Only 7 Days Left To File ITR: If you’re reading this, here’s your reality check: there are only 7 days left to file your Income Tax Return (ITR) for FY 2024–25 (AY 2025–26). The Indian government extended the deadline to September 15, 2025, but after that, things get costly. Missing this deadline could mean penalties of up to ₹5,000, interest on unpaid taxes, delays in refunds, and even notices from the tax department. Think of it like ignoring a red light—you may get away once or twice, but eventually, the fine catches up with you. Filing your ITR is the same. It may feel like a chore, but it saves you money, ensures peace of mind, and strengthens your financial credibility.

Only 7 Days Left To File ITR

With only 7 days left, time is running out. File your ITR before September 15, 2025, to avoid penalties, interest, and lost benefits. Filing on time is more than compliance—it’s an investment in your financial credibility. Don’t wait until the final hour when servers crash and stress levels spike. Take an hour today, file your return, and step into tomorrow with peace of mind.

| Point | Details |

|---|---|

| Deadline | September 15, 2025 (extended from July 31) |

| Penalty (Section 234F) | ₹1,000 if income ≤ ₹5 lakh; up to ₹5,000 if income > ₹5 lakh |

| Interest (Section 234A) | 1% per month on unpaid tax after the due date |

| Belated Return Option | Available till December 31, 2025, with penalties |

| Consequences | Delayed refunds, loss of loss carry-forward, possible scrutiny |

| Official Portal | Income Tax e-Filing Website |

Why Was the Deadline Extended?

Normally, the due date is July 31. However, the Central Board of Direct Taxes (CBDT) pushed the deadline to September 15, 2025. The reasons included:

- Increased demand from taxpayers and professionals

- Server overloads and system slowdowns on the e-filing portal

- A larger number of new taxpayers joining the system

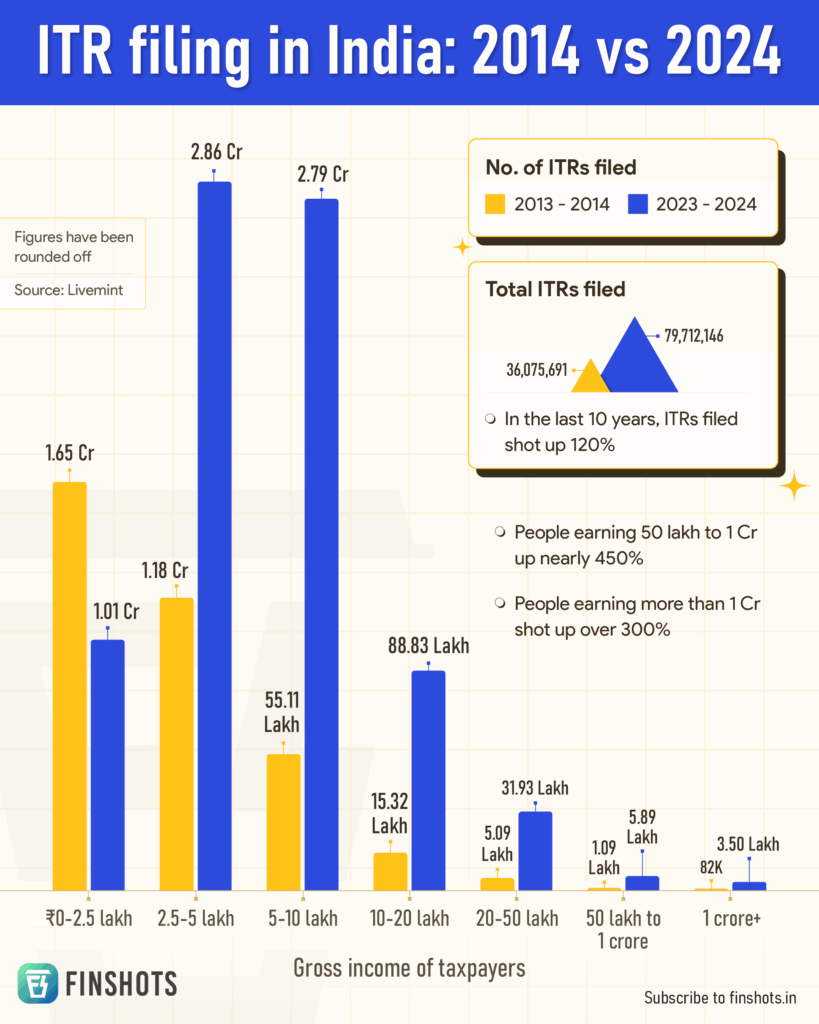

According to government data, in FY 2023–24, over 81 million returns were filed, with more than 20 percent filed in the last 10 days before the deadline. This shows how many of us tend to leave things for the last minute.

What Happens If You Miss 7 Days Left To File ITR?

