New GST Rates Announced: When the New GST Rates were announced in India, the news spread faster than wildfire. Shoppers, businesses, and investors are all buzzing about what it means. For everyday folks, it’s about groceries, gadgets, and school supplies costing less. For businesses, it’s about adjusting invoices, margins, and strategies. And for the government, it’s about balancing relief with revenue. Think of GST as India’s version of a national sales tax, similar to how state sales taxes work in the U.S. If Walmart suddenly dropped sales tax on essentials while hiking it for luxury cars and cigarettes, you’d feel it immediately. That’s exactly what’s happening across India right now.

New GST Rates Announced

The new GST rates are a landmark reform — the boldest since GST’s launch in 2017. Essentials are cheaper, electronics and cars more affordable, while luxury and sin goods carry heavier taxes. Families will save thousands annually, businesses gain clarity, and inflation should ease. This overhaul balances relief for citizens with fiscal responsibility, making GST simpler, fairer, and more growth-oriented.

| Category | Change in GST | Impact | Source |

|---|---|---|---|

| Essentials (bread, paneer, milk) | 0% GST | Cheaper groceries | Official GST Council |

| Toiletries & Food items | 5% GST | Affordable daily use items | Hindustan Times |

| Electronics (ACs, TVs, cement, cars) | 18% GST | Lower costs for appliances, vehicles | Reuters |

| Insurance policies | 0% GST | More savings on health & life cover | NDTV |

| Sin & Luxury goods (tobacco, soda, luxury cars) | 40% GST | Costlier products | Livemint |

Why This Matters?

The 56th GST Council meeting, chaired by Finance Minister Nirmala Sitharaman, simplified the earlier four-slab system (5%, 12%, 18%, 28%) into just two: 5% and 18%. On top of that, a new 40% slab was introduced to cover sin and luxury goods.

The impact? Economists project inflation could fall by 1.1 percentage points, giving the middle class much-needed relief while maintaining government revenues.

GST in Context: How We Got Here

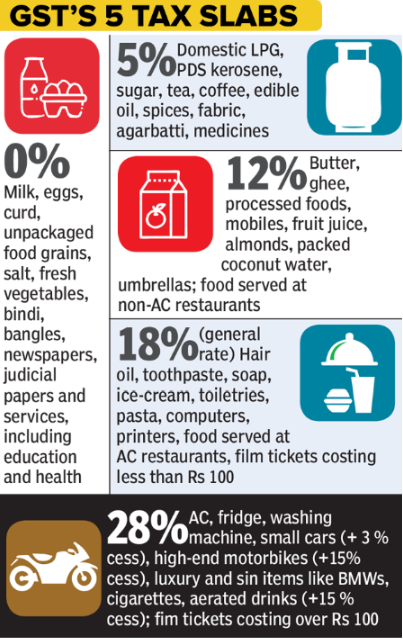

GST, or Goods and Services Tax, was introduced in July 2017 to replace a confusing maze of central and state taxes. While it simplified things on paper, the multiple slabs (0%, 5%, 12%, 18%, 28%) often created disputes and compliance headaches.

Businesses argued it wasn’t truly “one nation, one tax.” Consumers often complained about paying higher taxes on daily items like snacks or school stationery. After years of lobbying from industry and recommendations from economists, India has now moved closer to a two-slab structure, similar to Australia’s 10% GST or Canada’s 5% GST.

What Just Got Cheaper?

Zero Percent GST: Everyday Relief

- Pre-packaged paneer, chena, roti, chapati.

- UHT milk.

- Insurance products (life and health).

Example: A family paying ₹30,000 annually for health insurance earlier paid ₹32,400 with GST. Now, that’s ₹2,400 saved straight away.

Five Percent GST: Essentials Made Affordable

- Toiletries: Shampoo, soap, toothpaste, shaving cream.

- Packaged food: Biscuits, chocolates, pasta, noodles, sauces, jam.

- School supplies: Notebooks, pencils, crayons, maps, globes.

- Household items: Bicycles, feeding bottles, utensils, umbrellas.

- Medical: Glucometers, thermometers, corrective lenses.

- Agriculture: Tractors, fertilizers, bamboo furniture, compost machines.

Example: A ₹1000 bill on toiletries earlier cost ₹1180 with 18% GST. Now, with 5%, it’s ₹1050. That’s ₹130 saved per ₹1000 spent.

Eighteen Percent GST: Big-Ticket Items Slashed

- Electronics: TVs (above 32”), air conditioners, dishwashers, projectors.

- Construction: Cement, batteries.

- Automobiles: Motorcycles under 350cc, small cars, buses, ambulances, trucks.

