Imported Dry Dates Cleared: When it comes to international trade, things can get messy fast. Customs duty, country-of-origin rules, and shipping documents can make or break a business deal. And in India, Imported Dry Dates Cleared – Valid UAE Documents Lead CESTAT to Dismiss Fraud Charge is a headline-making case that proves just that. The case isn’t just about dry dates—it’s about how paperwork, compliance, and legal strategy can protect a business from crippling fraud charges. For importers and exporters, this decision offers practical lessons and a sense of relief. Let’s dig in.

Imported Dry Dates Cleared

The Imported Dry Dates Cleared – Valid UAE Documents Lead CESTAT to Dismiss Fraud Charge ruling is more than a quirky headline. It’s a lesson for every importer: get your paperwork right, protect yourself, and don’t panic when customs comes knocking. The case proves that with valid documents, businesses can win—even against government agencies. In today’s globalized supply chain, compliance isn’t just red tape—it’s survival.

| Aspect | Details |

|---|---|

| Case Name | S. S. Overseas vs. Principal Commissioner of Customs |

| Goods Involved | 55 MT of Imported Dry Dates |

| Dispute | Customs alleged dates were of Pakistani origin (fraudulent declaration) |

| Importer’s Documents | Certificate of Origin (Ajman Chamber of Commerce, UAE), invoice, packing list, fumigation, phytosanitary certificates |

| Tribunal’s Decision | Fraud charges dismissed; UAE origin upheld |

| Outcome | Duty demand and penalties canceled |

| Authority | CESTAT, Principal Bench New Delhi (Order Jan 14, 2025) |

| Official Order | Kolkata Customs PDF |

The Background: What Went Down?

In July 2019, Indian importer S. S. Overseas signed a deal with GVO Global FZC, UAE for 55 metric tonnes of dry dates. All documents were in place—invoice, packing list, fumigation certificates, and the golden ticket: a Certificate of Origin (CoO) from the Ajman Chamber of Commerce, UAE.

By August 2019, the goods cleared Indian customs, duty was paid, and everything seemed fine. Fast forward to December 2020, when Customs dropped a bombshell: a show cause notice (SCN) claiming the dates were not from the UAE but from Pakistan. Fraud, they said.

If proven, that would mean higher duties, penalties, and even possible blacklisting for the importer.

Why Customs Raised the Red Flag on Imported Dry Dates Cleared?

Authorities based their fraud allegations on:

- Container tracking data showing the cargo touched Karachi.

- An export declaration from a freight forwarder suggesting Pakistani origin.

Armed with this, the Commissioner reclassified the goods and imposed penalties under Sections 114A (fraudulent duty evasion) and 114AA (false declarations) of the Customs Act, 1962.

But the Tribunal wasn’t buying it.

CESTAT’s Take: Why the Fraud Allegation Fell Apart

When the appeal hit the Customs, Excise & Service Tax Appellate Tribunal (CESTAT), the bench tore into the evidence:

- Certificate of Origin stood valid. Customs never verified it with UAE authorities, even though they could under Rule 6 of the Customs (Administration of Rules of Origin) Rules, 2020.

- Freight forwarder’s document was shaky. It was an unsigned photocopy, riddled with errors (wrong consignee name, mismatched invoice). Courts don’t accept photocopies without authentication.

- No proof of fraud or suppression. The importer had disclosed all documents upfront—hardly the behavior of someone trying to hide origin.

Relying on its 2024 decision in Omega Packwell Pvt. Ltd. vs. Pr. Commissioner of Customs, the Tribunal ruled that unless a valid Certificate of Origin is officially disputed or canceled, it remains the final word.

Result? Fraud charges gone. Duties and penalties canceled.

Historical Context: India’s Tug-of-War With Origin Rules

This isn’t the first time importers have been dragged into court over country-of-origin disputes.

- In 2019, several textile importers faced similar cases when goods shipped via Singapore were alleged to be Chinese-origin.

- In 2020, the Indian government introduced CAROTAR (Customs Administration of Rules of Origin under Trade Agreements) 2020, tightening the process of verifying origin under free trade agreements (FTAs).

- Similar disputes have occurred with imports of electronics, chemicals, and steel, where routing through countries like Malaysia or Thailand was questioned.

The dry dates case reinforces that while rules exist to prevent misuse, genuine importers with valid papers should not suffer.

Impact of Imported Dry Dates Cleared on Businesses

So, what’s the ripple effect?

- Small and Medium Importers (SMEs): These businesses often lack big legal teams. This judgment gives them breathing space—valid documents protect them.

- Large Corporations: For giants importing electronics or auto parts, the ruling sets a precedent that compliance paperwork shields against arbitrary penalties.

- Trade Lawyers & Consultants: Expect more clients seeking proactive compliance strategies. Legal experts now have a stronger precedent to defend clients facing unfair charges.

In short: documentation is insurance.

