Updated Canada Disability Bill 2025: The Updated Canada Disability Bill 2025, officially known as Bill C-22 or the Canada Disability Benefit Act, is one of the biggest shifts in Canadian social policy in decades. This new federal program officially rolled out in July 2025 and provides direct financial support to Canadians with disabilities. For years, advocates have pushed for stronger protections against poverty for people with disabilities. With the passage of Bill C-22, Canada is finally addressing those concerns at the federal level. If you’re wondering what this means for you or your family—who qualifies, how much you’ll get, when payments arrive, and what comes next—this guide has all the answers in plain language.

Updated Canada Disability Bill 2025

The Updated Canada Disability Bill 2025 (Bill C-22) marks a new chapter for Canadians with disabilities. By providing up to $200/month, it helps reduce poverty and offers some financial relief. While the amount may not be enough to fully cover the high costs of disability, it is a strong foundation and a recognition of long-standing inequities. For anyone eligible, the message is clear: apply, file your taxes, and claim what’s yours.

| Category | Details |

|---|---|

| Law Enacted | Royal Assent: June 22, 2023 |

| Regulations Effective | May 15, 2025 |

| Eligibility Period | May 2025 onward |

| Eligibility Requirements | Ages 18–64, Disability Tax Credit (DTC) eligible, Canadian resident, recent tax return filed, not incarcerated (with some exceptions) |

| Benefit Amount | Up to $2,400/year ($200/month) |

| Back-Payments | Up to 24 months (not before June 2025) |

| Application Launch | June 2025 |

| First Payment | July 17, 2025 |

| 2025 Payment Dates | July 17, Aug 21, Sept 18, Oct 16, Nov 20, Dec 18 |

| Official Website | Canada Disability Benefit – Government of Canada |

How Did Bill C-22 Come to Life?

Bill C-22 didn’t come out of nowhere. Disability advocates have been calling for a federal benefit for years, pointing out that people with disabilities are among the most financially vulnerable in Canada.

