UP Man Arrested for Fake GST Bills: When you hear about scams, you might picture slick Wall Street hustlers or movie characters pulling fast ones in boardrooms. But fraud happens everywhere, and sometimes the schemes are surprisingly simple. Recently, a man from Uttar Pradesh (UP), India, was arrested for creating fake GST bills worth ₹10 crore (about $1.2 million USD) in order to claim a refund of ₹1.8 crore ($216,000 USD). At first glance, this may sound like something ripped from a Netflix crime series. But it’s a real-world example of how individuals exploit loopholes in tax systems. And this isn’t just India’s problem. Similar frauds plague the IRS in the United States and tax systems in Europe. By digging into this story, we can better understand how these scams work, why they’re dangerous, and what steps professionals and everyday taxpayers can take to protect themselves.

UP Man Arrested for Fake GST Bills

The story of the UP man arrested for fake GST bills worth ₹10 crore to claim ₹1.8 crore refund isn’t just a local crime report. It’s part of a bigger picture showing how fraudsters around the world exploit complex tax systems for personal gain. From India’s GST scams to U.S. IRS refund fraud, these schemes rob governments of funds meant for public good. The takeaway is clear: stay vigilant, protect your tax credentials, and invest in compliance systems. Fraud may be clever, but prevention is smarter.

| Detail | Information |

|---|---|

| Who was arrested? | Abhinav Tyagi, former private firm employee |

| Where? | Greater Noida, Uttar Pradesh, India |

| Fraud Amount | Fake GST bills worth ₹10 crore (~$1.2M USD) |

| Refund Claimed | ₹1.8 crore (~$216,000 USD) |

| How? | Generated fake GST invoices using company tax portal |

| Evidence Seized | Phones, SIMs, laptop, documents, car |

| Charges | Bharatiya Nyaya Sanhita & IT Act |

| Possible Penalty | Up to 5 years imprisonment + heavy fines |

| Reference | Official GST Portal |

The Crime: What Happened

The accused, Abhinav Tyagi, wasn’t some mastermind hacker. He was a regular employee working in the accounts department of a private company. That gave him access to GST (Goods and Services Tax) portals and tax-return filings. Using this access, he allegedly created fake invoices worth ₹10 crore. Then, he filed claims for Input Tax Credit (ITC) worth ₹1.8 crore — basically asking the government to refund taxes that were never actually paid.

When police caught up with him, they seized four phones, eight SIM cards, a laptop, multiple fake documents, and even a car purchased with fraudulent money. Investigators believe he worked with an accomplice who is still on the run.

UP Man Arrested for Fake GST Bills Explained

For those outside India, here’s the breakdown. The Goods and Services Tax (GST) is a value-added tax applied to most goods and services. It’s somewhat similar to sales tax in the U.S. or VAT in Europe. Businesses collect GST on sales but also pay GST on purchases. To avoid double taxation, they can claim Input Tax Credit (ITC) for the tax already paid on purchases.

That’s where fraudsters sneak in. By faking purchases through fake invoices, they can file for refunds that don’t exist. Imagine writing yourself a fake grocery receipt for $500 and then asking Uncle Sam to pay you back for it. Multiply that by millions, and you get the picture.

Why This Case Matters?

This isn’t just a random arrest in India. Here’s why it matters globally:

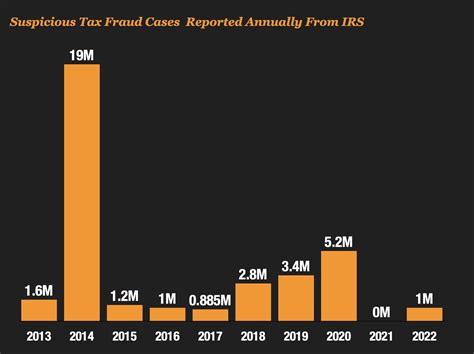

- Fraud is universal. Whether it’s GST in India, IRS returns in America, or VAT in the U.K., scammers use similar tricks everywhere.

- It costs taxpayers billions. In India alone, authorities uncovered fake invoice frauds worth over ₹57,000 crore ($7 billion USD) in 2022. In the U.S., refund fraud costs the IRS billions every year.

