Winners & Losers of the New GST System: The winners and losers of the new GST system in India are the talk of the town. From September 22, 2025, Prime Minister Modi’s government rolled out a sweeping Goods and Services Tax (GST) overhaul that reshaped how Indians pay for daily essentials, insurance, cars, and even luxury goods. This reform is not just about numbers on a receipt. It reflects a big shift in how India wants its people to spend, save, and invest. By cutting taxes on essentials and piling them on luxury or “sin” items like soda and tobacco, the government is sending a strong message: “Spend wisely, live smarter.”

Winners & Losers of the New GST System

The winners and losers of the new GST system highlight India’s balancing act: ease the burden on families and farmers, while taxing luxury and harmful consumption. Families, healthcare users, small car buyers, and rural India all win big. On the flip side, gamblers, soda drinkers, smokers, and luxury spenders take the hit. This isn’t just a tax reset — it’s a blueprint for India’s economic priorities. The big question is whether consumer demand will surge enough to offset revenue losses. If it does, GST 2.0 could go down as one of India’s smartest reforms.

| Category | What Gets Cheaper | What Gets Costlier | Official Source |

|---|---|---|---|

| Essentials & FMCG | Food, toiletries, stationery, dairy, packaged goods | — | Government of India GST Portal |

| Healthcare & Insurance | Medicines, devices, insurance premiums | — | Reuters |

| Automobiles | Small cars, EVs, commercial vehicles | Luxury vehicles, yachts, high-end bikes | Hindustan Times |

| Household Goods | TVs, ACs, cement, fertilizers | — | NDTV |

| Lifestyle & Apparel | Mass footwear, textiles | Premium clothing over ₹2,500 | Economic Times |

| Sin & Luxury | — | Tobacco, carbonated drinks, gambling, casinos | Financial Express |

| Overall Impact | Inflation could drop by 1.1% | Govt. revenue loss: ₹480 billion | Reuters |

