HMRC Uses AI to Catch Tax Cheats: When you think of the IRS in the U.S., you probably picture agents combing through paperwork, calling for audits, and investigating suspicious tax returns. But in the UK, the taxman has gone high-tech. Her Majesty’s Revenue & Customs (HMRC) is now using artificial intelligence (AI) to catch tax cheats by tracking lifestyle on social media. That means your Instagram photos, TikTok videos, or Facebook Marketplace sales might not only impress friends—they could also raise eyebrows at HMRC. This bold move has triggered debates about privacy, fairness, and whether governments are going too far. Yet it also shows how powerful technology has become in enforcing tax compliance. Whether you’re a professional, a freelancer with side gigs, or just curious about how modern tax enforcement works, this is a story worth paying attention to.

HMRC Uses AI to Catch Tax Cheats

The fact that HMRC uses AI to catch tax cheats by tracking lifestyle on social media marks a turning point in global tax enforcement. With its Connect system, whistleblower tips, and international cooperation, HMRC is setting a new standard for detecting hidden income. While critics warn of privacy risks and false positives, the message for everyday taxpayers is clear: report income honestly, keep clean records, and remember that your online life is part of your financial footprint. In today’s digital-first world, playing by the rules is the best—and safest—move.

| Topic | Details |

|---|---|

| Who’s involved? | HMRC (UK’s tax authority) using AI and the Connect system |

| What’s happening? | AI scans bank records, property data, and social media to catch tax evasion |

| Since when? | Connect launched in 2010; expanded powers since 2021 |

| Social Media Focus | Instagram, TikTok, Facebook Marketplace, YouTube, and more |

| Stats | 164,670 whistleblower tips in 2024–25, £850,000 in rewards paid |

| Global Reach | Data-sharing across 100+ countries under OECD agreements |

| Official Source | HMRC UK Official Website |

The Evolution of Tax Surveillance

Tax enforcement has always been a game of cat and mouse. In earlier decades, audits were manual, time-consuming, and often limited to people already under suspicion. Offshore accounts and unreported income slipped through the cracks.

As digital banking grew, so did digital tax evasion. Offshore accounts, crypto wallets, and online marketplaces made it easier to hide earnings. Governments worldwide needed a smarter weapon.

In 2010, HMRC launched Connect, an AI-driven system designed to collect and cross-reference data from more than 30 sources. Over time, it became one of the most sophisticated tools in global tax enforcement. By 2021, HMRC’s authority expanded: it could compel banks to share account details through a Financial Institution Notice, no court approval required.

This shift transformed tax surveillance from reactive to proactive. Instead of waiting for red flags, HMRC could now scan millions of records in near real time.

How Social Media Became a Tool for the Taxman?

Social media wasn’t created for tax enforcement, but it’s become a goldmine of evidence. HMRC legally scans publicly available posts, using AI to flag suspicious activity.

Here are some ways it works:

- Instagram: People flaunting designer clothes, new cars, or exotic vacations that don’t match reported income.

- TikTok and YouTube: Influencers bragging about six-figure incomes but failing to declare sponsorships or ad revenue.

- Facebook Marketplace: Users running side hustles without reporting earnings.

Consider this scenario: A London resident reports an annual income of £25,000. Yet on Instagram, they post photos of luxury vacations and a new Porsche. Connect cross-checks DVLA vehicle registrations, property records, and bank statements. The mismatch triggers an investigation.

This isn’t fiction—it’s how the system works in practice.

The Data Driving the Crackdown

The scale is massive:

- Connect System Reach: Access to bank accounts, property records, credit cards, and online sales platforms.

- Whistleblower Network: In 2024–25, HMRC received 164,670 tip-offs, paying £850,000 in rewards to informants.

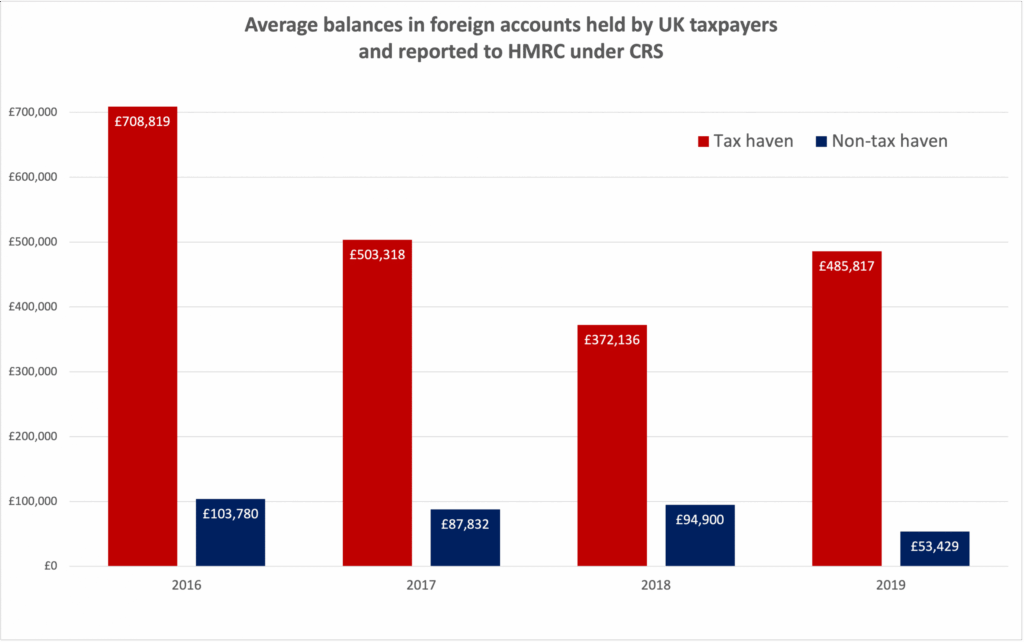

- International Data Sharing: Through the OECD’s Common Reporting Standard, HMRC partners with over 100 countries to trace hidden overseas accounts.

