GST Inversion Eases But Rate Gaps Still Hurt Industry: If you’ve been following India’s tax scene lately, you’ve probably heard the buzz about GST inversion easing but rate gaps still hurting industry. Now, before you roll your eyes at another tax talk, hear me out—this is a big deal not just for economists but for everyday businesses, workers, and even global markets. And I promise, by the end of this read, you’ll know exactly why it matters, how it affects people on the ground, and what might come next. At its core, this issue is about how India’s Goods and Services Tax (GST)—a unified tax system that replaced a messy patchwork of state and central taxes back in 2017—sometimes creates mismatches. These mismatches, or what experts call inverted duty structures (IDS), mean businesses pay more tax on raw materials than they do on the finished product they sell. Sounds backward, right? That’s because it is. And while reforms in 2025 fixed a chunk of the problem, big gaps still exist.

GST Inversion Eases But Rate Gaps Still Hurt Industry

At first glance, “GST inversion” might sound like another dry, technical tax topic. But when you peel back the jargon, it’s really about whether small factories can keep their lights on, whether exporters can compete globally, and whether India’s ambitious tax reform truly works for all. Yes, the government has made progress. The slab simplification and provisional refund plan are steps in the right direction. But until rate gaps are closed and refund processes become seamless, the pain is far from over. And for industries like pharma, textiles, and bicycles, this isn’t just policy—it’s survival.

| Point | Details |

|---|---|

| Main Issue | GST inversion has reduced after slab restructuring, but wide rate gaps still strain industries. |

| Sectors Affected | Bicycles, textiles, fertilizers, and pharmaceuticals. |

| Impact | Cash flow crunch, stuck Input Tax Credit (ITC), refund delays, MSME survival risk. |

| Government Fix | GST Council introduced simplified slabs (5% & 18%) and promised 90% provisional refunds. |

| Industry Ask | Align rates for raw materials and finished goods; include services & capital goods in refunds. |

| Reference | Official GST Council Website |

A Quick Background: How Did We Get Here?

