£180,000 Covid Relief Scam: When we talk about financial fraud, especially during tough times like the pandemic, it hits hard. UK accountant jailed for £180,000 Covid relief scam is more than just a headline—it’s a warning. It’s about how greed can twist trust, how programs meant to support struggling families and small businesses were abused, and how justice finally caught up with one man who thought he could beat the system. This story, while rooted in the UK, carries lessons that echo worldwide. Whether you’re an accountant in New York, a small business owner in Texas, or a student learning economics in Chicago, there’s a lot to unpack. And don’t worry—we’ll keep it straightforward, easy to understand, and relatable, with examples that make sense to everyone, from a 10-year-old to a financial pro.

£180,000 Covid Relief Scam

The story of the UK accountant jailed for £180,000 Covid relief scam is a powerful lesson. It highlights how vulnerable emergency aid programs are, how quickly fraudsters act, and how the consequences eventually catch up. For professionals, it reinforces that ethics matter more than shortcuts. For businesses and families, it underscores the need to stay vigilant and verify. And for governments, it’s a call to strengthen systems before the next crisis strikes.

| Topic | Details |

|---|---|

| Who? | Daniel Jee, 32, accountant from Leamington Spa, UK |

| What happened? | Fraudulently claimed £179,218 in COVID-19 relief funds |

| Schemes used | Coronavirus Job Retention Scheme (CJRS) & Self-Employment Income Support Scheme (SEISS) |

| Timeframe | March 2020 – late 2021 |

| Court ruling | Sentenced at Exeter Crown Court to 3 years & 4 months in prison (Sept 5, 2025) |

| How discovered? | HMRC flagged suspicious claims; his firm launched an internal investigation |

| Impact | Betrayed client trust, stole taxpayer money, undermined pandemic relief efforts |

| Official resource | HM Revenue & Customs (HMRC) |

Background: The UK’s COVID Relief Schemes

To really understand this case, we need to look at the relief programs in question.

- Coronavirus Job Retention Scheme (CJRS) – This was the famous “furlough scheme.” Employers could claim back up to 80% of wages for employees who could not work because of lockdowns. Millions of workers kept food on the table thanks to CJRS.

- Self-Employment Income Support Scheme (SEISS) – Aimed at freelancers and contractors who suddenly lost income. It offered taxable grants to self-employed workers whose earnings were hit by the pandemic.

These were designed for speed, not perfection. Money had to reach people fast. But speed meant the system became vulnerable to fraudsters.

The Case of Daniel Jee

Daniel Jee wasn’t just anyone—he was a trusted accountant. Over 18 months, from March 2020 through late 2021, he abused that trust.

- He filed fake CJRS and SEISS claims for ten businesses and two elderly clients.

- Instead of sending funds to them, he diverted payments to his own bank accounts.

- He attempted to steal £230,369 but successfully pocketed £179,218 before HMRC blocked further claims.

This wasn’t a one-time lapse. It was a carefully repeated pattern of dishonesty.

How the £180,000 Covid Relief Scam Worked?

Step 1 – Access Through Trust

As an accountant, Jee had full access to his clients’ sensitive financial data. Clients believed he was filing legitimate claims.

Step 2 – Redirecting Relief Funds

When HMRC processed claims, the money should have gone to his clients. Instead, Jee listed his own bank details.

Step 3 – Slipping Through Oversight

At first, these fraudulent claims seemed normal. But over time, patterns—like unusual amounts and repeated claims—raised red flags inside HMRC’s system.

HMRC’s Fraud Detection

HMRC (the UK equivalent of the IRS) has fraud detection units that cross-check claims against payroll records, tax filings, and bank accounts.

- Algorithms flag suspicious activity, such as claims inconsistent with payroll history.

- Human investigators then step in to review evidence.

- In this case, once irregularities popped up, Jee’s own firm was alerted and began an internal audit.

Fraud detection might seem slow, but it eventually closes in.

