Piyush Goyal Calls New GST Cuts Historic: The Goods and Services Tax (GST) has been one of India’s most significant economic reforms, aiming to streamline the country’s indirect tax structure. Recently, Finance Minister Piyush Goyal made waves by calling the latest GST cuts “historic,” positioning the move as a key step toward simplifying taxes and reducing the burden on consumers. With this development, the Indian government has not only overhauled the existing tax slabs but also promised direct benefits to the public, making this reform one of the most important in recent history. But what exactly are these GST cuts? How do they affect the everyday Indian consumer? And what does it mean for businesses? This article will break down all the key details surrounding the new GST cuts, their impact, and how they are reshaping the Indian economy. Whether you’re a student, a professional, or someone curious about the economic landscape, this guide will provide valuable insights into the subject.

Piyush Goyal Calls New GST Cuts Historic

India’s GST cuts are a welcome change for consumers and businesses alike, ushering in a new era of tax reform. By consolidating the tax slabs and reducing the burden on everyday products, the government is signaling a commitment to economic growth, lower prices, and greater market competitiveness. Whether you’re shopping for essentials or running a business, these changes offer tangible benefits that can make a real difference in your daily life. The simplified GST system, in line with the government’s vision of a self-reliant India, is a positive step toward building a stronger economy.

| Key Points | Details |

|---|---|

| GST Slabs Reduced | Consolidation of four tiers into two major slabs: 5% and 18%, with a special rate for luxury and sin goods. |

| Consumer Impact | Direct price reductions across sectors like healthcare, consumer goods, and infrastructure. |

| Historical Context | Piyush Goyal criticizes Congress for high taxation legacy and inefficient GST system. |

| Expected Benefits | Lower prices, reduced inflation, better market competitiveness, and enhanced compliance. |

| Official Reference | GST Updates on Times of India |

What Are GST Cuts and Why Are They Important?

GST, short for Goods and Services Tax, is a unified tax system introduced in India in 2017 to replace multiple indirect taxes. Before GST, businesses had to deal with a maze of state and central taxes like VAT, excise duty, and service tax. The idea behind GST was simple: streamline the tax structure to make it easier for businesses and consumers alike.

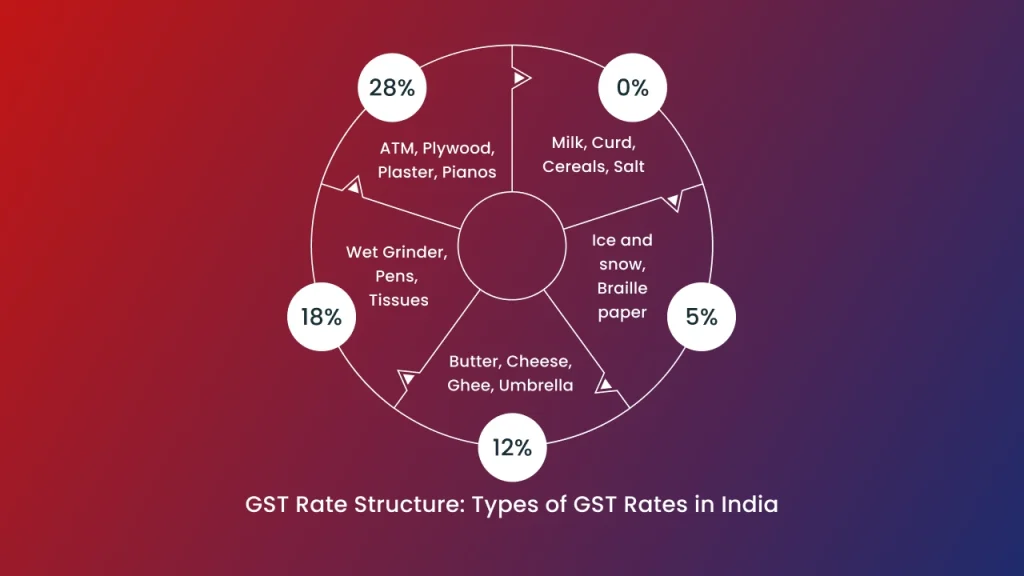

However, the GST system initially had four major tax slabs: 5%, 12%, 18%, and 28%. While it reduced the complexity of the old system, it wasn’t without its flaws. Businesses faced compliance challenges, and consumers still paid high taxes on many goods and services.

Now, under the new reforms, Finance Minister Piyush Goyal has announced significant GST cuts, consolidating the tax structure into just two primary slabs: 5% and 18%, with a separate rate for luxury items, alcohol, and sin goods. This move is hailed as historic for its potential to simplify tax rates and lower the cost of goods.

