ED Raids BPTP Offices Across Delhi-NCR: When the Enforcement Directorate (ED) comes knocking, you know it’s serious business. And that’s exactly what happened this week when the ED raided BPTP’s offices across Delhi-NCR in connection with an alleged ₹500 crore FEMA (Foreign Exchange Management Act) violation. This real estate shake-up has grabbed headlines in India and beyond, raising big questions about foreign investments, corporate accountability, and the legal checks around money movement. Now, before you scroll past thinking this is just another “big money” story, hang tight. We’ll break this down in a way that even a 10-year-old can follow while giving professionals the insights they need. Think of it like grabbing a coffee and chatting with a friend who also happens to be a lawyer and an accountant rolled into one.

ED Raids BPTP Offices Across Delhi-NCR

The ED raids on BPTP’s offices in Delhi-NCR aren’t just about one company—they’re a reminder that compliance isn’t optional in today’s global economy. Whether BPTP is guilty or not, the case underscores the importance of transparency, accountability, and following the rulebook when handling foreign investments. For businesses, the lesson is clear: cut corners with compliance, and you risk everything. For everyday people, this story is a peek into how financial systems work—and how they can go wrong.

| Point | Details |

|---|---|

| What Happened? | ED raided BPTP offices in Delhi, Noida, and Faridabad over alleged FEMA violations. |

| Amount Involved | Around ₹500 crore (~$60 million). |

| When & Where | Raids conducted on August 26, 2025, across NCR. |

| Key Allegations | Improper routing of foreign investment via Mauritius-based entities using put/swap options (2007–08). |

| Who’s Involved? | BPTP CMD Kabul Chawla allegedly held undisclosed foreign assets. |

| Company’s Stand | BPTP claims full cooperation and insists investments were legitimate, linked to Citi Group and JPMorgan. |

| Official Resource | Enforcement Directorate – Official Website |

What’s the Big Deal with FEMA?

The Foreign Exchange Management Act (FEMA) is India’s way of keeping track of how money moves in and out of the country. Think of it like your parents asking you where your allowance went—did you buy candy, or did you secretly loan it to a buddy?

Under FEMA, if companies want to bring in foreign money, they’ve got to follow strict rules. This ensures that money isn’t being laundered, hidden, or used in shady ways. So, when the ED says BPTP might have bent those rules, it’s like the financial referee blowing the whistle during a big game.

Who is BPTP?

For folks outside India, BPTP Limited is one of North India’s leading real estate developers. Founded in 2003, the company built its brand on large-scale housing projects, luxury apartments, and integrated townships in areas like Gurugram, Noida, and Faridabad.

But here’s the thing: BPTP hasn’t always enjoyed a spotless reputation. Over the years, there have been complaints of project delays, legal disputes, and regulatory hurdles. For many buyers, the name BPTP is familiar—sometimes for the right reasons (affordable townships) and sometimes for the wrong ones (customer grievances and lawsuits).

This latest raid, however, may be the most serious challenge the company has faced, with the potential to reshape its standing in the industry.

Breaking Down the Allegations

1. Routing of Investments

Between 2007–2008, BPTP allegedly received about ₹500 crore from Mauritius-based investors. Foreign investment in itself isn’t a crime. In fact, India’s real estate sector thrives on it. But the ED claims this was done through put and swap options—financial instruments that may not have complied with FEMA guidelines.

Imagine you’re told you can accept money to build a new playground. Instead, you accept it but also quietly use a part of it to bet on whether the price of swing sets will go up. That’s the kind of financial gymnastics being alleged here.

2. Undisclosed Assets

Another claim is that Kabul Chawla, BPTP’s chairman and managing director, held undisclosed foreign assets. If proven, this would be similar to hiding offshore accounts without telling the IRS in the United States. Regulators worldwide treat such nondisclosures as red flags for possible tax evasion or money laundering.

3. Multiple FIRs

The company and its directors already face several FIRs (First Information Reports) filed across Delhi-NCR police stations. Add these raids on top of that, and the picture becomes murky. It’s like showing up to a job interview with a pile of unresolved lawsuits in your backpack.

Who is the Enforcement Directorate (ED)?

For context, the Enforcement Directorate is India’s financial crime watchdog. They investigate violations of two big laws:

- FEMA (1999) – Governs foreign exchange and capital inflows.

