Toyota Fortuner, Innova and Vellfire Get Price Cuts Up to ₹3.49 Lakh: Big news, folks! If you’ve been eyeing a Toyota Fortuner, Innova, or Vellfire, now might be the perfect time to rev up your decision-making. Toyota Fortuner, Innova, and Vellfire get price cuts up to ₹3.49 lakh under GST 2.0, and it’s not just a small change—it’s a game-changer in India’s auto scene. Whether you’re a gearhead, a business executive, or a family person thinking of upgrading your ride, let’s break down everything in a way that even your 10-year-old niece could understand. Why the sudden markdowns? It’s all thanks to India’s rollout of GST 2.0, a restructured taxation system aimed at making high-end and utility vehicles more affordable. Toyota’s taking the cue and passing on the benefits to you. Let’s dig into what that means, how much you save, and why it’s a big deal—not just for your wallet, but for the auto market as a whole.

Toyota Fortuner, Innova and Vellfire Get Price Cuts Up to ₹3.49 Lakh

So there you have it. The big fat price drop on Toyota Fortuner, Innova, and Vellfire under GST 2.0 isn’t just a seasonal discount—it’s a structural shift that could redefine how India buys its premium rides. If you’ve been holding off on buying that dream SUV, your patience is finally paying off. From families to fleet managers, students to CEOs—this move opens the road to affordability and luxury, hand in hand.

| Feature | Details |

|---|---|

| Main Keyword | Toyota Fortuner, Innova, and Vellfire Get Price Cuts Under GST 2.0 |

| Maximum Price Drop | Up to ₹3.49 lakh |

| GST 2.0 Effective Date | September 22, 2025 |

| Top Models Impacted | Fortuner, Fortuner Legender, Vellfire, Innova Crysta, Innova Hycross |

| Reason for Cut | GST structure overhaul (flat 40% GST, no compensation cess) |

| Biggest Drop | Fortuner gets the highest cut: ₹3.49 lakh |

| Professional Impact | Fleet owners, rental companies, and executives can now access premium vehicles with lower TCO (total cost of ownership) |

