US Court Rules Jury Was Misled on Tax Fraud Conspiracy Charge: When the U.S. Court of Appeals for the Tenth Circuit ruled that a jury was misled on a tax fraud conspiracy charge, it wasn’t just another legal headline. It was a powerful reminder that fairness is the foundation of the American justice system. In this case, the jury received flawed instructions that didn’t properly explain the law, leading the appeals court to overturn the conviction. For taxpayers, professionals, and even kids learning about honesty, this case holds lessons. It shows how important clear rules are—whether you’re playing a game, filing your taxes, or deciding someone’s fate in court.

US Court Rules Jury Was Misled on Tax Fraud Conspiracy Charge

The Tenth Circuit’s ruling that a jury was misled on a tax fraud conspiracy charge is more than a legal technicality—it’s a vital reminder that fairness in trials protects us all. From mobsters like Al Capone to everyday taxpayers, the law must be applied clearly and consistently. For professionals, it’s a lesson in documentation. For taxpayers, it’s a call to stay honest and organized. And for the justice system, it’s proof that checks and balances still work.

| Key Point | Details |

|---|---|

| Court | U.S. Court of Appeals for the Tenth Circuit |

| Issue | Jury was misled by faulty instructions in a tax fraud conspiracy case |

| Main Error | Instructions didn’t require proof of deceitful conduct and limited “advice-of-counsel” defense |

| Impact | Conviction overturned; retrial may be needed |

| Why It Matters | Highlights importance of accurate jury instructions in complex tax cases |

| Official Source | U.S. Courts Website |

What Happened in This Case?

The case involved a man accused of conspiring to commit tax fraud by failing to report trust income. The government argued that he deliberately tried to cheat the IRS. His defense claimed he relied on advice from a tax professional, which can sometimes shield defendants if they acted in good faith.

However, the trial judge’s instructions limited this defense to just one charge—filing false returns—and excluded it from the conspiracy charge. Even worse, the instructions didn’t clearly state that deceitful conduct is a necessary part of proving conspiracy.

The Tenth Circuit Court of Appeals found these mistakes serious enough to overturn the conviction. The defendant isn’t automatically off the hook—the government could retry the case—but the ruling sent a strong message: jurors must be given clear and correct rules.

Jury Instructions: Why They Matter

Jury instructions are like the rulebook of the courtroom. Imagine playing football or basketball with the wrong rules—chaos would follow. In trials, unclear instructions can mean the difference between freedom and prison.

- Jurors aren’t legal experts. They rely on judges to explain the law in plain language.

- Every word matters. Leaving out key elements, like “intent to deceive,” can tilt a verdict unfairly.

- Appeals courts are referees. They step in when the trial “game” wasn’t played fairly.

This case highlights why instructions must be precise, especially in complicated cases like tax fraud.

Historical Context: Famous Tax Fraud Cases

Tax fraud isn’t new. Some of America’s most famous legal battles involved taxes:

- Al Capone (1931) – The mobster was untouchable for violent crimes, but the IRS got him for tax evasion. He served 11 years in federal prison.

- Leona Helmsley (1989) – The New York hotel magnate, known as the “Queen of Mean,” served 19 months for tax fraud. She once said, “Only the little people pay taxes.”

- Wesley Snipes (2008) – The Hollywood actor was sentenced to nearly three years in prison for failing to file tax returns.

These cases show that tax law can trip up anyone—gangsters, celebrities, or business leaders. They also prove how critical fair instructions are for jurors weighing guilt.

