House Sold for Lakhs but Declared Low in ITR: When we hear about a house sold for lakhs but declared low in ITR, it feels like a red flag for tax evasion. After all, how can someone sell a property worth a small fortune and report almost no income? But sometimes, it’s not fraud—it’s smart tax planning. A recent case in India proved this point. A taxpayer sold his house for ₹67 lakh and yet declared only ₹1,690 in his Income Tax Return. The Income Tax Department raised eyebrows, but the man walked away legally shielded from paying big taxes.

The reason? He used the Section 54 exemption under the Income Tax Act, backed up by documentation of expenses and reinvestment. This article breaks down the case, the law, and the lessons for anyone selling property in India. We’ll also cover common mistakes, practical examples, and planning strategies to help you make the most of your property transactions.

House Sold for Lakhs but Declared Low in ITR

The case of a house sold for lakhs but declared low in ITR shows that Indian tax law is not always rigid. With Section 54, taxpayers can legally minimize liability if they reinvest wisely and maintain records. The ITAT ruling proves even cash expenses, when genuine and supported by documentation, can stand up in court. This serves as a reminder: the law is designed not just to collect taxes, but also to encourage reinvestment in housing and protect honest taxpayers.

| Point | Details |

|---|---|

| Case | Sale of house for ₹67 lakh, only ₹1,690 income reported in ITR |

| Exemption Used | Section 54 of the Income Tax Act |

| Ruling Body | ITAT Ahmedabad (Income Tax Appellate Tribunal) |

| Unique Twist | Cash payments for house improvements accepted with proof |

| Practical Lesson | Proper documentation + reinvestment can legally slash taxes |

| Official Resource | Income Tax Department India – Section 54 Guide |

The Case: What Really Happened

The taxpayer sold his home for ₹67 lakh. Normally, this would trigger a big long-term capital gains tax liability. Instead, his return showed almost nothing taxable—just ₹1,690 in income—and even a reported capital loss.

The Income Tax Department suspected underreporting. On investigation, they found he had claimed exemption under Section 54 by showing:

- He reinvested the gains into another house.

- He added substantial costs of house improvements to his property’s purchase price.

- Some of these improvement expenses were paid in cash.

The case went to the Income Tax Appellate Tribunal (ITAT), Ahmedabad. To the surprise of many, the tribunal ruled in his favor. They held that genuine, well-documented cash payments for house improvements could be considered valid costs. This reduced his taxable gain significantly, leaving only a token income amount.

Capital Gains Tax Basics in India

Before diving into Section 54, let’s step back. When you sell property in India, you pay capital gains tax. The tax depends on how long you held the property:

- Short-term capital gain: If sold within 24 months of purchase, gains are taxed as per your income tax slab.

- Long-term capital gain (LTCG): If held for more than 24 months, gains are taxed at 20% with indexation benefit.

Indexation is crucial. It adjusts the purchase cost for inflation using the Cost Inflation Index (CII). For example, if you bought a house for ₹20 lakh in 2005 and sold it in 2024 for ₹80 lakh, indexation might increase your purchase cost to ₹55 lakh. Your taxable gain would then be ₹25 lakh, not ₹60 lakh.

Section 54 in Plain Language

Section 54 offers relief on long-term capital gains when you reinvest in another home. Here’s how it works:

- You must be an individual or Hindu Undivided Family (HUF).

- The sold asset must be a residential property held for at least 24 months.

- You can claim exemption if you:

- Buy another residential house within 1 year before or 2 years after the sale, or

- Construct a house within 3 years of the sale.

- The exemption is capped at the lower of the capital gains or the cost of the new property.

In short, sell a house, buy or build another, and the government won’t tax your gains.

Why Cash Payments Were Accepted in This Case?

The unusual twist here was the acceptance of cash payments. The taxpayer had spent on flooring, painting, and structural changes—all documented but paid in cash. Normally, cash invites suspicion, but the tribunal allowed it because:

- The expenses were genuine.

- Receipts, affidavits, and work evidence were provided.

- The payments increased the property’s value, qualifying as cost of improvement.

This ruling underscores that documentation is more important than the mode of payment.

Real-Life Examples and Case Law

The Indian courts have seen several similar cases:

- NRI Case: An NRI sold property abroad but reinvested in India. The court allowed Section 54 relief because the reinvestment was in an Indian residential property.

- Land vs. House Case: A woman sold land worth ₹4.5 crore. Normally, Section 54 applies to houses, not land. But a 1955 CBDT circular permitted relief since the land was linked to residential use.

- Multiple Properties: In some rulings, taxpayers were allowed to claim exemption on two houses if the law at the time permitted. Today, the general rule restricts it to one house.

