Will the 2026 Tax Season Be Delayed: If you’ve been following financial news, you’ve probably seen the big question: Will the 2026 tax season be delayed? Recently, the IRS Commissioner dropped a hint that has taxpayers, businesses, and accountants on edge. Instead of the usual late-January kickoff, the IRS may open filing season around Presidents’ Day, February 16, 2026. That’s about three weeks later than normal and would be the latest start since the 2021 pandemic delay. For millions of Americans counting on refunds, that’s a huge deal. But before you stress, let’s dig into what’s really going on.

Will the 2026 Tax Season Be Delayed

So, will the 2026 tax season be delayed? Maybe. The IRS Commissioner has hinted at a mid-February start, and internal challenges make it likely. But until January 2026, nothing is official. The best move? Prepare early, e-file, choose direct deposit, and budget for possible delays. That way, whether the IRS opens on Jan. 27 or Feb. 16, you’ll be ready.

| Topic | Details |

|---|---|

| Proposed Start Date | Around Feb. 16, 2026 (Presidents’ Day) |

| Official IRS Statement | No official start date yet; announcement expected Jan. 2026 |

| Reason for Possible Delay | Staffing shortages (25% workforce cut), major tax law changes, IT challenges |

| Historical Comparison | Last major delay: 2021 tax season (COVID-19 disruptions) |

| Impact on Taxpayers | Potential delays in filing, processing, and refund issuance |

| Official Resource | IRS.gov – Tax Season Information |

Why the 2026 Tax Season Be Delayed?

Running the IRS is like trying to run a massive customer service and IT company rolled into one. Each year, the agency processes over 260 million tax returns (IRS Data Book, 2024). That requires people, tech, and serious coordination.

Here are the top reasons why a delay is on the table:

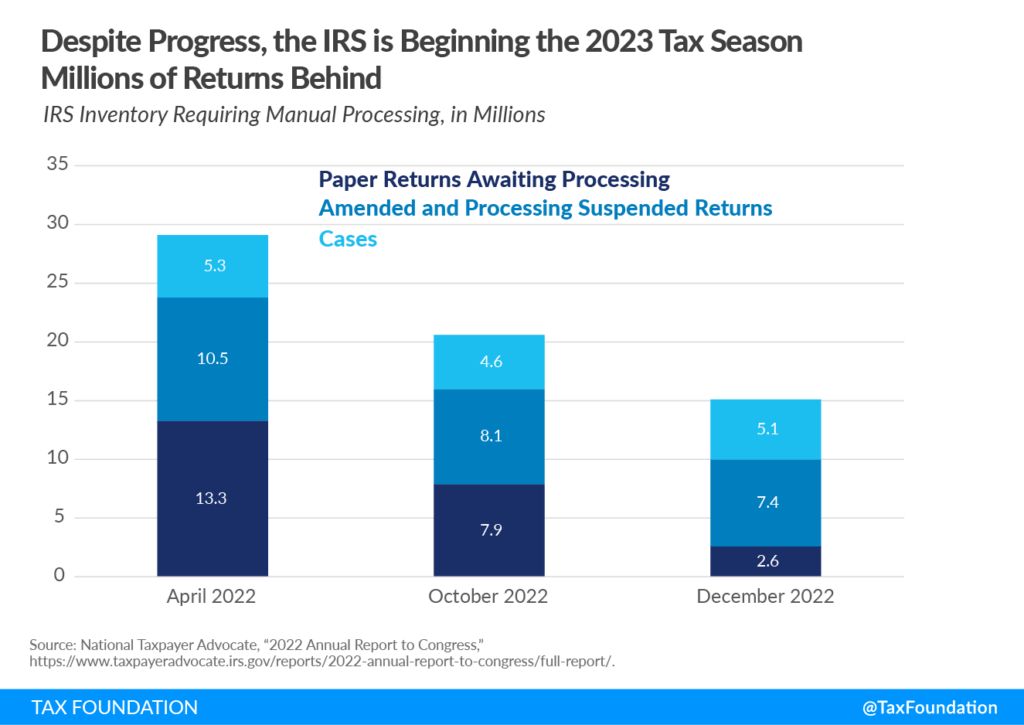

- Staffing shortages: IRS staffing has been cut by nearly 26% over the past two years, especially in IT and customer support. That slows down everything from system updates to refund processing.

- Major tax law changes: The “One Big, Beautiful Bill”, passed in 2025, overhauled deductions, credits, and business tax rules. Updating IRS systems to handle these changes isn’t a quick job.

- Leadership turnover: Billy Long became the seventh IRS commissioner of 2025. Constant leadership changes mean less stability and slower decision-making.