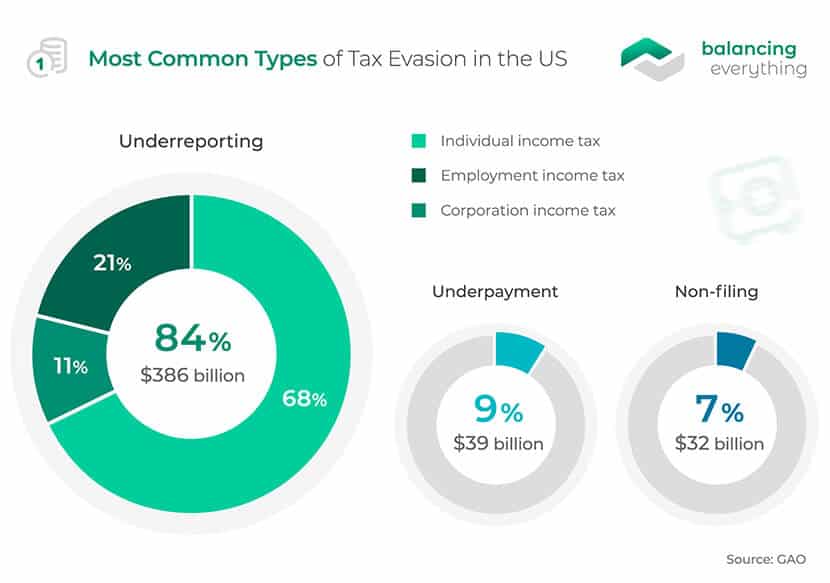

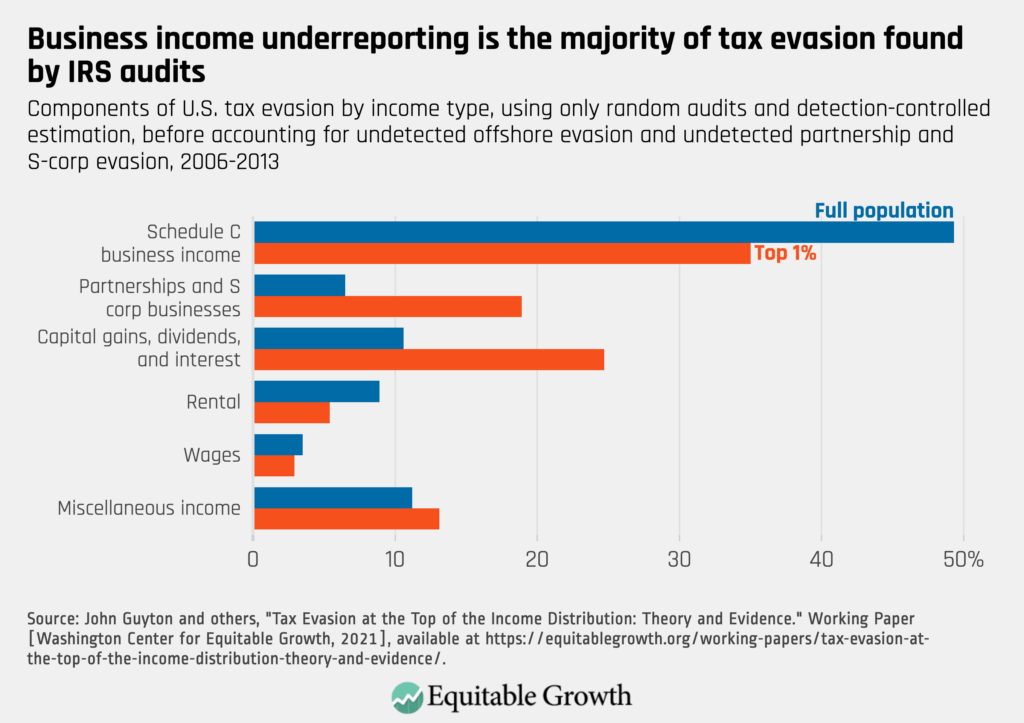

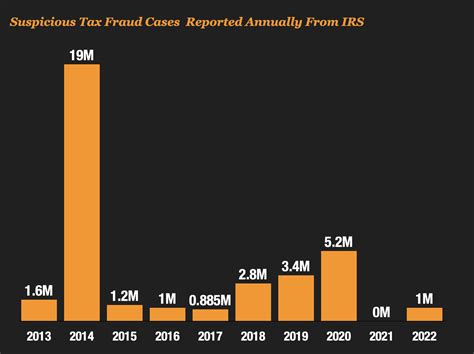

The Numbers: Tax Fraud in America

The IRS estimates that the annual “tax gap”—the difference between taxes owed and taxes paid—totals about $540 billion. That’s money the government never collects.