- PMLA (2002) – Tackles money laundering activities.

Think of them as a mix of the IRS and FBI in the United States. If the ED shows up at your door, it’s not a random audit. It usually means they’ve been tracking evidence for months.

Why ED Raids BPTP Offices Across Delhi-NCR Matters Beyond BPTP?

1. Impact on Real Estate Sector

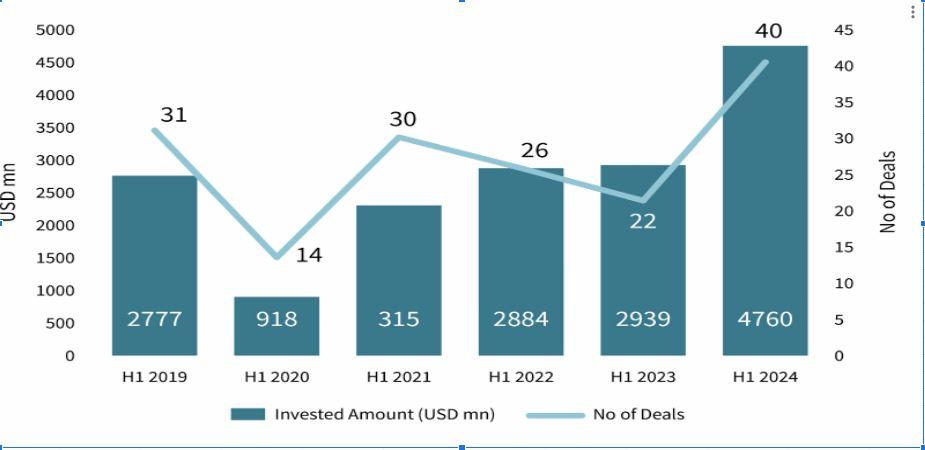

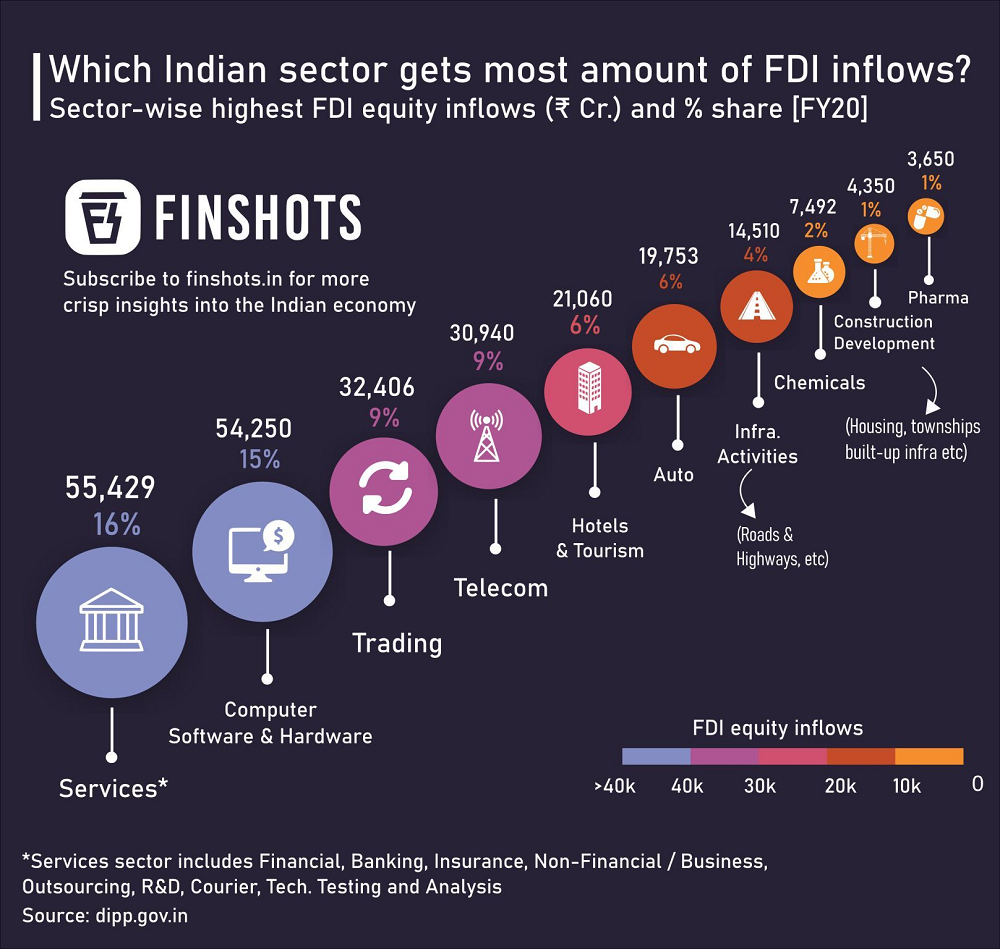

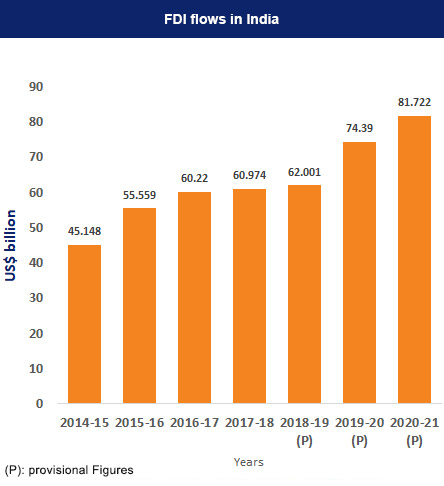

According to DPIIT, India’s real estate sector attracted more than $55 billion in foreign direct investment between 2000–2024. That’s huge. But scandals like this can scare off investors, making it harder for companies to raise funds.

2. Homebuyer Concerns

When developers are tied up in legal trouble, projects can slow down. Buyers waiting for their dream apartments may face delays or uncertainty. We’ve seen this before in India’s real estate market—legal tangles often translate to unfinished projects.

3. Broader Economy

Foreign investors keep a close watch on such cases. If the perception grows that India’s regulatory environment is either too loose (allowing shady deals) or too harsh (over-policing), it can impact confidence in one of the world’s fastest-growing economies.

Lessons for Businesses: A Compliance Guide

To avoid ending up in BPTP’s shoes, here are some practical steps companies should follow:

Step 1: Keep Clean Records

Every foreign transaction should be documented like a recipe book—step by step, nothing missing.

Step 2: Use Official Channels

Follow Reserve Bank of India (RBI)-approved routes for bringing in or sending out foreign funds. Shortcuts almost always backfire.

Step 3: Disclose Everything

Got an offshore account? A property abroad? Disclose it. Transparency is your best protection.

Step 4: Hire Professionals

Compliance isn’t DIY work. Lawyers, auditors, and consultants exist for a reason.

Step 5: Audit Regularly