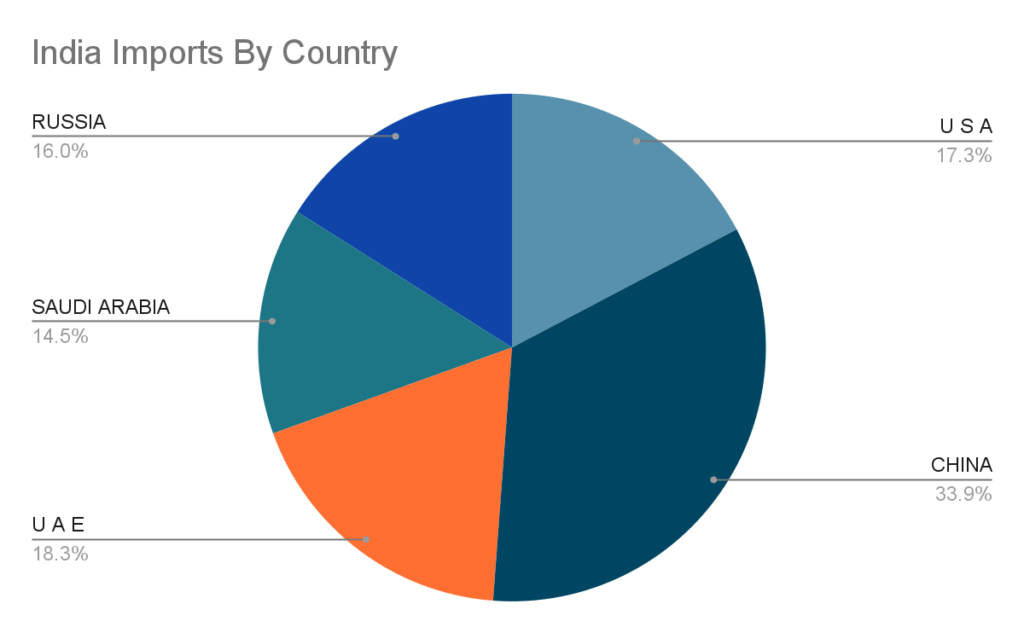

Global Trade Angle: Why UAE Shows Up in Indian Imports

Here’s where things get interesting. The UAE isn’t a major producer of dry dates. Pakistan is. So why UAE?

Because the UAE is a re-export hub. Goods from multiple countries land in Dubai or Ajman, get repackaged, certified, and re-exported. For Indian customs, this makes it tricky to track actual origins.

But as per global trade law, if the Certificate of Origin says UAE—and it’s valid—you can’t just override it with assumptions. That’s the law under the World Trade Organization (WTO) framework.

This is why CESTAT emphasized that origin certificates, unless proven fraudulent, remain binding.

Compliance Checklist for Importers

Want to avoid ending up in court? Here’s a practical checklist:

- Get authentic Certificates of Origin from recognized chambers or government trade bodies.

- Store all documents—physical and digital—for at least 5–7 years.

- Cross-check invoices, packing lists, and shipping details for consistency.

- Understand CAROTAR 2020 rules.

- Consult a trade lawyer if you get an SCN—don’t wait.

- Keep a compliance officer or consultant involved in your logistics process.

- Train staff to flag any inconsistencies in shipping or customs paperwork.

Expert Takeaway

Trade law experts highlight that this case is a “precedent-setting decision.” It signals that while customs is within its rights to scrutinize, importers cannot be penalized without rock-solid evidence.

As one consultant put it:

“If customs could reject a Certificate of Origin based on photocopies, every importer in India would be in trouble. This judgment restores balance and fairness.”

Real-Life Example: How This Applies Beyond Dates

Take an electronics importer bringing in circuit boards via Malaysia. If customs suspects Chinese origin and issues a show cause notice, the importer can now point to this precedent. As long as their certificate of origin is valid and uncontested, penalties may not hold.

Or consider a textile trader importing polyester yarn under an India-ASEAN trade pact. If customs raises doubts, this ruling proves that mere suspicion isn’t enough—verification through proper channels is mandatory.

Qatar Customs Cracks Down With Major Seizures of Drugs and Fraud

Madras HC Orders Reconsideration of 3-Year-Old Customs Duty Drawback Recovery Case

Big Win for Bus Services: CESTAT Grants Service Tax Exemption for Employee & School Transport

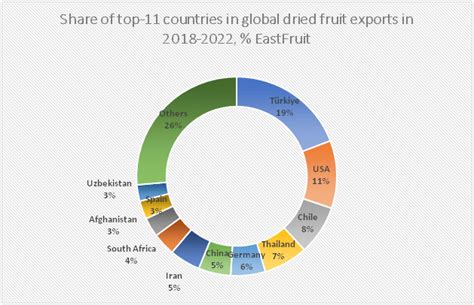

Numbers Don’t Lie: Dry Fruits & Trade

- India imported over $6 billion worth of dried fruits and nuts in FY 2022–23.

- Pakistan exports nearly 100,000 tonnes of dates annually.

- The UAE ranks among India’s top three trading partners, with bilateral trade crossing $84 billion in 2022–23.

Clearly, disputes like this are not going away anytime soon.