U.S. Bank’s New Platform Promises to Simplify Cash Flow Chaos: Running a small business in America is no joke. Between paying employees, handling bills, managing vendors, and waiting for customers to pay invoices, cash flow can feel like the most stressful roller coaster ride ever. According to the U.S. Small Business Administration, more than 82% of business failures happen because of poor cash flow management. That’s a scary statistic, but it shows just how critical managing your money really is. Enter U.S. Bank’s new all-in-one cash flow management platform. Officially launched in September 2025, this tool is designed to give small business owners something they’ve been asking for: a simpler way to manage money, bills, and cash flow in one place. No more juggling apps, spreadsheets, or late-night calculator sessions. Instead, U.S. Bank is offering a dashboard that keeps everything organized, automated, and visible.

U.S. Bank’s New Platform Promises to Simplify Cash Flow Chaos

At the end of the day, U.S. Bank’s new platform promises to simplify cash flow chaos for small business owners—and it’s delivering on that promise. By combining automation, accounting integration, and real-time cash insights, this platform gives entrepreneurs something priceless: peace of mind. Whether you run a café, construction company, or online shop, this tool can help you manage money smarter and avoid the pitfalls that sink so many small businesses.

| Feature / Insight | Details | Source |

|---|---|---|

| Launch Date | September 4, 2025 | U.S. Bank Release |

| Target Audience | U.S. small business owners | U.S. Bank |

| Core Functions | Accounts payable automation, bill scheduling, real-time visibility, fraud alerts | U.S. Bank |

| Technology Partners | Fiserv’s CashFlow Central℠ + Melio | U.S. Bank |

| Problems Solved | 75% of owners struggle with bill/invoice management; 88% want one platform | U.S. Bank Survey |

| Extra Features | Accounting sync, notifications, mobile-friendly dashboard | U.S. Bank |

| Related Products | Spend Management Platform, Business Essentials Checking, Cash Flow Forecast Tool | U.S. Bank |

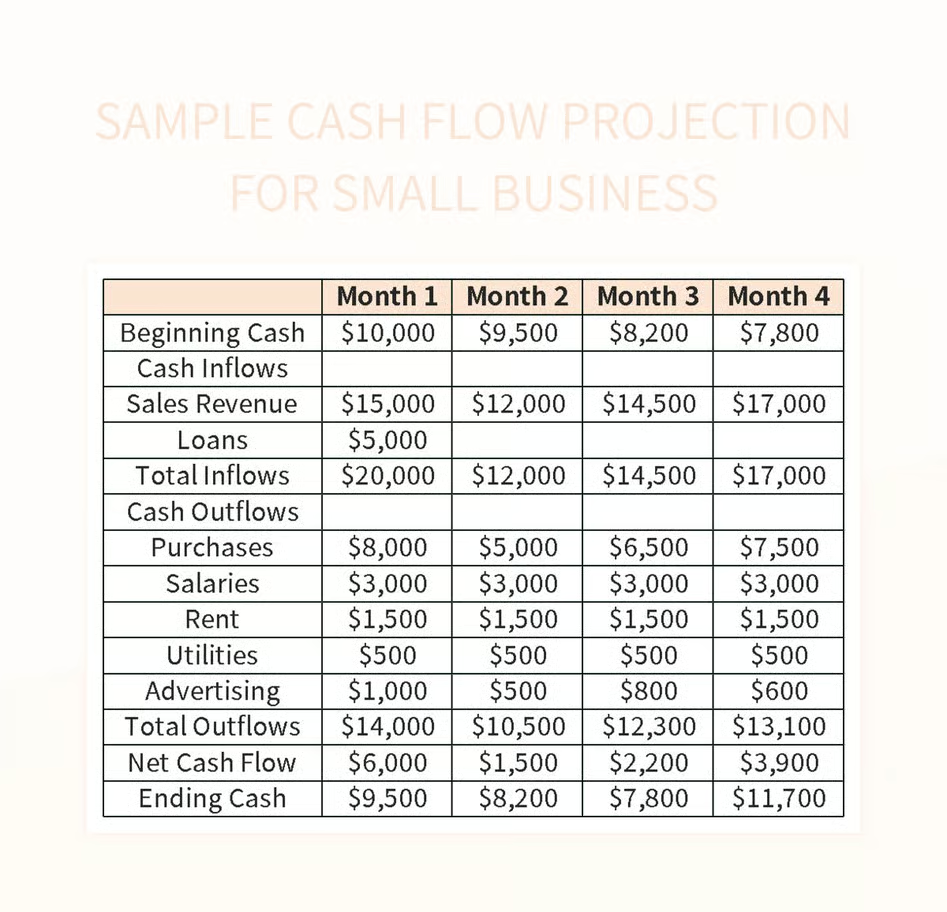

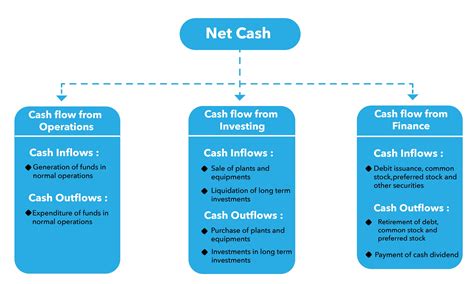

Why Cash Flow Is the Heartbeat of Business?

Think of cash flow like oxygen: without it, even the best business ideas can suffocate. It’s not that small businesses don’t make money—it’s that bills come due before revenue arrives. Rent, payroll, utilities, and vendor invoices don’t wait around.

The Federal Reserve’s 2024 Small Business Credit Survey reported that 59% of small businesses face financial challenges each year, with cash flow issues being the top concern. That makes sense: when revenue and expenses are out of sync, even healthy businesses can run into big trouble.