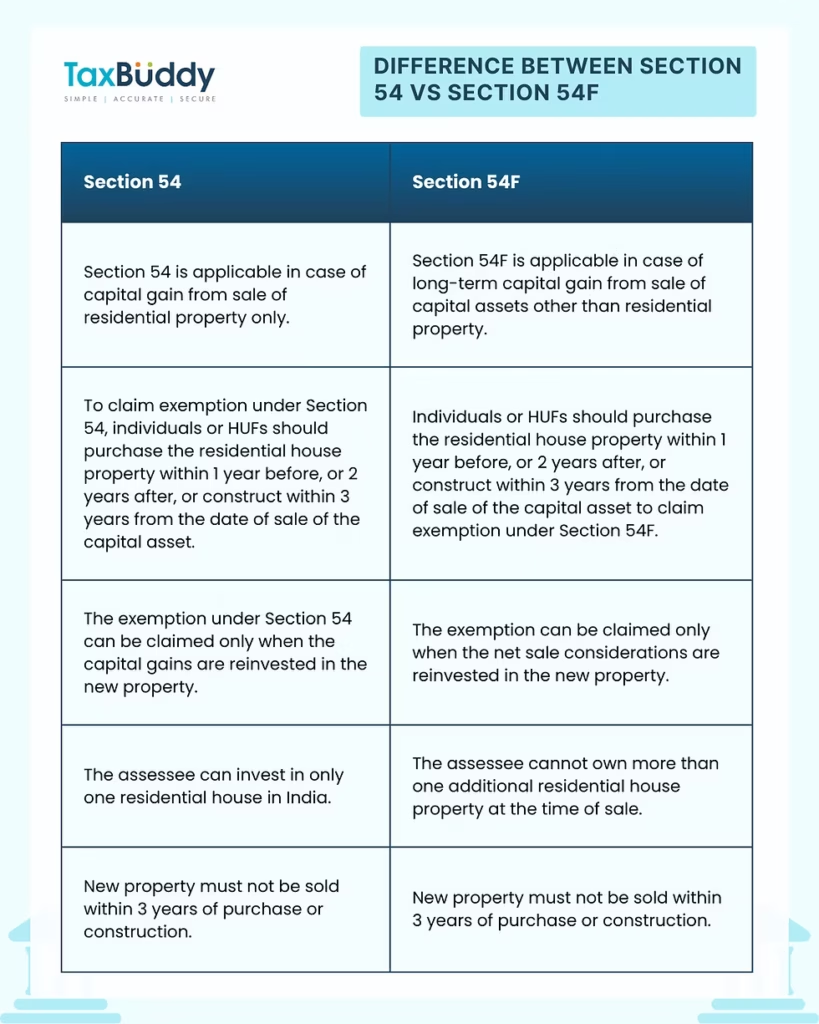

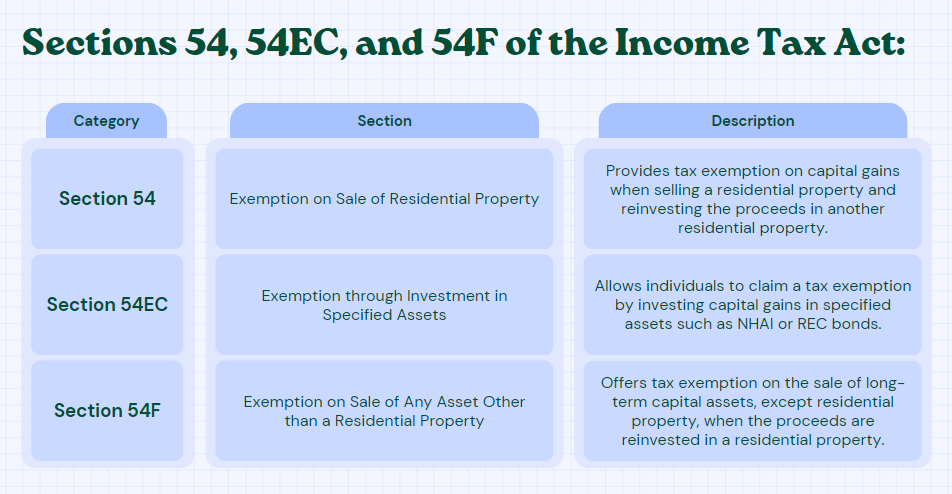

Section 54 vs. Section 54F

Many confuse Section 54 with Section 54F. Here’s the difference:

| Feature | Section 54 | Section 54F |

|---|---|---|

| Applies to | Sale of residential property | Sale of any long-term asset (land, shares, etc.) |

| Condition | Reinvest only capital gains | Reinvest entire sale proceeds |

| Exemption Limit | Lower of gain or new property cost | Proportionate to reinvestment |

Step-by-Step Guide to Using Section 54 For House Sold for Lakhs but Declared Low in ITR

Step 1: Verify eligibility. Ensure you sold a residential property held for at least 24 months.

Step 2: Calculate gains. Subtract indexed purchase price and improvement costs from the sale price.

Step 3: Reinvest. Buy or construct a residential house within the timelines.

Step 4: Park funds in a Capital Gains Account Scheme (CGAS) if reinvestment isn’t immediate.

Step 5: File ITR-2. Report the sale, gains, and exemption claim with all documentation.

Tax Planning Strategies

- Plan early: Identify reinvestment options before selling.

- Leverage indexation: Always calculate indexed cost before deciding tax.

- Use CGAS: If you can’t reinvest quickly, park funds in a designated account.

- Consider new LTCG rules: From 2024, taxpayers can choose between 12.5% without indexation or 20% with indexation. Compare both options.

- Avoid panic reinvestment: Rushed decisions often lead to poor property choices.

Common Mistakes to Avoid

- Believing land sales qualify for Section 54 automatically. They don’t, unless tied to residential use.

- Forgetting to deposit in CGAS before filing ITR if reinvestment hasn’t been done.

- Claiming exemption for more than one house under the new rules.

- Not keeping receipts for improvements or renovations.

- Missing deadlines for purchase or construction.

Professional Insights

Chartered accountants highlight that this ruling is a pro-taxpayer interpretation of the law. It shows the judiciary values fairness and practical realities, not just strict technicalities. Experts recommend taxpayers maintain thorough documentation, consult professionals before sales, and avoid shortcuts.

September 15 Deadline Looms – Last Date to File ITR and Pay Self-Assessment Tax Without Penalty

Filing ITR This Year? – 4 Key Points Every Salaried Taxpayer Must Remember

ITR Filing 2025 Warning: 7 Common Issues Taxpayers Must Watch Out For