IRS Stimulus Checks 2025: If you’ve been hearing chatter about IRS Stimulus Checks in 2025, you’re not alone. From neighborhood barbershops to Facebook groups, folks across the U.S. are buzzing about whether another check is coming. Let’s cut through the noise: as of September 2025, the IRS confirms there are no new federal stimulus checks this year. But that doesn’t mean there’s nothing to look forward to. Between state-level rebate programs, leftover credits from 2021, and the potential for a refund surge in 2026, there are still ways Americans may see extra money in their bank accounts. Understanding what’s real and what’s rumor can help you plan smarter.

IRS Stimulus Checks 2025

Here’s the bottom line: there are no new IRS Stimulus Checks in 2025. The last wave of Recovery Rebate Credits was sent earlier this year, and the deadline to claim has closed. But relief isn’t gone altogether. State programs, standard tax refunds, and a likely refund boom in 2026 mean there’s still opportunity to boost your finances. The best move? File on time, use official IRS tools, and stay cautious of scams. When it comes to taxes, the smartest taxpayers are the ones who stay informed.

| Topic | Details (2025) |

|---|---|

| New Federal Stimulus Checks | None scheduled; IRS confirms no 2025 payments |

| $1,400 Recovery Rebate Credit | Final wave sent to ~1 million taxpayers in late 2024–early 2025 |

| Deadline to Claim 2021 Stimulus | April 15, 2025 (now closed) |

| How to Track Payments | Use IRS “Where’s My Refund?” Tool or IRS Online Account |

| Future Relief in 2026? | JPMorgan forecasts average $3,743 refunds from tax law changes |

A Look Back: How Stimulus Checks Worked

To understand why people are still asking about stimulus checks, it helps to revisit what happened just a few years ago.

- In March 2020, the CARES Act delivered $1,200 per eligible adult to help during COVID-19 shutdowns.

- By December 2020, Congress approved another round of $600 checks.

- In March 2021, the American Rescue Plan sent out $1,400 per adult and dependent, the largest single round.

These payments put over $800 billion directly into American households, according to the Congressional Budget Office. For many families, it meant paying rent, keeping lights on, or simply putting food on the table.

Since then, no new federal stimulus packages have passed. But the memory of those checks—and the relief they brought—explains why every new rumor sparks attention.

What’s Left of Stimulus in 2025?

The Final Wave: 2021 Recovery Rebate Credit

The Recovery Rebate Credit was designed as a catch-up for anyone who missed their third stimulus check. For example, if you had a new baby in 2021 or your income dropped, you could claim extra money when filing your taxes.

- Starting in late 2024, the IRS automatically issued payments to about 1 million taxpayers.

- The average payout was $1,400 per eligible person, with families receiving much more.

- The deadline to claim was April 15, 2025. If you didn’t file a 2021 return by then, you’re no longer eligible.

This was the last official stimulus-related payment tied to COVID-era relief.

State Rebates: The Unsung Relief Programs

While Washington has gone quiet, several states are still stepping up. These aren’t technically “stimulus checks,” but they often work the same way—extra cash back in your account.

- California: The Middle Class Tax Refund gave residents up to $1,050, distributed in late 2022 and 2023, with some final payments clearing in early 2024.

- Colorado: Residents benefited from TABOR refunds of about $800 per filer, thanks to state budget surpluses.

- New Mexico: Offered $500 for single filers and $1,000 for couples in 2024, plus smaller relief checks in 2025.

- Minnesota: Sent out “Walz Checks” worth up to $260 per filer, with families receiving up to $1,300 in 2024.

If you live in one of these states, you may still qualify for leftover programs or tax credits. Always confirm through your state’s official Department of Revenue website.

How to Track Your IRS Stimulus Checks 2025 or Refund?

Even if no new stimulus is coming, many taxpayers are still owed refunds or past credits. The IRS offers several tools to help you track what’s yours.

Step 1: Check “Where’s My Refund?”

- Visit IRS Refund Tracker.

- Enter your Social Security Number, filing status, and exact refund amount.

- View your status: “Return received,” “Refund approved,” or “Refund sent.”

