Sasikala’s ₹450 Crore Factory Linked to Massive Fraud Probe: When news broke that Sasikala’s ₹450 crore factory had been linked to a massive fraud probe, it caught everyone’s attention. For many in India, the name V.K. Sasikala instantly brings back memories of her close ties with the late Tamil Nadu Chief Minister J. Jayalalithaa. But this time, the spotlight is on something far bigger: a huge cash transaction during demonetization and alleged bank fraud worth ₹120 crore. Now, I know what you’re thinking—fraud, demonetization, cash deals, banks… it sounds complicated, right? Don’t sweat it. In this article, we’ll break everything down in simple, easy-to-follow sections. By the end, you’ll not only understand what went down but also why this case matters—whether you’re a curious 10-year-old or a seasoned professional who reads financial reports with your morning coffee.

Sasikala’s ₹450 Crore Factory Linked to Massive Fraud Probe

The story of Sasikala’s ₹450 crore factory and the fraud probe is more than just a headline—it’s a deep dive into how financial fraud, political influence, and weak banking systems can collide. It’s also a lesson in why vigilance, accountability, and judicial oversight are essential. Whether you’re a banker in New York, a policymaker in Delhi, or a student learning economics in Ohio, the message is universal: when fraud thrives, everyone pays the price.

| Aspect | Details |

|---|---|

| Main Case | Sasikala allegedly bought a Kancheepuram sugar factory for ₹450 crore entirely in cash during India’s 2016 demonetization. |

| Bank Fraud Link | Connected to Padmaadevi Sugars Ltd., accused of cheating Indian Overseas Bank of ₹120 crore. |

| Evidence Found | 2017 IT raids revealed documents under the Benami Transaction Act linking Sasikala. |

| Court’s Role | Madras High Court ordered the CBI to pursue investigation despite initial hesitation. |

| Current Status | Case registered, raids held in multiple Tamil Nadu districts, probe ongoing. |

| Official Source | Central Bureau of Investigation (CBI) |

Who Is Sasikala and Why Does Her Name Matter?

V.K. Sasikala wasn’t just another businessperson; she was the closest aide of Jayalalithaa, Tamil Nadu’s powerful chief minister and one of India’s most influential women politicians. Sasikala managed Jayalalithaa’s household, handled finances, and slowly became one of the most powerful unelected figures in Tamil Nadu politics.

After Jayalalithaa’s passing in December 2016, Sasikala briefly tried to take over the AIADMK political party before being jailed in a disproportionate assets case. So when her name surfaces again—this time linked to a ₹450 crore cash deal—it naturally raises eyebrows.

For context, imagine someone closely associated with a U.S. President suddenly appearing in a $50 million fraud investigation. That’s the scale of shock this case has caused.

What Exactly Happened During Demonetization?