Breaking Down the New GST Structure

To better understand the changes, let’s break down what these new cuts actually mean for you, whether you’re a consumer or a business owner.

1. Consolidation of Slabs

Previously, India had four different GST rates, but now they’ve been trimmed down to just two major ones: 5% and 18%. The new system is cleaner, simpler, and easier to manage for both businesses and consumers. Some goods that were previously taxed at 12% or 28% will now fall under these two lower tax brackets, reducing prices across the board.

2. Luxury and Sin Goods

For certain high-end goods like luxury cars, expensive watches, and cigarettes, the 40% tax still applies. This ensures that only non-essential items like these carry a significantly higher tax burden, while most everyday goods see substantial tax relief.

3. Consumer Goods

Many consumer goods, especially daily necessities, are now taxed at 5%, down from higher rates in the previous system. Items like processed food, clothing, and small household products are all expected to get cheaper.

4. Healthcare and Infrastructure

Healthcare services, as well as infrastructure projects, will also benefit from these cuts. Hospitals, medicines, and construction materials will be more affordable, benefiting both consumers and industries that rely on these sectors.

The Economic Impact of Piyush Goyal Calls New GST Cuts Historic

Reducing Inflation

One of the primary goals of the GST cuts is to reduce inflation, which has been a persistent issue in India. By lowering the tax burden on many essential goods, the government expects a direct drop in the prices of goods and services. This is great news for the average Indian consumer, especially those from lower income brackets, as their day-to-day expenses should decrease.

Boosting Consumer Confidence

With lower prices, consumers are likely to feel more confident in their purchasing power. The changes are expected to stimulate demand for goods, especially in sectors like automobiles, electronics, and home appliances. This could lead to a surge in consumer spending, which is a significant driver of economic growth.

Incentivizing Businesses

For businesses, these changes simplify compliance. Smaller businesses, in particular, will find it easier to operate under the new tax structure, with fewer bureaucratic hurdles. This could lead to an uptick in business activity, particularly in the manufacturing and retail sectors.

Promoting Economic Growth

By streamlining the GST system, the government is positioning India for more robust economic growth. The easier tax system means businesses are more likely to expand, create jobs, and contribute to the economy in meaningful ways. The savings passed on to consumers can also create a multiplier effect, stimulating more growth.

Supporting the Government’s Vision for Atmanirbhar Bharat (Self-Reliant India)

The GST cuts also align with the government’s larger goal of achieving an Atmanirbhar Bharat or a self-reliant India. By lowering taxes, the government aims to reduce the reliance on imports and make Indian businesses more competitive globally. The reduction in prices for domestic goods can help local manufacturers increase production, leading to more jobs and a stronger economy.

Practical Advice: How Should Businesses and Consumers React?

For Businesses

If you’re a business owner, it’s crucial to stay updated on these changes. Ensure that your accounting and billing systems are updated to reflect the new GST rates. Simplifying the pricing structure may make your job easier in the long run, but the transition period may require some adjustments. Review your inventory and adjust pricing strategies to stay competitive. Moreover, businesses in sectors like healthcare, consumer goods, and infrastructure may want to explore partnerships or marketing strategies to take full advantage of the lower tax rates.

For Consumers

For everyday consumers, this is good news. You’ll likely see a drop in the prices of products you regularly purchase. Be mindful of price changes, especially if you’ve been planning to buy certain high-end or luxury items. The GST reductions make it an ideal time to shop for everyday products and essentials. Additionally, take advantage of discounts that businesses may offer due to the new tax cuts.

Impact on Key Sectors

- Automobile Industry

The automobile sector is expected to benefit from the new GST rates, especially for mid-range and entry-level cars. With a lower tax burden, manufacturers may pass on the savings to consumers, making vehicles more affordable. This could also boost demand in rural markets, where vehicle ownership is still growing. - Real Estate

The real estate sector could also see a rise in demand due to lower tax rates on construction materials. This can reduce the overall cost of housing and make homes more affordable. Moreover, lower taxes on affordable housing projects could spur development in this crucial segment. - Healthcare and Pharmaceuticals

Lower GST rates on essential medicines and healthcare services can improve affordability for the public. This will be particularly beneficial for middle and lower-income groups, making healthcare more accessible. - Tech and E-commerce

As GST rates on e-commerce products reduce, this could spur demand for online shopping. Tech companies and e-commerce platforms are expected to see an uptick in sales, especially in sectors like gadgets, electronics, and personal care.

Tariff Issues Ease While GST Reforms Become Next Growth Focus

GST Reforms Update — Will Insurance Finally Get Tax Exemption?

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?