IRS Order Could Change How You Pay Taxes: If you’ve been following the latest from Washington, you’ve likely heard about President Trump’s new IRS order that could reshape how millions of Americans pay and file their taxes. Starting next year, expect big shifts: no more paper checks from the IRS and a major new law called the “One Big Beautiful Bill” (OBBB) that introduces fresh deductions for workers, families, and retirees. This isn’t just technical tax jargon. Whether you’re a server picking up double shifts, a small business owner, a parent trying to save for your kids, or a retiree on a fixed income, these changes will directly affect your wallet. In this article, we’ll break everything down step by step — in plain English, with practical examples, and backed by official sources.

IRS Order Could Change How You Pay Taxes

Trump’s IRS order and the One Big Beautiful Bill are poised to transform how Americans handle taxes. With the end of paper checks and the arrival of new deductions for tips, overtime, and car loans, everyday taxpayers could see real relief starting in 2026. But the key is preparation: set up electronic payments, keep thorough records, and stay informed about your state’s tax policies. Handled wisely, these changes could mean faster refunds, smaller tax bills, and less stress during tax season.

| Change/Policy | Details | Who It Affects | Official Source |

|---|---|---|---|

| Electronic-only IRS payments | By Sept. 30, 2025, all IRS payments & refunds must be electronic (no paper checks) | All taxpayers | IRS.gov |

| No Tax on Tips | Up to $25,000 (single) or $300,000 (joint) tip income tax-free | Tipped workers, gig workers, influencers | Kiplinger |

| No Tax on Overtime | Deduct up to $12,500 of overtime pay | Hourly employees working extra shifts | IRS.gov |

| Car Loan Interest Deduction | Deduct up to $10,000 annually in car loan interest | Non-itemizing taxpayers | Duane Morris |

| SALT Cap Increase | Deduction cap jumps from $10,000 to $40,000 | Higher-income households | Tax Foundation |

| Standard Deductions Expanded | Bigger breaks for seniors & non-itemizers | Families, retirees | IRS.gov |

Why This IRS Order Matters?

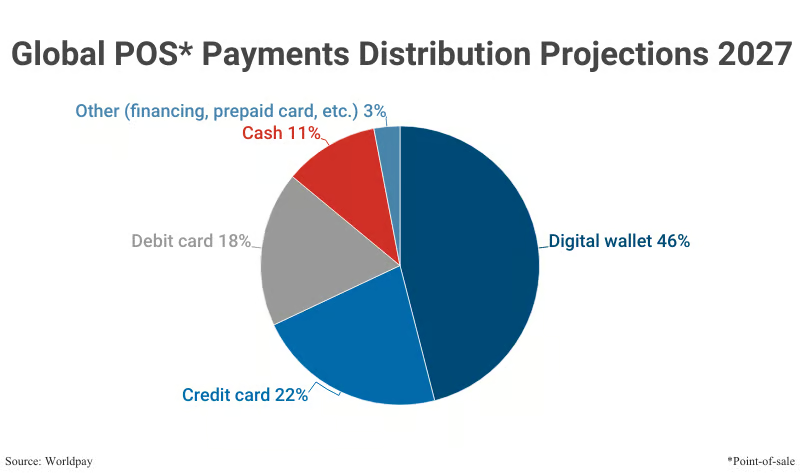

For decades, taxpayers could pay with paper checks and wait for refunds by mail. But starting in late 2025, that option disappears. All payments and refunds must be electronic — either through direct deposit, prepaid debit cards, or approved digital wallets.

At the same time, the OBBB Act introduces new deductions that could save many working families thousands of dollars. If you rely on tips, work overtime, or have a car loan, you could see significant tax savings starting with your 2025 income, filed in 2026.

Historical Context: How We Got Here

Tax reform isn’t new in America. In 1986, President Ronald Reagan simplified tax brackets and eliminated loopholes. In 2017, Trump signed the Tax Cuts and Jobs Act (TCJA), doubling the standard deduction and lowering corporate rates. Many TCJA provisions are set to expire in 2026.

The 2025 reforms are Trump’s second major tax legacy. Unlike TCJA, which focused heavily on business and corporate cuts, this new package is marketed as “working-class friendly.” It targets wage earners, gig workers, and families — groups who felt left behind by earlier reforms.

The End of Paper Checks

What’s Changing

- By September 30, 2025, the IRS will no longer issue or accept paper checks.

- Refunds will only be sent electronically.

- Payments must also be made electronically through approved systems.

Why It’s Happening

The Treasury estimates that moving away from paper checks will save billions in administrative costs and reduce fraud. Electronic payments are faster, safer, and less likely to be lost or stolen.