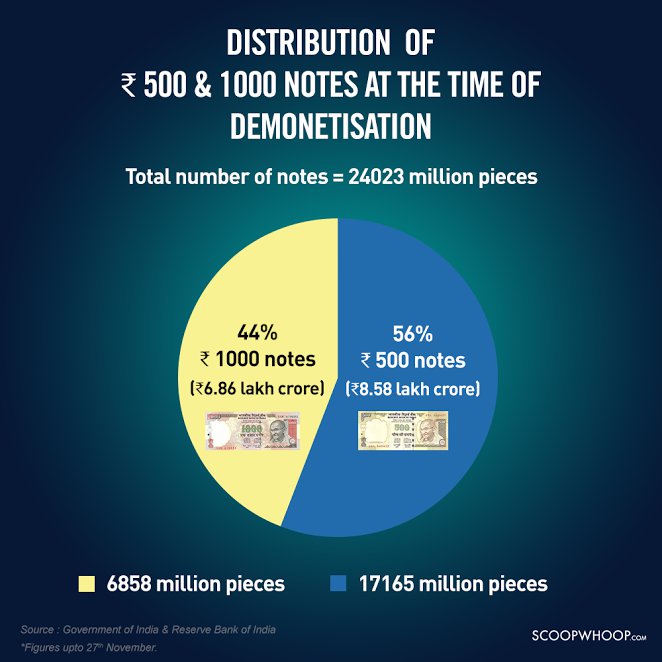

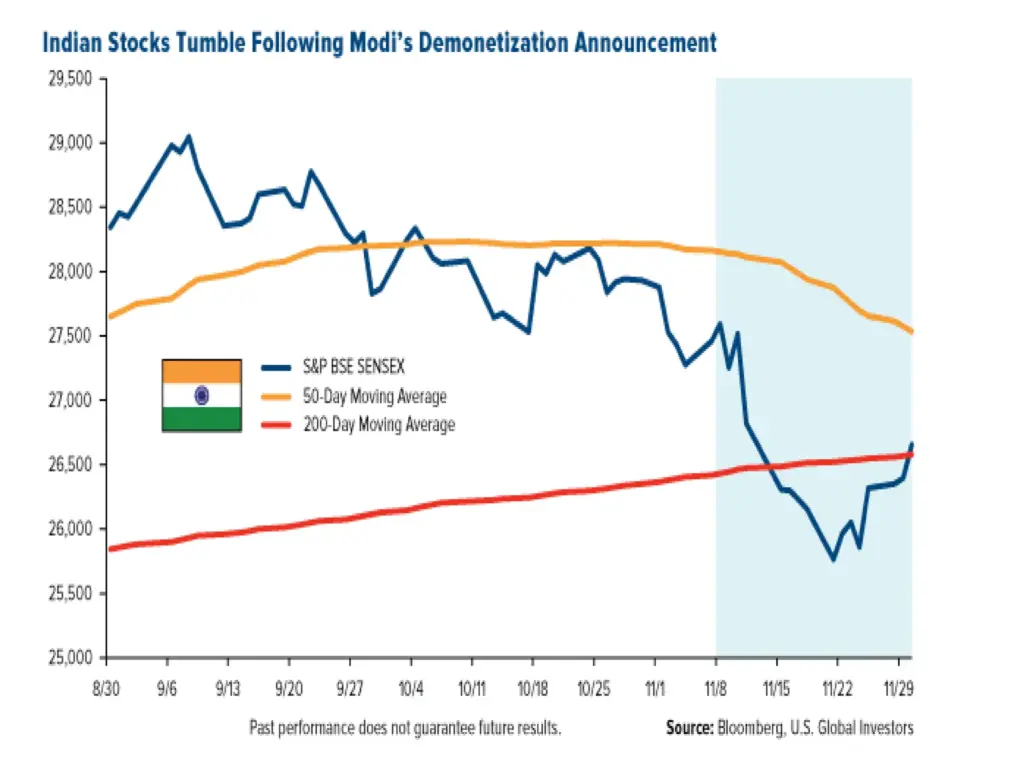

To understand this case, let’s revisit demonetization, one of India’s most controversial financial decisions. On November 8, 2016, Prime Minister Narendra Modi announced that ₹500 and ₹1000 notes—nearly 86% of India’s currency in circulation—would no longer be legal tender.

The goals were ambitious:

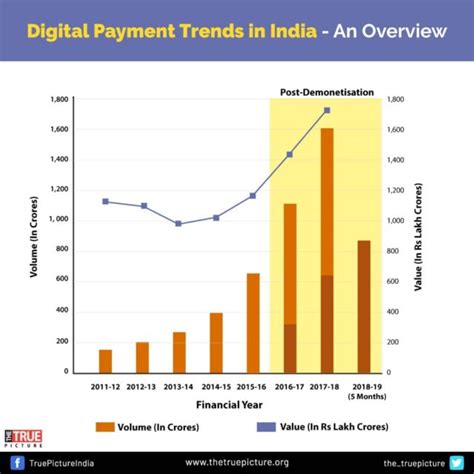

- Fight black money.

- End counterfeit currency.

- Push India toward a digital economy.

But the execution caused chaos. Long lines formed outside banks, businesses struggled with cash shortages, and millions of small traders were impacted.

In this climate, the idea of someone paying ₹450 crore in old notes for a sugar factory sounds almost unbelievable. Investigators allege that Sasikala and her associates found ways to bypass the restrictions and complete this massive cash deal—raising serious concerns about how such a transaction slipped through regulatory cracks.

The Bank Fraud Angle

The fraud probe is not just about cash purchases—it’s linked to Padmaadevi Sugars Ltd., which allegedly cheated Indian Overseas Bank out of ₹120 crore.

The CBI investigation highlights:

- Loans taken under false pretenses.

- Money diverted into shell companies.

- Suspicious deposits during demonetization.

- Interest-free advances to cover tracks.

