Angela Rayner Resigns After Tax Scandal: Angela Rayner, the Deputy Prime Minister of the United Kingdom, made headlines on September 5, 2025, when she resigned following a scandal involving her Hove flat and unpaid taxes. The issue stems from her mishandling of stamp duty related to her property dealings, which led to an ethics investigation and eventual resignation. But what exactly happened, and why is this such a significant event for the UK political landscape? Let’s break it down and discuss the broader implications of Rayner’s resignation.

Angela Rayner Resigns After Tax Scandal

Angela Rayner’s resignation has been a wake-up call for politicians and everyday individuals alike, reminding us of the importance of adhering to tax laws and ensuring transparency in financial dealings. For Rayner, it was a costly oversight, but for the public, it’s an important lesson in being diligent and proactive when managing finances. As the Labour Party navigates the fallout from this scandal, it will be interesting to see how the events unfold and what lessons can be learned from Rayner’s unfortunate misstep.

| Topic | Details |

|---|---|

| Event | Angela Rayner resigned as Deputy Prime Minister on September 5, 2025. |

| Scandal | The resignation stemmed from an underpayment of £40,000 in stamp duty on her Hove flat. |

| Resignation Cause | An ethics investigation found Rayner failed to seek specialist tax advice. |

| Impact | The scandal raised questions about leadership stability in the Labour Party. |

| Cabinet Reshuffle | Following her resignation, Keir Starmer reshuffled the Cabinet, appointing David Lammy as Deputy PM. |

| Official Source | For more on Rayner’s resignation, visit The Guardian’s coverage. |

Angela Rayner, once a prominent figure in UK politics and a trusted ally of Prime Minister Keir Starmer, became embroiled in a controversy that has rocked the political sphere. The investigation into her tax affairs revealed significant errors and mismanagement, leading to the conclusion that she had breached the ministerial code. This scandal not only forced her to step down but also triggered a Cabinet reshuffle, leaving many to question the future direction of the Labour Party.

But how did things escalate? And what can we learn from this incident? Let’s dive into the specifics and unpack the lessons this scandal offers, both for individuals navigating property taxes and for political leaders managing their careers in the public eye.