- System upgrades: Some of the IRS’s core systems date back to the 1960s. Modernization is happening, but it takes time.

The Taxpayer Advocate Service has already warned Congress about potential “significant delays” in 2026 unless these challenges are addressed.

Who Would Be Most Affected by a Delay?

Families Counting on Refunds

For many households, tax refunds are more than a bonus—they’re a lifeline. According to the IRS, the average refund in 2024 was $3,167. That money often goes toward paying bills, buying groceries, or covering medical expenses. A later start means families may not see refunds until March or April, pushing back important financial plans.

Small Businesses and Gig Workers

Self-employed workers and small businesses rely on filing early to manage quarterly estimates, payroll, and financial planning. A delay squeezes timelines and may create cash flow headaches, especially for seasonal businesses.

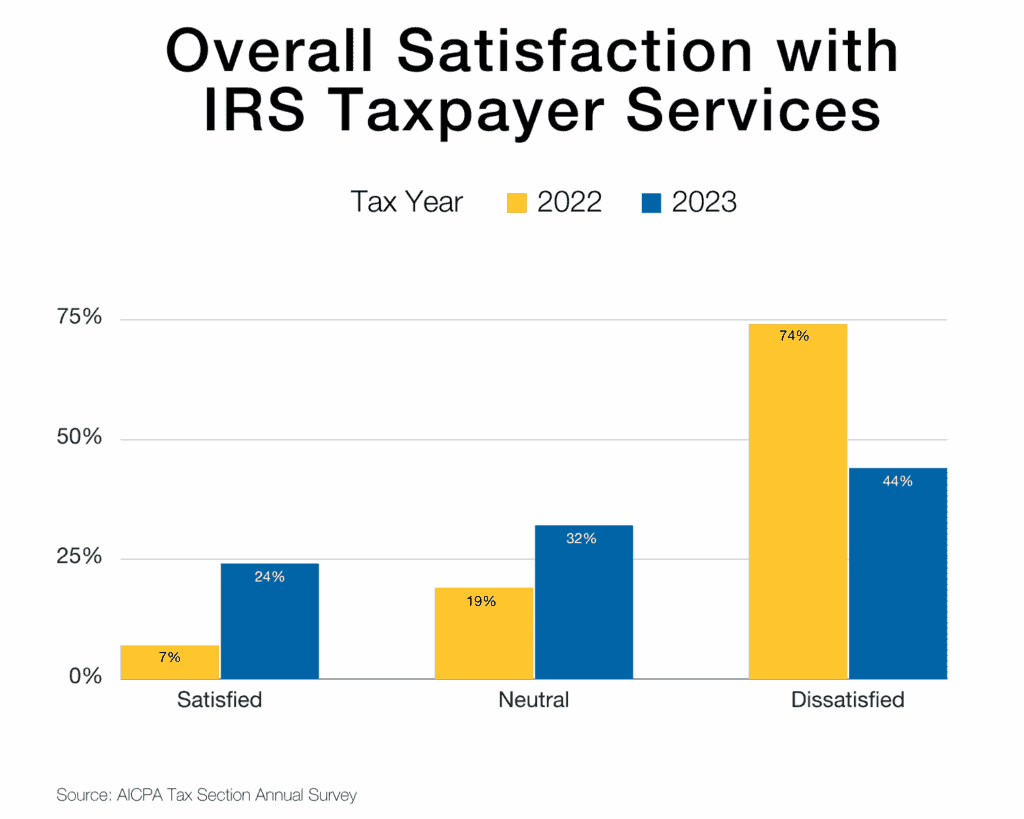

Tax Professionals

For CPAs and tax preparers, a shorter filing window means more clients in less time. Translation? Long hours, higher stress, and potential burnout. Accountants already juggle multiple deadlines, and a compressed season only makes things harder.

The Commissioner’s Comment: A Hint or a Warning?

At the 2025 Tax Summit, IRS Commissioner Billy Long casually mentioned that the filing season could start “around Presidents’ Day.” Within hours, the news went viral.

The IRS later clarified: no official start date is set, and the agency will announce the timeline in January 2026. But hints like this usually mean the IRS knows there are challenges ahead.

Step-by-Step Guide: How to Prepare for the 2026 Tax Season (Even if It’s Delayed)

You can’t control when the IRS opens, but you can control how ready you are. Here’s a simple checklist:

Step 1: Gather Your Documents Early

- W-2s from employers

- 1099s (freelance, gig work, investments)

- Mortgage interest statements

- Charitable donation receipts

Pro tip: Create a digital “Tax Folder” and save PDFs as they arrive.

