GST 2.0 Is Here: If you’ve been following India’s economic headlines, you’ve probably seen the buzz: GST 2.0 is here. Starting September 22, 2025, the Indian government is rolling out a major overhaul of its Goods and Services Tax (GST) system. Instead of the old, complex four-slab structure, we’re now moving to a leaner two-slab tax system — plus a high-end luxury tier. This change is not just about numbers on paper; it’s about how much you’ll pay at the grocery store, when buying a car, or even insuring your family. And here’s the kicker — this reform isn’t just for businesses and economists to geek out over. It’s designed to hit home for everyday folks. Whether you’re shopping for toothpaste, grabbing a soda, or looking at upgrading your car, GST 2.0 will change the price tags you see.

GST 2.0 Is Here

GST 2.0 is more than just a tax reform — it is a restructuring of India’s economic system. By moving to two main slabs and a separate luxury tier, the government is aiming to balance consumer relief with revenue needs. For households, this means lower bills and cheaper insurance. For businesses, it simplifies compliance and boosts demand. For the economy, it is a gamble on growth. Whether you are saving money on groceries or reconsidering a luxury purchase, GST 2.0 will shape your financial decisions starting September 22.

| Category | Tax Rate | Examples | Impact on You | Official Reference |

|---|---|---|---|---|

| Daily Essentials | 5% | Toothpaste, shampoo, packaged foods, medicines | Lower household bills | GST Council |

| Insurance | 0% | Life and health insurance premiums | More affordable coverage | Finance Ministry |

| Standard Goods | 18% | TVs, ACs, dishwashers, small cars, motorcycles ≤350cc | Cheaper durable goods | Reuters |

| Luxury/Sin Goods | 40% | Soft drinks, luxury cars, tobacco, yachts, helicopters | Higher costs for non-essentials | India Today |

| Revenue Impact | ₹48,000 crore loss | National estimate | Offset by growth & consumption | Hindustan Times |

| Inflation Impact | -1.1% points | Predicted drop | Lower consumer prices | Reuters |

A Quick Refresher: What is GST and Why It Matters

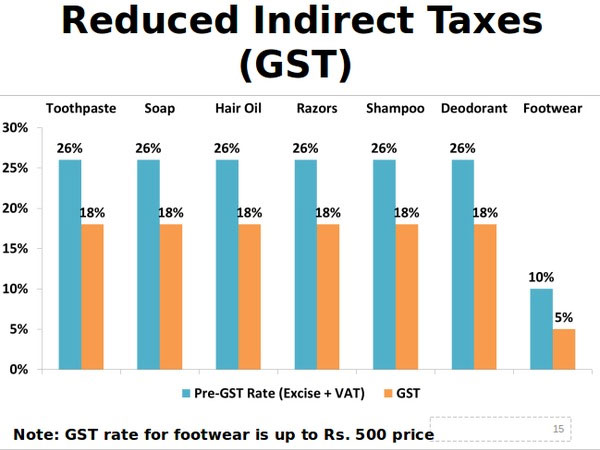

Introduced in 2017, India’s Goods and Services Tax was meant to replace a confusing system of excise duties, service taxes, and state VATs with one unified national tax. The slogan was “One Nation, One Tax.”

But the reality turned out to be more complicated. With four major slabs (5%, 12%, 18%, 28%) plus special cesses, businesses faced classification disputes and consumers struggled to understand why two nearly identical products carried different tax rates. Economists argued that the system was inflationary and compliance-heavy.

Now, after years of debate, GST 2.0 simplifies the structure into just two slabs plus one for luxury and sin goods. The goal is clarity, simplicity, and fairness.

GST 2.0 Is Here: Breaking Down the New Slabs

Essentials at 5%

This category is designed to give relief to households. It covers:

- Everyday items like toothpaste, shampoo, soaps

- Packaged foods such as biscuits, cereals, and instant noodles

- Medicines and healthcare products

- Personal care items

- Insurance premiums, which now carry 0% GST

Example: If your monthly essentials bill was ₹5,000 at the earlier average of 12% tax, GST 2.0 cuts that down, saving you around ₹350–400 each month.

Standard Goods at 18%

This is the broadest category, covering most goods and services that aren’t essentials but are widely used. Items include:

- Consumer electronics like televisions, refrigerators, and air conditioners

- Household appliances such as dishwashers and washing machines

- Automobiles such as small cars and motorcycles up to 350cc

Example: A compact car priced at ₹8 lakh under the old 28% tax slab would now be taxed at 18%, potentially saving the buyer around ₹80,000.

Luxury and Sin Goods at 40%

This new slab is aimed at non-essential or harmful items. The government’s clear message: if you want to indulge, you’ll pay for it. Items include:

- Soft drinks, energy drinks, and other aerated beverages

- Luxury SUVs, yachts, helicopters, racing cars

- Tobacco products such as cigarettes, pan masala, and gutkha

Example: A luxury SUV that cost ₹50 lakh before may now cross ₹55 lakh after GST 2.0.

