HMRC Uses AI To Catch Lifestyle Lies Of Tax Evaders: When we hear the phrase “HMRC uses AI to catch lifestyle lies of tax evaders,” it almost sounds like a sci-fi thriller. But this isn’t Hollywood—it’s real life. HM Revenue & Customs (HMRC), the UK’s tax authority, is deploying artificial intelligence tools to uncover when someone’s public flexing on Instagram, TikTok, or Facebook doesn’t match what they told the government about their income. Imagine you’re posting shots of yourself cruising the Caribbean on a private yacht, but your tax return says you’re earning minimum wage. That’s the exact kind of mismatch HMRC’s AI is designed to flag. And while this is happening across the pond, folks in the United States should pay attention—because the IRS is already experimenting with similar tech.

HMRC Uses AI To Catch Lifestyle Lies Of Tax Evaders

The phrase “HMRC uses AI to catch lifestyle lies of tax evaders” might sound dramatic, but it reflects a new reality: tax enforcement is going digital, fast. With a tax gap of tens of billions and rising fraud, governments see AI as a game-changer. For everyday taxpayers, the lesson is straightforward—report honestly, keep your records clean, and think twice before flexing online. AI may be sharp, but integrity is sharper.

| Topic | Details |

|---|---|

| Who | HMRC (UK’s tax authority) |

| What | Uses AI to catch “lifestyle lies” of suspected tax evaders |

| How | Scans social media posts, matches them with official income/tax data via the Connect system |

| Scope | Focused on criminal tax investigations, not routine taxpayers |

| Stats | UK’s tax gap is ~£36 billion annually |

| System | Connect holds 55+ billion data items including bank records, property sales, and DVLA data |

| Efficiency | AI saves HMRC officials ~26 minutes per day each, boosting productivity |

| Concerns | Privacy, false positives, ethical oversight, “Horizon scandal” comparisons |

| Official Website | HMRC UK |

A Quick History of HMRC’s Digital Muscle

Back in 2010, HMRC launched a mega-database called Connect, designed to spot inconsistencies in taxpayer records. It gathers information from:

- Banks and financial institutions

- Property and mortgage records

- DVLA vehicle registration data

- Online marketplaces like eBay, Amazon, and Airbnb

- Employer payroll and benefits records

Fast-forward to today, and Connect reportedly stores over 55 billion data points. According to some estimates, it has helped HMRC recover billions of pounds in lost tax revenue every year. Adding AI to this setup means it can now comb through data faster, spot patterns humans might miss, and even monitor social media for signs of fraud.

How the “Lifestyle Lie Detector” Works?

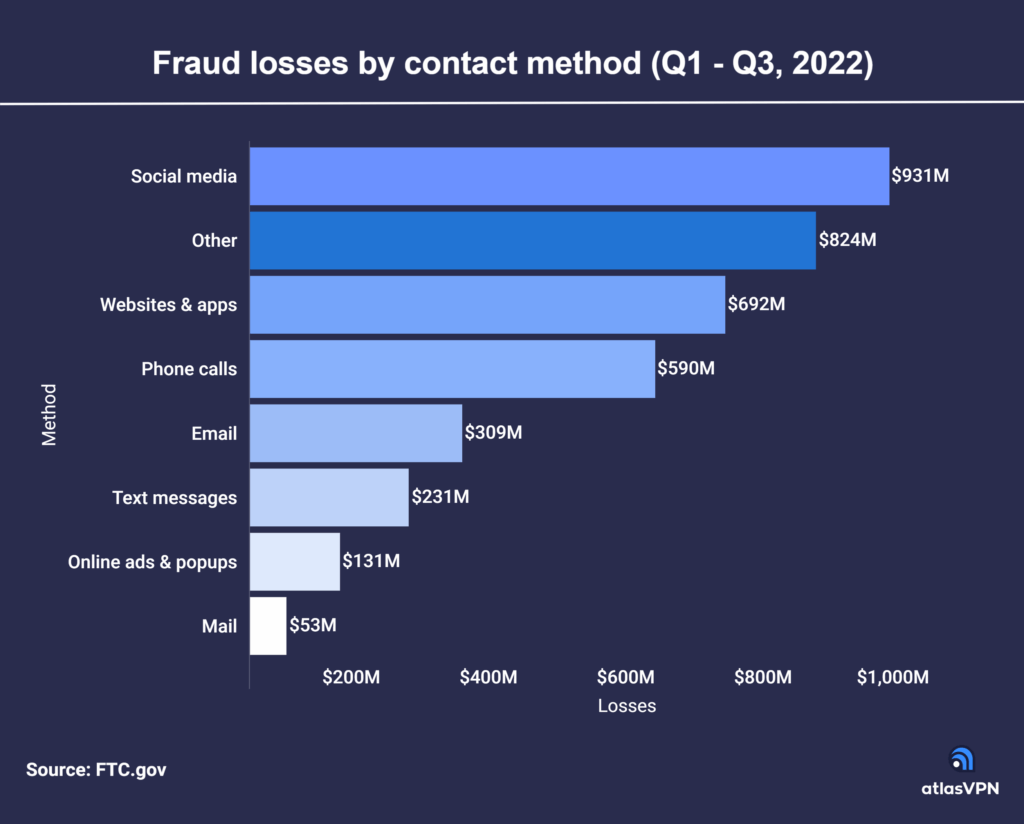

Step 1: Social Media Scans

AI tools crawl public posts for signs of wealth—luxury cars, designer handbags, expensive vacations, and other lifestyle indicators.