Step 2: Double-Check New Tax Laws

The 2025 reform bill may affect standard deductions, child tax credits, or business expenses.

Step 3: File Electronically

Over 90% of Americans already e-file, and for good reason. It’s faster, safer, and refunds arrive in about 21 days if you choose direct deposit. Paper returns can take 6–8 weeks.

Step 4: Use IRS Online Tools

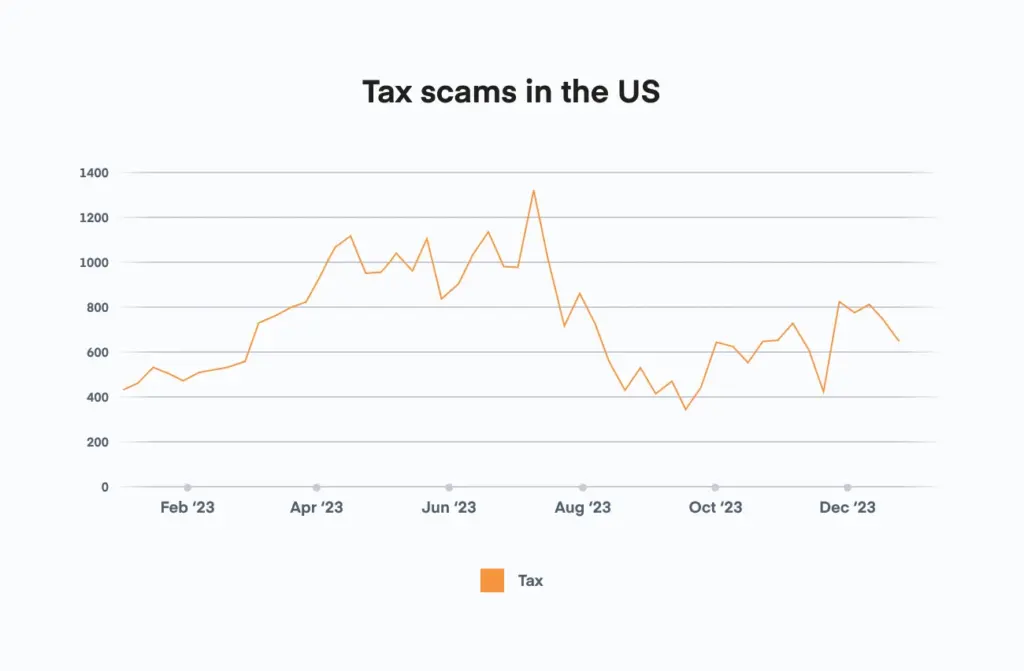

Step 5: Watch for Scams

The IRS never emails, texts, or DMs you about refunds. If you get a message promising to “speed up” your refund, it’s a scam.

Historical Perspective: Past IRS Delays

Delays aren’t new. Here are some throwbacks:

- 2021: Filing started Feb. 12 due to COVID-19 relief measures.

- 2014: A 10-day delay due to IT upgrades.

- 1987: IRS scrambled to implement the Tax Reform Act of 1986.

Moral of the story? The tax season isn’t set in stone—it bends when the IRS has too much on its plate.

Tax Law Changes to Watch in 2026

Thanks to the 2025 bill, here are some potential changes that may hit your 2026 taxes:

- Standard deduction increases for both single and married filers.

- Child tax credit expansion with different income phase-outs.

- Business expense deductions simplified, but with caps.

While details are still being worked out, these shifts mean more IRS updates and possible bottlenecks.

State Taxes: Will They Also Be Delayed?

One important detail that often gets overlooked: not all states follow the IRS’s lead. Some states like California and New York align closely with federal filing dates, while others set their own schedules.

- If the IRS delays, many states may adjust to match.

- Some states may still open earlier, allowing residents to file state taxes before federal returns.

- Always check your state’s Department of Revenue website for local deadlines.

This is especially important for taxpayers in states with separate refund systems.

Professional Advice: How to Stay Ahead

Here’s what tax experts recommend:

- Don’t procrastinate. Even if you can’t file, prep your return now.

- Plan for cash flow. If you’re used to a February refund, budget as if it may arrive in March or April.

- Hire help early. Tax pros get booked up fast, especially in a shortened season.

- Stay informed. Follow updates on IRS.gov or reliable outlets like Investopedia and Kiplinger.

Diwali Tax Cuts May Backfire as Trump’s Tariff Threat Looms Large

Big Tax Bill Update – Child Tax Credit Changes Every Family Should Know About

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big