Global Context: How India Compares

The reform also positions India more in line with global practices.

- The United States does not have a national GST; sales taxes are levied at the state level, ranging from 0% to over 10%.

- The European Union generally uses a two- or three-slab VAT system. For instance, Germany has 7% and 19%.

- Australia has a flat GST rate of 10% across most goods and services.

India’s new two-slab model is closer to these global examples, making cross-border trade and investment easier.

Impact on Businesses and Professionals

For businesses, especially small and medium enterprises, GST 2.0 simplifies compliance. With fewer slabs, disputes over classification should decrease, and filing becomes easier. Digital tools in the GST Network (GSTN) are being upgraded to reflect the new rates.

For professionals such as accountants, auditors, and tax consultants, the change creates opportunities. Companies will need advice on reclassification, transition strategies, and updated compliance systems. Students and finance professionals should pay attention, as GST 2.0 will feature in competitive exams and case studies for years to come.

Sectoral Impact: Who Wins and Who Loses

- FMCG Sector: Big winner. With essentials now cheaper, demand is expected to rise.

- Automobile Industry: Small cars and motorcycles become more affordable, while luxury vehicles get costlier. This could shift buying patterns.

- Healthcare and Insurance: A major win. With 0% GST on premiums, more families may take up life and health coverage.

- Beverages and Tobacco: Clear losers. Higher rates on soft drinks and tobacco could dampen sales, though health advocates may cheer the move.

Real-Life Scenarios

The Sharma family, a middle-class household in Delhi, expects their monthly budget of ₹25,000 to stretch further as groceries, medicines, and personal care items become cheaper. They also plan to buy a new car after September 22 to take advantage of the lower tax slab.

Raj, who owns a small electronics shop in Mumbai, is already seeing more inquiries for TVs and ACs. With lower prices post-GST 2.0, he expects a 15–20% boost in festive season sales.

On the flip side, a corporate firm that was considering luxury SUVs for its senior executives is now rethinking its purchase plans because of the steep 40% tax.

Expert Opinions and Criticism

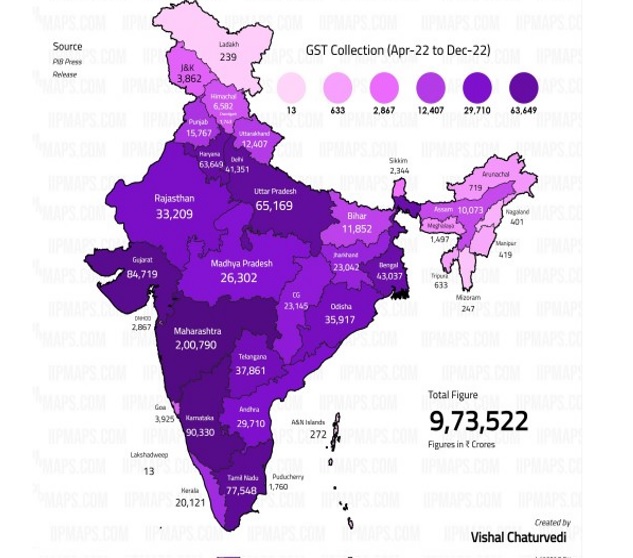

While the government expects a revenue loss of around ₹48,000 crore, it argues this will be offset by higher consumption and growth. Economists are divided. Some believe the reforms will indeed cool inflation and boost demand, while others worry about fiscal deficits if consumption does not rise as expected.

Critics also warn that enforcement will be key. Without strong monitoring, there may be attempts at misclassification to take advantage of lower slabs.

The Economic Big Picture

India’s GDP growth has slowed in recent years, and inflation has been a persistent worry. GST 2.0 is timed to stimulate demand ahead of major festivals and to reassure both consumers and businesses. Early market reactions have been positive, with FMCG and auto stocks rising.

If the reforms work as intended, inflation could fall by 1.1 percentage points, and consumer demand could rise significantly. If not, the government will have to find ways to manage the revenue shortfall.

Practical Advice: How to Navigate GST 2.0

- Time your purchases. If you’re considering buying a car or a big appliance, wait until after September 22 to maximize savings.

- Review insurance. With GST at 0%, now is the best time to secure life and health coverage.

- Shop smart. Essentials are cheaper — consider bulk purchases where possible.

- Be cautious with luxuries. Factor in the new 40% tax before making indulgent buys.

- For professionals. Stay updated and advise clients on how to restructure their tax planning under the new system.

GST 2.0 Promises Consumption Boost – Can Lower Taxes Also Tame Inflation?

GST 2.0: How Modi’s Big Reform Could Boost Autos, FMCG, and Cement

PM Modi’s GST 2.0 Reform Explained — 5 Big Reasons It Matters for Everyone