Businesses to Pass On GST Cuts to Consumers Immediately: In a bold move to streamline the Indian economy, Finance Minister Nirmala Sitharaman recently urged businesses to immediately pass on the benefits of Goods and Services Tax (GST) cuts to consumers. With the announcement of new tax slabs and reductions set to take effect from September 22, 2025, this policy shift is poised to make a significant impact on the prices of goods and services across the nation. But what does this mean for businesses and consumers alike? Let’s dive into the details. The Goods and Services Tax, or GST, is a value-added tax imposed on goods and services in India. The tax reform, which came into effect in 2017, has undergone several revisions to improve the efficiency of the taxation system.

With the recent cuts, it’s clear that the government is focused on ensuring that consumers directly benefit from lower prices. However, it’s not just about numbers; it’s about improving the purchasing power of the average citizen, especially amid inflation concerns and the global economic scenario. This article will break down the recent GST developments, highlight the key changes, and provide practical advice on how businesses can comply with the new rules and ensure the savings are passed along to consumers. Whether you’re a small business owner, a consumer, or someone looking to understand the economics behind these cuts, this guide will give you the context, insights, and actionable steps you need to navigate this transition.

Businesses to Pass On GST Cuts to Consumers Immediately

The recent GST cuts introduced by Nirmala Sitharaman are a game-changer for both businesses and consumers. While these cuts aim to alleviate the financial strain on the average citizen, businesses have an important role to play in ensuring that the savings are passed on. By following the necessary steps and staying compliant with the new tax regulations, businesses can build customer loyalty, avoid penalties, and contribute to a more economically balanced India. As a business, you should be proactive in updating your billing systems and communicating changes clearly to your customers. Consumers, on the other hand, can look forward to lower prices for many essential goods and services, making life a little more affordable in these challenging times.

| Topic | Details |

|---|---|

| GST Rate Cut | Effective from September 22, 2025, GST will be cut for several products, especially everyday essentials. |

| Tax Slabs Introduced | Two primary tax slabs: 5% for essential goods and 18% for most items, with 40% for luxury goods. |

| Urgency for Businesses | Nirmala Sitharaman urges businesses to pass on the tax savings to consumers immediately. |

| Government Oversight | The government will actively monitor compliance to ensure consumers benefit from the cuts. |

| Practical Examples | GST reductions apply to items like ACs, TVs, dishwashers, etc., which will now be cheaper. |

| Key Resources | For more details on GST rates, refer to the official GST Council website. |

The Need for GST Cuts: Why Now?

Before diving into the specifics, let’s understand why these cuts are happening now. The Indian economy is dealing with rising inflation, which impacts the cost of living for every individual. On top of this, many small businesses are struggling with high operational costs, leading to a direct impact on consumer prices. In such a scenario, GST cuts provide relief for both businesses and consumers by reducing the cost burden on essential items. By lowering GST rates, the government hopes to:

- Encourage consumer spending: Lowering taxes on goods and services makes everyday items more affordable, which could boost demand.

- Ease financial pressure on small businesses: The relief helps small businesses remain competitive, even in challenging times.

- Combat inflation: The overall goal is to reduce price increases for the average citizen, making life more affordable.

These objectives aim to stimulate both consumer confidence and economic growth, creating a win-win situation for businesses and consumers alike.

What Exactly Is Changing?