The message is clear: in today’s world, it’s harder than ever to hide income.

Why HMRC Uses AI to Catch Tax Cheats Matters Beyond the UK?

Even if you’re based in the United States or elsewhere, this trend should grab your attention. The IRS in the U.S. is also experimenting with AI tools, particularly for monitoring cryptocurrency transactions and gig economy income.

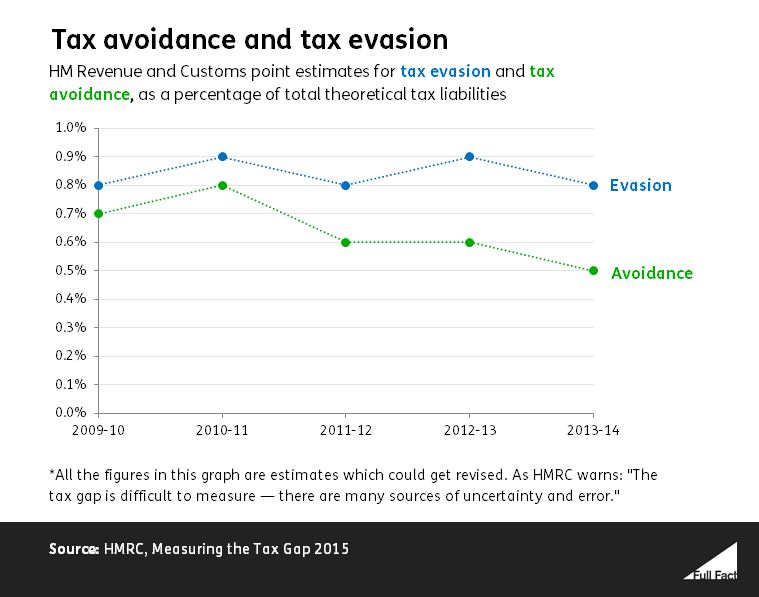

Both agencies share a common challenge: digital businesses, online creators, and freelancers often underreport income. With trillions lost to tax evasion globally, authorities are getting more aggressive.

For professionals, this means compliance is no longer optional. Even a “small side hustle” might show up in AI-powered systems.

Real-World Scenarios and Examples

To make this more relatable, here are some situations where AI could intervene:

- A freelance designer underreports income but posts about luxury gadgets online.

- A property owner rents out apartments via Airbnb without declaring it. Connect picks it up through property and council tax records.

- An influencer accepts free products and trips but doesn’t declare them as taxable income. Their YouTube videos provide the evidence.

In each case, the mismatch between declared income and lifestyle sparks an HMRC review.

The Ethical and Legal Debate

Critics argue that using AI and social media monitoring risks turning everyday taxpayers into suspects.

- Privacy advocates say this resembles mass surveillance.

- Lawmakers warn of false positives, such as when someone borrows a luxury car or posts old vacation photos.

- Comparisons to Horizon Scandal: UK MPs note the dangers of relying too heavily on automated systems, referencing the wrongful prosecutions in the Post Office Horizon case.

Proponents, however, argue that it’s fair. Tax evasion drains billions from public services, and technology ensures everyone pays their share.

Practical Advice: How to Stay Compliant

The good news? If you’re honest with your taxes, you’re unlikely to have problems. Still, here are steps to protect yourself:

1. Report All Income

From Uber driving to selling crafts on Etsy, every dollar counts.

2. Keep Thorough Records

Use accounting apps like QuickBooks, FreshBooks, or Wave. Good documentation makes audits less stressful.

3. Be Careful on Social Media

Post freely, but don’t flaunt lifestyles that contradict your tax filings.

4. Hire a Professional

If your income comes from multiple sources, especially international or crypto, consult a tax advisor.

5. Stay Educated

Check out official resources like the IRS Small Business Center or HMRC Self Assessment Guide.

Global Comparisons: HMRC vs. IRS vs. Others

- HMRC (UK): Openly uses social media surveillance, with a robust AI system since 2010.

- IRS (U.S.): Heavy focus on crypto, gig economy, and digital payments. Less transparent about social media but just as aggressive.

- Australia & Canada: Also adopting AI-powered tax enforcement, targeting hidden income and offshore accounts.

The trend is global, signaling a new era in tax policing.

UK Tax Fraud Crackdown — Indian-Origin Mastermind Ordered to Pay £90 Million

Indian Woman Quits UK After 10 Years, Calls Taxes ‘Insane’ and Costs Unbearable

UK Can Squeeze More From Oil and Gas With Faster Tax Changes, Says Lobby

The Future of AI in Tax Enforcement

Experts predict several developments in the next decade:

- Greater automation of audits, reducing the role of manual review.

- Real-time monitoring of digital payments and bank activity.

- Global data integration, making it nearly impossible to hide assets abroad.

- Potential AI partnerships with tech companies and payment processors for deeper monitoring.

For businesses and professionals, this means compliance must be airtight. Transparency is the safest path forward.