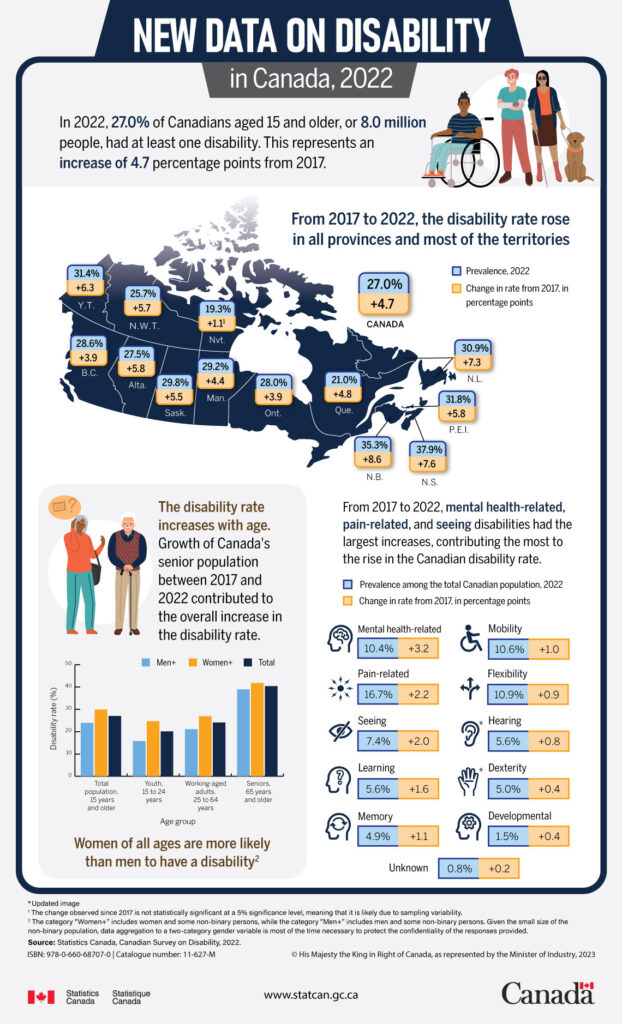

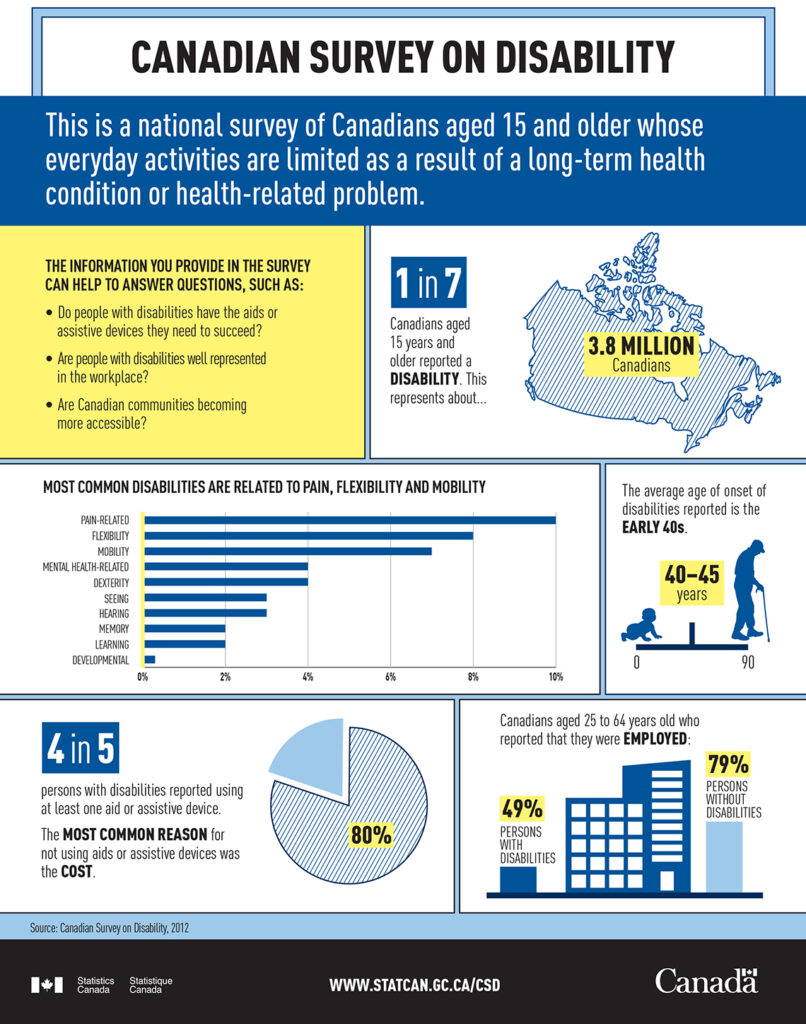

The COVID-19 pandemic only highlighted those struggles. According to Statistics Canada, nearly 22% of Canadians aged 15 and older live with a disability, and they are twice as likely to live in poverty compared to those without disabilities. Food banks reported record-breaking demand from disabled households during 2020 and 2021.

In response, the government introduced Bill C-22 in 2022. After more than a year of debate, amendments, and input from advocacy groups, the bill received Royal Assent on June 22, 2023. The regulations, which spelled out the details of eligibility and payments, came into effect on May 15, 2025. By July 2025, the first payments were made.

Who Qualifies for the Canada Disability Benefit?

Eligibility is straightforward, but there are a few important details to keep in mind. You qualify if you meet all the following:

- Age: Between 18 and 64 (you’re also eligible the month you turn 65).

- Disability Status: Approved for the Disability Tax Credit (DTC) under the Income Tax Act.

- Residency: Must be a Canadian resident—citizen, permanent resident, protected person, or Indigenous resident.

- Taxes: Must have filed your most recent income tax return.

- Incarceration: People serving sentences of two years or more aren’t eligible during incarceration, with exceptions if released mid-year.

A key detail: if you live with a spouse or common-law partner, both of you must file taxes. However, exceptions exist for cases of separation, family violence, or non-residency of the spouse.

