Noida Man Busted For Rs 10 Crore Fake GST Bills: If you’ve been following financial news lately, one headline stood out: “Noida Man Busted For Rs 10 Crore Fake GST Bills.” Yes, you read that right—₹10 crore (about $1.2 million USD) worth of fake invoices created by a former accountant. It sounds like the plot of a crime thriller, but this case is very real. The accused, Abhinav Tyagi, believed he had found a clever way to cheat India’s Goods and Services Tax (GST) system. But his plan unraveled quickly, thanks to an internal audit that exposed irregularities. While the case took place in India, invoice fraud is a global problem. Whether you’re a small business owner in California or a corporate executive in Mumbai, there are lessons to be learned here about financial transparency, fraud prevention, and corporate accountability.

Noida Man Busted For Rs 10 Crore Fake GST Bills

The Noida fake GST scam is more than a local crime story. It’s a case study on how fraud works, why it persists, and what businesses must do to protect themselves. Tyagi’s ₹10 crore scheme collapsed with a simple audit—proof that vigilance and transparency are stronger than any scam. For businesses, the takeaway is clear: trust but verify. Fraud may evolve, but audits, accountability, and awareness remain the ultimate defense.

| Detail | Information |

|---|---|

| Accused | Abhinav Tyagi, ex-accounts staffer |

| Scam Value | ~₹10 crore (approx. $1.2M USD) in fake invoices |

| GST Benefit Attempted | ₹1.8 crore (~$216,000 USD) in fraudulent Input Tax Credit |

| Caught By | Internal audit in July 2025 |

| Charges Filed Under | IT Act & Bharatiya Nyaya Sanhita |

| Arrest Date | September 6, 2025 |

| Current Status | In custody, accomplice still at large |

| Official Source | GST Council India |

Understanding GST and Input Tax Credit

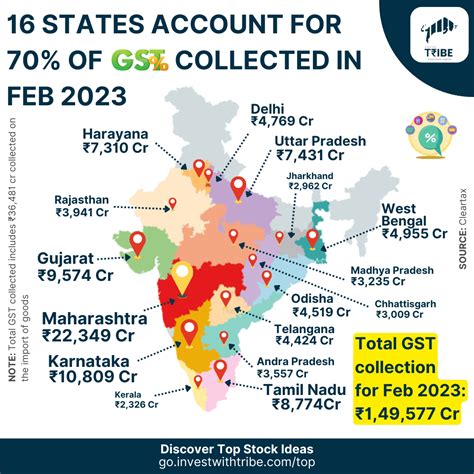

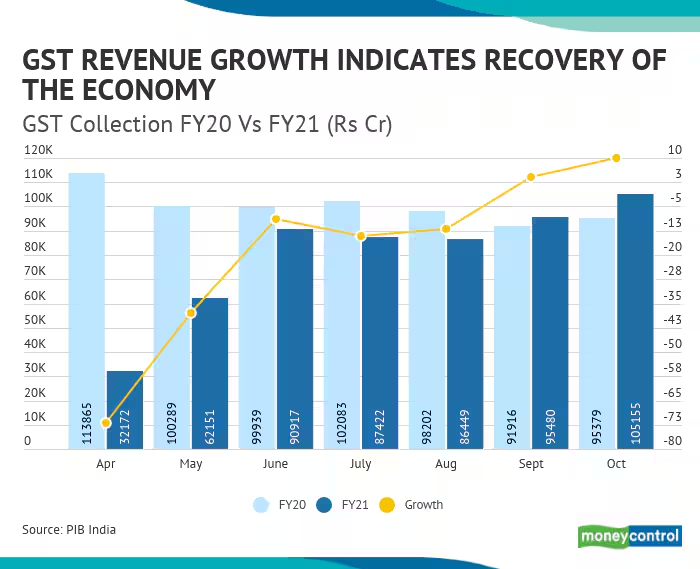

To appreciate the magnitude of this scam, you need to understand how GST (Goods and Services Tax) works. Introduced in India in 2017, GST replaced multiple indirect taxes with a single, unified system. Businesses collect GST on sales, then claim Input Tax Credit (ITC) for the GST they paid on purchases.

For example, if a company buys raw materials and pays ₹1,00,000 GST, then sells finished products where it collects ₹1,50,000 GST, it only needs to pay the government the difference: ₹50,000. This prevents double taxation and makes trade smoother. But here’s the catch—if someone generates fake invoices, they can claim ITC on purchases that never happened. That’s exactly what Tyagi attempted, aiming to pocket ₹1.8 crore in credits he wasn’t entitled to.

How the Noida Man Busted For Rs 10 Crore Fake GST Bills Worked?

- Fake Companies: Tyagi set up bogus firms such as BAU Handicrafts and United Security Services. These were just names on paper.