A Quick Look Back: India’s GST Journey

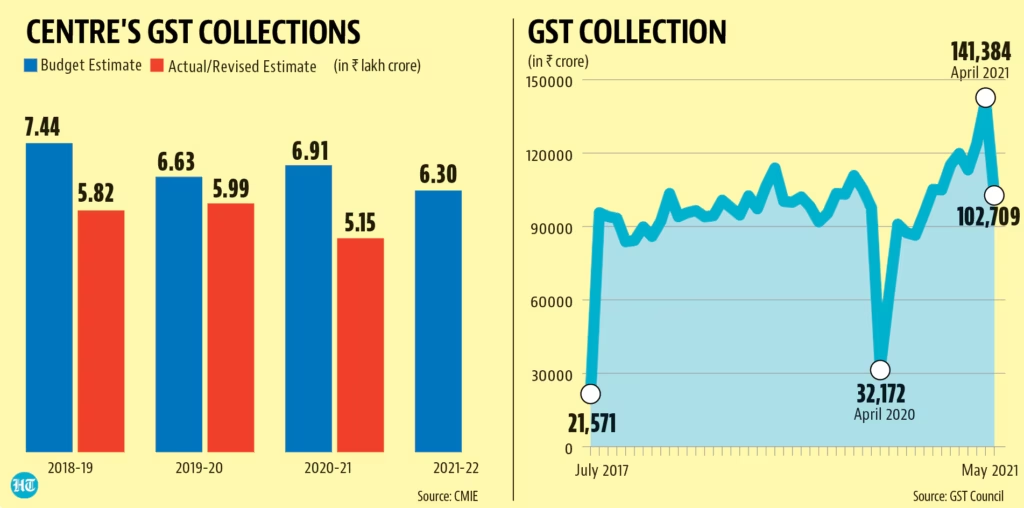

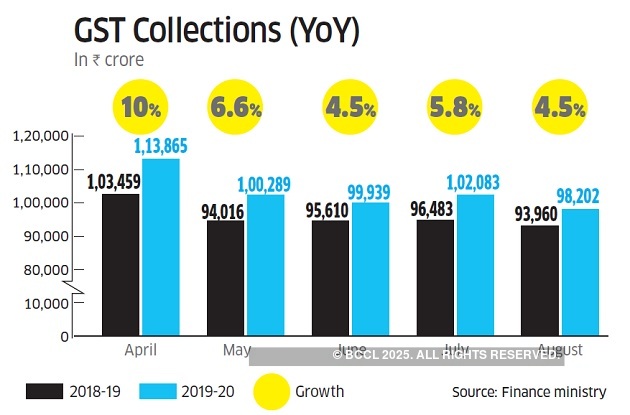

GST in India launched in July 2017, replacing a messy mix of central excise, VAT, service tax, and dozens of state-level levies. Back then, it was hailed as India’s “big bang” tax reform, unifying the country into a single market.

But cracks showed quickly. Multiple tax slabs (0%, 5%, 12%, 18%, 28%) made things complicated. Businesses, especially small ones, struggled with compliance. Consumers often felt items were unfairly taxed — for example, biscuits and chocolates taxed at 18%, while luxury hotels sometimes escaped with lower effective rates due to loopholes.

After eight years of tweaking, the government hit reset in 2025 with GST 2.0, trimming slabs and realigning priorities.

Winners: Who Benefits Under the New GST

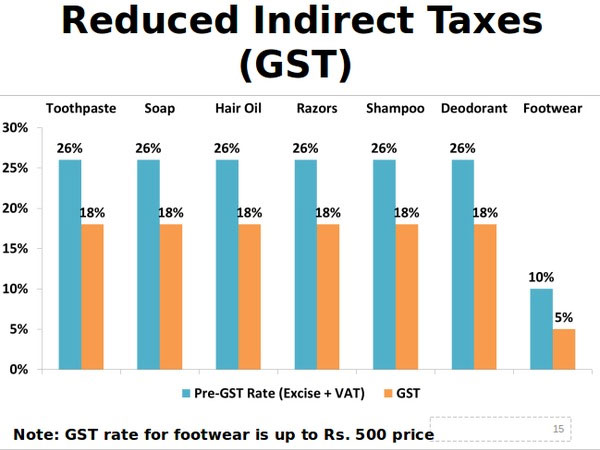

Household Essentials & FMCG

Everyday goods are cheaper, including milk, butter, ghee, cheese, noodles, biscuits, chocolates, soap, toothpaste, shampoo, stationery items, and chapatis.

Case Study: The Kumar family in Lucknow used to spend around ₹6,000 on monthly groceries. With reduced GST, their bill has dropped by about ₹500. That’s enough for extra school supplies or a family weekend outing.

Healthcare & Insurance

This is perhaps the biggest relief.

- 33 lifesaving drugs are now tax-free.

- Medical equipment such as thermometers, oxygen cylinders, test kits, and spectacles are at 5%.

- Insurance premiums are GST-free (earlier taxed at 18%).

For a middle-class family paying ₹20,000 annually in health insurance, this reform means direct savings of ₹3,600. In a country where healthcare costs push millions into poverty, this is a step toward financial security.

Automobiles and Electric Vehicles

Middle-class buyers rejoice.

- Small petrol/diesel cars now face 18% GST instead of 28%.

- EVs remain at 5%.

- Commercial vehicles like buses, trucks, and ambulances are at 18%.

Case Study: A young professional buying a ₹10 lakh hatchback now saves ₹80,000 compared to earlier. That’s practically the down payment for insurance and accessories.

Construction & Real Estate

- Cement reduced from 28% to 18%.

- Fertilizers, tractors, irrigation equipment, and farm parts now at 5%.

This is good news for both farmers and urban homeowners. Lower cement costs mean cheaper housing projects, while cheaper fertilizers strengthen rural demand.