Conduct internal audits to catch mistakes before regulators do.

Global Perspective

India isn’t alone in cracking down on foreign exchange violations.

- United States: The IRS and SEC impose harsh penalties on undeclared foreign accounts. Civil fines can be as high as 50% of account balances per year.

- European Union: The European Central Bank closely monitors capital flows, and violations can lead to multimillion-euro penalties.

- Singapore: Known for strict oversight, businesses can lose their licenses over even minor compliance slips.

So, the ED’s actions are part of a broader, global trend: countries want transparency in cross-border transactions.

The Company’s Response

BPTP isn’t denying that money came in. But they argue it was legitimate foreign investment routed through respected institutions like Citi Group and JPMorgan Chase. A spokesperson emphasized that the company is fully cooperating with the ED and is confident of clearing its name.

This is essentially BPTP saying, “We borrowed money from major Wall Street banks, not fly-by-night operators.” Whether regulators accept that defense depends on how the deals were structured under FEMA’s rules.

Historical Context: FEMA Violations in India

This isn’t the first high-profile FEMA case. In recent years:

- 2019 – The ED fined several Indian companies for parking money abroad without disclosure.

- 2021 – Investigations into e-commerce giants over alleged FEMA breaches made global headlines.

- 2023 – A major real estate firm in Mumbai faced probes for misusing foreign direct investment routes.

In each case, penalties ranged from fines to freezing assets. The BPTP raid adds another chapter to this ongoing saga.

Income Tax Department Raids Over 10 Locations Across Tamil Nadu

Former MP Ranjith Reddy Under IT Scanner After Tax Raids

Ajanta Pharma Offices Face Tax Raids – What Investors Should Know About Ongoing Search