- Bogus Invoices: He created fake invoices totaling around ₹10 crore, showing business transactions that never took place.

- Claiming ITC: Using these invoices, he tried to claim ₹1.8 crore as tax credit.

- Digital Trail: Since GST filings are digital, the invoices looked legitimate on the surface—until someone double-checked.

Think of it as someone creating fake receipts to get refunds from the government. It’s like returning an empty box to a store and demanding cashback.

How He Got Caught?

The turning point came in July 2025 when the company conducted an internal audit. The auditors noticed discrepancies between invoices filed under GST and the company’s actual transactions.

When confronted, Tyagi’s story fell apart. The company immediately filed a police complaint. On September 6, 2025, the Noida Cyber Police arrested him. Investigators seized four mobile phones, eight SIM cards, a laptop, GST-related documents, and even his car.

This proves an important point: no matter how sophisticated a fraud seems, simple audits can bring it down.

Why This Scam Matters Beyond India?

While GST is unique to India, similar systems exist worldwide. In Europe, it’s called VAT (Value Added Tax), and in the U.S., the IRS monitors sales and business taxes. Fake invoice fraud isn’t local—it’s global.

- The European Union loses over €50 billion annually to VAT fraud, according to Europol.

- In the United States, the IRS has prosecuted multiple tax credit scams, especially involving pandemic relief claims.

- A PwC survey found that 46% of global companies experienced some form of financial fraud between 2020–2022.

So while Tyagi’s scam was worth $1.2 million, globally, the damage runs into hundreds of billions of dollars every year.

A Look Back: History of GST and Invoice Frauds

Tyagi’s case is one of many.

- In 2020, India uncovered a nationwide fake invoice racket worth ₹50,000 crore.

- By 2023, authorities had identified more than 20,000 fake firms across the country.

- In Maharashtra and Gujarat, several rackets involving import-export fraud were busted, where fake invoices were used to launder black money.

Globally, tax frauds aren’t new either. The “carousel fraud” in Europe during the 2000s drained billions from EU tax systems through repeated bogus claims across borders.

Expert Take: Why Fraud Persists

Why do fraudsters still try this when digital systems exist? According to experts:

- Documentation Loopholes: Fraudsters exploit weak verification processes.

- Delayed Detection: Most companies don’t run frequent audits.

- Low Awareness: Many small businesses don’t know how to verify vendors properly.

As Dr. Rajeev Kumar, a tax consultant, pointed out in the Economic Times:

“Fraud detection systems are improving, but without proactive audits and vendor checks, loopholes remain open. Fraudsters count on negligence, not brilliance.”

Impact on Businesses and the Economy

The fallout from such scams extends beyond government losses.

- Compliance Burden: Governments respond with stricter rules, making honest companies spend more on compliance.

- Trust Deficit: Genuine small businesses often get flagged during investigations, delaying their refunds.

- Revenue Loss: Governments lose funds that could be used for infrastructure, healthcare, or social programs.

- International Reputation: Frequent fraud cases can hurt investor confidence.

How Businesses Can Protect Themselves?

Here’s a practical playbook for staying safe:

Conduct Regular Internal Audits

Quarterly audits help catch red flags early. Don’t wait until year-end.

Verify Vendors and Clients

Cross-check GST numbers using the official GSTN portal.

Use Automated Accounting Tools

Platforms like Tally, SAP, QuickBooks, or government-linked tools can flag mismatches automatically.

Train Employees

Educate staff to identify suspicious invoices. Most fraud begins with insider involvement.

Establish a Whistleblower Policy

Encourage employees to report suspicious activity without fear of retaliation.

Legal Awareness

Under India’s GST Act, fake invoice fraud can lead to 5 years in jail, along with fines and blacklisting.

Legal Consequences

Tyagi faces charges under:

- Information Technology Act – for manipulating digital data.

- Bharatiya Nyaya Sanhita – for cheating, forgery, and impersonation.

If convicted, he could face:

- 3–5 years imprisonment

- Heavy fines

- Permanent blacklisting from conducting business

The authorities are also investigating whether more people were involved in the racket.

Lessons for Global Businesses

Fraud doesn’t respect borders. Whether it’s GST fraud in India, VAT scams in Europe, or sales tax evasion in the U.S., the fundamentals are the same.

For instance, in 2019, a U.S. case involved a Florida business owner who created fake invoices worth $7 million to reduce his tax liability. He was sentenced to prison and ordered to repay millions in penalties.

This demonstrates that while systems differ, fraud techniques are strikingly similar worldwide.

GST Sleuths Bust Electronics Firm in ₹5 Crore Tax Fraud

Hope Travels Dragged Into Prosecution Over Major Tax Fraud Case

Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases