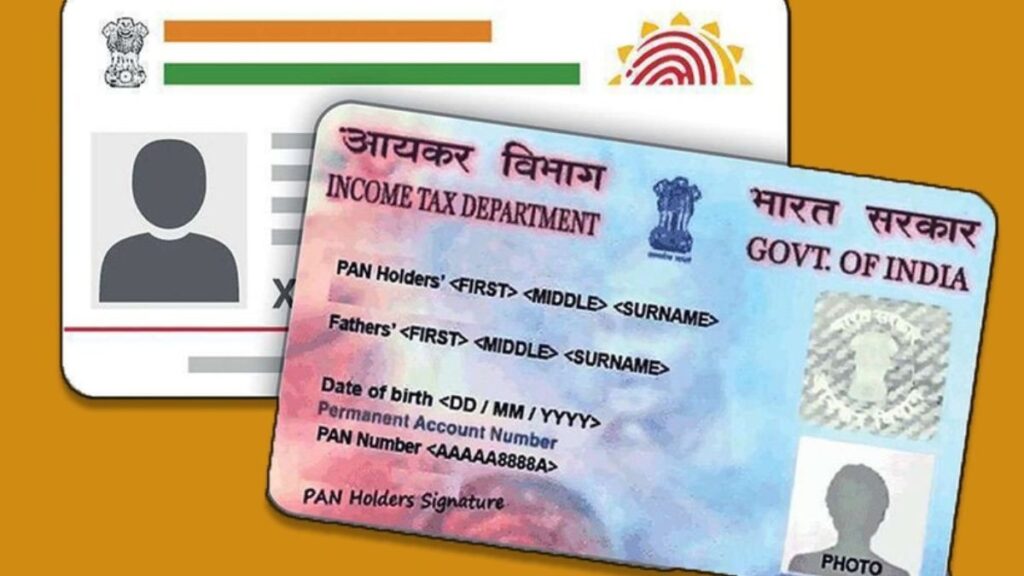

Who Is Exempt from PAN-Aadhaar Linking?

Not every taxpayer is required to link PAN and Aadhaar. Exemptions include:

- Non-Resident Indians (NRIs) who are not required to have Aadhaar

- Foreign nationals who hold a PAN for investments or business in India

- Super senior citizens above 80 years of age

- Residents of Assam, Jammu & Kashmir, and Meghalaya, where Aadhaar coverage is lower

If you fall into these categories, the deadline and penalties do not apply. However, if you are an ordinary resident Indian with both PAN and Aadhaar, you must complete the linkage.

Timeline of PAN-Aadhaar Linking Deadline

The government has extended the deadline multiple times:

- March 31, 2022 – Original deadline set by CBDT

- June 30, 2023 – Extension granted; ₹1,000 penalty applied for late linkers

- May 31, 2024 – Deadline for general taxpayers after another extension

- December 31, 2025 – Current final deadline for PAN holders whose cards were issued using Aadhaar enrolment ID before October 1, 2024

From January 1, 2026, all such unlinked PANs will become inoperative.

Consequences of Missing the Deadline

If you do not link PAN with Aadhaar within the deadline, the following consequences apply:

1. No Tax Filings

You cannot file your Income Tax Return (ITR), which is legally required for many individuals and companies.

2. Refunds Blocked

If the Income Tax Department owes you a refund, it will not be processed until your PAN is reactivated.

3. Higher Tax Deduction

Banks and financial institutions will deduct TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) at twice the regular rate under Sections 206AA and 206CC.

4. Invalid Forms

Forms such as 15G and 15H, used by senior citizens to avoid unnecessary TDS, will not be valid.

5. Restricted Transactions

You cannot open a new bank account, invest in stocks or mutual funds, or apply for a loan.

6. Credit Score Issues

If PAN-based reporting stops, your CIBIL score and credit profile may be disrupted.

In short, missing the deadline creates roadblocks in almost every financial activity.

