No Federal Stimulus in September: If you’ve been scrolling through social media lately, you’ve probably seen posts about “stimulus checks in September 2025.” Let’s set the record straight: there’s no new federal stimulus this month. The IRS confirmed it, and the viral $1,390 rumor? Totally fake. But don’t lose hope—some states are stepping up. From New York to Alaska, millions of Americans will see rebate checks, property tax refunds, or monthly cash deposits. Let’s break it down in plain English, so you know what’s real, what’s not, and how to check if you’re eligible.

No Federal Stimulus in September

So here’s the bottom line: no federal stimulus checks are coming in September 2025. Don’t buy into the hype. But state programs are alive and kicking. Whether it’s New York’s inflation refund, Alaska’s $1,702 dividend, or California’s family pilot program, millions of Americans will still see cash relief this month. Stay smart: always verify on official government websites, not random posts. Relief may not be nationwide, but if you live in the right state, September could still bring some extra breathing room.

| Topic | Details |

|---|---|

| Federal Stimulus | No federal payments in September 2025. IRS confirms no new checks. |

| Rumors | Viral posts about $1,390 stimulus checks are false. |

| New York | Sending inflation refund checks ($150–$400) in late September. NY Tax Dept. |

| California | Family First Economic Support Pilot gives $725/month to select Sacramento families. |

| Alaska | Annual Permanent Fund Dividend (PFD) of about $1,702 arrives Sept. 11. PFD Official Site |

| Other States | Colorado, Georgia, Michigan, Virginia, and Pennsylvania running rebate/tax credit programs. |

Why No Federal Stimulus in September?

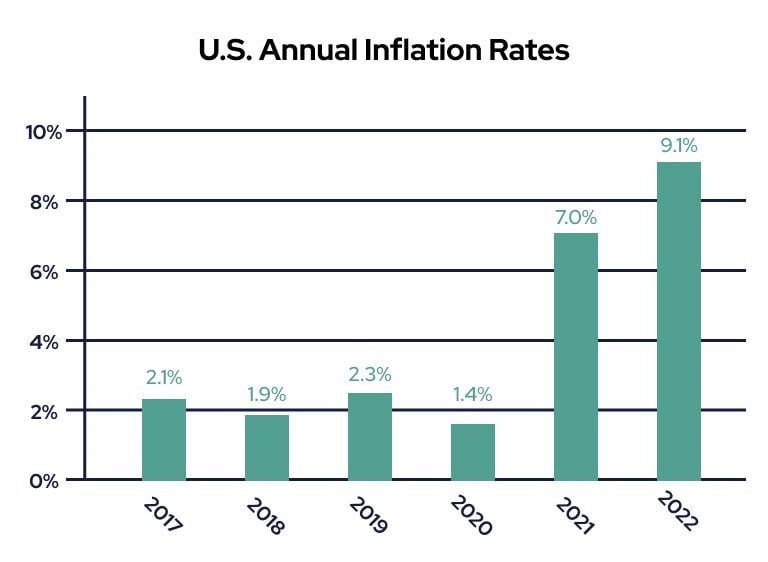

The last federal stimulus check was years ago during the pandemic. Since then, Washington hasn’t approved another round. Why? The economy, while still tough for families, is growing. Inflation has cooled from its peak but is still hovering around 3.2% (Bureau of Labor Statistics, 2025). Lawmakers argue the crisis that justified federal checks is over.

There’s buzz about the American Worker Rebate Act, a bill that would give $600 rebates funded by tariffs. But until Congress passes it, it’s just talk. The political appetite for another nationwide relief program is slim. Some lawmakers worry fresh checks would fuel inflation, while others argue federal aid should target only the lowest-income households.

The Bigger Economic Picture

To really understand why federal checks have stopped but state rebates continue, it helps to look at the numbers:

- Inflation: Prices for essentials like groceries are still nearly 20% higher than in 2020, even though inflation is cooling.

- Unemployment: At 4.1% nationally (BLS, July 2025), the job market is steady but uneven, with manufacturing states seeing slower recovery.

- Household Debt: According to the Federal Reserve, household debt has hit a record $17.6 trillion, fueled by credit card balances and student loans.