Missing the deadline has several consequences that go beyond just a fine. Here’s a breakdown:

Penalty Fees under Section 234F

- Income less than or equal to ₹5 lakh → Penalty = ₹1,000

- Income above ₹5 lakh → Penalty = ₹5,000

Interest Charges under Section 234A

- 1% per month (or part of a month) on unpaid tax.

- Example: If you owe ₹30,000 and delay filing by 3 months, you’ll pay ₹900 in interest, in addition to penalties.

Refund Delays

If you’re due a refund, late filing means you’ll wait longer for your money.

Loss of Carry-Forward Benefits

Losses under “Capital Gains” or “Business/Profession” cannot be carried forward if the return is filed late.

Higher Risk of Scrutiny

The tax department often flags late returns for deeper inspection, which can lead to notices.

A Real-Life Example

Take Ananya, a software engineer with an annual income of ₹10 lakh. Her employer deducted ₹1.2 lakh in TDS, but her total tax liability is ₹1.25 lakh.

- If she files on time: She pays ₹5,000 and closes the year.

- If she files on October 1: She pays:

- ₹5,000 balance tax

- ₹500 interest (1% for part of a month)

- ₹5,000 penalty (income above ₹5 lakh)

Total = ₹10,500.

By waiting just 15 days, her outgo doubled.

Step-by-Step Guide to File Your ITR Before the Deadline

Step 1: Collect Your Documents

You’ll need Form 16, Form 26AS, bank statements, investment proofs, and TDS certificates.

Step 2: Log Into the Portal

Visit the Income Tax e-Filing Portal. Use your PAN or Aadhaar to log in.

Step 3: Select the Right ITR Form

- ITR-1 (Sahaj): Salaried up to ₹50 lakh

- ITR-2: Individuals with capital gains, more than one property, or foreign assets

- ITR-3 & 4: Business owners and professionals

Step 4: Enter Income Details

Fill in salary, interest, rental income, capital gains, and other income.

Step 5: Claim Deductions

Apply deductions under sections like 80C (investments), 80D (health insurance), and 80G (donations).

Step 6: Pay Any Pending Taxes

Clear outstanding tax dues using Challan 280 before submission.

Step 7: Submit and E-Verify

Your return is only valid after e-verification via Aadhaar OTP, net banking, or pre-validated bank account.

Why Filing On Time is a Smart Move?

Timely filing is more than just avoiding penalties. It:

- Keeps your financial record clean

- Helps you get refunds faster

- Strengthens loan and visa applications

- Allows carry-forward of losses for future tax benefits

It’s like paying your credit card bill on time—it saves you from interest and builds your financial credibility.

Impact of Missing ITR on Credit and Finance

Filing your ITR on time doesn’t just keep the taxman happy—it also protects your financial reputation. Banks and financial institutions often use ITRs as proof of income before approving loans, mortgages, or even credit cards. A missed or delayed return could signal poor financial discipline, making lenders cautious. For professionals, late filing might create hurdles in securing contracts or visas, since embassies and government agencies also ask for ITR proofs. In short, timely filing acts like a financial “resume”—it shows that you’re responsible, trustworthy, and organized. Skipping the deadline may save a few hours today, but it can cost big opportunities tomorrow.

Belated Returns: Your Second Chance

If you miss September 15, you can still file until December 31, 2025. This is called a belated return.

But here’s the catch:

- You’ll pay penalties under Section 234F

- You’ll pay interest on unpaid tax

- You lose the right to carry forward losses

Common Mistakes Taxpayers Make

- Waiting until the last day (server crashes are common)

- Forgetting to verify the return (unverified = incomplete)

- Entering wrong bank details (refunds bounce back)

- Missing income from multiple sources (like interest income)

- Ignoring Form 26AS and AIS mismatches

ITR-6 Excel Utility Released – Check If You Need to File This Year

September 15 Deadline Looms – Last Date to File ITR and Pay Self-Assessment Tax Without Penalty

Income Tax Guide: How to Report Foreign Assets in ITR AY2025-26

Pro Tips from Professionals

- File a week before the deadline to avoid portal slowdowns

- Double-check Form 26AS and Annual Information Statement (AIS) for accuracy

- Save a copy of your filed ITR and acknowledgment for at least 6 years

- Use a chartered accountant if you have foreign income or complex investments

- Pre-validate your bank account to ensure refunds are credited smoothly

Additional Insights: Comparison with the U.S.

In the United States, the IRS deadline is April 15, with a six-month extension option. Late filing can lead to a penalty of 5% per month of unpaid tax. Compared to this, India’s penalty system is lighter, but the consequences of scrutiny and refund delays can be equally frustrating.

Statistics to Know

- 81 million returns were filed last year in India

- Over 20 percent filed in the last 10 days before the deadline

- Refund delays for late filers averaged 90 to 120 days longer

- According to the CBDT, nearly 10 million taxpayers paid penalties in the last assessment year

These numbers show why timely filing matters—it saves both time and money.