| Official GST Info | Check Government GST Rates |

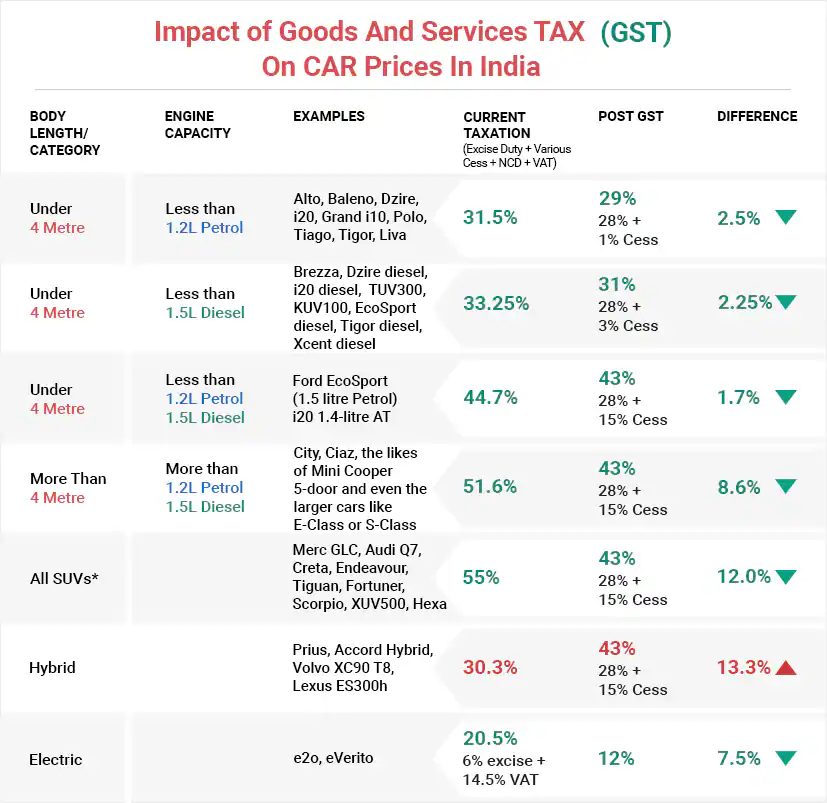

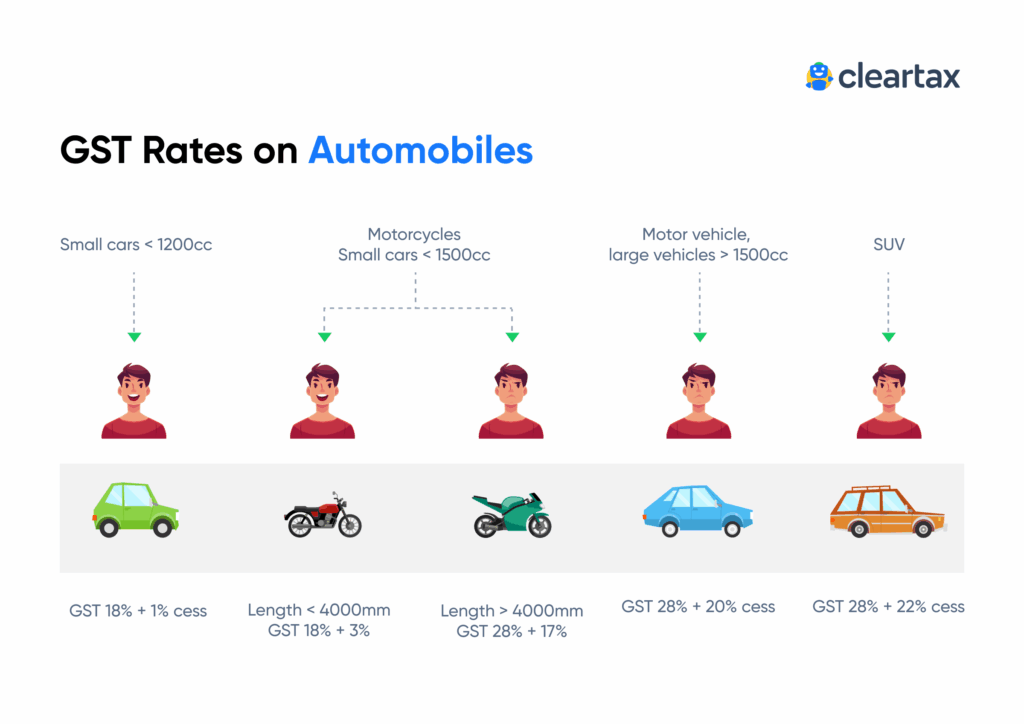

What Is GST 2.0 and Why Should You Care?

Think of GST 2.0 as a reboot of India’s goods and services tax, specifically targeted at simplifying vehicle taxes. Under the old system, luxury SUVs and MPVs like Fortuner and Vellfire were slapped with up to 50% total tax—including a whopping 22% compensation cess. With GST 2.0, that cess is gone.

Now it’s just a flat 40% GST across large vehicles. That’s like getting a deluxe burger at the price of a regular one—same flavor, but friendlier on your wallet.

This move simplifies the vehicle buying process and enhances transparency in pricing. Earlier, the tax structure was riddled with complicated cess slabs, often making it hard for customers to estimate total costs. With GST 2.0, the buying experience becomes more consumer-friendly and helps auto companies streamline their pricing strategy across states.

Breakdown of the Toyota Fortuner, Innova and Vellfire Get Price Cuts Up to ₹3.49 Lakh

Here’s a full list of how much money you can save under GST 2.0 if you’re going for a Toyota:

Top-Selling Models and Price Drop (approximate ex-showroom cuts)

| Model | Old Price | New Price | Discount (₹) |

|---|---|---|---|

| Fortuner | ₹50.34 lakh | ₹46.85 lakh | ₹3.49 lakh |

| Fortuner Legender | ₹52.37 lakh | ₹49.03 lakh | ₹3.34 lakh |

| Vellfire | ₹96.99 lakh | ₹94.21 lakh | ₹2.78 lakh |

| Innova Crysta | ₹27.03 lakh | ₹25.23 lakh | ₹1.80 lakh |

| Innova Hycross | ₹30.34 lakh | ₹29.19 lakh | ₹1.15 lakh |

| Hilux | ₹40.03 lakh | ₹37.50 lakh | ₹2.53 lakh |

Source: Toyota India press release, Economic Times, Hindustan Times Auto

These revised prices are expected to remain stable unless another structural tax reform is announced. For now, the reduced GST creates a win-win situation for consumers and automakers alike.

