CBIC Confirms Caramel Popcorn at Just 5% GST: If you’ve ever walked into a movie theater, smelled that buttery goodness in the air, and hesitated at the counter because the caramel popcorn price felt way too high, here’s some news you’ll love. The Central Board of Indirect Taxes and Customs (CBIC) has finally cleared the air: caramel popcorn is now under 5% GST—not 18%. That’s right. Whether you love your popcorn salty, spiced, plain, or drenched in caramel, the taxman is taking a much smaller bite. This isn’t just a sweet deal for snack lovers—it’s a big step toward simplifying India’s complicated tax system.

CBIC Confirms Caramel Popcorn at Just 5% GST

The CBIC’s clarification that all popcorn—including caramel—is now under 5% GST is a win for consumers, businesses, and the economy. It ends years of confusion, lowers prices, and helps small vendors comply easily. So, whether you’re at the movies, at home streaming, or buying from a local cart, you can finally enjoy your popcorn without worrying about unfair taxes. With this move, the government has made snacking simpler, cheaper, and a whole lot sweeter.

| Aspect | Details |

|---|---|

| Previous GST Rates | Salted loose: 5%, Packaged salted: 12%, Caramel: 18% |

| New GST Rate | All popcorn varieties (salted, spiced, caramel, packaged, loose): 5% |

| Effective Date | September 22, 2025 |

| Why It Matters | Simplifies GST slabs, lowers caramel popcorn price, eases compliance for vendors |

| Official Source | CBIC Official Website |

Why Was Popcorn Taxed Differently Before?

To really understand the change, let’s break it down in simple terms.

- Plain salted popcorn: Seen as basic food → taxed at 5%.

- Packaged branded popcorn: Treated like processed snacks → taxed at 12%.

- Caramel popcorn: Classified as sugar confectionery → taxed at 18%.

The result? A single food item fell into three separate tax categories, depending on how it was flavored or packaged. This wasn’t just confusing; it led to legal disputes, billing mistakes, and frustrated consumers.

Imagine this: you buy two popcorns—one salty, one caramel—from the same shop. One is taxed at 5%, the other at 18%. Same corn kernels, same oil, same vendor, but a sugar coat makes the tax skyrocket. That’s the kind of inconsistency CBIC is now fixing.

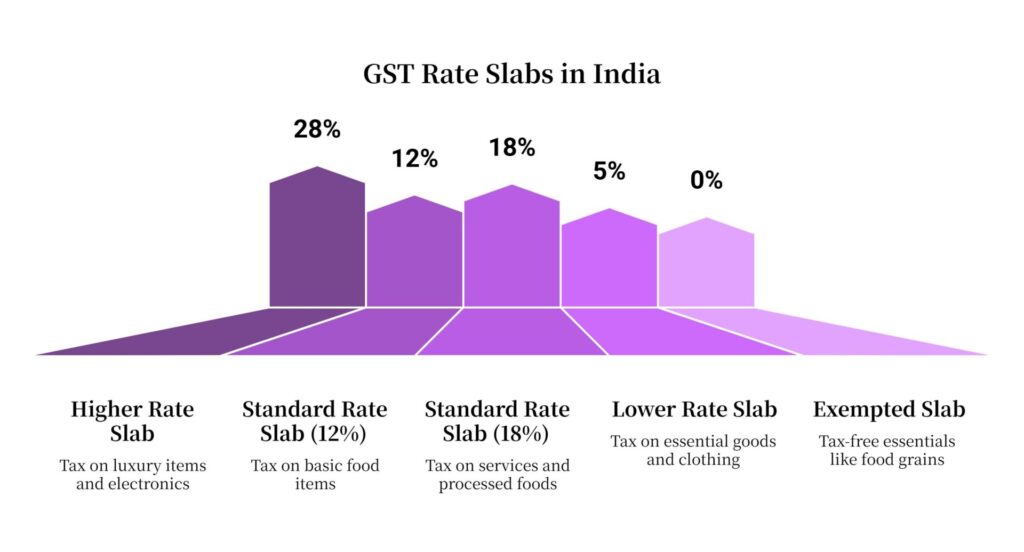

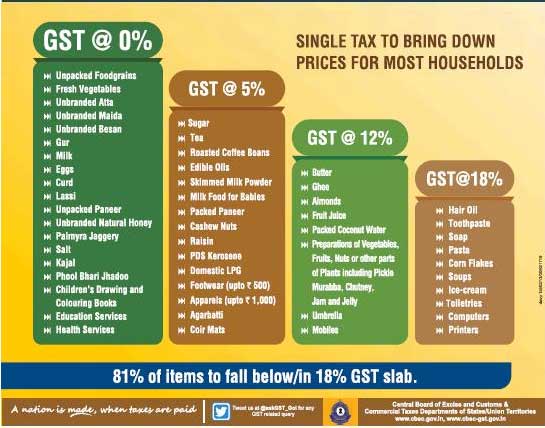

What Is GST and Why Does It Matter Here?