- It exposes weak points. Fraudsters thrive on loopholes in complex tax systems. Each case highlights areas where oversight and technology need to improve.

Legal Consequences in India

India has strict laws against GST fraud. According to the Central Board of Indirect Taxes and Customs (CBIC):

- Fake invoices above ₹5 crore can lead to up to 5 years in prison.

- The government can seize assets, blacklist businesses, and impose fines.

- If digital manipulation is involved, charges under the Information Technology Act may also apply.

In this case, Tyagi faces charges under the Bharatiya Nyaya Sanhita (BNS), India’s new criminal code, and sections of the IT Act.

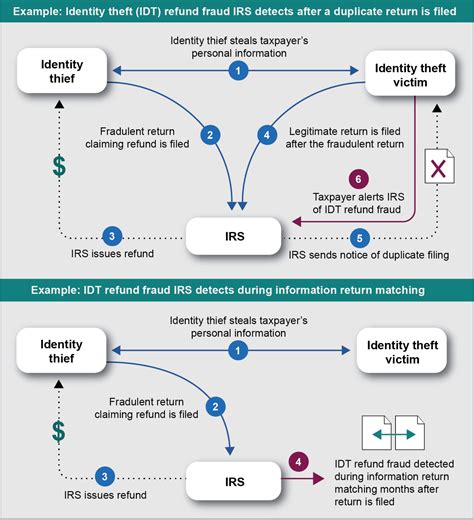

How Fraudsters Operate: Step-by-Step

- Gain Access

Fraudsters get access to legitimate tax systems, often through jobs in accounting departments or stolen login details. - Create Fake Invoices

They set up fake transactions, sometimes involving shell companies or bogus vendors. - Claim Refunds

Using these fake invoices, they file for ITC refunds from the government. - Move the Money

The funds are transferred across multiple accounts, often laundered into assets like real estate, gold, or vehicles. - Cover Their Tracks

Fraudsters sometimes use multiple SIM cards, fake documents, or even relocate to avoid detection.

Global Comparisons: Fraud Everywhere

- United States: The IRS deals with identity theft refund fraud where scammers file fake tax returns using stolen Social Security Numbers. At one point, this cost the U.S. Treasury over $6 billion annually.

- United Kingdom: VAT carousel fraud — where goods are moved between fake companies across borders — costs billions of pounds every year.

- India: In addition to Tyagi’s case, multiple nationwide crackdowns in recent years have revealed frauds running into tens of thousands of crores.

This shows that while the systems differ, the criminal mindset is the same: exploit loopholes, grab quick money, and hope not to get caught.

Why These Scams Keep Happening?

Fraud continues because of three main reasons:

- Complex tax systems. The more complicated the rules, the easier it is to exploit loopholes.

- Weak oversight. Smaller businesses often lack regular audits or strong compliance measures.

- Greed and overconfidence. Many fraudsters think “everyone does it” or believe they won’t get caught.

Practical Advice for Staying Safe

Whether you’re a small-business owner, freelancer, or corporate professional, fraud prevention should be on your radar.

For Individuals

- Use strong passwords and enable two-factor authentication (2FA).

- Never share tax portal logins with unauthorized people.

- Watch out for phishing emails pretending to be from tax authorities.

For Small Businesses

- Verify vendor invoices before processing payments.

- Run quarterly audits instead of waiting for year-end.

- Train employees to spot fraud indicators.

For Corporations

- Use secure software with audit trails.

- Rotate employees in sensitive finance roles.

- Work with certified auditors to strengthen compliance.

If you suspect fraud:

- In India, report it at the GST portal.

- In the U.S., use the IRS Fraud Hotline.

Professional Insights: Building a Fraud-Proof System

Experts recommend a layered approach:

- Technology + People. Software can catch anomalies, but well-trained employees are the first line of defense.

- Regular Reconciliation. Match invoices against bank statements and GST/IRS filings.

- Whistleblower Policies. Encourage employees to report suspicious activities anonymously.

- Third-Party Audits. Independent checks often reveal red flags missed internally.

Bidar Youth Arrested For ₹9.25 Crore GST Evasion Using Fake Bills