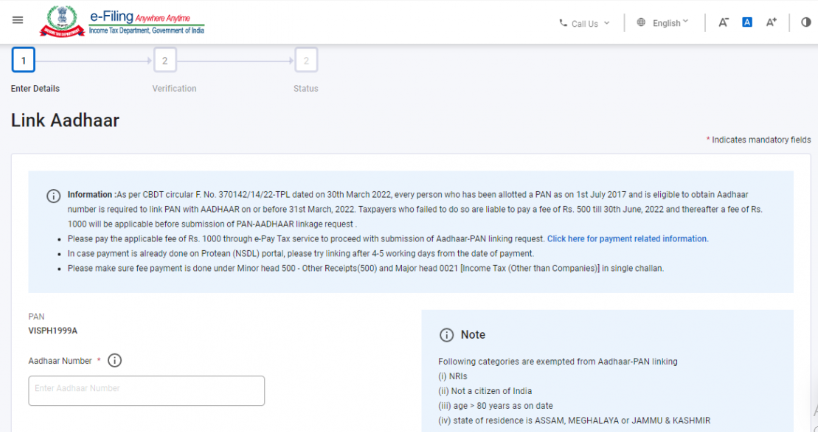

Step-by-Step Guide to PAN-Aadhaar Linking

The process is straightforward and can be done online in a few minutes.

Step 1: Visit the Income Tax Portal

Go to the Income Tax e-Filing website.

Step 2: Click on “Link Aadhaar”

The option is visible on the homepage under Quick Links.

Step 3: Fill in Details

Enter your PAN number, Aadhaar number, and captcha code.

Step 4: Verify with OTP

You’ll receive a one-time password on your Aadhaar-linked mobile number. Enter it to continue.

Step 5: Pay Fee (if required)

If you missed previous deadlines, a fee of ₹1,000 may apply. For those covered under the new December 31, 2025 deadline, no penalty is charged until then.

Step 6: Check Linking Status

You can confirm whether PAN and Aadhaar are linked through the “Link Aadhaar Status” option.

Common Mistakes to Avoid

- Ensure your name, date of birth, and gender match exactly on both PAN and Aadhaar.

- Do not use unofficial websites; only the government portal is valid.

- Aadhaar must have your current mobile number for OTP verification.

- Avoid waiting until the last week of December 2025 when servers are likely to be overloaded.

Real-Life Scenarios

Consider the case of Anil, a salaried professional in Mumbai. He delayed linking his PAN until after the June 2023 deadline. He had to pay a ₹1,000 fine, and his tax refund of ₹18,000 was stuck for several months.

Meanwhile, Shreya, a freelancer, linked her Aadhaar with PAN the moment she received reminders from her bank. She faced no penalties and received her refund without delay.

The difference? Acting early versus waiting until the last minute.

PAN-Aadhaar Linking and Businesses

Businesses also face serious issues if PAN cards of directors, partners, or key employees become inoperative:

- Annual filings with the Ministry of Corporate Affairs can get delayed.

- Employee tax deductions (TDS) can be challenged.

- Vendor payments may get blocked if PAN is inactive.

Startups and MSMEs, in particular, need to ensure that all PANs involved in compliance are active and linked.

Global Comparison

In the United States, the IRS tracks taxpayers using the SSN. Every individual must file taxes using this ID, and employers also report income against it. Similarly, in India, linking PAN with Aadhaar ensures that every transaction is tied to a verified identity.

This system prevents misuse and strengthens financial accountability.

Safety Tips: Avoiding Scams

Since this is a widely discussed topic, scammers often take advantage by sending fake emails and texts.

- Always check the URL before entering personal details. The only official site is incometax.gov.in.

- Do not share OTPs or Aadhaar numbers over the phone.

- If in doubt, visit a nearby Aadhaar Seva Kendra or PAN service center.

Bidar Youth Arrested For ₹9.25 Crore GST Evasion Using Fake Bills

₹92 Crore Digital Arrest Scam Exposed – Mohali Police Nab Mastermind Gang

Government Bans Online Money Games – Here’s Why and How It Could Hit the Economy