Las Vegas Man Faces Prison in $3.5 Million Tax Fraud Case: When you hear the phrase “Las Vegas man faces prison in $3.5 million tax fraud case,” you might picture a high-stakes casino scam. But this isn’t about slot machines or blackjack—it’s about tax fraud, one of the most serious white-collar crimes in America. Recently, Michael J. Moore, a tax preparer from Las Vegas, pled guilty to running a fraudulent scheme that cheated the government out of over $3.5 million. This case isn’t just another headline; it’s a wake-up call for anyone who pays taxes (that’s all of us). Whether you’re a business owner, a W-2 employee, or just filing your first return, there’s a lot to learn from this story about the dangers of tax scams, IRS penalties, and how to protect yourself.

Las Vegas Man Faces Prison in $3.5 Million Tax Fraud Case

The case of the Las Vegas man facing prison in a $3.5 million tax fraud case is more than just a courtroom drama—it’s a roadmap of what not to do. Michael J. Moore’s story is a reminder that tax fraud is costly, dangerous, and life-changing. Whether you’re a working parent, a hustling freelancer, or a CEO, the lesson is clear: play it straight with the IRS. Stay informed, hire trustworthy professionals, and always double-check your returns.

| Aspect | Details |

|---|---|

| Defendant | Michael J. Moore, Las Vegas tax preparer (X Tax Pros) |

| Crime | Promoted fraudulent “Special Tax Shelter Strategy” |

| Timeline | 2015 – April 2025 |

| Fraudulent Tactics | Fake business losses, inflated deductions, false royalty expenses |

| Total Loss | Over $3.5 million to the U.S. government |

| Guilty Plea | September 5, 2025 |

| Sentencing | December 8, 2025 (faces up to 5 years in prison + fines + restitution) |

| Investigators | IRS Criminal Investigation & DOJ Tax Division |

| Source | U.S. Department of Justice |

The Story Behind the Las Vegas Man Faces Prison in $3.5 Million Tax Fraud Case

Moore ran a business called X Tax Pros, where he marketed a so-called “Special Tax Shelter Strategy.” It promised his clients a way to pay less in taxes legally—but the trick was, it wasn’t legal at all.

Between 2015 and 2025, Moore filed false tax returns for clients. He made up businesses that didn’t exist, inflated deductions, and created fake expenses. For example, he would list phony “royalty payments” or costs of goods sold that weren’t real. Some of his clients got tens of thousands in refunds they didn’t deserve—and Moore pocketed hefty fees for making it happen.

On paper, it looked like his clients had huge losses, but in reality, the businesses never operated. It was all smoke and mirrors. And the IRS eventually caught on.

Why This Case Matters?

You might be thinking: “Why should I care about some guy in Vegas messing with taxes?” Well, here’s why:

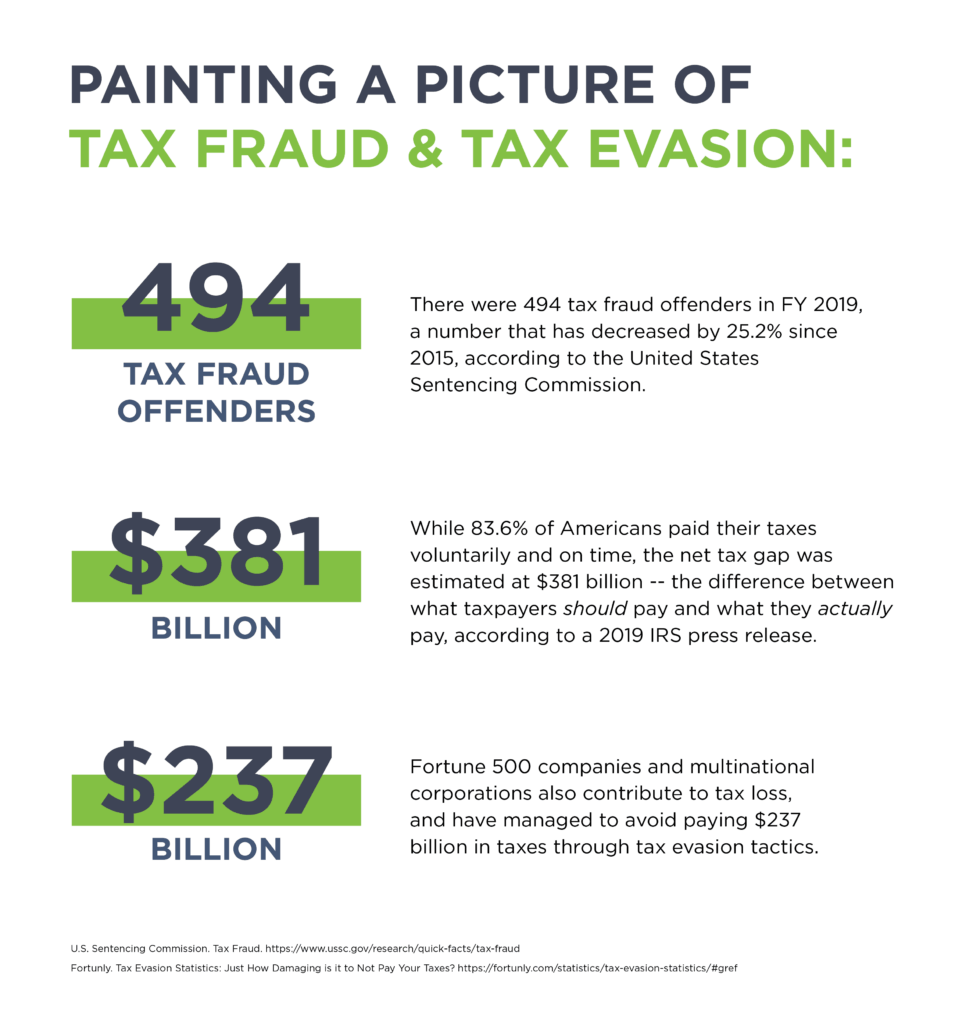

- It impacts all taxpayers. Fraud like this costs the U.S. government (a.k.a. taxpayers) billions every year.

- It shows how scams are disguised. Moore didn’t sell shady drugs or rob a bank—he wore a suit and acted like a trusted professional. That’s what makes these schemes dangerous: they look legit.

- It’s a lesson in compliance. Whether you’re an entrepreneur or freelancer, you need to know what’s legal and what’s not.

According to the IRS, the U.S. loses over $500 billion annually due to tax evasion and fraud. That’s money that could fund schools, hospitals, and infrastructure.

The Bigger Picture: Famous Tax Fraud Cases in U.S. History

This case isn’t unique. America has seen some notorious tax fraud scandals:

- Al Capone – The infamous gangster was convicted of tax evasion in the 1930s, proving the IRS is often the agency that takes down big criminals.

- Wesley Snipes – The Hollywood actor served three years in prison (2010–2013) for failing to file tax returns.

- Paul Daugerdas – A tax attorney convicted in 2013 for creating fraudulent tax shelters, costing the IRS billions.

These cases remind us that nobody is too big (or too small) to escape IRS scrutiny.

Why Do People Commit Tax Fraud?

Here’s the truth: most tax cheats don’t see themselves as criminals. Instead, they convince themselves it’s just “bending the rules.” Some common reasons include:

- Greed – Wanting a bigger refund or lower bill.

- Desperation – Financial struggles push people to cut corners.

- Misinformation – Trusting shady “advisors” who claim to have “special loopholes.”

- Arrogance – Believing they’ll never get caught.

But the IRS has sophisticated tracking systems and audits that can flag suspicious filings years later.

Sentencing and Legal Consequences

Moore pled guilty in September 2025. His sentencing is set for December 8, 2025, where a federal judge will decide his fate. He faces:

- Up to 5 years in prison

- Supervised release after prison

- Restitution to pay back the $3.5 million

- Additional monetary penalties

The sentencing process will weigh several factors, including the U.S. Sentencing Guidelines, the impact on victims, and Moore’s cooperation with investigators.

What Happens if You Commit Tax Fraud?

Moore’s case is a prime example, but let’s break it down simply:

- Back Taxes: You still owe the IRS the money you cheated.

- Fines & Penalties: You could pay up to 75% of the unpaid tax amount as a penalty.

- Interest: The IRS adds interest on top of the debt.

- Criminal Charges: In severe cases, you go to prison.

The IRS Criminal Investigation division investigates over 1,500 cases a year with a 90% conviction rate.

IRS Audit Red Flags

The IRS doesn’t audit everyone, but certain things can raise red flags:

- Reporting unusually high deductions compared to your income.

- Claiming business losses year after year with no proof of activity.

- Excessive charitable contributions that don’t match income level.

- Using round numbers only instead of actual figures.

- Claiming dependents that aren’t real or that multiple taxpayers claim.

If your return triggers these signs, expect the IRS to take a closer look.

The Impact on Families and Communities

Tax fraud isn’t a victimless crime. Sure, Moore’s clients got refunds, but when fraud like this spreads:

- Communities lose funding for schools, roads, and healthcare.

- Families suffer when breadwinners go to prison, leaving behind children and spouses.

- Reputation damage follows professionals for life—try getting a job after being labeled a tax cheat.

It’s not just about money—it’s about trust and stability.

Step-by-Step: How to File Taxes Safely

Want to avoid falling into traps like Moore’s clients? Here’s a mini-guide:

- Gather Your Documents – W-2s, 1099s, receipts, and bank statements.

- Choose a Filing Method – DIY software (like TurboTax), IRS Free File, or a certified CPA.

- Double-Check Deductions – Stick to deductions you can prove with records.

- Review Before Submitting – Look for red flags like inflated numbers.

- File Early – Beat scammers who file fake returns in your name.

How to Protect Yourself from Tax Scams?

Here are five practical steps:

- Work with Legitimate Professionals.

- Ask Questions if deductions sound sketchy.

- Never Sign Blank Forms.

- Keep Records for at least 3–7 years.

- Trust Your Gut—if it sounds too good to be true, it probably is.

Las Vegas Woman Says Ex-Husband Offered $339,000 Just to Stay Married for US Citizenship

US Court Rules Jury Was Misled on Tax Fraud Conspiracy Charge – Check Details

Los Angeles Lab Owner Admits $11.2 Million Tax Evasion in Medicare Payment Scam: Check Details