- State Budgets: Many states collected extra tax revenue in recent years due to higher consumer spending and inflation. That’s why they have “surplus” funds available for rebates.

In short, Washington says the emergency is over, but states are choosing to cushion their residents from lingering inflation and debt burdens.

State Programs Filling the Gap

Since Washington is quiet, state governments are rolling out their own relief. Think of it as “DIY stimulus,” customized for local needs.

New York: Inflation Refunds & STAR Tax Relief

- Inflation Refund Checks: $150–$400 per household, automatic payments starting late September. More than 8 million New Yorkers are eligible.

- STAR Program: Property tax relief continues, saving households $350–$600, and seniors up to $1,500.

These refunds are especially important in New York, where rent and property taxes are among the highest in the nation. For families in New York City and Long Island, even a few hundred dollars can help offset utilities or school supply costs.

California: Family First Pilot Program

- The big rebates like the Middle Class Tax Refund (which provided $200–$1,050) are finished.

- But in Sacramento County, families in six ZIP codes (95815, 95821, 95823, 95825, 95828, 95838) get $725/month if they have kids under age 5.

- Payments continue through November 2025.

While it’s limited to a small population, this program is designed to test whether guaranteed income can reduce poverty and improve children’s development. Similar pilots in Stockton, California, showed families used funds mostly for food, rent, and childcare.

Alaska: Permanent Fund Dividend (PFD)

- Every year, Alaska pays residents from oil profits.

- This September, it’s $1,702 per eligible person, dropping on September 11, 2025.

- For a family of four, that’s nearly $6,800—huge relief before winter heating bills hit.

The PFD is unique in the U.S. and reflects Alaska’s philosophy that residents should share in the state’s natural resource wealth. For many rural Alaskan families, it helps cover expensive fuel and groceries.

Other States Running Rebates

- Colorado: Refunds from the TABOR surplus law, up to $1,130.

- Georgia: Rebates of $250–$500 under House Bill 112.

- Michigan: Expanding the Working Families Tax Credit—up to $750 per child.

- Virginia & Pennsylvania: Issuing property tax relief and inflation-based refunds.

Federal vs. State Relief: What’s the Difference?

| Federal Stimulus | State Rebates |

|---|---|

| Issued by U.S. Congress, nationwide. | Issued by individual states. |

| Last major checks: pandemic era. | Active in 2025 in at least 8 states. |

| Usually automatic via IRS. | Some automatic, others require applications. |

| Funded through federal taxes. | Funded through state surpluses, oil, or special laws. |

This difference matters: a family in Alaska could receive thousands, while a family in Texas sees nothing. That’s why it’s crucial to check your own state’s programs.

Step-by-Step: How to Check If You Qualify

- Start at official websites – Visit IRS.gov for federal info, or your state’s Department of Revenue.

- Confirm your 2023 tax filing – Many rebates are based on your last return.

- Watch your delivery method – Some states use paper checks, others direct deposit, and some debit cards.

- Stay alert for scams – If someone asks you to “apply” for a federal stimulus in 2025, it’s fake.

- Bookmark deadlines – A few programs, like Michigan’s child credit, require claims before year-end.

- Track state news updates – Relief programs can expand or change based on budgets.

Real-Life Examples

- Alaska Family: A family of four will see $6,808 from the PFD. That can cover winter heating oil or pay down credit card debt.

- New York Couple: Married with two kids, earning under the threshold—they’ll get $400 refund plus $600 STAR credit, a total of $1,000 relief.

- Sacramento Parent: A single mom with two toddlers in ZIP 95823 gets $725/month, enough to cover rent or childcare.

These examples show how relief programs can be the difference between struggling and breathing easier.

Common Misconceptions

- “I heard everyone’s getting $1,390 this month.”

False. That rumor has been debunked by the IRS. No federal stimulus exists in September 2025. - “If I didn’t get last year’s rebate, I’ll miss this year’s too.”

Not necessarily. Some states allow late filers or amended returns to claim missed rebates. Always check deadlines. - “These rebates are taxable.”

It depends. Federal stimulus checks during the pandemic were not taxable, but some state rebates may affect your taxes.

What Is the Digital Services Tax That Could Spark New Trump Tariffs?

Big Tax Bill Update – Child Tax Credit Changes Every Family Should Know About

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big