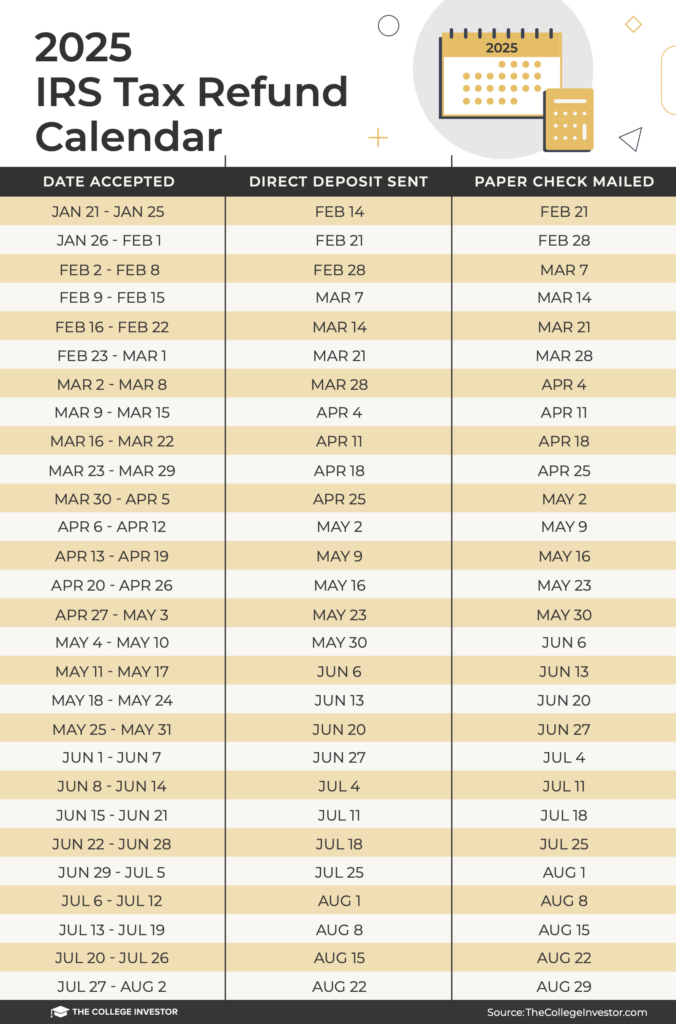

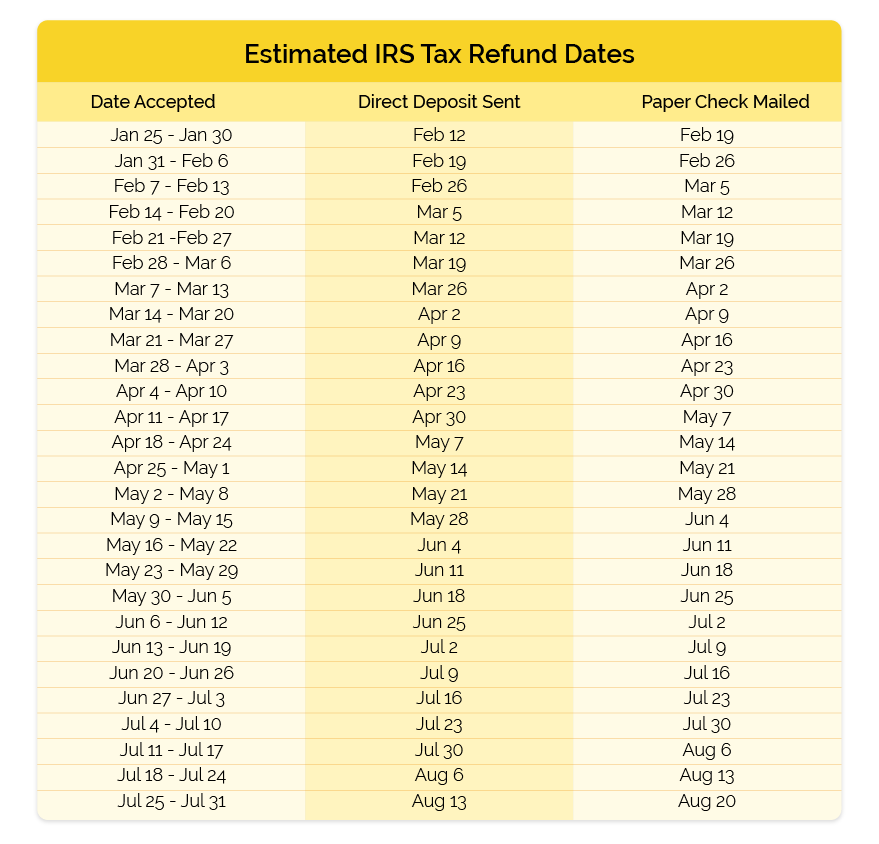

Electronic filers usually get updates within 21 days, while paper filers may wait several months.

Step 2: Log Into Your IRS Online Account

This digital dashboard provides more detail, including:

- How much stimulus money you already received.

- Any Recovery Rebate Credits applied to your account.

- Past tax transcripts and notices.

This is often the fastest way to confirm whether you missed a payment.

Step 3: File a Payment Trace (Form 3911)

If the IRS shows a payment as “issued,” but your mailbox is empty, file Form 3911. This allows the IRS to investigate whether your check was cashed, lost, or misdelivered. If it was stolen, they’ll reissue after verification.

A Real-Life Example

Consider Mark and Angela, a married couple in Ohio with two children.

- In 2021, their household income dropped below $150,000, making them eligible for the full $1,400 per adult plus $1,400 per dependent.

- They forgot to claim it when filing, but in early 2025, the IRS automatically applied the Recovery Rebate Credit when they submitted a late return.

- Total refund: $5,600.

This example shows why filing taxes—even late—can still bring financial relief.

Looking Ahead: The 2026 Refund Boom

While 2025 might feel quiet, 2026 could bring a big payoff.

Thanks to the newly passed One Big Beautiful Bill Act (OBBBA), tax refunds are projected to rise significantly.

- JPMorgan predicts average refunds of $3,743 in 2026.

- Roughly 110 million taxpayers are expected to benefit.

- Expanded credits and adjusted brackets will drive bigger returns.

For households, this could mean money for vacations, paying down debt, or investing. For the economy, it means a likely surge in consumer spending.

Common Mistakes to Avoid

Many taxpayers miss out on money because of avoidable errors:

- Entering the wrong refund amount in the tracker (must match your return exactly).

- Ignoring IRS mail—many critical notices only arrive by paper.

- Falling for scams: the IRS will never text, call, or DM you asking for personal info.

- Skipping tax filing because they “don’t owe.” Even if you owe nothing, you could be missing out on credits and refunds.

Professional Insights

Tax professionals emphasize planning ahead.

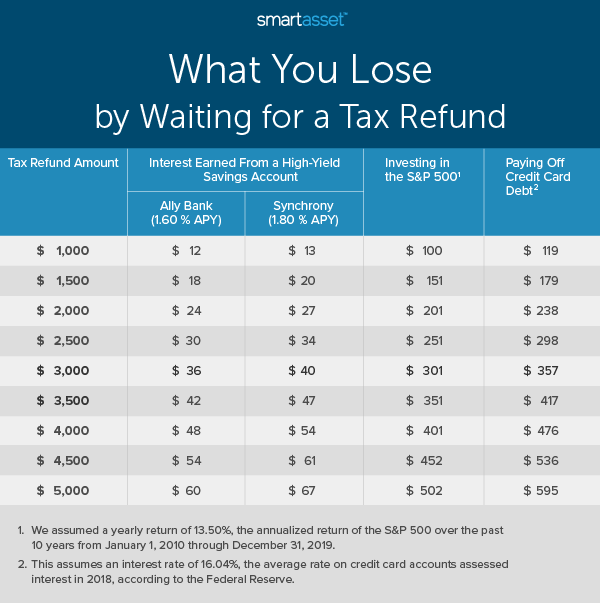

“Think of your refund as an interest-free loan you gave the government. If you’re consistently getting thousands back, it may be time to adjust your withholdings,” says Lisa Howard, CPA in Florida.

This way, you keep more cash in each paycheck instead of waiting a year.

What Is the Digital Services Tax That Could Spark New Trump Tariffs?

Big Tax Bill Update – Child Tax Credit Changes Every Family Should Know About

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big