GST 2.0 Slashes Prices on TVs, Bikes & Cement: If you’ve been waiting for a big tax shake-up in India, GST 2.0 is here—and it’s making serious waves. From TVs, bikes, and cement getting cheaper to milk and paneer now completely tax-free, this new tax structure is a game-changer for households and businesses alike. Whether you’re a shopper, a small business owner, or an economist keeping score, this update is one you can’t afford to ignore. The move, which kicks in from September 22, 2025, simplifies the old confusing four-tier system into just two main slabs (5% and 18%) plus a 40% sin-luxury rate. The goal? To cut down on red tape, boost spending during the festive season, and ease the burden on everyday consumers.

GST 2.0 Slashes Prices on TVs, Bikes & Cement

GST 2.0 is more than a tax update—it’s a consumer relief package. By slashing rates on essentials, construction goods, and electronics while keeping luxury and harmful items pricey, it balances growth with responsibility. Families will see lighter grocery bills, builders will save lakhs on materials, and businesses will enjoy smoother compliance. The festive season of 2025 may very well be remembered as the moment India’s wallets truly got heavier.

| Feature / Item | Old GST Rate | New GST Rate | Impact |

|---|---|---|---|

| Milk & Paneer | 5% | 0% (Tax-Free) | Cheaper groceries for households |

| Butter, Cheese, Biscuits | 12–18% | 5% | Lower food bills |

| TVs, ACs, Cement, Bikes | 28% | 18% | Affordable electronics & construction |

| Life-Saving Drugs | 12% | 0% (Tax-Free) | Healthcare relief |

| Luxury Cars, Tobacco, Aerated Drinks | 28% + cess | 40% flat | Higher costs for luxury/harmful goods |

| Official Reference | GST Council Website | — | Source for updates |

A Quick History of GST in India

India rolled out its Goods and Services Tax (GST) in July 2017, consolidating over 17 state and central taxes into one national system. The aim was simple: to replace a maze of excise duties, VAT, and service tax with one uniform structure.

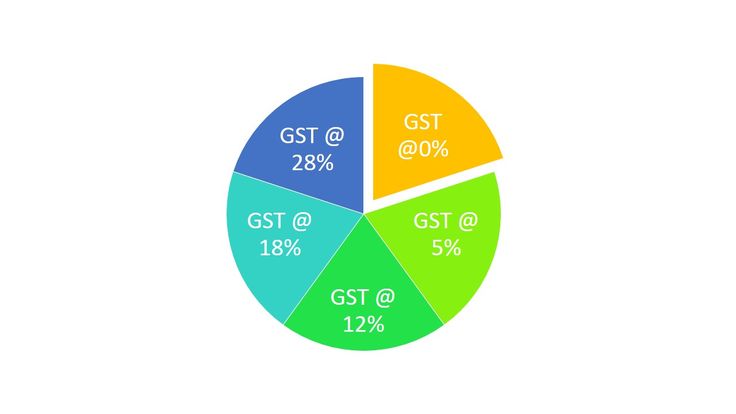

But things didn’t go exactly as planned. The original GST had four slabs—5%, 12%, 18%, and 28%, plus cesses on luxury and sin goods. Businesses found it complicated, consumers saw uneven price changes, and states sometimes felt shortchanged on revenues.

By 2020, several rounds of tweaks were made, but confusion persisted. Fast-forward to 2025, and the government has decided to reset the clock with GST 2.0.

Step-by-Step Guide: Understanding GST 2.0 Slashes Prices on TVs, Bikes & Cement

Step 1: Know the New Slabs

- 5%: Essentials like food, personal care, daily-use items.

- 18%: Standard goods such as TVs, cement, and vehicles.

- 40%: Luxury and harmful goods (tobacco, high-end cars, sugary drinks).

Step 2: Check the Zero-Rate List

- Milk, paneer, roti, paratha, and life-saving medicines are now tax-free.

Step 3: Calculate Your Savings

Example: Buying a refrigerator worth ₹30,000.

- Old tax (28%): ₹8,400 GST.

- New tax (18%): ₹5,400 GST.

- Savings: ₹3,000 straight up.

Step 4: Businesses Must Update Systems

- POS machines, invoicing software, and compliance tools need new rates loaded.

Step 5: Consumers Should Double-Check Bills

For the first few weeks, errors may happen. Always scan the receipt.

What’s Getting Cheaper?

Everyday Essentials

- Milk and paneer: Now at 0% GST, a major relief for households.

- Butter, ghee, cheese, biscuits, chocolates: Dropped to 5%, cutting monthly bills.

- Personal care items like soaps, shampoos, toothpaste: Now just 5%.

A middle-class family spending ₹12,000 monthly on essentials could save nearly ₹10,000 annually.

Gadgets & Home Appliances

- TVs, ACs, washing machines, refrigerators: From 28% down to 18%.

- Savings range from 8–12%, making festive electronics purchases more attractive.

Vehicles & Construction

- Two-wheelers, three-wheelers, small cars: Reduced to 18%.

- Cement: From 28% to 18%, significantly reducing construction costs.

For a builder constructing a 10-flat apartment project, the cement savings alone could be ₹10–15 lakh.

What’s Getting Expensive?

The 40% sin-luxury tax ensures luxury or harmful goods stay pricey:

- Cigarettes, gutkha, pan masala.

- High-end SUVs and motorcycles above 350cc.

- Aerated and sugary beverages.

This mirrors global policies. In the USA, “soda taxes” exist in cities like Philadelphia. In UK, tobacco is taxed heavily to discourage smoking.

Global Comparisons

India isn’t alone in wrestling with tax simplicity.

