Taxman Now Uses AI To Spy On Social Media: If you’ve been flexing your new truck on Instagram, posting TikToks about your Airbnb side hustle, or bragging on Facebook about that dream vacation—watch out. The taxman now uses AI to spy on social media, and yes, it could land you in hot water if your online lifestyle doesn’t match your reported income. It sounds like something out of a sci-fi movie, right? But it’s real. Around the world, governments are rolling out artificial intelligence (AI) tools to peek at what people are posting online. The big question is: does this mean the IRS or HMRC is creeping on your selfies? Let’s break it down in plain English, American-style—straight talk, no legalese.

Taxman Now Uses AI To Spy On Social Media

So, are you at risk? If you’re an honest taxpayer in the U.S., not much—for now. The IRS isn’t yet deploying AI to stalk your TikTok dances. But globally, the direction is clear: governments are embracing AI to hunt down tax cheats, and your digital footprint is part of the game. The smartest move? Stay compliant, keep records, and think twice before flaunting wealth online. Because in the digital age, what happens on social media doesn’t just stay on social media—it can end up on a tax investigator’s desk.

| Aspect | Details |

|---|---|

| Who’s using AI to monitor social media? | UK’s HMRC confirmed it monitors posts during criminal tax investigations. India’s proposed Income Tax Bill 2025 may expand authority even further. |

| What’s being tracked? | Social media posts, bank records, property purchases, crypto transactions, and online investments. |

| Risk level in the U.S.? | Low for now. IRS uses data analytics but hasn’t confirmed widespread social media snooping. |

| Safeguards? | UK: Legal oversight for criminal cases only. India: Bill may allow broader, less restricted access. |

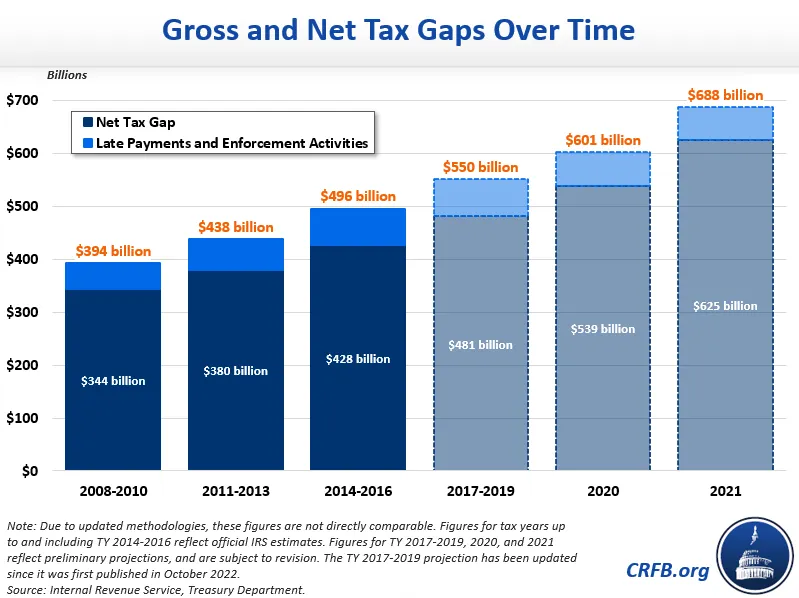

| Estimated tax evasion losses | U.S.: ~$688 billion annually (IRS estimate, 2021). Globally: ~$427 billion lost per year (Tax Justice Network). |

| Official Source | UK HMRC – official tax authority. |

Why the Taxman Cares About Your Social Media?

Here’s the deal: taxes are the lifeblood of government. Roads, schools, hospitals—they all run on tax money. When people cheat the system, everyone else picks up the slack.

The numbers are huge:

- The IRS estimates the U.S. loses about $688 billion annually due to tax evasion.

- Globally, the Tax Justice Network says governments lose about $427 billion every year to corporate and individual tax abuse.

