Greek PM Rules Out Snap Polls: When news broke that the Greek Prime Minister ruled out snap polls and promised big tax cuts for families, it sent ripples across Europe and even got attention in the United States. Why? Because this isn’t just about politics in Athens—it’s about how countries are wrestling with rising costs of living, shrinking populations, and the challenge of supporting families in tough times. Let’s be honest—when politicians start talking about tax cuts, people tune in. Whether you’re in Greece, Texas, or small-town Ohio, tax breaks mean more money left in your pocket. But what Greece is doing goes deeper. It’s not just about easing today’s grocery bills—it’s about trying to shape the country’s future.

Greek PM Rules Out Snap Polls

The story of how the Greek PM ruled out snap polls and unveiled a €1.6 billion tax cut for families isn’t just about politics—it’s about the future of a nation. It’s about how countries can use tax relief to tackle demographics, ease cost-of-living pressures, and support families without wrecking the budget. For families, the takeaway is simple: know your tax benefits, file smart, and stay informed. For policymakers, the lesson is even bigger: strong families mean strong economies. Greece is showing what happens when a country decides to bet its future on families.

| Topic | Details |

|---|---|

| Snap Elections | PM Kyriakos Mitsotakis ruled out early elections; next vote scheduled for 2027 |

| Tax Cuts Value | €1.6 billion ($1.7 billion) relief package announced for 2026 |

| Who Benefits | Families with kids, low-income earners, pensioners, young workers, rural and island residents |

| Birth Rate Issue | Greece’s fertility rate is 1.4 children per woman; population projected to fall below 8 million by 2050 |

| Political Angle | Ruling party New Democracy struggling with polls dropping from 41% (2023) to ~22–25% |

| Official Reference | Hellenic Government Official Site |

Why Greece Is in the Spotlight?

Picture this: grocery prices are climbing, rents are tough to cover, and raising kids feels like running a marathon on a hot summer day. Now add to that a shrinking population that threatens the future workforce. That’s Greece in a nutshell.

Prime Minister Kyriakos Mitsotakis took a bold stance. Instead of calling snap elections, which could have ended his leadership early, he ruled them out and focused on solutions. His weapon of choice? A €1.6 billion tax-cut package set to kick in by 2026. The idea is simple—help families today, strengthen the country tomorrow.