Potential Problems

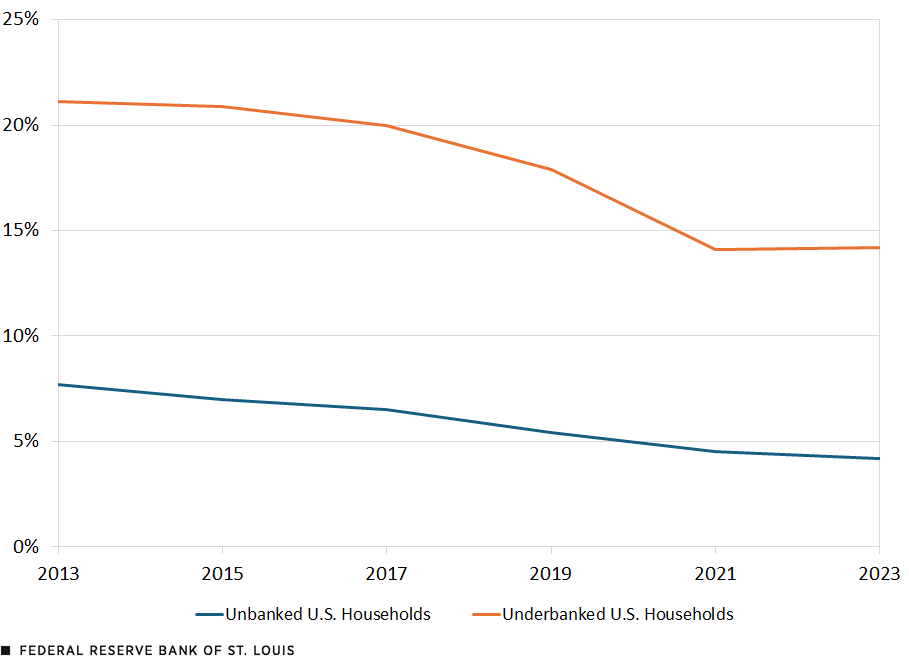

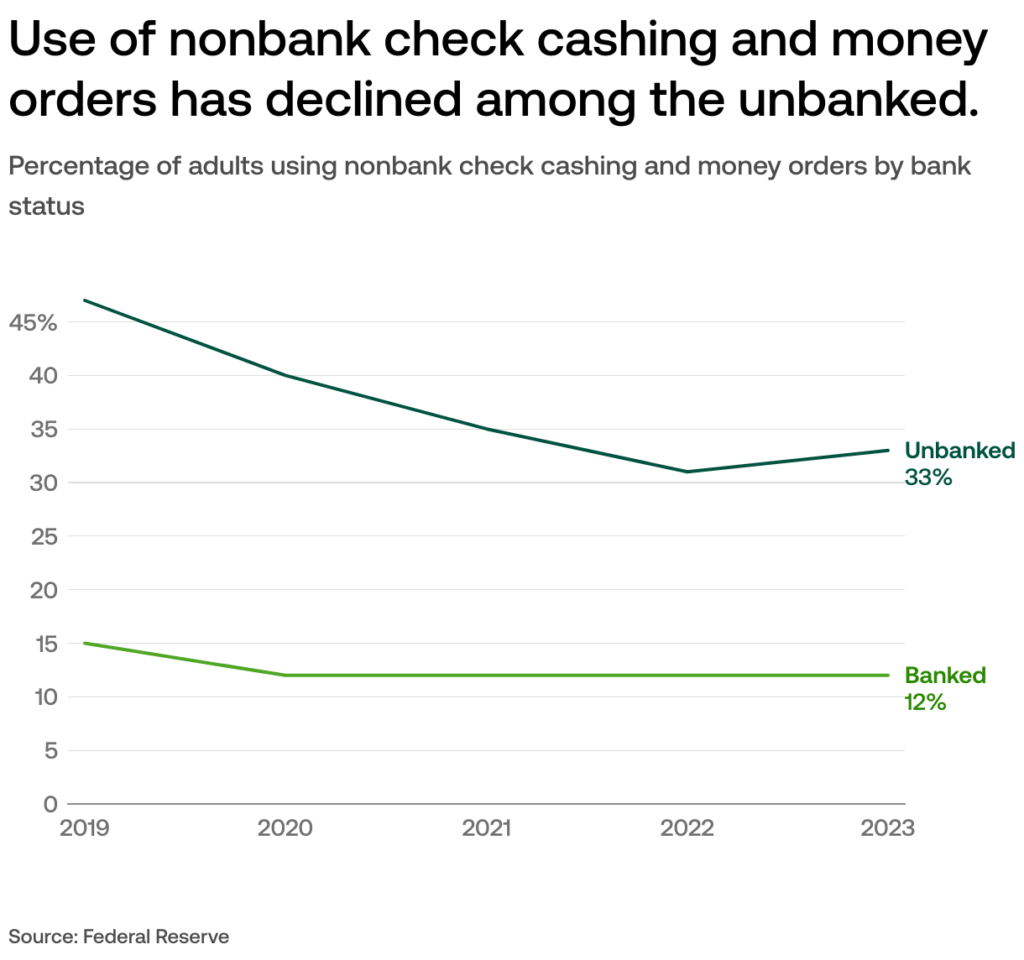

Critics argue that this transition could hurt older Americans or rural households without reliable internet or bank accounts. According to the FDIC, about 4.5% of U.S. households remain unbanked — meaning they have no checking or savings account. These individuals may need prepaid debit cards or other alternatives.

Action Step: If you haven’t already, set up direct deposit with the IRS.

Big Tax Breaks in the “One Big Beautiful Bill”

The OBBB Act introduces sweeping deductions and adjustments to the tax code. Here’s what matters most:

No Tax on Tips

- Workers can deduct up to $25,000 in tip income (single) or $300,000 (married).

- Applies to servers, bartenders, rideshare drivers, hairstylists, influencers, and podcasters on Treasury’s approved list.

- Example: A server earning $20,000 in tips won’t pay federal tax on that money.

No Tax on Overtime

- Overtime pay deductions up to $12,500.

- Covers the “time-and-a-half” portion of pay.

- Example: A warehouse worker earning $9,000 in overtime can exclude it from taxable income.

Car Loan Interest Deduction

- Deduction of up to $10,000 annually for personal car loan interest.

- Available even if you take the standard deduction.

- Example: Paying $4,000 in car loan interest means a direct reduction in taxable income.

SALT Deduction Cap

- Increased from $10,000 to $40,000, with gradual increases through 2029.

- Benefits homeowners in high-tax states such as California, New York, and New Jersey.

Expanded Standard Deduction

- Bigger breaks for seniors, retirees, and non-itemizers.

- Designed to simplify filing for middle-income households.

Impact on Different Groups

Workers and Gig Economy Earners

Tipped workers and overtime employees are the biggest winners. Gig workers like Uber drivers or content creators also benefit under the “no tax on tips” provision.

Families and Retirees

The expanded standard deduction and child-saving accounts help families. Seniors gain larger deductions, easing the burden on fixed incomes.

Small Business Owners