Other eye-opening numbers:

- Audit rates are shrinking. In 2019, only 0.4% of individual returns were audited, down from 0.9% in 2010.

- Convictions are common. According to the Department of Justice, conviction rates for tax crimes are above 90%.

- Sentences are serious. Tax fraud can lead to up to 5 years in prison and fines of $250,000 for individuals or $500,000 for corporations.

So while your odds of being audited are slim, once you’re in court, the government usually wins—unless a case like this reveals unfair instructions.

Breaking Down the US Court Rules Jury Was Misled on Tax Fraud Conspiracy Charge

The Tenth Circuit identified several major issues:

1. Misleading Definition of Conspiracy

Jurors weren’t told that intentional deceit is essential to proving conspiracy. Without this, they could have thought even sloppy accounting was criminal.

2. Advice-of-Counsel Defense Restricted

The defendant said he relied on professional tax advice. But the jury was told this only applied to filing false returns, not conspiracy. That unfairly limited the defense.

3. Appeals Court Corrects the Record

The appellate court overturned the conviction, stating that fair instructions are vital. The government can retry the case but must ensure jurors are properly guided.

Lessons for Professionals and Taxpayers

For Tax Professionals

- Document everything. Keep detailed records of your advice.

- Be clear. Explain risks to clients in writing.

- Stay updated. Cases like this show how the law evolves.

For Everyday Taxpayers

- Keep good records. Store tax forms and receipts for at least 7 years.

- Don’t cut corners. Claiming fake deductions might seem small but can spiral into big trouble.

- Ask for help. A CPA’s fee is cheaper than IRS penalties.

For Lawyers

This ruling is a reminder that jury instructions are fertile ground for appeals. Defense attorneys will use it to challenge unfair trials in the future.

Practical Guide: Avoiding Tax Trouble

Here’s a simple roadmap to stay on the safe side:

- Report all income. Even cash gigs and side hustles must be reported. Payment apps like Venmo and PayPal now report transactions over $600.

- Understand deductions. Legitimate business expenses are fine, but make sure they’re real.

- File on time. Penalties for late filing are steep, even if you can’t pay the full amount.

- Use reliable tools. Software like TurboTax or H&R Block can help prevent mistakes.

- Communicate with the IRS. If in doubt, use their official hotline: IRS Help.

Appeals: How They Work

Many people wonder: what happens when a conviction is overturned? Here’s the process:

- Step 1: Trial verdict. A defendant is convicted or acquitted.

- Step 2: Appeal filed. The defense argues that legal errors affected the verdict.

- Step 3: Appellate review. Judges examine the trial record, not new evidence.

- Step 4: Decision. The appeals court can uphold, reverse, or send the case back for retrial.

In this case, the Tenth Circuit reversed the conviction and opened the door for a possible retrial with corrected instructions.

Hope Travels Dragged Into Prosecution Over Major Tax Fraud Case

Two Company Directors Arrested – Separate Tax Fraud Cases Expose New Crackdown

₹332 Crore Bogus Copper Supply Scam Uncovered in Telangana Tax Fraud Raid

Future Implications

This case could influence how courts nationwide handle tax fraud conspiracy charges. Judges may now be more cautious in drafting instructions, ensuring jurors get the clearest possible guidance.

It may also embolden defendants in other cases to appeal if they believe jury instructions were faulty. Prosecutors, on the other hand, may adjust strategies to avoid such pitfalls.

The big takeaway? This ruling balances the scales, reminding both sides that fairness is as important as justice.