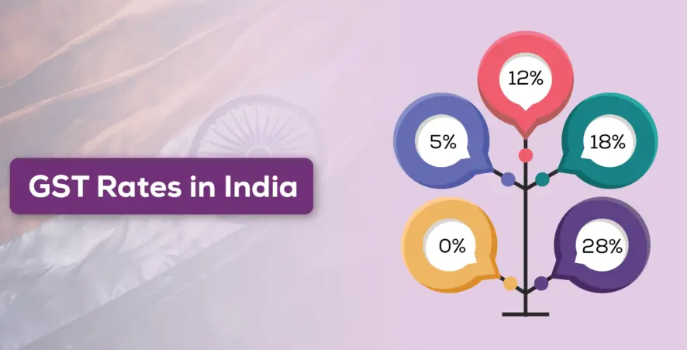

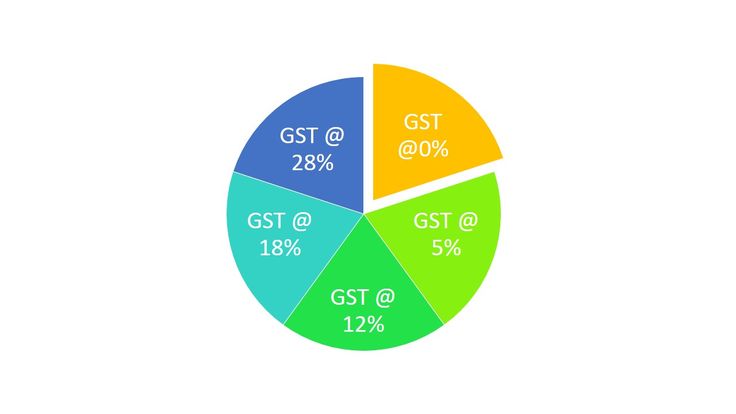

The recent changes in the GST structure are significant and affect a wide range of products. Here’s a breakdown of the new tax slabs:

1. 5% GST Slab:

Essential goods such as food items, medicines, and other daily necessities will see their tax rates reduced to 5%. This will have a direct impact on consumers’ wallets, making basic products more affordable.

2. 18% GST Slab:

Most goods and services, including products like electronics (smartphones, TVs, ACs), furniture, and kitchen appliances, will be taxed at 18%. While this is a slight increase from the previous slab, it still remains manageable for the average consumer.

3. 40% GST Slab:

Luxury items and sin goods, such as high-end watches, alcohol, and tobacco products, will be taxed at the highest rate of 40%. This aims to reduce consumption of non-essential, high-cost products, while generating more revenue for the government.

Why Is It Important for Businesses to Pass On GST Cuts to Consumers Immediately?

The government has made it clear that these cuts are designed to benefit the common man. However, for the benefits to truly reach consumers, businesses need to pass on these savings immediately. Here’s why it’s critical:

1. Building Consumer Trust:

If businesses don’t pass on the GST savings, they could lose customer loyalty. Consumers expect to pay less for products and services when tax rates are reduced. If businesses do not comply, they could face backlash and even regulatory scrutiny.

2. Government Monitoring:

The government has said it will actively monitor businesses to ensure that the savings are passed on to consumers. If businesses fail to comply, they could face penalties or even legal action. Nirmala Sitharaman has emphasized that the Ministry of Finance will keep a close eye on businesses.

3. Competitive Advantage:

Businesses that pass on the tax savings will likely stand out in the marketplace. Consumers will appreciate the lower prices, which could lead to an increase in sales and customer loyalty. On the other hand, businesses that keep the savings for themselves could lose market share to competitors who are more consumer-focused.

Practical Steps for Businesses

If you’re a business owner, here are the steps you should take to pass on the savings and comply with the new GST rules:

Step 1: Review Your GST Registration

Before making any changes, ensure your business is properly registered under GST. If you’re already GST-registered, you can easily adjust your billing to reflect the new tax rates.

Step 2: Update Your Billing System

Ensure your billing software and POS (point-of-sale) systems are updated to reflect the new tax rates. Many modern POS systems have automatic updates for tax changes, but it’s always best to double-check.

Step 3: Communicate the Change to Customers

Be transparent with your customers about the GST reduction. Display signage in your store or announce on your website that prices have been adjusted to reflect the new tax structure. This transparency will help build trust and loyalty.

Step 4: Monitor Compliance

Stay on top of any new notifications or guidelines issued by the GST Council or the Finance Ministry. Ensure your business is fully compliant to avoid penalties.

India Plans GST Cuts On Hybrid Cars And Electronics

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

FM Sitharaman Clears the Air on GST Issue for Apartment Associations—What You Need to Know