Tata Motors, Mahindra and Other Carmakers Revise Prices: When it comes to buying cars, nothing gets folks talking like a major price drop. Right now, India’s auto industry is buzzing with excitement because Tata Motors, Mahindra, Toyota, and several other big carmakers have revised their prices after the GST rate cut. We’re not just talking about small discounts here — we’re talking tens of thousands to even lakhs of rupees shaved off sticker prices.

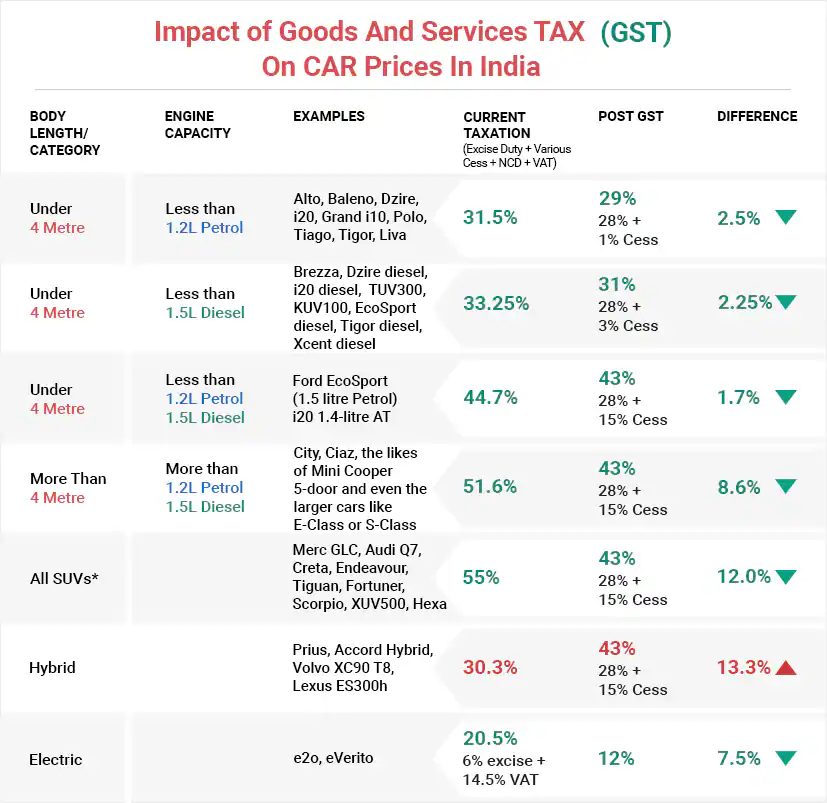

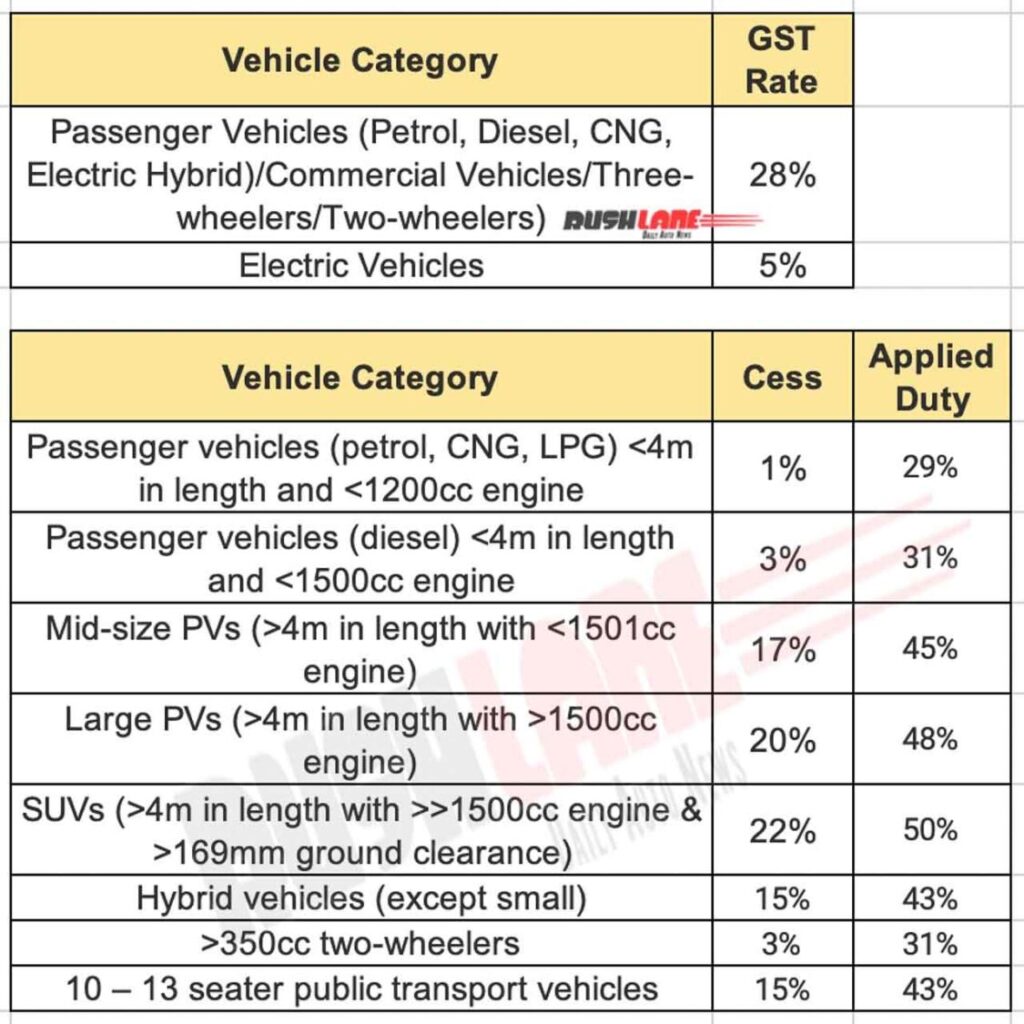

India’s new GST 2.0 reform has officially changed the game:

- Small cars now attract 18% GST (down from 28%).

- Larger SUVs and premium vehicles that once faced nearly 50% tax (including cess) are now at a flat 40%.

This means that whether you’re a college grad eyeing your first hatchback or a family planning to upgrade to a luxury SUV, the timing couldn’t be better.

Tata Motors, Mahindra and Other Carmakers Revise Prices

The fact that Tata Motors, Mahindra, Toyota, and others are revising prices after the GST cut is a game-changer. This isn’t just a tax adjustment — it’s a massive opportunity for consumers to save big and for the auto industry to fire on all cylinders. Families will finally see cars as more accessible, automakers will ride the festive wave, and India’s auto sector could roar into a new era of growth. If you’ve been waiting to buy a car, 2025 may be the year you finally drive home your dream ride.

| Feature | Details | Source/Reference |

|---|---|---|

| Effective Date | September 6–22, 2025 (varies by automaker) | Press Release – Tata Motors |

| Tax Reform | GST reduced: 18% for small cars, 40% for larger vehicles (no cess) | Govt PIB India |