- Canada: Uses a Harmonized Sales Tax (HST) of around 13–15%, consistent across provinces.

- Australia & New Zealand: Both run on a single slab GST (10% and 15% respectively), known for simplicity.

- European Union: Typically one standard VAT rate (17–27%), with a reduced rate for essentials.

India’s two-slab system may not be as simple as New Zealand’s, but it’s a leap forward from the old four-slab tangle.

Sector-by-Sector Impact

FMCG (Fast-Moving Consumer Goods)

- Cheaper biscuits, chocolates, shampoos, and soaps boost rural and urban demand.

- Companies like HUL and ITC could see volume growth.

Real Estate & Construction

- Lower cement costs reduce construction expenses, making homes more affordable.

- Builders may pass savings to buyers or improve margins.

Auto Sector

- Two-wheelers and small cars get cheaper, driving up sales in semi-urban areas.

- Luxury cars get hit harder, possibly dampening high-end sales.

Healthcare

- Life-saving drugs at 0% GST reduce out-of-pocket expenses.

- Hospitals save on equipment taxed lower, indirectly benefiting patients.

Voices from the Ground

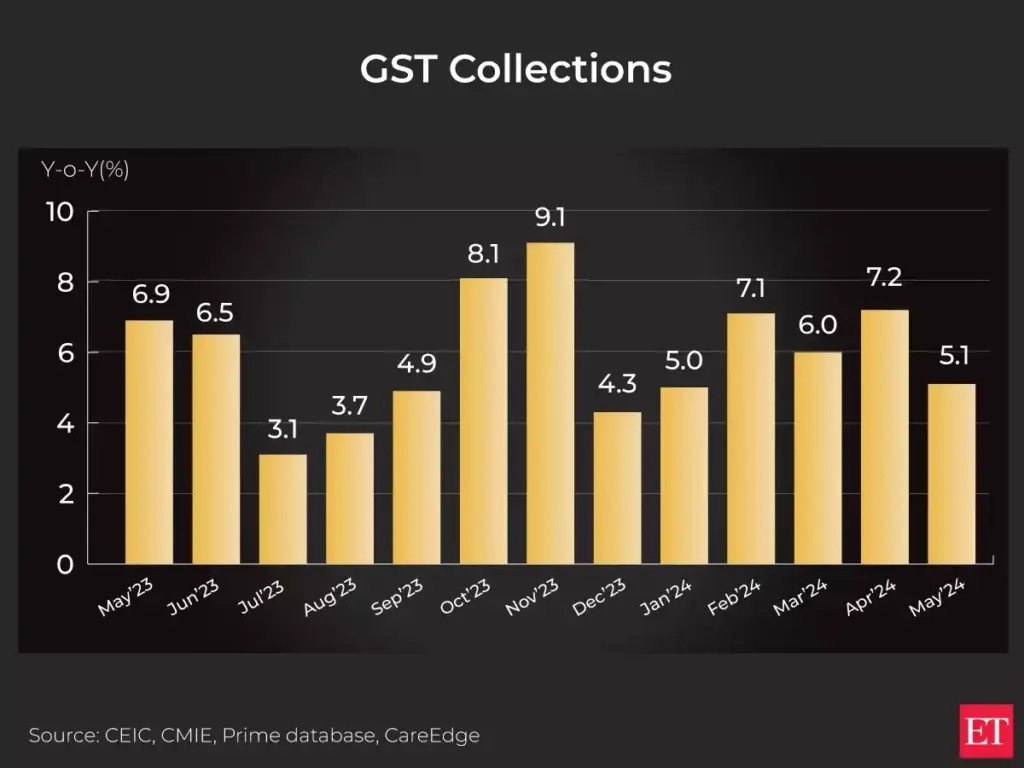

Economists: Some estimate GST 2.0 could add 1–1.5% to India’s GDP in the next year.

Small Business Owner: Ramesh, a Delhi grocer, says, “Earlier customers complained biscuits were too expensive. Now I can offer them cheaper and keep them loyal.”

Consumer: Priya, a working mom in Mumbai, says, “Milk and paneer tax-free? That’s my kids’ breakfast sorted, and my budget feels lighter.”

Case Studies

Family Example

Monthly grocery spend: ₹12,000

Old GST cost: ₹1,500

New GST cost: ~₹700

Annual savings: ₹9,600—almost one month’s rent in a metro city.

Small Café Example

Monthly input cost on cheese, butter, packaged food: ₹50,000

Old GST: ~₹6,000

New GST: ~₹2,500

Savings: ₹3,500/month → ₹42,000/year (enough for one staff salary).

Challenges and Criticisms

While GST 2.0 looks rosy, challenges remain:

- Implementation Lag: Businesses need to quickly update billing systems. Smaller shops may struggle.

- Revenue Risks: Lower rates may shrink government income initially. States could demand compensation.

- Black Market Risk: With some goods at 40% tax, smuggling and illegal sales might rise.

Cement Stocks Could Boom as Analysts Eye a Possible GST Slash

New GST Slash May Slash Car Prices—See How Much You Could Save on Your Dream Ride

Medical Device Industry Warns Govt: Sudden GST Cuts Could Disrupt Entire Supply Chain

Impact on Inflation

Market analysts suggest GST 2.0 could lower retail inflation by 0.2–0.4%. With cheaper essentials and cement, consumer confidence rises. The RBI may hold interest rates steady, benefiting borrowers.

Future Outlook

Will there be a GST 3.0? Possibly. Experts predict India may eventually move to a single slab GST like Singapore. With digital invoicing, AI-driven compliance, and e-invoicing already in place, the groundwork for an even simpler tax regime is being laid.