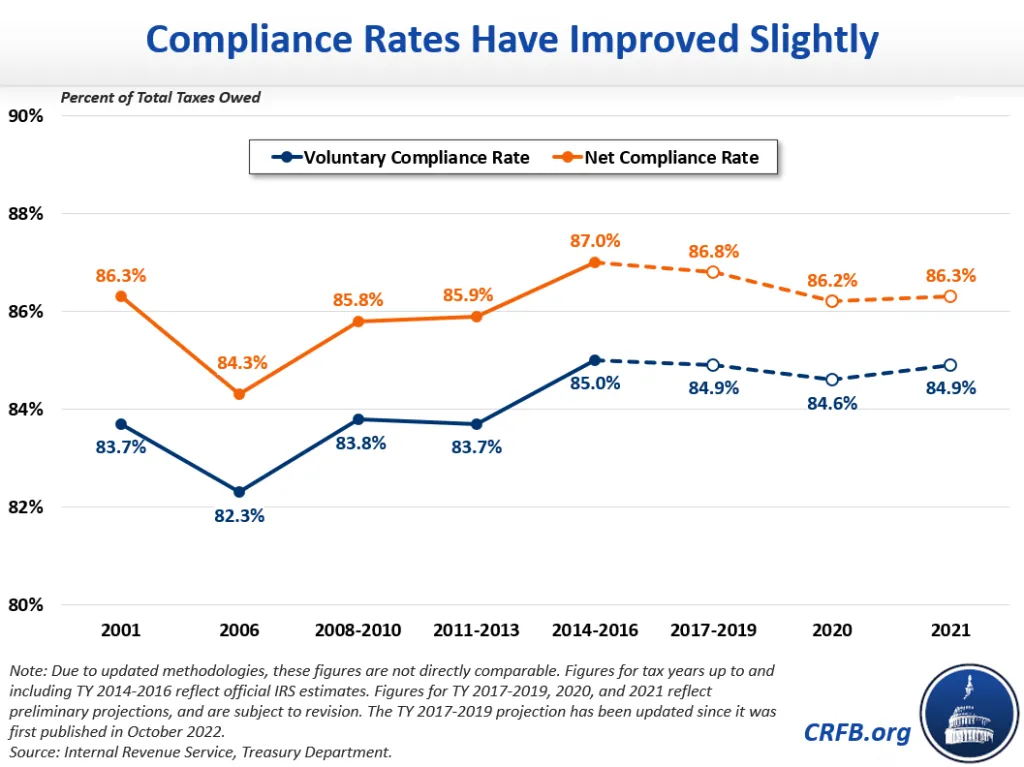

For decades, agencies relied on traditional audits, whistleblowers, and paper trails. In the 2010s, the UK revolutionized tax enforcement with its Connect system, pulling in over 55 sources of data—from bank transfers to property registries. Now, artificial intelligence adds a new layer by sweeping through social media.

Imagine this: you claim you earn $40,000 a year. But your TikTok shows luxury trips to Europe, designer watches, and a new Tesla. That’s a red flag. AI doesn’t need sleep, and it can process thousands of such mismatches in seconds.

How Taxman Now Uses AI To Spy On Social Media?

AI isn’t scrolling your feed for cat memes. Here’s the real process:

1. Data Collection

The system gathers publicly available posts from Instagram, TikTok, Facebook, LinkedIn, YouTube, and other platforms.

2. Pattern Recognition

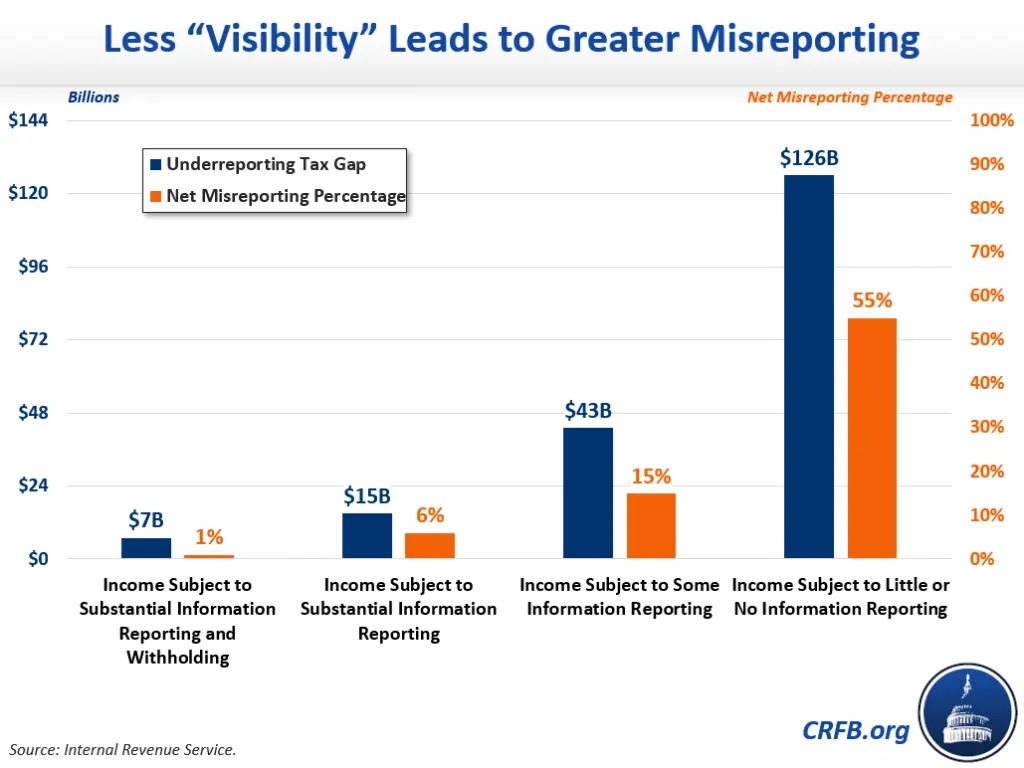

It compares your social media lifestyle with your tax returns, property records, bank statements, and even crypto wallets.