This is why U.S. Bank’s tool matters. It’s built to give you real-time visibility, automation, and fewer headaches—so you can focus on growth, not just survival.

Breaking Down the U.S. Bank’s New Platform Promises to Simplify Cash Flow Chaos

So, what exactly does this new platform do? Let’s break it down step by step.

Streamlined Accounts Payable

- Pay vendors directly from your business checking dashboard.

- Schedule one-time or recurring payments.

- Split payments or handle multiple invoices at once.

This is huge for small businesses that often juggle dozens of bills at different times. Instead of writing checks or manually logging into vendor portals, you can do it all from one place.

Smart Automation

- Bills and invoices can be automatically created from uploaded documents.

- Approval workflows let managers or owners approve big expenses before they’re sent.

- Integration with accounting software ensures no double entry.

This means less time punching numbers into spreadsheets and more time actually running your business.

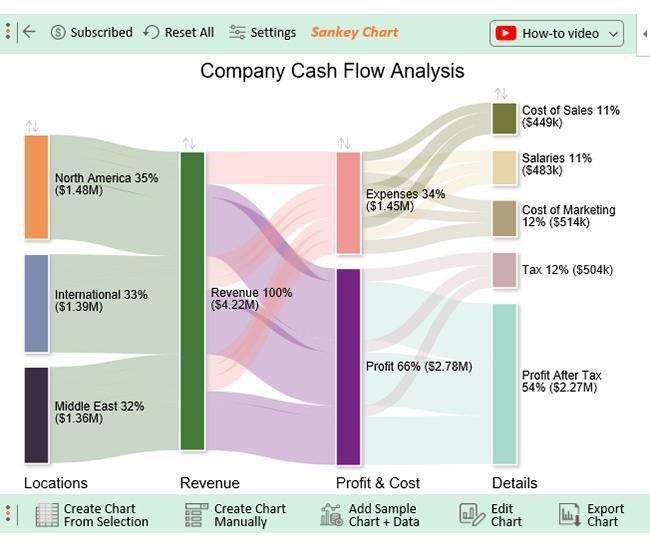

Real-Time Cash Visibility

- Track your available balance instantly.

- See pending transactions in real time.

- Monitor all accounts in one place.

This eliminates the “Monday morning surprise” of logging in and realizing your balance is lower than expected.

Notifications and Security

- Custom alerts warn you when bills are due.

- Multi-step fraud detection protects your funds.

- Payment approval steps reduce the risk of mistakes.

For business owners who can’t afford overdraft fees or late charges, this alone could be a lifesaver.

Step-by-Step: How to Get Started

Here’s how a business owner could set up the platform in under an hour:

- Open or Use an Existing U.S. Bank Business Checking Account.

The platform is exclusive to U.S. Bank customers. - Log In to Online Banking.

Navigate to “Cash Flow Management” from your dashboard. - Upload or Sync Your Bills.

Either upload invoices manually or link your accounting software. - Set Payment Preferences.

Choose how and when vendors get paid. - Turn on Alerts and Approvals.

Protect your cash by setting rules for large payments or low balances. - Check Weekly.

Get in the habit of reviewing your dashboard every Friday before the weekend.

Real-Life Example: Maria’s Coffee Shop

Let’s bring this down to earth with an example.

Maria runs Main Street Coffee, a café in St. Paul. Every month she deals with:

- Rent due on the 1st.

- Payroll every Friday.

- Utility bills mid-month.

- Catering invoices with customers who sometimes pay late.

Before, Maria kept reminders on sticky notes and checked three apps to keep track of invoices. She once even missed payroll because she didn’t realize an auto-payment cleared the day before.

With the new U.S. Bank platform, she:

- Schedules rent and utilities automatically.

- Sees her weekly payroll costs on the dashboard.

- Gets alerts if a catering invoice isn’t paid on time.

- Has one central hub instead of three disconnected tools.

Now Maria actually sleeps through the night—and her employees never worry about paychecks.

Competitor Comparison

How does U.S. Bank stack up against other options?

- Chase Business Online: Offers decent bill pay but lacks integrated automation and accounting sync.

- Bank of America CashPro: Designed for larger corporations; too complex for many small shops.

- Brex & Stripe: Great for startups, but they live outside traditional banks, requiring extra steps to transfer funds.

The edge U.S. Bank has is integration. Because it’s tied to your business checking account, there’s no need to juggle apps or transfer money between systems.

Practical Advice for Small Business Owners

Here are some tips to get the most out of this platform:

- Link Your Accounting Tools: Sync with QuickBooks or Xero to save hours of bookkeeping.

- Set Recurring Payments for Essentials: Rent, utilities, and software subscriptions should be automated.

- Customize Alerts: Set low-balance alerts for payroll weeks to avoid overdrafts.

- Review Weekly, Forecast Monthly: Use the platform for day-to-day cash management, but combine it with U.S. Bank’s cash flow forecasting tool for 30–90 day planning.

- Use Approvals if You Have Staff: Protect yourself from accidental (or fraudulent) payments.

Expert Insights

Karen Richardson, Senior VP at U.S. Bank, explained the motivation:

“Small business owners don’t fail because of lack of ideas—they fail because they run out of cash. Our goal is to give them tools that let them manage their money smarter, faster, and safer.”

Industry experts agree. According to Harvard Business Review, businesses that actively manage cash flow are 60% more likely to survive downturns than those that don’t. This platform aligns with that research by offering proactive tools, not just reactive reporting.

September 2025 Tax Calendar: Key Income Tax Deadlines You Can’t Miss

Never Broke, Always Ahead: These 11 Daily Habits Separate the Financially Free from the Rest

Trump’s 50% Tariffs on India: Why US Left Indian Pharma Out of Tax Bracket