GST (Goods and Services Tax) is India’s landmark tax reform that replaced a web of state and central taxes. Introduced in 2017, GST is meant to be a “one nation, one tax” system, but the multiple slabs—0%, 5%, 12%, 18%, 28%—often cause confusion.

The idea is simple:

- Necessities = low tax

- Luxury or sin goods = high tax

The problem? Many food items didn’t fit neatly into one category. Caramel popcorn got pushed into the luxury slab because it contained sugar, even though it’s an everyday snack.

This is why the clarification matters: it corrects a classification error and aligns popcorn with its real category—ready-to-eat food.

CBIC’s Clarification: One Rule for All

On September 4, 2025, CBIC announced that all popcorn varieties will now attract a flat 5% GST from September 22, 2025.

No more guessing games. No more disputes between sellers and tax officers. And no more unfair pricing for customers.

This step is part of the government’s larger Next-Gen GST reforms, which aim to reduce the number of slabs, simplify compliance, and create a smoother business environment.

The Impact: Who Wins?

Movie Theaters

Cinemas like PVR and INOX make big margins on popcorn—sometimes more than on tickets. With GST dropping from 18% to 5% on caramel tubs, theaters have two choices:

- Pass the savings on to customers.

- Keep prices steady and pocket the difference.

Either way, accounting gets easier.

Packaged Brands

Brands like Act II, 4700BC, Cornitos, and Popcorn & Co. will see a boost. Lower tax means they can market caramel variants more aggressively. Expect price cuts, combo packs, and online discounts as competition heats up.

Street Vendors

Street sellers often struggled to classify their products correctly. The flat 5% makes compliance easier and reduces the risk of being fined for “wrong” billing. This is a direct support to India’s micro and small businesses.

Consumers

For families, this is where the difference really shows:

- Old price: ₹200 caramel popcorn + 18% GST = ₹236

- New price: ₹200 + 5% GST = ₹210

- Savings: ₹26 per tub

For a family of four, that’s more than ₹100 saved per outing. Multiply that across millions of consumers, and the economic impact is huge.

Why CBIC Confirms Caramel Popcorn at Just 5% GST Is a Big Deal?

Simplicity

One slab removes confusion. Sellers no longer need to argue with tax inspectors about which code applies.

Transparency

Consumers can clearly see tax charges. No more “hidden extras” at the billing counter.

Economic Efficiency

According to Economic Times, tax disputes over food items were clogging GST tribunals. Uniform rates mean fewer lawsuits and better compliance.

Popcorn: A Cultural Staple in India

Popcorn isn’t just food—it’s part of Indian culture.

- Cinemas: No Bollywood night is complete without a tub of popcorn.

- Street food: Vendors selling masala popcorn with chili and lime on paper cones are a common sight.

- At home: Packaged popcorn has become a staple for “Netflix and chill” nights.

This GST clarification doesn’t just save money—it makes an everyday cultural experience more affordable.

How India Compares Globally?

- USA: Tax on popcorn varies state to state. In New York, hot popcorn at theaters is taxed, but grocery popcorn may not be.

- UK: Cold popcorn sold in shops is VAT-free, but hot popcorn at cinemas is taxed at 20%.

- India (Now): At 5%, India is among the lowest globally, making it one of the most snack-friendly regimes.

Practical Guide for Consumers

Here’s how to make sure you benefit from this change:

- Check your bill: The GST rate should say 5%.

- Watch out for overcharging: If you see 18% applied, ask the vendor to correct it.

- Report violations: Use the GST grievance portal to file a complaint.

- Plan smarter movie nights: With savings on snacks, your entertainment budget stretches further.

- Look for promotions: Expect brands to roll out offers as the new rates kick in.

Expert Opinions

Tax consultant Arvind Datar (quoted in Economic Times):

“This clarification is not about popcorn alone—it signals a broader move toward rationalizing GST slabs, which businesses have demanded for years.”

Economist Rituparna Sen:

“By treating food as food, not luxury, India is aligning taxation with common sense. This decision reduces disputes and benefits small vendors the most.”

A Brief History of Popcorn in India

Popcorn may have originated in the Americas thousands of years ago, but in India it has its own legacy. Rural regions have long sold “makai ke dane” roasted over fire. In the 1990s, packaged popcorn entered supermarkets with brands like Act II. By the 2000s, multiplex culture turned popcorn into a premium snack.

This GST clarification could mark the next chapter—making even premium caramel popcorn more accessible to the average consumer.

GST Reforms Update — Will Insurance Finally Get Tax Exemption?

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

India’s Aggressive Investment Reforms: GST Relief, PLI Tweaks, and a Simpler Future