The Background: A Hove Flat and Tax Oversights

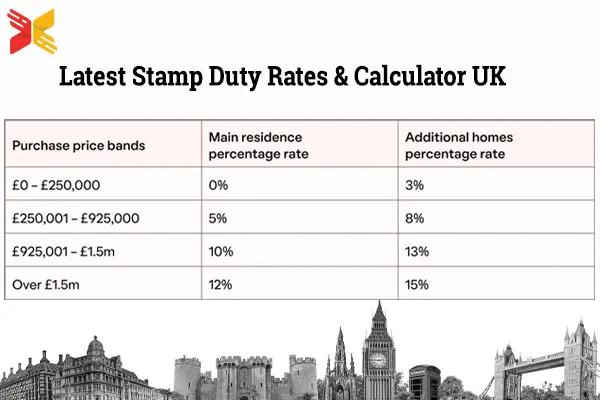

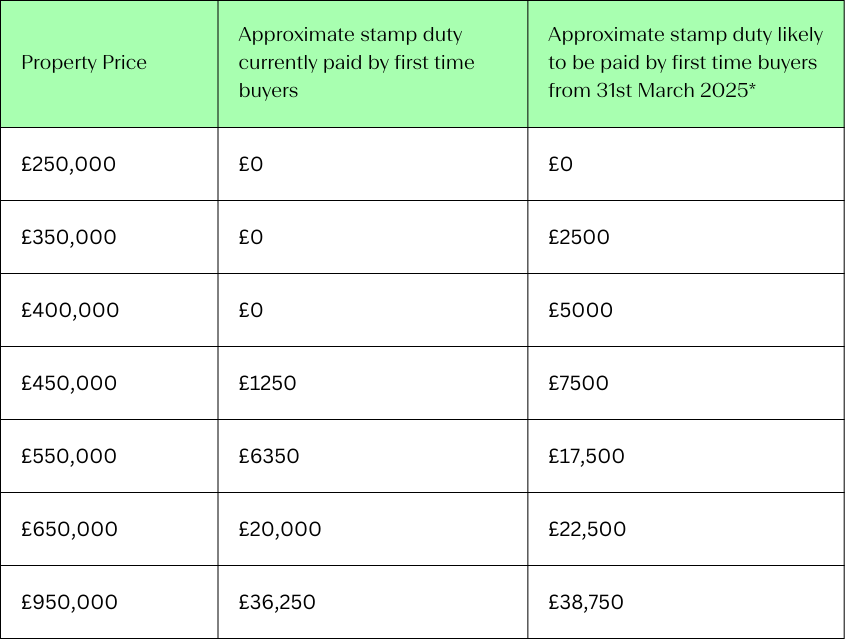

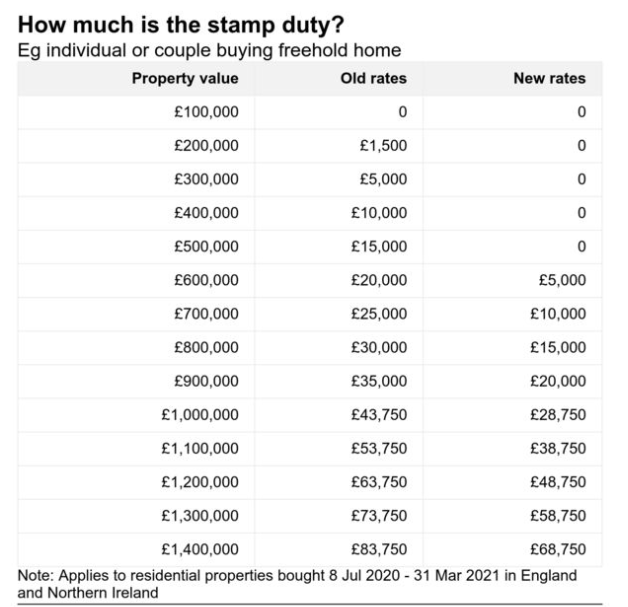

Angela Rayner’s troubles began with her Hove flat—a property that, unbeknownst to many, had a complicated tax history. Rayner had purchased the flat some years ago, but problems began when she failed to correctly pay stamp duty. Stamp duty is a tax levied by the UK government when you buy a property, and it varies depending on the cost of the home and whether it’s your primary residence.

In this case, Rayner mistakenly paid £30,000 in stamp duty instead of the £70,000 required for a second home. You see, Rayner had declared her constituency home in Ashton-under-Lyne as her primary residence for council tax purposes, while the Hove property was treated as a second home. This discrepancy between the declarations triggered an ethics investigation, as it became clear that Rayner had violated financial and tax regulations.

What Went Wrong?

Rayner admitted that she had been advised by a legal team but failed to seek specialist tax advice on her property dealings. According to the investigation, this oversight—combined with her failure to update records and make the correct tax payments—was a direct breach of the ministerial code, which requires transparency and proper handling of public financial affairs.

Although she acted in good faith, Rayner’s failure to address these tax issues sooner ultimately led to her resignation. It was a harsh reminder that even those in powerful positions need to be meticulous with financial matters, as mistakes can have long-lasting consequences.

What Angela Rayner Resigns After Tax Scandal Means for the Labour Party?

Rayner’s resignation was a significant blow to the Labour Party. Not only did it expose a lack of oversight within the political ranks, but it also sparked a chain reaction, leading to a Cabinet reshuffle. Prime Minister Keir Starmer quickly appointed David Lammy as Deputy Prime Minister and shuffled other key positions to fill the void left by Rayner’s departure.

The Internal Struggles of the Labour Party

The fallout from Rayner’s resignation has fueled internal divisions within the Labour Party. Some members argue that this scandal undermines the credibility of the party, while others believe it is a wake-up call to implement stricter financial oversight and accountability within the leadership. As the Labour Party gears up for upcoming elections, this incident has added a layer of uncertainty to their campaign.

Many critics also suggest that Rayner’s resignation has provided an opening for populist parties like Reform UK, who are looking to capitalize on Labour’s perceived instability. The scandal has, at the very least, raised concerns about leadership stability and the effectiveness of the current political leadership.

How This Affects the UK Political Landscape

Rayner’s resignation and the subsequent reshuffle send a clear message about the importance of transparency and accountability in public office. With the resignation of a high-ranking official, the UK government faces increased scrutiny from the public and the media. This creates challenges for Prime Minister Keir Starmer, who must now contend with not only his party’s internal strife but also external pressure as he navigates the fallout from Rayner’s departure.

For the public, this scandal has also underscored the importance of adhering to tax regulations and ensuring that financial dealings are above board. As more people become aware of the issues surrounding property taxes and stamp duty, individuals may be more cautious when making similar financial decisions in the future.

Practical Advice for Navigating Property Taxes

The Rayner scandal provides an excellent opportunity to discuss property taxes and the importance of correct filings. Whether you’re a homeowner or looking to invest in real estate, understanding stamp duty and tax laws is crucial for avoiding costly mistakes.

Key Tips for Handling Property Taxes

- Understand the Basics of Stamp Duty

Stamp duty is a tax that applies to the purchase of properties over a certain value. The amount you pay depends on the price of the home and whether it’s your primary residence or a second property. Get familiar with the rates in your region to avoid surprises. - Seek Specialist Advice

Just as Rayner’s mistake was compounded by a lack of specialist tax counsel, it’s important to consult with a tax advisor when making big property purchases. A professional can ensure you’re paying the correct amount and avoid missteps that could lead to penalties. - Keep Your Records Up to Date

Rayner’s issue was exacerbated by her failure to update records and declare the Hove flat as a second home. Make sure that all property-related paperwork, including tax filings and declarations, is current and accurate. - Plan for Long-Term Financial Impact

Property purchases can have a long-term impact on your finances. Consider the full scope of taxes involved and budget accordingly. This includes planning for potential tax increases, maintenance costs, and other hidden expenses. - Stay Informed

Tax laws are subject to change, so it’s essential to stay updated on the latest regulations, especially when it comes to property taxes.

UK Tax Fraud Crackdown — Indian-Origin Mastermind Ordered to Pay £90 Million

New £40,000 Pension Rule Could Hit Every UK Household; Here’s What You Need to Know

Indian Woman Quits UK After 10 Years, Calls Taxes ‘Insane’ and Costs Unbearable