Step 2: Cross-Checking Data

The system compares these digital signals with tax returns and financial data. A mismatch triggers a red flag.

Step 3: Human Review

Contrary to fearmongering, AI isn’t making arrests. Every flagged case goes to a human tax investigator for further review.

Case Studies and Scenarios

- Case Study 1: An influencer shows off multiple brand partnerships online but reports minimal self-employment income. HMRC questions undeclared sponsorships.

- Case Study 2: A landlord brags on Facebook about expanding their property empire, yet only declares modest rental income. Connect matches land registry records against returns.

- Case Study 3: A crypto trader posts screenshots of six-figure gains but doesn’t file capital gains tax. The mismatch becomes an investigative lead.

- Case Study 4: A business owner posts about driving a Lamborghini, but records show only modest profits. Investigators check whether revenue was hidden in offshore accounts.

These examples show how online bragging—real or exaggerated—can spark official scrutiny.

The Scale of the Tax Gap

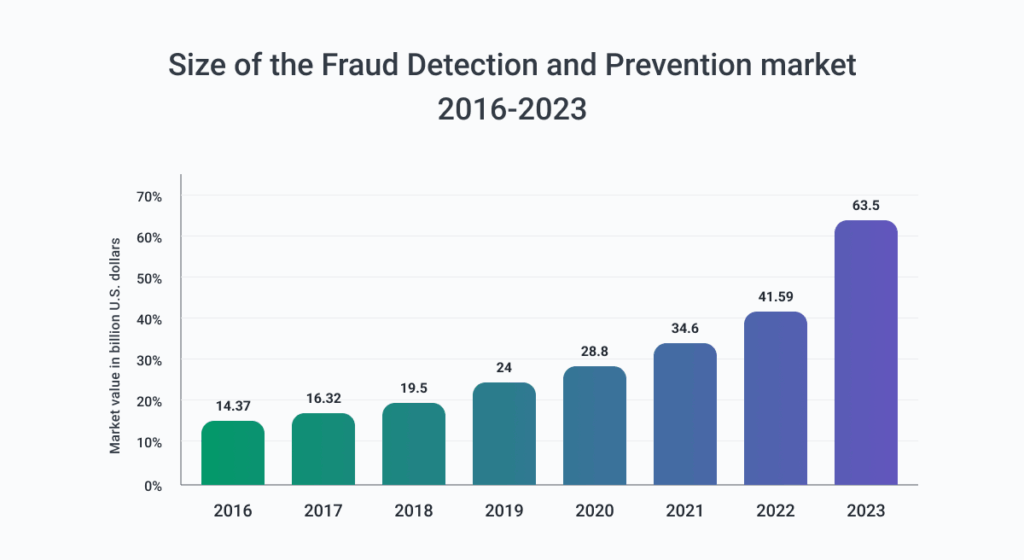

Why all this effort? Because the stakes are huge.

- In the UK, the latest HMRC Measuring Tax Gaps report puts the tax gap at £36 billion ($46 billion) annually.

- In the U.S., the IRS estimates the tax gap at $540 billion per year.

That’s money that could fund schools, hospitals, and infrastructure. AI-driven enforcement is one way to close the gap.