3. Risk Scoring

If the AI sees a mismatch—say, expensive vacations paired with a modest reported income—it flags the case.

4. Human Review

Before action is taken, an investigator reviews the flagged case. AI acts as the watchdog, but humans make the call.

Think of AI as a 24/7 detective that never takes a lunch break.

Who’s Using This Tech Now?

United Kingdom (HMRC)

- HMRC confirmed it uses AI to monitor social media during criminal tax investigations only.

- It works hand-in-hand with the Connect system.

- Officials insist it won’t target everyday taxpayers, but critics remain skeptical.

India

- The proposed Income Tax Bill, 2025 is a game-changer.

- It may allow tax officials to access emails, social media, and even cloud data during searches.

- Civil rights groups warn this could become a tool for overreach and misuse.

United States (IRS)

- The IRS already uses big data analytics to detect fraud.

- While it hasn’t confirmed social media AI use, public posts have been used in court as evidence of tax crimes.

- With billions allocated to technology upgrades through the Inflation Reduction Act, experts believe the IRS could expand into AI-driven monitoring within the decade.

Why Freelancers and Small Business Owners Should Care

This technology isn’t just aimed at billionaires hiding money offshore. Everyday Americans can get swept up.

- Freelancers: Side gigs on platforms like Upwork, Fiverr, or Venmo payments may raise red flags if not reported.

- Small Business Owners: Flashing a new storefront or equipment online while underreporting income can look suspicious.

- Side Hustlers: Airbnb hosts, Etsy sellers, or crypto traders are already on IRS radar thanks to 1099 forms. AI just makes detection faster.

The bottom line: the days of “cash jobs” or “under the table” income are numbered.

Privacy and Ethical Concerns

AI-driven surveillance raises serious questions.

- False Positives: An algorithm may misinterpret a gifted car or family-financed vacation as fraud.

- Civil Liberties: Groups like the ACLU warn this creates a slippery slope of government surveillance.

- Accuracy Issues: Just ask the victims of the UK’s Post Office Horizon scandal, where faulty software ruined lives by falsely accusing workers of fraud.

The big worry: if tax agencies rely too much on machines, innocent people could get dragged into costly investigations.

Historical Context: How Did We Get Here?

Back in the 1980s and 1990s, tax enforcement relied almost entirely on audits and whistleblowers. Investigators manually combed through bank records and property deeds. By the 2000s, as e-commerce and digital banking took off, authorities adopted large-scale databases.

The UK’s Connect system (2010) marked a turning point, analyzing billions of records. Now, the jump to AI-powered social media monitoring feels like the natural evolution—an extension of data analytics into the world of selfies and hashtags.

Practical Guide: How to Stay Safe and Compliant

Here’s a no-nonsense checklist to avoid trouble:

- Report All Income – Side hustles, crypto, Airbnb, and Etsy shops are taxable. Don’t ignore them.

- Keep Documentation – Save receipts, invoices, bank records, or gift letters for big-ticket purchases.

- Post Carefully – Don’t flaunt luxury items online unless you can explain how you afforded them.

- File on Time – Late or missed filings raise red flags.

- Stay Updated – Laws evolve. Follow updates from IRS.gov.

- Get Professional Help – If finances are complicated, work with a CPA or tax attorney.

Real-Life Examples

- In the UK, workers claiming benefits while posting pictures of expensive cars were flagged by HMRC investigators.

- In India, critics fear the 2025 bill could give officials power to bypass passwords and dig into private data.

- In the U.S., Facebook posts have already been used as courtroom evidence in tax fraud prosecutions—even without AI.

Future Trends: What’s Next in AI and Tax Enforcement

Looking ahead, expect these developments:

- Broader U.S. Adoption – The IRS could expand into AI monitoring as tech upgrades roll out.

- Cross-Border Data Sharing – Countries may collaborate to track offshore accounts and assets.

- Beyond Taxes – AI monitoring could spill into benefit fraud, loan applications, and even immigration checks.

- Regulation Battles – Privacy advocates will likely push back, demanding oversight and legal limits.

Tax Evasion Crackdown: Income Tax Raids After Overpriced Medicine Purchases

HMRC Uses AI to Catch Tax Cheats by Tracking Lifestyle on Social Media

Tax Scammers Just Got Smarter — Here’s How They’re Tricking People in 2025