Why This Matters for Businesses and Professionals?

For corporate buyers, fleet managers, and entrepreneurs, this isn’t just about getting a cheaper car—it’s about smarter investment. Here’s why:

1. Lower Total Cost of Ownership (TCO)

Thanks to the cut, you’re saving not just on the purchase price, but also on insurance premiums, registration fees, and taxes that are linked to vehicle cost. These benefits can significantly improve a company’s balance sheet when applied across an entire fleet.

2. Better ROI for Fleet Operators

If you’re in logistics, car rentals, or executive transport, every lakh saved on a vehicle translates to stronger bottom lines. In competitive sectors like B2B leasing and airport pickups, these price drops might make premium fleet upgrades finally viable.

3. Executive Perks

Mid-level to senior-level executives now have easier access to high-end company rides. For businesses offering vehicles as part of compensation packages, this creates a fresh value proposition for attracting and retaining top talent.

4. New Opportunities for Small Businesses

Even small-scale travel agencies and self-drive rental startups can now consider investing in premium models. This levels the playing field in a segment long dominated by larger players.

How This Affects the Indian Auto Market

It’s not just Toyota—industry experts believe GST 2.0 could trigger an SUV and MPV sales boom. As prices realign, brands like Mahindra (XUV700), Hyundai (Alcazar), and Kia (Carnival) may follow suit. This might create a ripple effect across the auto market with new product launches and revised pricing.

“We expect at least a 15-20% spike in premium vehicle bookings post-GST 2.0,” says Rajiv Sharma, an auto market analyst at CRISIL.

This might also trigger:

- Increased domestic manufacturing to meet rising demand

- More CKD (completely knocked down) assembly operations to reduce costs

- Greater localization in the supply chain

- Tech upgrades to justify renewed interest in premium segments

Environmental and Hybrid Vehicle Impacts

While GST 2.0 focuses on ICE vehicles, the auto industry’s transition toward hybrids and EVs is in full throttle. Many Toyota models, such as the Innova Hycross Hybrid, already leverage reduced GST (5% for EVs, 12% for hybrids).

This change could actually accelerate hybrid adoption. As more buyers gravitate toward SUVs due to pricing relief, their proximity to hybrid versions can lead to faster hybrid sales. It’s a gateway to greener mobility while keeping options open for consumers.

This move aligns with India’s goal to achieve net-zero carbon emissions by 2070 and promotes green mobility adoption in urban and rural areas alike.

Step-by-Step: How to Make the Most of This Price Cut

If you’re ready to grab this golden opportunity, here’s a handy checklist:

1. Check Official Pricing

Visit Toyota India’s official website for updated price lists by city and variant.

2. Compare Loan Offers

With reduced car prices, you might also qualify for better auto loan rates.

3. Time Your Purchase

Prices go live starting September 22, 2025, so booking your car early could help you skip long waiting periods.

4. Negotiate Extras

Lower ex-showroom prices mean dealerships may offer freebies like accessories, maintenance packages, or extended warranties to sweeten the deal.

5. Tax Benefits

Business buyers can still claim input tax credit (ITC) under certain conditions. Consult a certified tax consultant or CA for guidance.

6. Evaluate Resale Value

With revised prices, the depreciation curve for these models may improve, resulting in better resale value down the line.

Tariff Issues Ease While GST Reforms Become Next Growth Focus

High-End Electric Vehicles May Soon Attract 18% GST – Buyers Beware

Lower GST On ICE Vehicles Could Impact EV Growth – HSBC Report

Future Outlook: What Comes Next?

Experts suggest this move could usher in a new era of affordability for premium cars in India. Expect:

- More localized manufacturing to meet demand

- New feature-loaded variants as competition intensifies

- A resale market surge for used Fortuners and Innovas

- Flexible financing and subscription models for younger buyers

- A wider portfolio of hybrid offerings