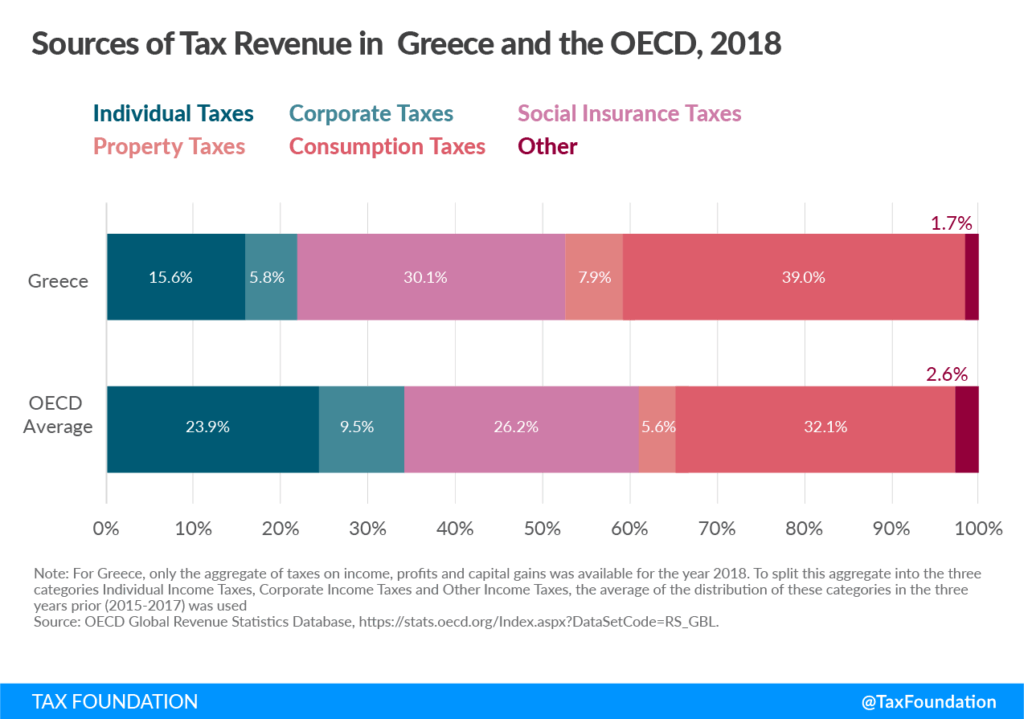

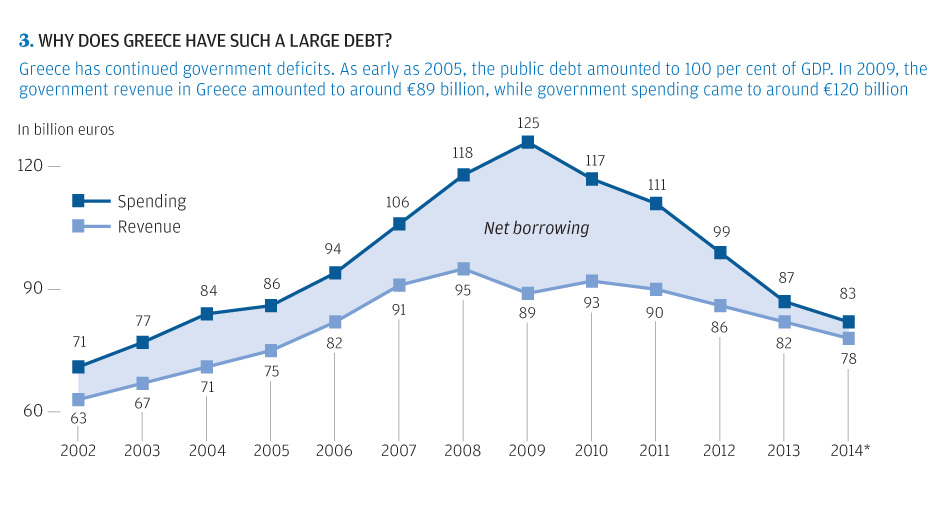

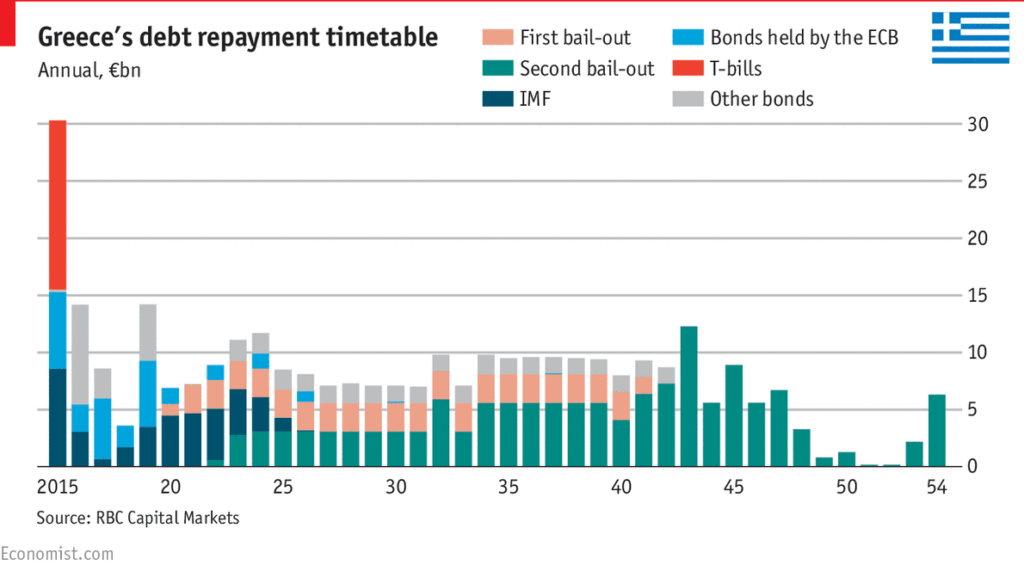

A Look Back: From Debt Crisis to Surplus

To really appreciate this move, you need to rewind to the 2008 global financial crisis. Greece became ground zero for debt problems, needing multiple bailouts from the European Union and International Monetary Fund. Between 2010 and 2018, the country went through harsh austerity measures—higher taxes, deep pension cuts, and slashed public spending. Families bore the brunt of it.

Fast forward to now: Greece has rebuilt trust with financial markets, posts a primary budget surplus, and can finally talk about cutting taxes instead of raising them. For many Greeks, this shift feels like breathing fresh air after years underwater.

Greek PM Rules Out Snap Polls: Breaking Down the Tax Package

Here’s what the relief package promises:

Income Tax Cuts

- Across most income brackets, income tax rates will fall by 2%.

- Low-income families with four or more children won’t pay income tax at all.