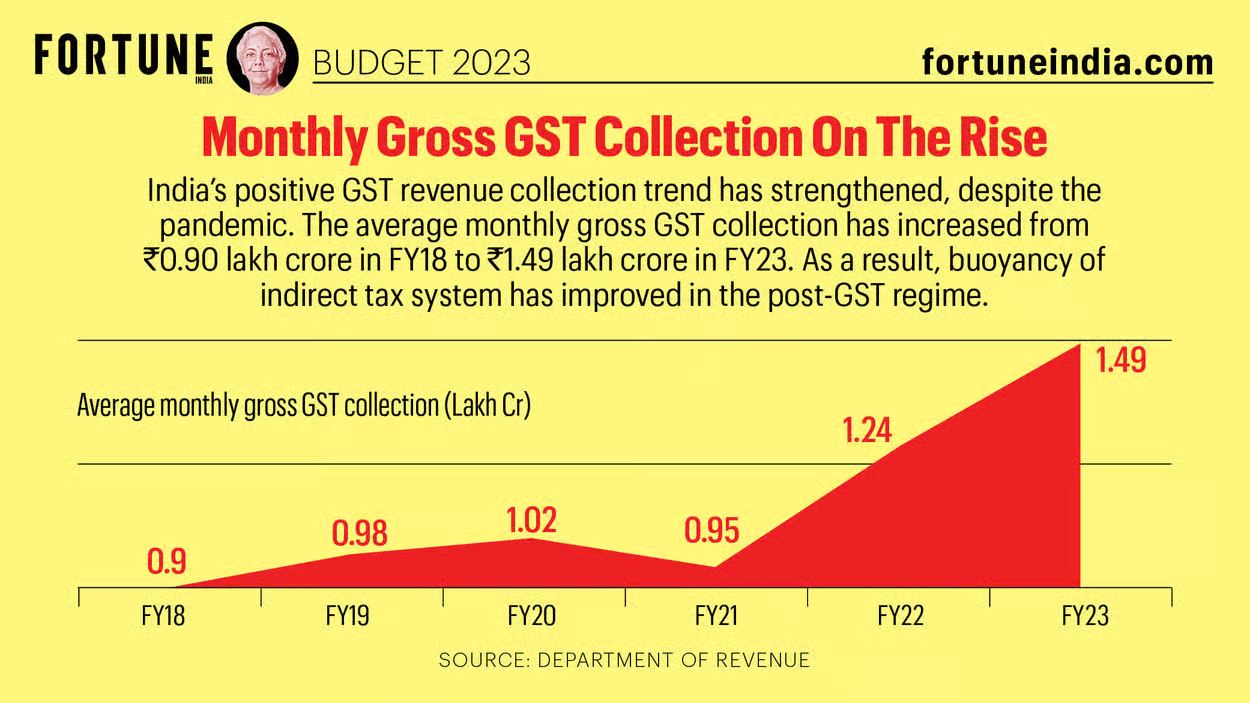

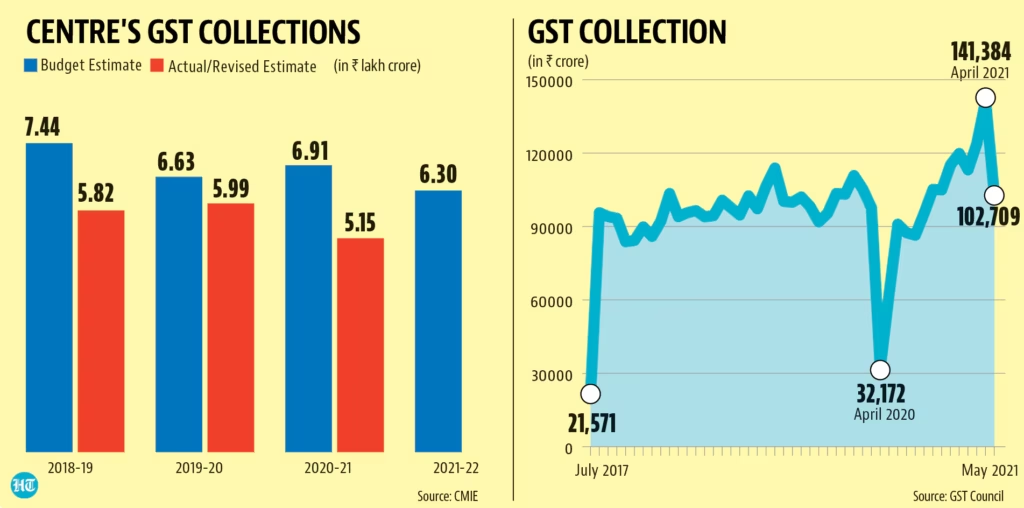

When GST launched in 2017, it was marketed as a “one nation, one tax” system. And honestly, it was a game-changer—no more juggling different state taxes or hidden levies. But like any big reform, the devil was in the details.

One of those devils was the inverted duty structure. This happens when the input tax rate is higher than the output tax rate, leaving businesses stuck with unutilized credits. It wasn’t new—India’s earlier VAT systems had similar issues—but GST magnified it because of how slabs were structured.

Over the years, sectors like fertilizers, textiles, and bicycles screamed for relief. The government made piecemeal fixes, but it wasn’t until GST 2.0 in 2025 that real simplification happened, bringing most goods into two slabs: 5% and 18%. Still, the fixes weren’t complete.

What Exactly Is GST Inversion?

Let’s break it down with an example.

Say you run a bicycle factory in Punjab. You buy steel and rubber as raw materials, and those get taxed at 18% GST. But when you sell your shiny new bicycles, they fall under the 5% GST slab. That gap—13 percentage points—creates what we call inversion.

Instead of helping your business grow, it blocks your cash flow. You’ve got a mountain of Input Tax Credit (ITC) sitting with the government, but you can’t easily get it back. Sure, you can apply for a refund, but the process is slow, loaded with paperwork, and excludes big chunks like input services and capital goods.

Why Does GST Inversion Eases But Rate Gaps Still Hurt Industry So Much?

1. Cash Flow Crunch

Think about running a small shop. You can’t afford to have money locked up in refunds for months. For MSMEs (Micro, Small, and Medium Enterprises)—the backbone of India’s manufacturing economy—this is the difference between staying open and shutting down.

2. Sector-Specific Pain

- Bicycles: Steel at 18% vs. finished cycles at 5%. That gap has doubled in the new structure. Manufacturers in Punjab estimate losses of up to 13% of working capital.

- Textiles: Relief came on synthetic yarn, but polyester inputs and textile machinery remain taxed higher than final fabrics or garments. This creates uneven competition between large organized players and smaller handloom weavers.

- Pharma: Active Pharmaceutical Ingredients (APIs) are taxed at 12–18%, while many medicines are taxed at 5%. Exporters say this mismatch adds millions in locked credit every quarter.

- Fertilizers: Farmers get fertilizers at a low GST rate of 5%, but input chemicals remain taxed at 12–18%. Fertilizer companies say the inversion reduces margins and limits reinvestment.

3. Unfair Market Distortions

When genuine manufacturers can’t recover costs, some shady players step in with fake invoices or shortcuts. That hurts the honest folks and tilts the market against transparency.

4. Global Competitiveness Risk

For exporters—especially pharma and textiles—the delays in refunds and stuck credits mean less money to reinvest in R&D, marketing, and scaling production. It directly affects India’s positioning in the global supply chain.