Think of it like a friend borrowing $1 million to build a restaurant but instead using half of it to buy sports cars and hiding the rest offshore. That’s the kind of misuse investigators believe occurred here.

The Smoking Gun: 2017 Income Tax Raids

The turning point came in November 2017, when the Income Tax Department raided multiple properties linked to Sasikala. Officials seized documents that included:

- A Memorandum of Understanding (MoU) signed by businessman Hitesh Shivgan Patel and family.

- Proof of ₹450 crore paid in now-invalid currency.

- Evidence pointing to Sasikala as the real beneficiary.

This led authorities to attach the sugar mill under the Benami Transactions (Prohibition) Act, which allows the government to seize properties purchased in someone else’s name but with illicit funds.

Judicial Push That Changed Everything

Initially, the CBI dragged its feet, saying there wasn’t enough evidence and citing the need for state government approval. But in June 2025, the Madras High Court directed the CBI to proceed.

By July 2025, the CBI filed a case. A month later, raids were conducted in Chennai, Trichy, and Tenkasi. This sequence shows the importance of judicial oversight—sometimes courts are the only check against investigative inertia.

The Bigger Picture: Banking Frauds in India

Sasikala’s case isn’t an isolated incident. According to the Reserve Bank of India, Indian banks reported frauds worth ₹30,252 crore ($3.6 billion USD) in FY 2023-24 alone.

Some high-profile cases include:

- Punjab National Bank Scam (2018): Nirav Modi and Mehul Choksi siphoned off ₹13,000 crore using fraudulent letters of undertaking.

- ICICI Bank-Videocon Case: Loans given without proper checks, leading to defaults.

These cases add to India’s rising Non-Performing Assets (NPAs), which stood at nearly ₹6.3 lakh crore ($75 billion) in 2024, according to RBI data.

Global Comparisons

Financial fraud isn’t just an Indian issue—it’s global.

- Enron Scandal (U.S., 2001): Executives hid billions in debt, costing investors $60 billion.

- Wells Fargo Fake Accounts Scandal (U.S., 2016): Employees created 3.5 million unauthorized accounts.

- Wirecard Collapse (Germany, 2020): Fabricated €1.9 billion cash reserves exposed Europe’s fintech weaknesses.

These parallels show fraud thrives anywhere oversight is weak. Whether in Houston, Frankfurt, or Chennai, the story is the same—when regulators blink, fraudsters pounce.

Political Implications in Tamil Nadu

This case isn’t just financial—it has major political ripples. Sasikala still commands loyalty within sections of the AIADMK. A fraud probe of this magnitude could:

- Revive divisions within the party.

- Impact voter sentiment ahead of Tamil Nadu elections.

- Fuel debates on corruption and governance.

For citizens, it’s a reminder that political-business ties often come at a cost to public trust.

How Sasikala’s ₹450 Crore Factory Linked to Massive Fraud Probe Like This Works: A Simple Breakdown

Here’s a step-by-step version of how investigators believe the fraud played out:

- Form Shell Companies – Set up firms with little real activity.

- Obtain Loans – Secure credit under inflated or false claims.

- Divert Funds – Channel money into unrelated ventures or cash deposits.

- Make Cash Purchases – Use illicit money to buy assets like factories.

- Cover Up – Falsify accounts, create fake invoices, or give interest-free advances.

Practical Lessons for Everyone

Fraud cases like this aren’t just headlines—they hold lessons.

- For Citizens: Don’t trust deals without paper trails. If it sounds too good to be true, it probably is.

- For Banks: Invest in forensic auditing and AI-driven fraud detection.

- For Politicians: Transparency builds trust; shady deals erode it.

- For Investors: Always check regulatory compliance before committing funds.

In plain terms: think of the economy like a game of basketball. If one player cheats, the whole game loses credibility.

Expert Opinions

Economists have been quick to weigh in. According to a report by the World Bank, countries lose nearly 5% of GDP annually to corruption and fraud. In India, watchdogs argue for stricter enforcement of the Prevention of Money Laundering Act (PMLA).

Former RBI governor Raghuram Rajan has long warned that weak banking practices enable fraud, saying, “When banks chase growth without governance, fraudsters fill the gap.”

Shopkeeper Receives ₹141 Crore Tax Notice: Learn How PAN Misuse Can Affect You

Qatar Customs Cracks Down With Major Seizures of Drugs and Fraud

Israeli AI Startup Bags $60 Million to Help Governments Fight Fraud