- Workers under age 25 earning less than €20,000 will also pay no income tax.

Group-Specific Relief

- Pensioners will see their burden lighten, giving retirees more breathing room.

- Residents of rural areas and small islands will enjoy reduced value-added tax (VAT) and property tax cuts, designed to keep people from leaving their hometowns.

- Young workers are being courted with tax incentives to reduce “brain drain,” a big issue as many Greek graduates leave for better-paying jobs abroad.

Demographic Strategy

This isn’t just about balancing household budgets. Greece is staring down a demographic crisis. Its fertility rate sits at 1.4 births per woman, one of the lowest in Europe. Without intervention, the population could dip below 8 million by 2050. The government hopes these incentives make raising families more affordable, nudging birth rates upward.

Why This Matters Beyond Greece?

Some might shrug and say, “That’s Greece’s problem.” But the truth is, this has lessons for the U.S. and other countries.

- The U.S. fertility rate is around 1.6 births per woman, also below the replacement level.

- The Child Tax Credit in the U.S. briefly lifted millions of kids out of poverty during the pandemic when expanded, but has since been rolled back. Greece is moving in the opposite direction—expanding family support instead of cutting it.

- Countries like Hungary and France have rolled out family-friendly tax perks to fight similar population declines. Hungary, for instance, offers lifetime tax exemptions for mothers with four or more children.

This global trend shows that governments are realizing something simple: families are the backbone of the economy. No families, no workers. No workers, no growth.

The Numbers Game: Demographics and Economics

Here’s why low birth rates send shivers down economists’ spines:

- Fewer workers means fewer taxpayers supporting pension and healthcare systems.

- More retirees strain public budgets, as pensions and healthcare costs rise.

- Slower economic growth: According to the OECD, every 1% decline in workforce participation costs billions in GDP.

Greece is trying to get ahead of this snowball effect. By investing in families now, the hope is to secure a stronger labor force tomorrow.

What Experts Are Saying?

Harvard economist Megan Greene puts it plainly:

“Tax cuts aimed at families aren’t just politics—they’re an investment in future economic stability.”

Even the International Monetary Fund has warned countries with declining populations to rethink fiscal policies and incentivize child-rearing. Greece’s package could become a test case for the rest of Europe.

A Step-by-Step Guide for Families

Whether you’re in Greece or the U.S., here’s how to think about tax benefits in practical terms:

Step 1: Know Your Credits

- In Greece: Families with four kids? Zero tax bill.

- In the U.S.: Use the Child Tax Credit ($2,000 per child) and Earned Income Tax Credit if eligible.

Step 2: File Smart

- Many households miss benefits because they file incorrectly or late. Free programs like the IRS Free File in the U.S. help families avoid mistakes.

Step 3: Think Long-Term

- Use savings accounts like 529 Plans in the U.S. for kids’ education.

- In Greece, families in rural areas can plan around reduced property taxes, making countryside living more affordable.

Step 4: Stay Informed

Government policies change often. Families who track new credits and programs can save thousands each year.

The Political Angle

Of course, there’s politics behind it. Mitsotakis’s party, New Democracy, won big in 2023 with 41% of the vote. Today, polls show them at just 22–25%. Scandals and soaring prices dented their popularity.

These tax cuts are not just policy—they’re a political reset button. If families feel relief by 2026, Mitsotakis could ride that wave into a third term. If not, he risks being remembered as the leader who gambled big and lost.

How This Affects Europe?

Greece isn’t alone. Across Europe, countries are experimenting with similar strategies:

- France offers generous parental leave and child allowances, helping it maintain one of Europe’s highest fertility rates (about 1.8).

- Germany has expanded childcare benefits to keep women in the workforce while raising kids.

- Italy faces the same struggles as Greece, with fertility rates around 1.2—the lowest in the EU.

Greece’s package adds fuel to the wider debate: should Europe shift more public spending toward families instead of infrastructure or defense?

Future Outlook

So what happens next? Two big scenarios:

- Success: Families breathe easier, Greece sees even a small bump in birth rates, and fiscal stability holds. That could make Greece a model for Europe.

- Failure: Revenues dip, deficits grow, and the package doesn’t change demographics. That would reignite old fears about Greek debt.

Either way, this experiment will be watched closely not just in Brussels, but also in Washington, where the same fertility and affordability debates are playing out.

Europe Blocks U.S.-Bound Parcels – Tax Rule Change Behind The Move

Tax Evasion Crackdown: Income Tax Raids After Overpriced Medicine Purchases

Ladies, It’s Time to Shop! GST on Handbags Slashed to Just 5%; Big Win for Fashion Lovers