Example: A ₹15 lakh car previously taxed at 28% now attracts 18%. That’s nearly ₹1.5 lakh saved — enough to fund insurance, accessories, or fuel for a year.

What Got Costlier?

The New 40% Slab

- Tobacco products: Cigarettes, cigars, chewing tobacco, gutkha.

- Sugary and caffeinated drinks: Cola, energy drinks.

- Luxury cars, online gambling, and certain high-end services.

This aligns with global practice. In the U.S., for example, “sin taxes” on cigarettes or sugary drinks are common to discourage harmful consumption.

Sector-Wise Breakdown of New GST Rates Announced

Retail & FMCG

Lower GST on soaps, toothpaste, chocolates, and snacks will directly boost sales in India’s massive $1 trillion retail sector. FMCG giants like Hindustan Unilever and Nestlé stand to benefit.

Automobiles

With taxes cut from 28% to 18% on motorcycles and small cars, the auto industry is eyeing a revival. After years of slowing sales, this could be the boost manufacturers like Maruti Suzuki and Bajaj Auto needed.

Real Estate & Construction

Cement and batteries dropping to 18% will reduce construction costs, making housing and infrastructure more affordable. Builders project homebuyers could see 2–4% savings in property costs.

Healthcare & Insurance

Health insurance premiums going tax-free is a big incentive. Medical devices at 5% make diagnostics cheaper. This could expand coverage in a country where only 35% of people currently have insurance.

Agriculture

Tractors, fertilizers, and equipment at 5% means farmers will spend less on inputs, helping agricultural productivity.

Global Comparison

- India (2025): 0%, 5%, 18%, 40%.

- U.S.: No national GST; state sales tax varies (0–10%).

- UK: Standard 20% VAT; 5% on essentials.

- Australia: Flat 10% GST.

- Singapore: Flat 9% GST.

India remains more layered than these countries but has moved closer to simplification.

The Psychological and Cultural Impact of GST Changes

While most discussions around the new GST rates focus on numbers and percentages, it’s equally important to understand how these changes affect consumer behavior and cultural spending habits. In India, festivals like Diwali, Navaratri, and Holi are peak shopping seasons, where families often spend more on food, clothes, and home appliances. By announcing the new rates to take effect just before Navaratri (September 22, 2025), the government has tapped into this cultural rhythm, encouraging households to shop more confidently.

From a psychological standpoint, consumers tend to respond positively to tax cuts on daily-use items. When everyday products like shampoo, notebooks, and biscuits become cheaper, people feel their purchasing power has grown—even if the actual savings are modest. This “feel-good factor” often leads to higher discretionary spending on bigger items such as electronics, vehicles, or even property.

Moreover, lowering taxes on essentials while hiking them for luxury and sin goods signals fairness. Middle-class families see it as a government policy that aligns with their values, rewarding responsible consumption while discouraging harmful habits. This cultural acceptance is critical for the success of GST reforms, ensuring people not only save money but also trust the system more deeply.

Case Studies: How It Plays Out

- Middle-Class Family in Delhi

Monthly grocery bill of ₹10,000 (previously taxed at 12%). Earlier cost: ₹11,200. Now at 5%, it’s ₹10,500. ₹700 saved per month, ₹8,400 annually. - Small Business Owner in Pune

Sells stationery worth ₹5 lakh annually. At 12% GST, paid ₹60,000 tax. Now at 5%, tax is ₹25,000. ₹35,000 saved, which can be reinvested in inventory. - First-Time Car Buyer in Bengaluru

Buying a ₹10 lakh hatchback. Earlier GST at 28% added ₹2.8 lakh. Now, at 18%, it’s ₹1.8 lakh. ₹1 lakh saved instantly.

New GST Rates Likely By Dussehra – Govt Prepares For Revenue Shortfall

Your Expenses Could Change Soon—GST Council Eyes Rationalising 12% & 18% Rates

Infosys Fined by Singapore Over GST Payments—Here’s What the Company Just Revealed

Expert Opinions

- “This rationalization is consumer-friendly and growth-oriented. It encourages spending while curbing harmful consumption,” says Radhika Rao, Economist, DBS Bank.

- The Confederation of Indian Industry (CII) called it, “A Diwali gift for middle-class India, especially ahead of the festive season.”

Practical Advice for Consumers

- Delay big purchases like cars, ACs, or appliances until after September 22, 2025.

- Families should budget for savings on toiletries, school supplies, and insurance.

- Farmers should prepare for cheaper tractor parts and fertilizers.

Business Tips for GST Compliance

- Update Invoicing Systems: Ensure billing software reflects new rates.

- Reprice Products: Pass on tax benefits to gain customer loyalty.

- Inventory Planning: Align purchases with rate changes to maximize savings.

- Educate Customers: Highlight cheaper prices in promotions.