Industries reliant on tips, like restaurants and salons, may see happier employees with higher take-home pay.

Higher-Income Taxpayers

The higher SALT cap provides relief, especially for high earners in coastal states, though critics argue this tilts benefits toward wealthier households.

Pros and Cons Debate on IRS Order Could Change How You Pay Taxes

Pros

- Faster refunds and lower processing costs.

- Meaningful tax relief for working-class Americans.

- Encourages digital banking and financial inclusion.

Cons

- Unbanked and rural Americans may struggle to adapt.

- Complexity of new deductions may confuse taxpayers.

- Federal government could lose hundreds of billions in revenue over the next decade.

Step-by-Step Example

Meet Jessica, a 27-year-old server in Dallas, Texas.

- Base wages: $25,000

- Reported tips: $15,000

- Car loan interest: $3,500

Old rules: Taxable income = $43,500 (before standard deduction).

New rules: $15,000 in tips and $3,500 in interest excluded. Taxable income = $25,000.

Jessica saves nearly $2,000 in federal taxes under the new system.

Expert Insights

Certified Public Accountants (CPAs): Stress that taxpayers should keep meticulous records of tips, overtime, and car loan interest. Without documentation, deductions could be denied.

Economists: Predict short-term boosts in consumer spending as Americans keep more of their income. Long-term effects on the deficit remain a concern.

Policy Analysts: Some argue the bill’s provisions may disproportionately benefit specific industries like hospitality while leaving salaried workers with fewer advantages.

How to Prepare for 2026

- Set up electronic payment methods now to avoid refund delays.

- Track income and expenses — use apps, spreadsheets, or even a notebook.

- Save supporting documents like car loan statements and pay stubs.

- Check your state’s rules — not all states automatically follow federal changes.

- Consult a tax professional for personalized advice.

What Is the Digital Services Tax That Could Spark New Trump Tariffs?

Big Tax Bill Update – Child Tax Credit Changes Every Family Should Know About

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big