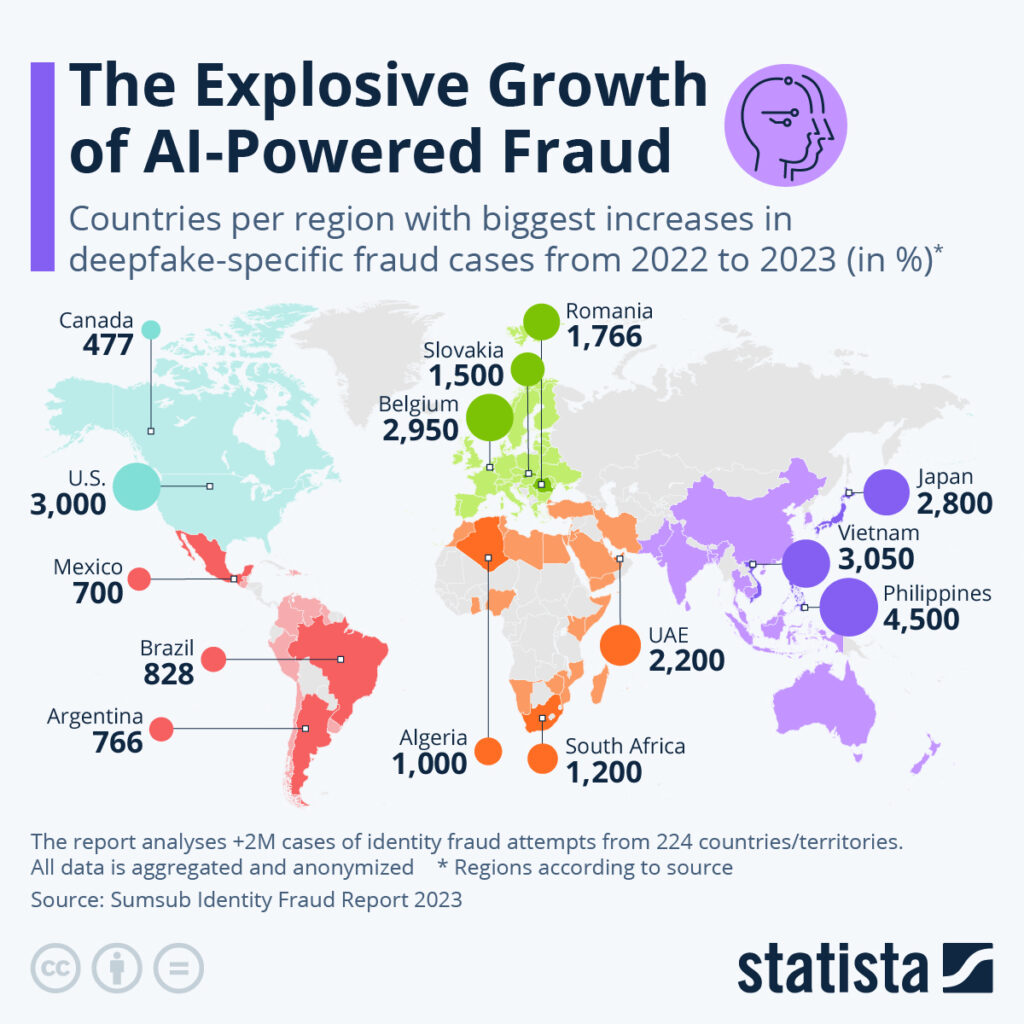

Comparisons: AI in Tax Enforcement Worldwide

- United States (IRS): Already using AI to track cryptocurrency transactions, audit suspicious ERC (Employee Retention Credit) claims, and detect refund fraud.

- Australia: Deploys AI for data-matching between tax returns and financial activity, including online sales.

- Canada: Leverages AI for cross-border audits, e-commerce monitoring, and risk analysis.

- France & Germany: Experimenting with AI-based fraud detection in VAT and corporate tax systems.

The UK’s social media scanning makes headlines, but the reality is that tax AI is now a global tool.

Privacy Concerns and Criticism

Critics say the system raises serious concerns.

- Privacy Overreach: Should a vacation selfie really be used as evidence in a criminal investigation?

- False Positives: Borrowed cars, rented yachts, or fake flexes can be misinterpreted.

- Civil Liberties: Groups like Big Brother Watch warn of creeping surveillance powers.

- Trust Issues: MPs have compared the risks to the Horizon IT scandal, where faulty tech falsely accused thousands of UK postmasters.

The balance between catching fraudsters and respecting personal privacy remains a heated debate.

Legal Safeguards

HMRC operates under the Data Protection Act 2018 and UK GDPR, which prevent purely automated decisions from impacting taxpayers. That’s why human oversight remains central. Oversight is also provided by the Information Commissioner’s Office (ICO), which ensures personal data isn’t misused.

Professional Guidance: How to Stay Safe

Whether you’re a taxpayer, freelancer, or financial advisor, here are practical steps to avoid trouble:

- Declare All Income – Side hustles, rental income, crypto, and gig work are taxable.

- Keep Documentation – Receipts, invoices, contracts, and bank statements should be on file.

- Stay Consistent – Don’t flaunt a lifestyle that doesn’t match your declared income.

- Get Advice – A certified accountant can guide you on compliance.

For professionals, it’s also wise to educate clients about their digital footprint. Many taxpayers still don’t realize social media can be used as part of fraud investigations.

The Bigger Picture: AI’s Role in Government

HMRC’s AI push isn’t happening in isolation. The agency is investing in:

- Debt Prediction Models – to identify taxpayers likely to fall behind.

- Generative AI in Customer Service – reducing wait times and automating FAQs.

- Advanced Fraud Detection – covering e-commerce, cross-border payments, and offshore accounts.

The U.S. IRS and other agencies are following similar paths, proving that AI is quickly becoming a cornerstone of modern tax enforcement.

Future Outlook Of HMRC Uses AI To Catch Lifestyle Lies Of Tax Evaders

Experts predict:

- More Real-Time Monitoring – linking payment apps like PayPal and Venmo directly into tax systems.

- Predictive Analytics – identifying patterns of potential evasion before they happen.

- International Collaboration – sharing AI insights across borders for joint fraud crackdowns.

- Increased Transparency Demands – citizens and lawmakers pushing for greater oversight to prevent abuse.

In short, AI isn’t going anywhere. It will keep evolving, and taxpayers will need to adapt.

UK Accountant Jailed for £180,000 Covid Relief Scam

HMRC Uses AI to Catch Tax Cheats by Tracking Lifestyle on Social Media

The Best-Rated Tax Software in the UK for 2025? Millions Are Making the Switch to Pie