Two Winners Split $1.787 Billion Powerball Jackpot: The buzz across the country is electric: the $1.787 billion Powerball jackpot has finally been won, and it wasn’t by just one person — two lucky players, one in Texas and another in Missouri, will split the prize. It’s the second-largest Powerball jackpot in U.S. history, and the kind of story that makes everyday Americans line up for tickets hoping to beat impossible odds. But here’s the thing: while $1.787 billion looks incredible in headlines, the winners won’t actually see anywhere close to that figure in their bank accounts. Between taxes, payout choices, and state laws, the final take-home amount is far less — though still enough to buy more than a few dream homes, yachts, and maybe even a private island.

Two Winners Split $1.787 Billion Powerball Jackpot

The $1.787 billion Powerball jackpot split between Texas and Missouri proves just how wild lottery outcomes can be. While the winners won’t see the full advertised amount, walking away with $242M–$258M each is still life-changing. The story highlights more than luck — it’s about taxes, financial discipline, and smart planning. For the rest of us, the lesson is clear: while we may never win billions, the principles of responsibility, investing, and protecting what we earn apply to everyone.

| Point | Details |

|---|---|

| Jackpot Total | $1.787 billion (second-largest in U.S. history) |

| Number of Winners | 2 (Texas & Missouri) |

| Lump-Sum Option | ~$410.3 million each before taxes |

| Federal Tax Rate | 37% (24% withheld upfront, balance due later) |

| Texas Winner Take-Home | ~$258.5 million (no state income tax) |

| Missouri Winner Take-Home | ~$242.1 million (after 4% state tax) |

| Annuity Option | ~$893.5 million each over ~30 years |

| Source | Powerball Official Website |

Powerball 101: How the Game Works

To understand why jackpots soar into the billions, it helps to know how Powerball operates.

- Tickets cost $2, with an optional $1 Power Play multiplier.

- Players choose five white balls (1–69) and one red Powerball (1–26).

- The jackpot requires matching all six numbers.

The odds of winning the jackpot are 1 in 292.2 million. By comparison:

- Odds of being struck by lightning in a lifetime: 1 in 15,300.

- Odds of becoming a U.S. president: 1 in 32 million.

When nobody wins, the prize rolls over, creating the mega-jackpots that spark national lottery fever.

Lump-Sum vs. Annuity

Winners choose between:

- Annuity

- About $893.5 million each, paid over nearly 30 years.

- Payments start smaller and grow by 5% annually.

- Safer for long-term planners but less flexible.

- Lump-Sum

- About $410.3 million each before taxes.

- Immediate access, but significantly less overall.

- Most winners — including these two — choose this option.

Why? Control. With money upfront, winners can invest, buy assets, or donate on their own terms.

The Tax Breakdown

Federal Taxes

- IRS takes 24% right away.

- Additional 13% due at tax time for a total of 37%.

- From $410.3M, each winner nets about $258.5M after federal taxes.

State Taxes

- Texas Winner: Keeps the full $258.5M (no state income tax).

- Missouri Winner: Loses another 4% ($16.4M), ending up with $242.1M.

That’s a $16.4 million difference just based on state residency.

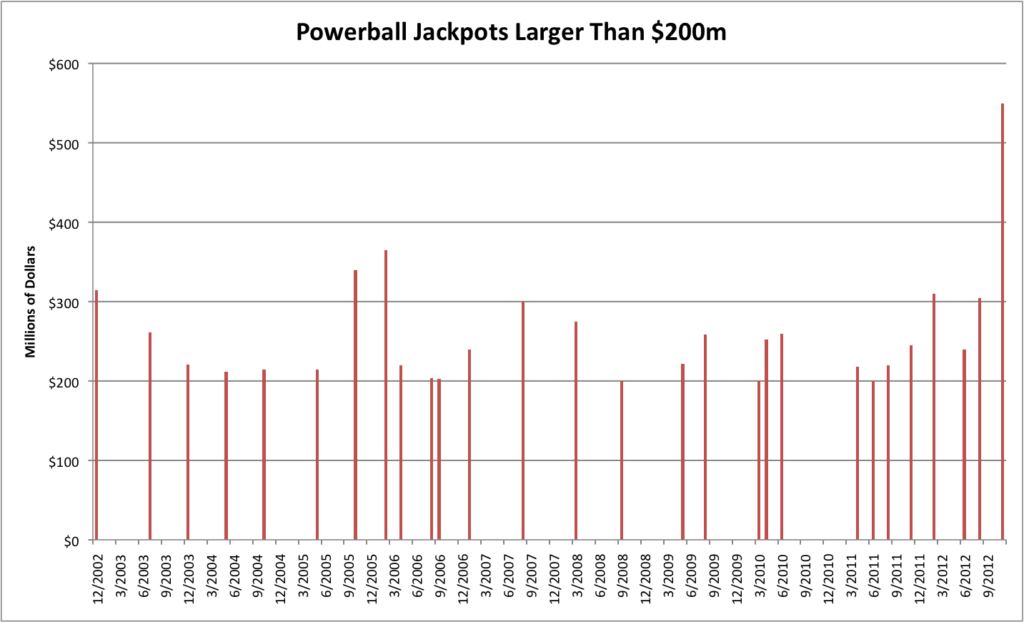

Jackpot Comparisons: A Historical Look

This isn’t America’s first eye-popping lottery story:

- $2.04B Powerball (Nov 2022, California): The largest jackpot ever. Winner Edwin Castro claimed the lump sum.