Real-Life Examples

- Emily, 34, in Ontario, has Type 1 diabetes and already qualifies for the DTC. She filed her 2024 taxes. She was among the first to receive $200 in July 2025.

- Mike, 62, in Alberta, is on provincial disability assistance but hasn’t filed taxes since 2021. He must file his taxes before he can receive CDB payments.

- Lila, 19, Indigenous student in Winnipeg, recently approved for the DTC. She qualifies immediately and started receiving payments in August 2025 after filing her return.

How Much Money Can You Get?

The maximum payment is $200/month, or $2,400/year.

However, this is income-tested. That means if you have a higher household income, your benefit amount could be reduced. Low-income individuals with disabilities are expected to receive the full $200/month.

Another important feature is retroactive payments. You can receive back-payments for up to 24 months prior to approval, though payments cannot be made for months before June 2025.

For example, if your application was approved in October 2025 but you were eligible starting in June 2025, you would receive a lump-sum retroactive payment covering June through September.

How To Apply for Updated Canada Disability Bill 2025?

Applications opened in June 2025. Here’s what you need to know:

Where To Apply

- Online: Service Canada

- Phone: By calling Service Canada.

- Mail or In-Person: Through local Service Canada offices.

What You’ll Need

- Social Insurance Number (SIN)

- Proof of Disability Tax Credit approval

- Most recent tax return

- Bank account details for direct deposit

Processing Time

- Direct applicants: About 28 days.

- Through a representative: Up to 49 days.

Payment Dates for 2025

Payments are issued on the third Thursday of each month. For 2025, the dates are:

- July 17

- August 21

- September 18

- October 16

- November 20

- December 18

From 2026 onward, payments will follow the same monthly schedule.

How Does It Compare to Other Benefits?

Compared to U.S. programs, the Canada Disability Benefit is smaller but works differently.

- Canada Disability Benefit: Maximum $200/month, designed as a supplement to provincial disability programs.

- U.S. Social Security Disability Insurance (SSDI): Average benefit in 2024 was about $1,537 USD per month, according to the U.S. Social Security Administration.

Within Canada, the benefit stacks with provincial programs like Ontario Disability Support Program (ODSP) or Alberta’s Assured Income for the Severely Handicapped (AISH). In many cases, the federal benefit will not reduce provincial payments, making it a top-up rather than a replacement.

Challenges and Criticisms

While the benefit is a step forward, it’s not without criticism.

- Too Low: Many argue that $200/month is not enough to make a meaningful difference. Research shows Canadians with disabilities face about $9,000 in additional annual costs due to disability-related expenses.

- Tax Credit Barrier: Tying eligibility to the DTC can be problematic, as the application process is complex and many are denied.

- Provincial Clawbacks: While most provinces have promised not to reduce existing benefits, there’s concern some may offset provincial supports.

Advocates are pushing for higher benefit amounts and a simpler, more inclusive eligibility process.

Real-World Impact

Even though $200/month may not sound like much, for many households it’s the difference between making it through the month or falling behind.

- It could mean groceries for two weeks.

- It might cover a month’s internet bill.

- It could offset part of the cost of prescriptions or transportation.

For families already on the financial edge, it’s not just money—it’s stability.

Practical Tips to Maximize Your Benefit

- File Taxes Early: No tax return, no benefit. Even if you have no income, file.

- Check DTC Eligibility: If you don’t have it, apply through the CRA.

- Use Direct Deposit: Payments arrive faster and more securely.

- Keep Records: Save approval letters, notices, and receipts in case of reviews.

“No One’s Picking Up!”: Canadians Furious as CRA Phone Lines Go Silent

Costly Mistake: CRA Penalizes Taxpayer for Not Reporting Home Sale

Outrage Erupts as Federal Union Slams Cuts to CRA Call Centres

Future Outlook

The Canada Disability Benefit is still in its early days. Many expect future governments to expand it. The law allows for annual reviews of benefit amounts, meaning payments could rise in line with inflation or future policy changes.

Some organizations are pushing for increases that would bring the benefit closer to a basic income model—possibly $800 to $1,000 per month. Whether that happens depends on political will and funding, but the door is open.