Real-World Examples

- Punjab’s Bicycle Makers: Many small and mid-sized factories are operating on thin margins, with some shutting down entirely because they can’t keep up with blocked cash flow.

- Textile Hubs in Surat and Tirupur: While man-made fibers saw relief, refund delays continue for unfinished fabrics. Exporters say India risks losing ground to Bangladesh and Vietnam.

- Pharma Exporters in Hyderabad: One mid-sized pharma company reported nearly ₹50 crore in blocked credits, which could have been reinvested in new production lines.

Global Context: Is India Alone in This?

Not at all. Even the European Union’s VAT system has struggled with similar issues. For example, in Germany, certain renewable energy equipment once had lower output tax than input tax, creating a temporary inversion.

The difference is that European countries generally process refunds quickly—sometimes in weeks. In India, businesses often wait months, sometimes over a year, to recover ITC. That delay is the real killer.

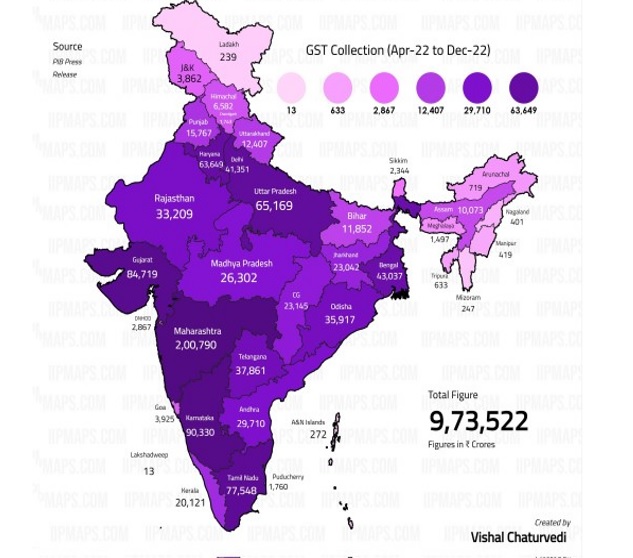

The Numbers Don’t Lie

- Bicycle manufacturers in Punjab report working capital deficits up to 13% due to inversion.

- The pharma sector says refund delays can hold back millions of dollars worth of ITC every quarter, directly impacting exports.

- A Dhruva Advisors report (2025) points out that refund processes exclude services and capital goods—two major cost heads for industries.

- The GST Council’s own data shows that over ₹35,000 crore in ITC refunds were pending as of mid-2025, a massive liquidity crunch across sectors.

What’s Being Done?

The government isn’t ignoring this. The GST Council, in its 2025 reforms, did a few important things:

- Simplified Slabs – Merged multiple GST rates into 5% and 18%, plus a 40% sin/luxury slab.

- Provisional Refunds – Approved 90% provisional refunds for industries struggling with IDS. This is supposed to roll out from November 2025, maybe even earlier.

- Sectoral Corrections – Fixed some textile and fertilizer mismatches but left many others hanging.

- Consultations with Industry – Trade bodies like FICCI, CII, and ASSOCHAM have been called in to suggest solutions for unresolved sectors.

That said, experts argue this is just the beginning. Businesses want more systemic changes like including services and capital goods in refunds, and aligning rates between inputs and outputs.

Practical Advice for Businesses

If you’re a business owner or manager, here’s how to cope:

- Keep Documentation Tight: Refunds take time, but having error-free paperwork makes the process smoother.

- Advance Rulings: Approach Advance Ruling Authorities for clarity on disputes.

- Cash Flow Planning: Build a cushion and consider short-term bank credit.

- Collective Lobbying: Join industry groups like FICCI or CII for stronger representation.

- Digitize Compliance: Use GST-compliance software to track ITC and file claims faster, reducing the risk of errors.

Future Outlook: What’s Next for GST?

- More Rate Alignment: Expect debates on lowering input rates for sectors like pharma and bicycles.

- Refund Digitization: A push toward faster, automated refunds via the GSTN portal.

- Possible Inclusion of Services: Pressure is building to let businesses claim refunds on input services, not just goods.

- Single-Rate GST Dream: Long-term, policymakers talk about a single-rate GST of around 12–15%, similar to global systems, but that’s still years away.

- Political Angle: With general elections around the corner, tax reform could be a key talking point. Businesses are watching closely.

MSMEs Eye Relief as GST Revamp Promises Easier Compliance and Faster ITC Refunds

Congress Warns GST 2.0 Could Crush Growth Unless One Big Change Is Made

Infosys Fined by Singapore Over GST Payments—Here’s What the Company Just Revealed