- $1.58B Mega Millions (Aug 2023, Florida): The largest Mega Millions prize, won by one anonymous Floridian.

- $1.586B Powerball (Jan 2016): Split among winners in California, Tennessee, and Florida.

Big jackpots are rare but becoming more common as ticket sales skyrocket during rollovers.

The “Lottery Curse”

Winning isn’t always the dream it seems. About 70% of lottery winners go broke within a few years (CNBC). Why?

- Sudden pressure from friends and family.

- Overspending on luxuries and poor investments.

- Scams targeting winners.

Case study: Jack Whittaker, who won $315 million in 2002, lost most of his fortune to theft, lawsuits, and personal tragedy.

On the flip side, winners like Brad Duke, who won $220 million in 2005, turned his prize into long-term investments and philanthropy.

What Winners Should Do Immediately?

For anyone lucky enough to win:

- Sign the Ticket – Secure your claim.

- Stay Anonymous if Possible – Texas allows anonymity; Missouri does not.

- Hire Professionals – Lawyer, CPA, and financial advisor.

- Set Up a Trust – Protect assets for future generations.

- Plan Investments – Diversify: stocks, bonds, real estate.

- Avoid Lifestyle Inflation – Spend wisely, don’t overextend.

Cultural Impact of Two Winners Split $1.787 Billion Powerball Jackpot: Why America Loves Big Jackpots

There’s a reason Powerball is part of American culture:

- It feeds into the dream of “rags to riches” overnight.

- Even when odds are slim, the chance of a life-changing win is irresistible.

- Huge jackpots boost ticket sales, creating a cycle of excitement and higher payouts.

In 2023 alone, U.S. lottery sales topped $113 billion (NASPL). For many, buying a ticket isn’t just gambling — it’s buying a piece of hope.

The Role of Taxes in Lottery Advertising

One of the biggest misconceptions about jackpots like the $1.787 billion Powerball prize is that winners get to pocket the full amount. In reality, the advertised jackpot represents the annuity value — spread over 29 years — before taxes. Lottery ads focus on the big number because it attracts players, but the actual lump-sum cash option is always much smaller. Then, federal and state taxes slash it down further. For instance, the Texas winner walked away with roughly $258.5 million, less than 15% of the headline jackpot. That’s still life-changing, but it shows why many financial experts urge people to temper expectations. Advertising rules allow lotteries to market the larger annuity figure, but financial professionals often argue for more transparent messaging. This gap between perception and reality is one of the reasons so many new millionaires feel shocked once the check arrives.

How Powerball Jackpots Shape Communities?

While the winners grab headlines, jackpots like the $1.787 billion Powerball also have a broader social and economic impact. Every ticket sold contributes to state revenues, which in turn support education, infrastructure, veterans’ programs, and community projects. For example, Texas channels a large portion of lottery proceeds to its Foundation School Program, while Missouri invests heavily in public education initiatives. The buzz of a record jackpot also boosts local economies — gas stations, convenience stores, and supermarkets see spikes in foot traffic, creating temporary boosts in small business revenue. Even tourism can get a bump when the winning location becomes a mini-pilgrimage spot for curious visitors. Though lottery critics argue it acts as a “voluntary tax” on the poor, state officials defend the system by pointing out billions in yearly funding for public programs. So, beyond changing two lives, this jackpot also leaves ripples across communities nationwide.

Economic Impact of the Lottery

Lotteries aren’t just about winners; they support public programs:

- Missouri: Proceeds go toward public education.

- Texas: Funds the Foundation School Program.

- Nationwide, lottery revenues fund schools, infrastructure, and veterans’ programs.

So even if you don’t win, your $2 ticket helps support community needs.

Everyday Financial Lessons

Most of us won’t win Powerball — but there are still valuable takeaways:

- Budget Like a Winner: Think net income, not gross. Taxes take a bite.

- Invest Early: Treat bonuses, inheritances, or tax refunds as opportunities to grow wealth.

- Play Responsibly: Don’t gamble more than you can afford.

- Protect Windfalls: Whether it’s $10,000 or $10 million, financial planning matters.

BBC Drops a Tax Secret That Could Save You Thousands in 2025

Trump’s IRS Order Could Change How You Pay Taxes Next Year

No Federal Stimulus in September—But These States Are Sending Out Rebate Checks