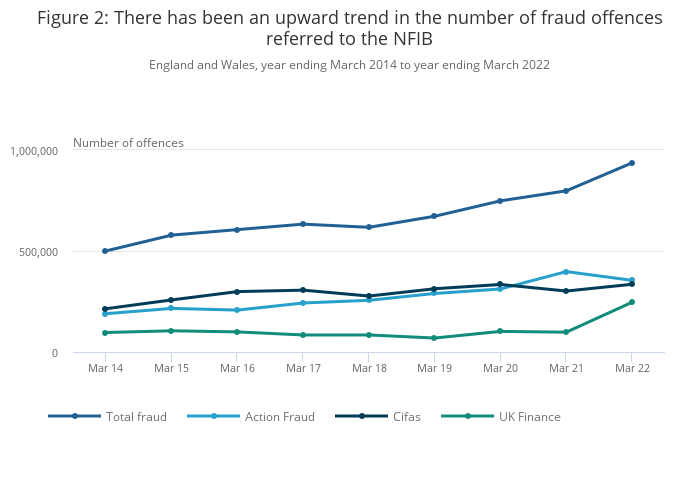

The Global Fraud Picture

Jee’s scam is not unique. Across the globe, relief programs faced widespread fraud.

- United States: The Department of Justice estimates over $200 billion was stolen through fraudulent Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL).

- European Union: Europol uncovered organized crime groups exploiting pandemic relief across multiple countries.

- Worldwide: The OECD found tens of billions siphoned from emergency funds.

No matter the country, the pattern was the same: rushed money, weak checks, and opportunists exploiting loopholes.

Impact on Taxpayers

Fraud like this has real consequences:

- Every stolen pound or dollar is taxpayer money gone.

- Fraud reduces funding for critical services like schools, hospitals, and infrastructure.

- It increases pressure on future budgets, meaning higher taxes or cuts elsewhere.

- Public trust in relief programs declines, which makes people hesitant to seek legitimate help.

When accountants—people trusted to manage finances—are involved, the betrayal cuts even deeper.

Legal Ramifications

At Exeter Crown Court, Jee was sentenced to three years and four months in prison. His punishment aligns with UK sentencing guidelines for fraud involving breach of trust.

Other potential consequences include:

- Repayment orders: Courts can require repayment through confiscation of assets.

- Career destruction: Jee is unlikely to ever work in accountancy again. Professional bodies like ICAEW and ACCA would strip his license.

- Personal fallout: Criminal records affect everything—from securing loans to traveling abroad.

Fraud may look tempting in the moment, but it leaves permanent scars.

The Psychology of Fraud

Why do professionals like Jee risk it all? Several factors often play a role:

- Desperation: Financial stress during the pandemic tempted many to “just take a little.”

- Greed: Some saw it as easy money.

- Arrogance: Belief that they were smarter than the system.

But history proves the opposite—fraudsters almost always get caught. From Bernie Madoff in the U.S. to small-scale scams, the pattern ends the same: exposure, trial, and jail.

Lessons for Accountants

For accountants worldwide, this case is a reminder:

- Ethics are everything. Trust is your most valuable currency.

- Transparency protects. Document every claim and share records with clients.

- Training matters. Stay updated on fraud detection and compliance requirements.

Professional associations emphasize ethics for good reason—careers can collapse overnight without it.

Lessons for Businesses and Individuals

Businesses and individuals aren’t powerless. Here are practical steps:

- Double-check filings: Always ask for copies of claims filed on your behalf.

- Use official portals: Submit claims directly through government websites when possible.

- Review bank details: Ensure relief payments are going to the correct account.

- Stay informed: Scammers thrive on confusion. Follow official sources like gov.uk or sba.gov.

- Get second opinions: An occasional audit from a different accountant can catch issues early.

Fraud Prevention Checklist

Here’s a simple guide anyone can follow:

- If it sounds too easy, it probably is.

- Never share personal or financial data over email or text unless verified.

- Keep your records organized—chaos is a scammer’s best friend.

- Educate employees and family members on spotting suspicious requests.

Accountant Hacks Firm’s GST Portal and Steals ₹1.80 Crore with Fake Invoices!

UK Tax Fraud Crackdown — Indian-Origin Mastermind Ordered to Pay £90 Million

UK Can Squeeze More From Oil and Gas With Faster Tax Changes, Says Lobby

Ethical Takeaways

This case isn’t just about fraud—it’s about ethics. Professions like accounting, law, and medicine rely on trust. Without it, the system crumbles.

Ethics isn’t an abstract idea; it’s a daily decision. For professionals, choosing honesty even when shortcuts appear tempting is what sustains careers and reputations.