| Tata Motors Cuts | ₹65,000 – ₹1.55 lakh | Hindustan Times Business |

| Mahindra Cuts | Up to ₹1.56 lakh | Economic Times |

| Toyota Cuts | Up to ₹3.49 lakh | Economic Times Auto |

| Mercedes-Benz Cuts | 5–8% (up to ₹10 lakh) | Times of India Auto |

| Consumer Impact | Affordable cars, better resale value, festive-season sales boom | Reuters |

Why the GST Cut Matters?

In simple words, GST (Goods and Services Tax) is like India’s version of sales tax. Before this reform, car buyers were paying nearly half the vehicle’s value in taxes. That’s like walking into a dealership in Texas, paying $20,000 for a car, and then realizing Uncle Sam tacked on another $10,000 in taxes. The new reform streamlines everything. Smaller, more affordable cars get a big break, while SUVs and premium rides no longer face multiple layers of tax. The government’s goal is clear: make cars affordable, boost consumer confidence, and spark growth in the auto industry.

Tata Motors, Mahindra and Other Carmakers Revise Prices

Tata Motors

- Tiago: Up to ₹75,000 off

- Altroz: Up to ₹1.10 lakh off

- Nexon: Up to ₹1.55 lakh off

- Safari: Up to ₹1.45 lakh off

For a middle-class family buying a Tata Nexon, this means saving nearly two months of average household income. Those savings could be redirected toward accessories, insurance, or even a family vacation.

Mahindra & Mahindra

- Thar 2WD (Diesel): ₹1.35 lakh cut

- XUV700: ₹1.43 lakh cut

- Scorpio-N: ₹1.45 lakh cut

Mahindra SUVs are as iconic in India as pickup trucks are in the U.S. With these cuts, demand is expected to skyrocket, particularly in rural and semi-urban areas where Mahindra has deep roots.

