Canada’s 2025 GST/HST Payment Dates: If you’re living in Canada and wondering about your GST/HST credit payments in 2025, you’re not alone. This topic has been buzzing around dinner tables, tax forums, and even casual coffee shop chats. Why? Because for many Canadians, these payments provide that little extra cash cushion—helping with groceries, rent, and just keeping up with the cost of living. So, let’s break it down in plain English. Whether you’re a parent trying to balance bills, a student stretching every dollar, or even a professional looking for clarity—this guide covers everything you need to know about GST/HST credit payments in 2025.

Canada’s 2025 GST/HST Payment Dates

The 2025 GST/HST payment dates—January 3, April 4, July 4, and October 3—are already set. For millions of Canadians, these quarterly payments provide steady, predictable financial support. While the amounts won’t solve affordability challenges, they remain an important tool in helping households manage day-to-day costs. The best way to make sure you never miss a payment? File your taxes, keep your info current, and set up direct deposit.

| Topic | Details |

|---|---|

| Payment Dates (2025) | January 3, April 4, July 4, October 3 |

| Frequency | Quarterly (4 times per year) |

| Eligibility | Based on income, marital status, and number of children |

| Average Credit | About $496/year for individuals and up to $650+ for families (varies) |

| Official Source | Canada Revenue Agency (CRA) |

| Purpose | To offset GST/HST costs for low- and modest-income Canadians |

What Exactly is the GST/HST Credit?

The GST/HST credit is a tax-free payment issued by the Canada Revenue Agency (CRA). Its purpose is simple: to help low- and modest-income individuals and families cover part of the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST).

Unlike many government programs where you need to apply separately, this one is automatic. If you file your taxes, CRA checks whether you’re eligible and, if so, pays you out in four quarterly installments.

Canada’s 2025 GST/HST Payment Dates

Here are the official CRA payment dates for 2025:

- January 3, 2025

- April 4, 2025

- July 4, 2025

- October 3, 2025

These dates are consistent with CRA’s schedule of paying around the 5th of January, April, July, and October. When the 5th lands on a weekend or holiday, CRA pays slightly earlier. That’s why in 2025, you’ll see payments hit on the 3rd and 4th.

It’s a predictable system—so if you depend on these credits, you can budget ahead knowing exactly when the money will arrive.

Who Qualifies for the GST/HST Credit?

Eligibility is determined by three main factors:

- Income – The lower your household income, the higher your chance of qualifying. For 2025, a single Canadian generally qualifies if their income is under about $49,166.

- Marital Status – Whether you’re single, married, or common-law matters because CRA adjusts amounts for couples.

- Children – Parents with kids under 19 get extra credits, boosting the overall payment.

For example:

- A single person earning $25,000 will likely qualify.

- A family of four earning $60,000 may receive an even higher benefit, especially with children factored in.

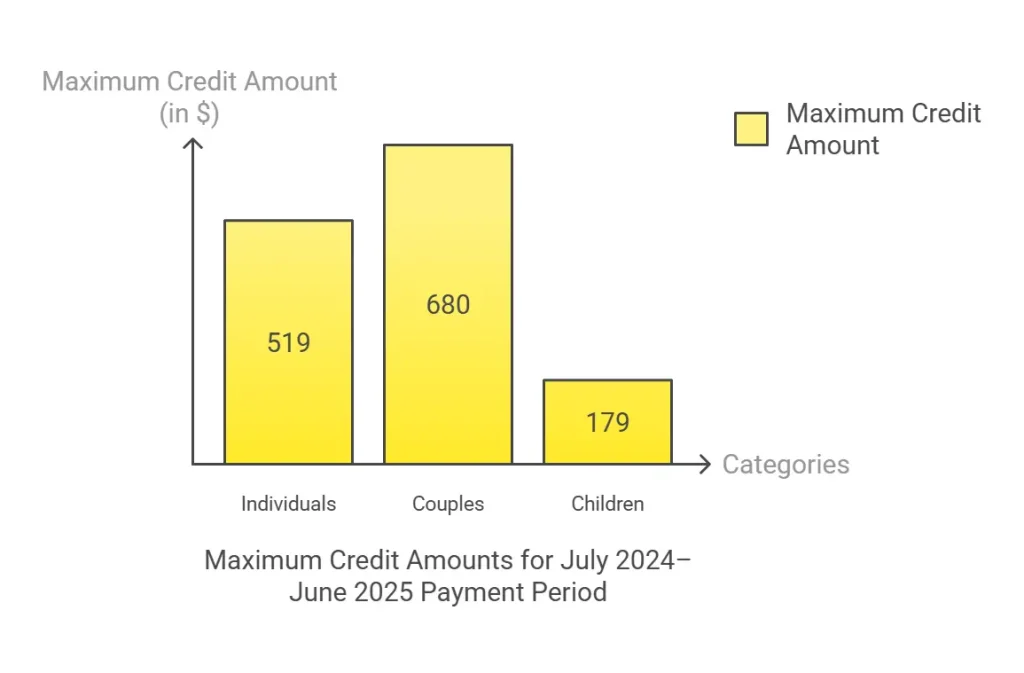

How Much Can You Expect to Receive?

The amount isn’t one-size-fits-all. It depends on your personal situation.

- Single adults: Up to about $496 per year

- Married/common-law couples: Around $650+ per year combined

- With children: Add-ons per child, making the benefit larger

Let’s put it into real terms.

Example 1: A single student earning $18,000 in 2024 could get about $450 for 2025, split into four quarterly payments of around $112.50 each.

Example 2: A family of four earning $50,000 may qualify for $700–$800 in total credits. That’s close to $200 every few months, which can go toward bills or groceries.