Entertainment & Wellness

Services like gyms, yoga centers, and salons now attract only 5% GST (without input credit). For urban millennials, this makes wellness and fitness more accessible.

Losers: Who Pays More Now

Fashion and Apparel

Clothes priced above ₹2,500 now attract 18% GST, up from 12%. While mass-market brands get relief, high-end retail will feel the pinch.

Energy and Coal

Coal moves from 5% to 18%. While this raises input costs for industries, it’s also aligned with India’s long-term green energy goals.

Sin and Luxury Goods

This is where the government cracked down:

- Tobacco, cigarettes, gutka, pan masala → 40%.

- Soda, energy drinks, sweetened beverages → 40%.

- Casinos, betting, lotteries, online gaming → 40%.

- Luxury cars, yachts, private jets, big bikes → 40%.

This mirrors the U.S. concept of “sin taxes,” where harmful or extravagant products carry heavy levies to discourage overuse.

Sectoral Impact of Winners & Losers of the New GST System: A Closer Look

- FMCG: Expect companies like HUL and ITC to launch “price cut” campaigns, boosting sales in rural and semi-urban areas.

- Healthcare: Insurance uptake could rise as premiums drop. Hospitals welcome cheaper medical devices.

- Auto Sector: Small car and EV sales could soar, but luxury brands like Mercedes and BMW may struggle.

- Real Estate: Developers expect construction costs to drop by 8–10%, possibly reducing housing prices.

- Agriculture: Fertilizer and tractor tax cuts will boost rural productivity.

- Hospitality: Luxury hotels with premium packages may get costlier, but mid-range dining remains stable.

- Aviation: Airlines benefit slightly from cheaper equipment and inputs, though fuel remains outside GST.

Impact on State Governments

One overlooked angle is federalism. States rely on GST compensation from the center. With lower tax rates on essentials, states fear losing revenue. Analysts estimate the reform could widen the fiscal deficit unless consumer demand surges.

Some states, like Maharashtra and Tamil Nadu, have already flagged concerns. The center has promised GST compensation extensions, but political tussles are expected.

Expert Opinions

Economists are divided.

- Proponents argue this will cut inflation by 1.1 percentage points and boost demand, especially ahead of the festive season.

- Critics warn of a ₹480 billion revenue shortfall, which could rise if consumer demand doesn’t rebound fast.

Raghuram Rajan, former RBI governor, recently noted: “This is a gamble worth taking. Lowering taxes on essentials boosts confidence, but we must watch how the deficit plays out.”

Global Comparison

- United States: Sales tax varies by state (5–10%). Essentials like groceries are usually exempt, much like India’s move now.

- European Union: VAT ranges from 15–25%, with reduced rates for essentials. India’s GST overhaul makes it closer to this model.

- Singapore: Uses a single 9% GST across all goods, far simpler but less flexible.

India’s GST 2.0 blends these approaches, offering relief while retaining targeted “sin taxes.”

Practical Advice for Consumers

- Shop Smart: Plan your big-ticket buys (cars, ACs, TVs) now and lock in savings.

- Get Insured: With GST-free insurance, there’s no excuse to skip health coverage.

- Cut Sin Spending: Switch soda for fresh juice; your wallet and health will thank you.

- Track Receipts: Ensure retailers pass on GST cuts to you — compliance will take a few months to settle.

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials

GST Tax Cuts Could Spark Market Rally and Boost Demand, Says Ajay Bagga

Should States Get Compensated for GST Reform Losses? The Debate Heats Up

Practical Advice for Businesses

- Update Pricing: Re-label products and services quickly. Non-compliance could mean fines.

- Boost Marketing: Promote “GST savings” campaigns to drive sales.

- Stay Agile: Watch sectoral demand shifts. For example, soda makers may need to pivot toward juices or bottled water.

- Plan for Compliance: Simpler slabs make filings easier, but errors can still attract penalties.