Toyota Kirloskar Motor

- Fortuner: ₹3.49 lakh reduction

- Innova Crysta: ₹1.80 lakh reduction

- Hyryder: ₹65,400 reduction

These are serious savings for Toyota loyalists. Imagine paying $45,000 for a family SUV in the U.S. and suddenly finding out it’s dropped to $42,000 overnight.

Renault India

- Discounts up to ₹96,395 on budget models like Kwid, Kiger, and Triber.

Perfect for first-time car buyers in cities.

Mercedes-Benz India

- Prices slashed by 5–8%, with up to ₹10 lakh off on select models.

This is a rare opportunity for luxury buyers. For context, that’s like walking into a Mercedes dealership in Los Angeles and scoring a $12,000 discount.

Maruti Suzuki (Expected Cuts)

- Alto K10: ~₹50,000 off

- Wagon R: ~₹67,000 off

As India’s #1 carmaker, Maruti’s official announcement will be the biggest driver of demand in the small car segment.

Historical Context: GST and Automobiles

When GST was first rolled out in 2017, cars were slotted into the highest tax slab of 28%, plus an additional cess that pushed SUV rates close to 50%. At the time, automakers grumbled, but buyers adjusted because there wasn’t much choice.

Fast forward eight years, and GST 2.0 finally addresses long-standing concerns. By reducing slabs and eliminating cess for larger cars, the government has signaled that it wants to make vehicle ownership less of a luxury and more of a necessity.

Expert Insights

- Anand Mahindra (Chairman, M&M): “This reform is about unlocking demand across Bharat (rural India), where affordability makes all the difference.”

- R.C. Bhargava (Chairman, Maruti Suzuki): “We expect sales growth of 6–10% in the next quarter alone.”

- Auto Analysts at ICRA: “GST cuts could pump nearly $2 billion in additional auto sales by year-end.”

Consumer Example: Real-World Savings

Take Ananya, a young professional in Bangalore, who has been planning to buy her first car. She had her eyes on a Tata Altroz priced at ₹9.5 lakh. After the GST cut, her car is now nearly ₹1.1 lakh cheaper. That’s money she can now use for insurance, a better loan rate, and maybe even a road trip down India’s coastal highways.

For families like hers, the reform isn’t just numbers on paper — it’s real savings that improve quality of life.

Ripple Effects on the Economy

- Job Creation: More demand for cars means more work at factories, dealerships, and suppliers.

- Stronger Supply Chain: Parts makers, from tire manufacturers to software developers, benefit from increased sales.

- Exports Boost: Lower prices make Indian-made cars more attractive globally.

- Dealer Confidence: Salespeople can pitch deals that are actually compelling, leading to healthier turnover.

Practical Advice for Buyers

- Compare Across Brands – Don’t stick to just one. A Toyota buyer might find a better deal on a Tata SUV.

- Secure Financing Early – Lock in interest rates before banks adjust to rising demand.

- Understand On-Road Price – The ex-showroom price is the headline, but you’ll also pay registration, road tax, and insurance.

- Plan Ahead – Festive season rush means waitlists. Get your booking done now.

- Think Resale Value – Cars purchased post-GST reform may retain better resale because of lower depreciation.

Comparison with Global Practices

- United States: Car sales tax ranges from 6–10%, depending on the state.

- Europe: VAT averages around 20%.

- India Pre-GST 2.0: SUVs taxed at ~50%, among the highest globally.

By cutting rates, India is aligning itself closer to international norms. This move is expected to encourage foreign automakers to increase local production, boosting investment and jobs.

High-End Electric Vehicles May Soon Attract 18% GST – Buyers Beware

Lower GST On ICE Vehicles Could Impact EV Growth – HSBC Report

Haryana To Impose New Tax On Vehicles Entering State – Impact On Stone, Gravel And Sand Prices

Future Outlook

- EV Growth: Electric vehicles continue to enjoy a low 5% GST, making them competitive with ICE vehicles.

- Market Expansion: Analysts forecast India’s car market could grow by double digits in 2026, driven by affordability.

- Policy Stability: No further tax cuts are expected soon, giving automakers stable ground to plan future launches.

- Export Hub Potential: Lower costs could help India become a leading exporter of compact cars to Africa and Southeast Asia.