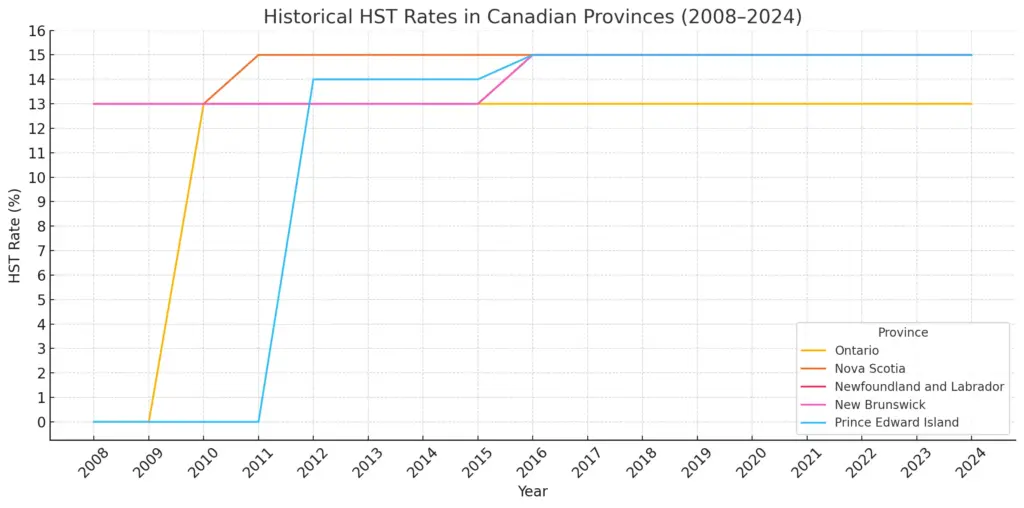

Provincial Variations and HST

Canada has two sales tax systems:

- GST (federal only): In provinces like Alberta, Saskatchewan, British Columbia, and Manitoba.

- HST (blended federal + provincial tax): In Ontario, Nova Scotia, New Brunswick, Newfoundland & Labrador, and Prince Edward Island.

Even though taxes differ by province, the GST/HST credit works the same nationwide. CRA adjusts payments based on federal formulas, not your specific province.

Historical Trends in GST/HST Credit

The credit has been around since the early 1990s and has evolved gradually. CRA increases the amounts yearly to keep pace with inflation.

- In 2019, the max benefit for individuals was about $443.

- By 2023, that number had climbed to nearly $500.

- For families, the growth has been even larger thanks to child top-ups.

This slow but steady increase makes sure the credit keeps its value in the face of rising prices.

Why It Matters More in 2025?

Canadians have been dealing with higher costs for just about everything. According to Statistics Canada, food prices rose nearly 20% between 2021 and 2023. While inflation is cooling, affordability is still a top concern.

That makes programs like the GST/HST credit even more important in 2025. They don’t solve the problem of high living costs, but they do provide consistent support.

Myths vs. Facts

Myth 1: The GST/HST credit is a bonus cheque.

Fact: It’s not a bonus—it’s a tax credit meant to offset sales taxes you already pay.

Myth 2: Only families with kids get it.

Fact: Many single adults and seniors also qualify.

Myth 3: You have to apply every year.

Fact: Not true. File your taxes and CRA automatically reassesses.

How CRA Notifies You?

Each year, CRA sends out a GST/HST Notice of Determination. This letter shows:

- If you qualify

- How much you’ll get

- When you’ll be paid

Keep this letter in your records. It’s your proof of eligibility, and it helps you track payments.

Step-by-Step: How to Check Your Credit

- Log in to CRA My Account to view your payment info.

- File your taxes by the deadline—even if you don’t owe money.

- Set up direct deposit to get paid quickly.

- Review your CRA notices to confirm your credit amounts.

What If You Don’t Get Paid?

Sometimes payments don’t arrive. Common reasons include:

- Taxes weren’t filed on time.

- Direct deposit info is outdated.

- Your income rose above the eligibility limit.

- You moved, and CRA doesn’t have your new address.

If that happens, check your CRA account first. If the issue isn’t clear, call CRA directly.

Special Situations: Who Should Pay Extra Attention?

- Students: Even if you don’t owe taxes, file anyway—you may qualify.

- Seniors: Many receive GST/HST credits alongside Old Age Security (OAS).

- Indigenous Communities: The credit applies equally, regardless of living on or off reserve.

- Newcomers: If you recently moved to Canada, you may need to fill out Form RC151 to apply.

How Inflation Impacts Your Credit

CRA adjusts payments every July based on inflation. That means your 2025 payments could be slightly higher than 2024’s, reflecting the cost of living. While not huge, this adjustment helps the credit remain meaningful.

Costly Mistake: CRA Penalizes Taxpayer for Not Reporting Home Sale

Outrage Erupts as Federal Union Slams Cuts to CRA Call Centres

$496 GST/HST Credit Confirmed for 2025—Here’s Who Qualifies and When You’ll Get Paid

What If You Disagree With CRA’s Decision?

If you think CRA made a mistake:

- Contact CRA for clarification.

- If you’re still unhappy, file a formal objection within 90 days using Form T400A.

- Keep supporting documents like T4 slips or marital status records.

Practical Budgeting Tips

- Treat quarterly credits as “mini bonuses” for essentials like groceries.

- If your budget allows, save one payment each year for emergencies.

- Combine it with other benefits like the Canada Child Benefit (CCB) or Climate Action Incentive for maximum impact.

Comparison With U.S. Programs

For American readers, the GST/HST credit is similar to the Earned Income Tax Credit (EITC). Both aim to give back to low- and middle-income households. The difference is timing: Canadians get payments quarterly, while Americans usually get EITC during tax season.